概述

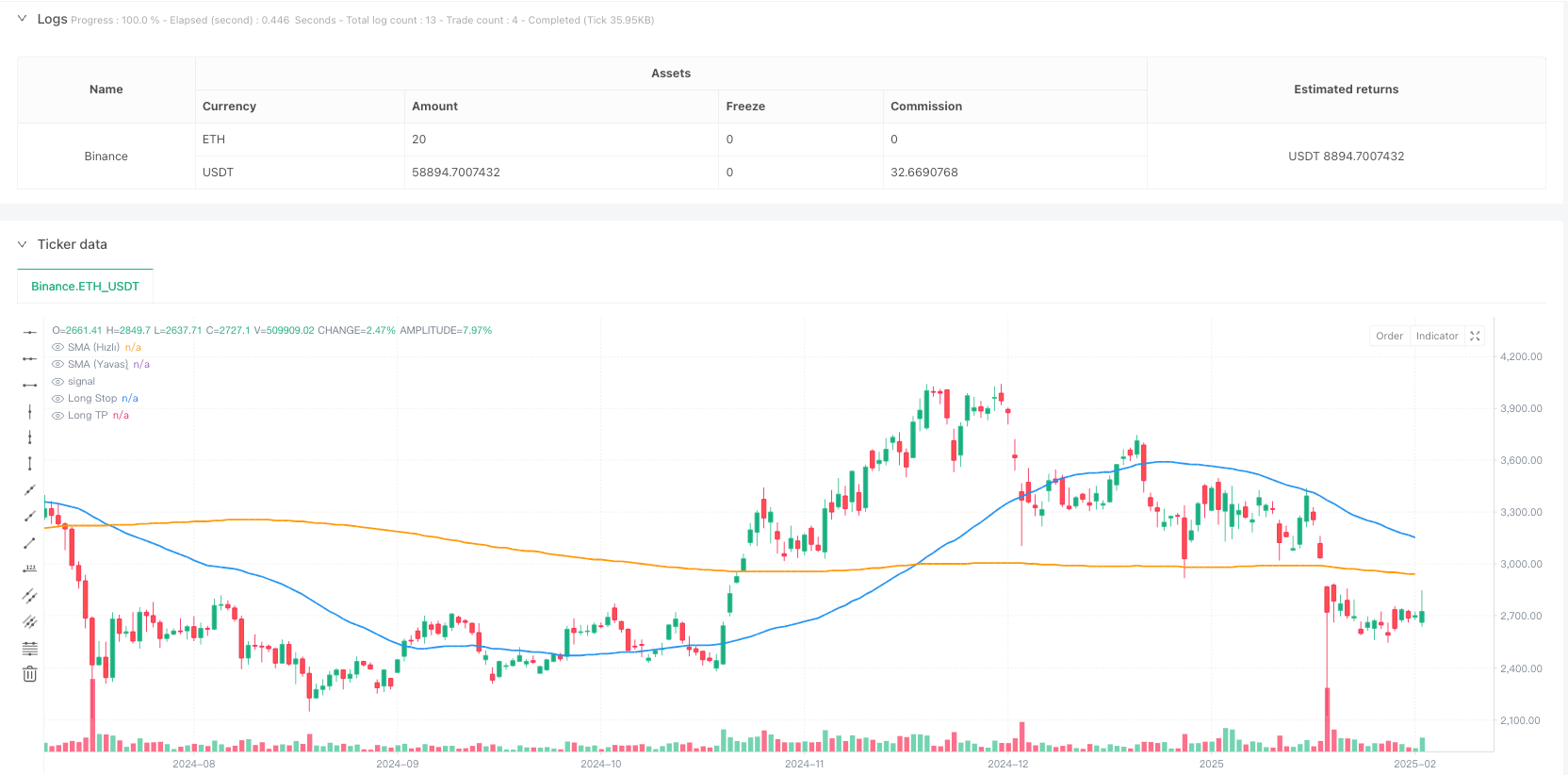

本策略是一个结合了多个技术指标的趋势跟踪系统。它主要基于RSI、MACD和SMA的交叉信号来确定交易方向,同时使用ATR指标动态调整止损和获利水平。该策略还整合了交易量过滤器来确保在足够的市场流动性下进行交易,并采用部分止盈机制来优化资金管理。

策略原理

策略使用了三重验证机制来确认交易信号: 1. 通过50和200日均线的位置关系判断主要趋势方向 2. 利用RSI在超买超卖区域的交叉来寻找入场时机 3. 结合MACD指标来确认趋势动能 4. 使用成交量过滤器确保足够的市场流动性 5. 采用基于ATR的动态止损和获利目标设置

多重验证的目的是降低虚假信号,提高交易的准确性。策略在做多条件满足时(趋势向上+RSI上穿40+MACD向上+成交量确认)开仓,并使用ATR的2倍作为止损,4倍作为止盈。

策略优势

- 多重技术指标交叉验证,有效降低虚假信号

- 动态的波动率止损机制,适应不同市场环境

- 采用部分止盈策略,在保留上涨空间的同时锁定部分利润

- 交易量过滤确保了足够的市场流动性

- 完整的风险管理体系,包括固定止损、追踪止损和部分获利

策略风险

- 多重指标可能导致错过部分交易机会

- 在剧烈波动市场中可能遭受较大回撤

- 参数优化过度可能导致过拟合

- 交易量过滤可能在低流动性市场错过好机会

- 动态止损可能在高波动期间被过早触发

策略优化方向

- 考虑加入市场波动率适应机制,在不同波动环境下动态调整参数

- 引入多周期分析,提高趋势判断的准确性

- 优化部分止盈比例,在不同市场环境下调整止盈策略

- 增加趋势强度过滤器,避免在弱趋势环境交易

- 考虑加入季节性因素分析,优化交易时机

总结

这是一个全面的趋势跟踪策略,通过多重技术指标的配合使用,建立了一个稳健的交易系统。策略的主要特点是在保证安全性的同时,通过动态的止损和获利机制来适应市场变化。虽然存在一些需要优化的地方,但整体框架是合理的,适合进一步完善和实盘测试。

策略源码

/*backtest

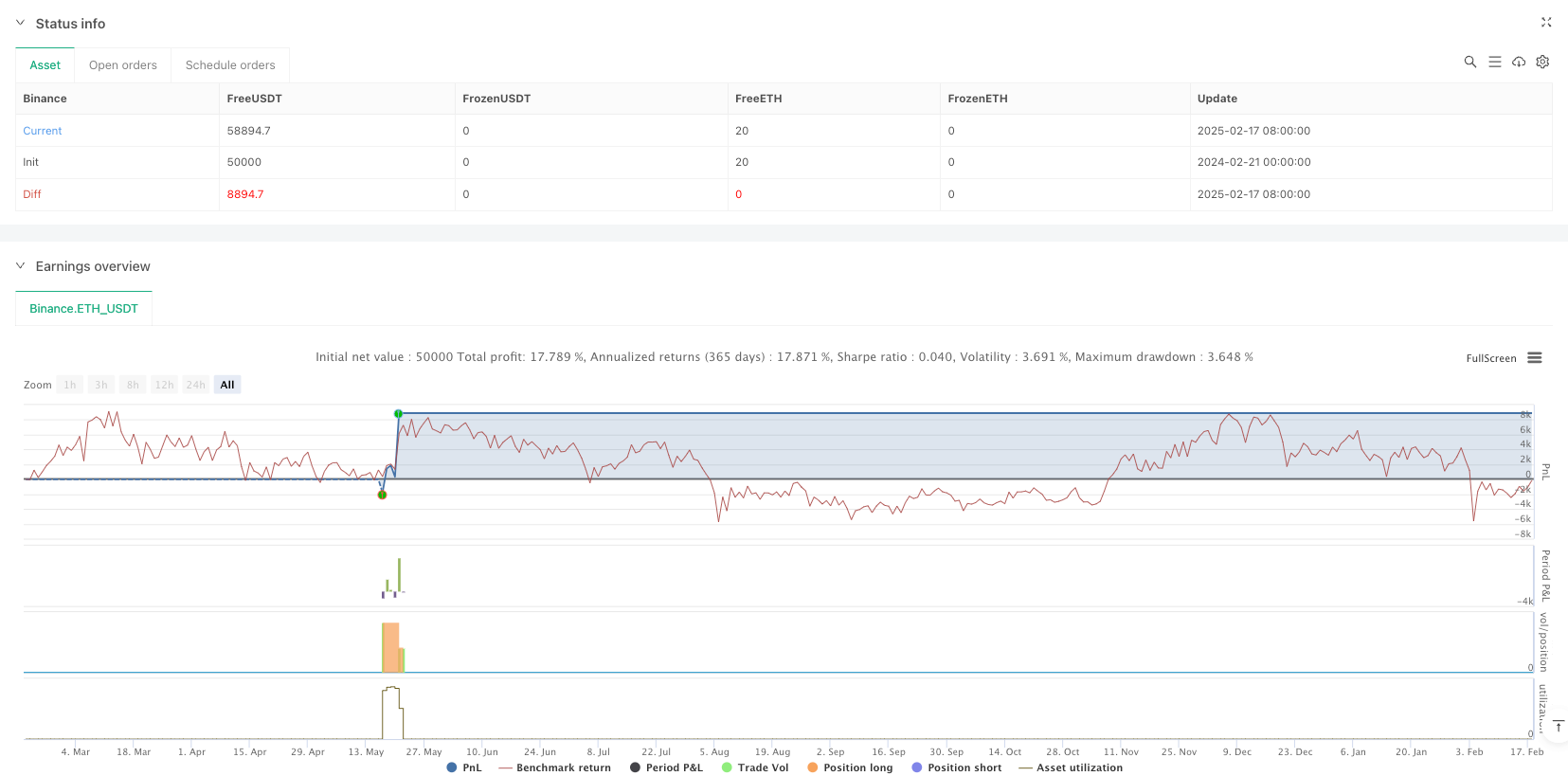

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy( title="AI Trade Strategy v2 (Extended) - Fixed", shorttitle="AI_Trade_v2", overlay=true, format=format.price, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, pyramiding=0)

//============================================================================

//=== 1) Basic Indicators (SMA, RSI, MACD) ==================================

//============================================================================

// Time Filter (optional, you can update)

inDateRange = (time >= timestamp("2018-01-01T00:00:00")) and (time <= timestamp("2069-01-01T00:00:00"))

// RSI Parameters

rsiLength = input.int(14, "RSI Period")

rsiOB = input.int(60, "RSI Overbought Level")

rsiOS = input.int(40, "RSI Oversold Level")

rsiSignal = ta.rsi(close, rsiLength)

// SMA Parameters

smaFastLen = input.int(50, "SMA Fast Period")

smaSlowLen = input.int(200, "SMA Slow Period")

smaFast = ta.sma(close, smaFastLen)

smaSlow = ta.sma(close, smaSlowLen)

// MACD Parameters

fastLength = input.int(12, "MACD Fast Period")

slowLength = input.int(26, "MACD Slow Period")

signalLength = input.int(9, "MACD Signal Period")

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

//============================================================================

//=== 2) Additional Filter (Volume) ========================================

//============================================================================

useVolumeFilter = input.bool(true, "Use Volume Filter?")

volumeMaPeriod = input.int(20, "Volume MA Period")

volumeMa = ta.sma(volume, volumeMaPeriod)

// If volume filter is enabled, current bar volume should be greater than x times the average volume

volMultiplier = input.float(1.0, "Volume Multiplier (Volume > x * MA)")

volumeFilter = not useVolumeFilter or (volume > volumeMa * volMultiplier)

//============================================================================

//=== 3) Trend Conditions (SMA) ============================================

//============================================================================

isBullTrend = smaFast > smaSlow

isBearTrend = smaFast < smaSlow

//============================================================================

//=== 4) Entry Conditions (RSI + MACD + Trend + Volume) ====================

//============================================================================

// RSI crossing above 30 + Bullish Trend + Positive MACD + Volume Filter

longCondition = isBullTrend and ta.crossover(rsiSignal, rsiOS) and (macdLine > signalLine) and volumeFilter

shortCondition = isBearTrend and ta.crossunder(rsiSignal, rsiOB) and (macdLine < signalLine) and volumeFilter

//============================================================================

//=== 5) ATR-based Stop + Trailing Stop ===================================

//============================================================================

atrPeriod = input.int(14, "ATR Period")

atrMultiplierSL = input.float(2.0, "Stop Loss ATR Multiplier")

atrMultiplierTP = input.float(4.0, "Take Profit ATR Multiplier")

atrValue = ta.atr(atrPeriod)

//============================================================================

//=== 6) Trade (Position) Management ======================================

//============================================================================

if inDateRange

//--- Long Entry ---

if longCondition

strategy.entry(id="Long", direction=strategy.long, comment="Long Entry")

//--- Short Entry ---

if shortCondition

strategy.entry(id="Short", direction=strategy.short, comment="Short Entry")

//--- Stop & TP for Long Position ---

if strategy.position_size > 0

// ATR-based fixed Stop & TP calculation

longStopPrice = strategy.position_avg_price - atrValue * atrMultiplierSL

longTakeProfit = strategy.position_avg_price + atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTP = strategy.position_avg_price + (atrValue * 2.5)

strategy.exit( id = "Partial TP Long", stop = na, limit = partialTP, qty_percent= 50, from_entry = "Long" )

// Trailing Stop + Final ATR Stop

// WARNING: trail_offset=... is the offset in price units.

// For example, in BTCUSDT, a value like 300 means a 300 USDT trailing distance.

float trailingDist = atrValue * 1.5

strategy.exit( id = "Long Exit (Trail)", stop = longStopPrice, limit = longTakeProfit, from_entry = "Long", trail_offset= trailingDist )

//--- Stop & TP for Short Position ---

if strategy.position_size < 0

// ATR-based fixed Stop & TP calculation for Short

shortStopPrice = strategy.position_avg_price + atrValue * atrMultiplierSL

shortTakeProfit = strategy.position_avg_price - atrValue * atrMultiplierTP

// PARTIAL EXIT: (Example) take 50% of the position at early TP

partialTPShort = strategy.position_avg_price - (atrValue * 2.5)

strategy.exit( id = "Partial TP Short", stop = na, limit = partialTPShort, qty_percent= 50, from_entry = "Short" )

// Trailing Stop + Final ATR Stop for Short

float trailingDistShort = atrValue * 1.5

strategy.exit( id = "Short Exit (Trail)", stop = shortStopPrice, limit = shortTakeProfit, from_entry = "Short", trail_offset= trailingDistShort )

//============================================================================

//=== 7) Plot on Chart (SMA, etc.) =========================================

//============================================================================

plot(smaFast, color=color.blue, linewidth=2, title="SMA (Fast)")

plot(smaSlow, color=color.orange, linewidth=2, title="SMA (Slow)")

// (Optional) Plot Stop & TP levels dynamically:

longStopForPlot = strategy.position_size > 0 ? strategy.position_avg_price - atrValue * atrMultiplierSL : na

longTPForPlot = strategy.position_size > 0 ? strategy.position_avg_price + atrValue * atrMultiplierTP : na

shortStopForPlot = strategy.position_size < 0 ? strategy.position_avg_price + atrValue * atrMultiplierSL : na

shortTPForPlot = strategy.position_size < 0 ? strategy.position_avg_price - atrValue * atrMultiplierTP : na

plot(longStopForPlot, color=color.red, style=plot.style_linebr, title="Long Stop")

plot(longTPForPlot, color=color.green, style=plot.style_linebr, title="Long TP")

plot(shortStopForPlot, color=color.red, style=plot.style_linebr, title="Short Stop")

plot(shortTPForPlot, color=color.green, style=plot.style_linebr, title="Short TP")

相关推荐