概述

该策略是一个结合了双均线交叉系统与相对强弱指数(RSI)的趋势跟踪策略。通过9周期与21周期指数移动平均线(EMA)的交叉来捕捉市场趋势,同时利用RSI指标进行超买超卖过滤,并结合成交量确认来提高交易信号的可靠性。策略还整合了基于真实波动幅度(ATR)的动态止损机制,实现了全方位的风险控制。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用快速EMA(9周期)和慢速EMA(21周期)的交叉来识别潜在的趋势变化 2. 通过RSI指标进行超买超卖过滤,RSI值在40-60区间内才允许交易 3. 设置最小成交量阈值(100,000)作为交易确认条件 4. 采用1.5倍ATR作为动态止损距离,实现灵活的风险控制

当快速EMA向上穿越慢速EMA,且RSI大于40,同时成交量超过阈值时,系统产生做多信号。反之,当快速EMA向下穿越慢速EMA,且RSI小于60,同时成交量确认时,系统产生做空信号。

策略优势

- 指标组合科学合理:将趋势跟踪、动量指标和成交量分析有机结合

- 风险控制完善:通过RSI过滤和动态止损实现多层次风险管理

- 参数设置灵活:关键参数均可根据不同市场特征进行优化调整

- 信号确认严格:要求多重条件同时满足,有效降低虚假信号

- 执行逻辑清晰:策略规则明确,便于实盘操作和回测验证

策略风险

- 横盘市场可能产生频繁交易:在震荡市中双均线交叉较多

- RSI过滤可能错过部分趋势起点:强势行情初期RSI可能已处于高位

- 成交量过滤在某些市场可能过于严格:部分低流动性品种难以满足条件

- 固定倍数的ATR止损在剧烈波动时可能不够灵活

- 没有设置固定止盈点位可能影响资金利用效率

策略优化方向

- 引入自适应参数:可根据市场波动率动态调整EMA周期和RSI阈值

- 优化止损机制:结合支撑阻力位设置多层次止损

- 增加市场环境过滤:添加趋势强度指标,仅在明确趋势中交易

- 完善资金管理:根据信号强度和市场波动调整持仓规模

- 添加止盈机制:设置基于ATR的动态止盈点位

总结

该策略通过科学组合经典技术指标,构建了一个逻辑严密的趋势跟踪系统。策略的多重过滤机制和风险控制手段使其具有较强的实战应用价值。通过建议的优化方向,策略还有进一步提升的空间。特别适合波动较大且流动性充足的市场,但使用前需要充分测试和参数优化。

策略源码

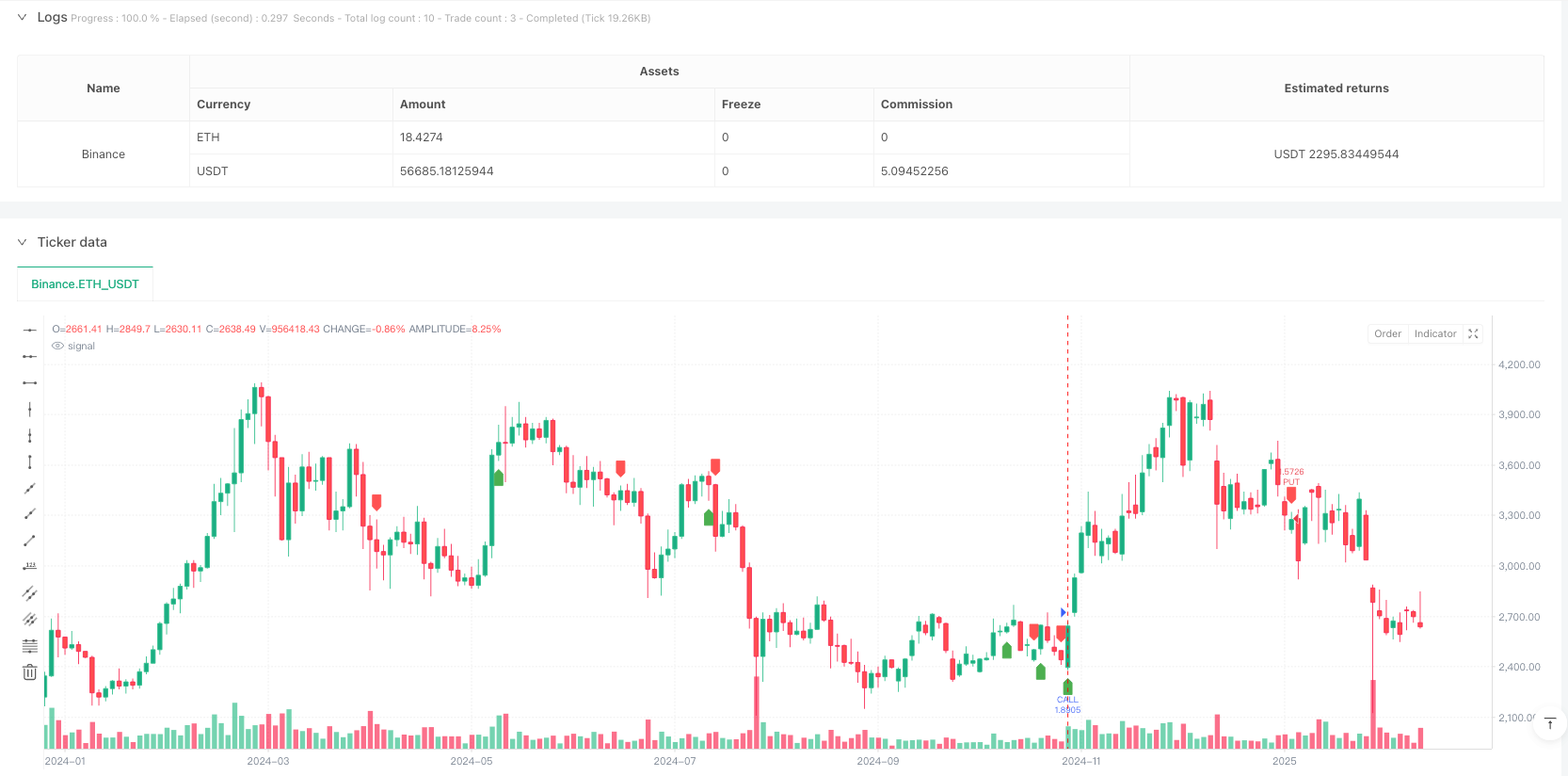

/*backtest

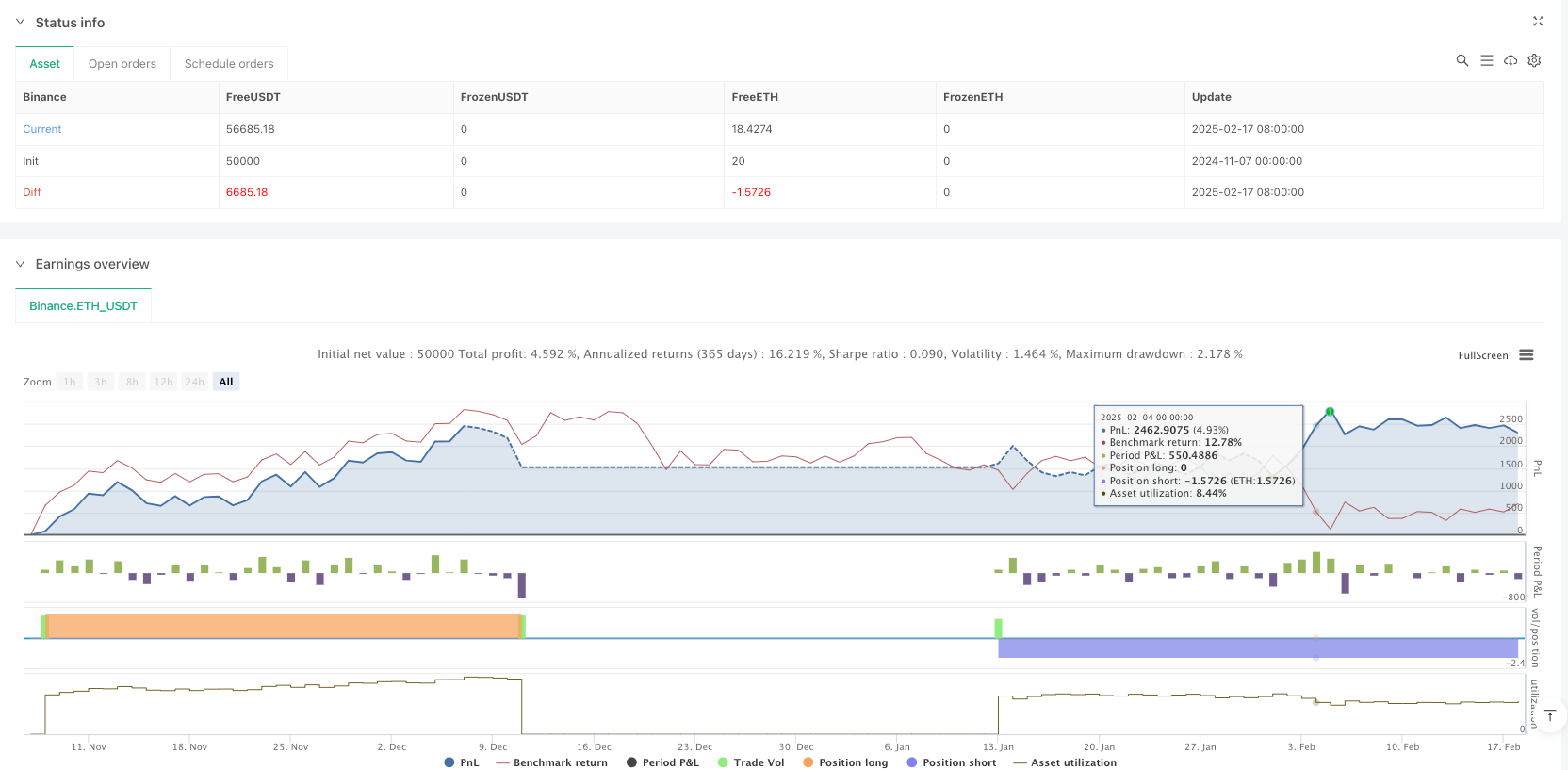

start: 2024-11-07 00:00:00

end: 2025-02-18 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Call & Put Options Strategy (Optimized)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// 📌 Configuration Parameters

emaShort = input(9, title="Short EMA")

emaLong = input(21, title="Long EMA")

rsiLength = input(14, title="RSI Period")

rsiOverbought = input(60, title="RSI Overbought") // Adjusted for more signals

rsiOversold = input(40, title="RSI Oversold") // More flexible to confirm buys

atrLength = input(14, title="ATR Period")

atrMult = input(1.5, title="ATR Multiplier for Stop Loss")

minVol = input(100000, title="Minimum Volume to Confirm Entry") // Volume filter

// 🔹 Indicator Calculations

emaFast = ta.ema(close, emaShort)

emaSlow = ta.ema(close, emaLong)

rsi = ta.rsi(close, rsiLength)

atr = ta.atr(atrLength)

vol = volume

// 📌 Entry Signal Conditions

condCALL = ta.crossover(emaFast, emaSlow) and rsi > rsiOversold and vol > minVol

condPUT = ta.crossunder(emaFast, emaSlow) and rsi < rsiOverbought and vol > minVol

// 🚀 Plot signals on the chart

plotshape(condCALL, location=location.belowbar, color=color.green, style=shape.labelup, title="CALL", size=size.small)

plotshape(condPUT, location=location.abovebar, color=color.red, style=shape.labeldown, title="PUT", size=size.small)

// 🎯 Alert conditions

alertcondition(condCALL, title="CALL Signal", message="📈 CALL signal confirmed")

alertcondition(condPUT, title="PUT Signal", message="📉 PUT signal confirmed")

// 📌 Risk Management - Stop Loss and Take Profit

longStop = close - (atr * atrMult)

shortStop = close + (atr * atrMult)

strategy.entry("CALL", strategy.long, when=condCALL)

strategy.exit("CALL Exit", from_entry="CALL", stop=longStop)

strategy.entry("PUT", strategy.short, when=condPUT)

strategy.exit("PUT Exit", from_entry="PUT", stop=shortStop)

相关推荐