概述

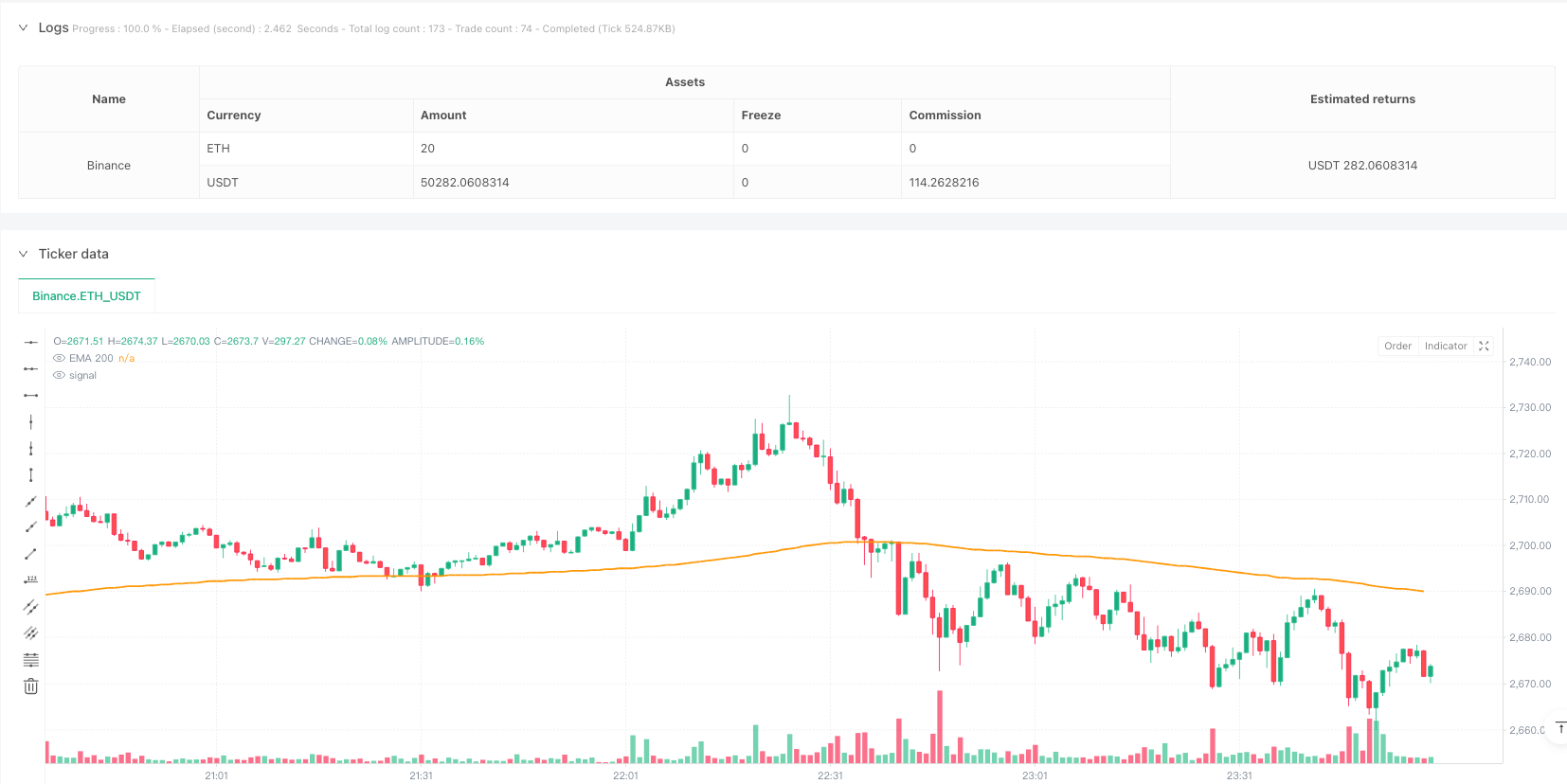

该策略是一个结合了MACD动量指标和EMA均线的双向交易系统。它主要基于MACD指标的交叉信号和价格相对于EMA(200)的位置来判断入场时机。策略采用了2:1的风险收益比,可以在5分钟时间周期上运行,并且支持灵活的参数调整。

策略原理

策略的核心逻辑基于以下几个关键条件: 1. 多头入场条件: - 价格位于EMA(200)之上 - MACD线从下方穿越信号线 - MACD值位于零线下方 2. 空头入场条件: - 价格位于EMA(200)之下 - MACD线从上方穿越信号线 - MACD值位于零线上方 3. 风险管理采用预设的止损和止盈比率,默认为1:2

策略优势

- 逻辑清晰简单,易于理解和实施

- 结合了趋势和动量指标,提供了更可靠的交易信号

- 具有灵活的参数设置,可以根据不同市场条件进行优化

- 支持双向交易,可以充分把握市场机会

- 内置风险管理机制,有助于保护资金安全

策略风险

- 在横盘市场可能产生频繁的假信号

- 固定的止损止盈比率可能不适合所有市场环境

- 对市场波动性变化比较敏感

- 频繁交易可能导致较高的手续费支出

- 在快速行情中可能错过部分机会

策略优化方向

- 引入波动率指标来动态调整止损和止盈水平

- 增加交易量确认信号,提高入场质量

- 添加市场环境过滤器,避免在不利条件下交易

- 实现动态的参数优化系统

- 加入时间过滤器,避免在低流动性时期交易

总结

这是一个设计合理的策略系统,通过结合技术指标提供了相对可靠的交易信号。虽然存在一些潜在风险,但通过合理的优化和风险管理,该策略具有良好的实战应用潜力。建议在实盘使用前进行充分的回测,并根据具体市场情况调整参数。

策略源码

/*backtest

start: 2025-02-12 00:00:00

end: 2025-02-19 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © @DieBartDie

//@version=5

strategy("Strategy with MACD and EMA", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Editable parameters

ema_length = input.int(200, title="EMA Length")

tp_ratio = input.float(2.0, title="Take Profit Ratio (%)") // Take Profit ratio

sl_ratio = input.float(1.0, title="Stop Loss Ratio (%)") // Stop Loss ratio

// MACD configuration

fast_length = input.int(12, title="MACD Fast Length")

slow_length = input.int(26, title="MACD Slow Length")

signal_length = input.int(9, title="MACD Signal Length")

// Operation type configuration

operation_type = input.string("Long & Short", title="Operation Type", options=["Long", "Short", "Long & Short"])

// Indicators

ema_200 = ta.ema(close, ema_length)

[macd, signal, _] = ta.macd(close, fast_length, slow_length, signal_length)

// Conditions for LONG entries

price_above_ema = close > ema_200

macd_above_signal = ta.crossover(macd, signal) // MACD crosses above the signal line

macd_below_zero = macd < 0

long_condition = price_above_ema and macd_above_signal and macd_below_zero

// Conditions for SHORT entries

price_below_ema = close < ema_200

macd_below_signal = ta.crossunder(macd, signal) // MACD crosses below the signal line

macd_above_zero = macd > 0

short_condition = price_below_ema and macd_below_signal and macd_above_zero

// Calculate Stop Loss and Take Profit

stop_loss_long = close * (1 - sl_ratio / 100)

take_profit_long = close * (1 + tp_ratio / 100)

stop_loss_short = close * (1 + sl_ratio / 100)

take_profit_short = close * (1 - tp_ratio / 100)

// Execute LONG position if conditions are met

if (operation_type == "Long" or operation_type == "Long & Short") and long_condition

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", stop=stop_loss_long, limit=take_profit_long)

// Execute SHORT position if conditions are met

if (operation_type == "Short" or operation_type == "Long & Short") and short_condition

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Short", stop=stop_loss_short, limit=take_profit_short)

// Plot the EMA

plot(ema_200, color=color.orange, linewidth=2, title="EMA 200")

相关推荐