概述

该策略是一个结合了高斯通道(Gaussian Channel)和随机相对强弱指标(Stochastic RSI)的量化交易系统。策略通过监测价格与高斯通道的交叉以及随机RSI的走势来捕捉市场的趋势反转机会。高斯通道由移动平均线和标准差构建,能够动态地反映市场波动范围,而随机RSI则提供了动量方面的确认信号。

策略原理

策略的核心逻辑包含以下几个关键部分: 1. 高斯通道的构建:使用20周期的指数移动平均(EMA)作为通道中轴线,通道上下边界则是中轴线加减2倍标准差得到。 2. 随机RSI的计算:首先计算14周期的RSI,然后对RSI值应用14周期的随机公式,最后对结果进行3周期的平滑处理得到K线和D线。 3. 交易信号生成:当价格突破高斯通道上轨且随机RSI的K线上穿D线时,产生做多信号;当价格跌破高斯通道上轨时,平仓出场。

策略优势

- 信号可靠性高:结合了趋势和动量两个维度的指标,能够有效降低虚假信号。

- 风险控制完善:利用高斯通道的动态特性,能够根据市场波动自动调整交易区间。

- 适应性强:通过参数化设计,策略可以适应不同的市场环境和交易品种。

- 执行效率高:策略逻辑清晰简单,计算量小,适合实时交易。

策略风险

- 滞后性风险:移动平均和标准差的计算具有一定滞后性,可能导致入场时机延迟。

- 假突破风险:在震荡市场中,可能出现频繁的假突破信号。

- 参数敏感性:策略效果对参数设置较为敏感,不同市场环境可能需要调整参数。

- 市场环境依赖:在趋势不明显的横盘市场中,策略表现可能不佳。

策略优化方向

- 信号过滤优化:可以添加成交量、波动率等辅助指标来过滤交易信号。

- 动态参数调整:引入自适应机制,根据市场状态动态调整通道参数和随机RSI参数。

- 止损机制完善:增加追踪止损或基于波动率的动态止损机制。

- 仓位管理优化:根据信号强度和市场波动率动态调整持仓比例。

总结

该策略通过结合技术分析中的趋势跟踪和动量指标,构建了一个逻辑完整、风险可控的量化交易系统。虽然存在一些固有的风险,但通过持续优化和完善,策略有望在不同市场环境下保持稳定的表现。策略的模块化设计也为后续的优化和扩展提供了良好的基础。

策略源码

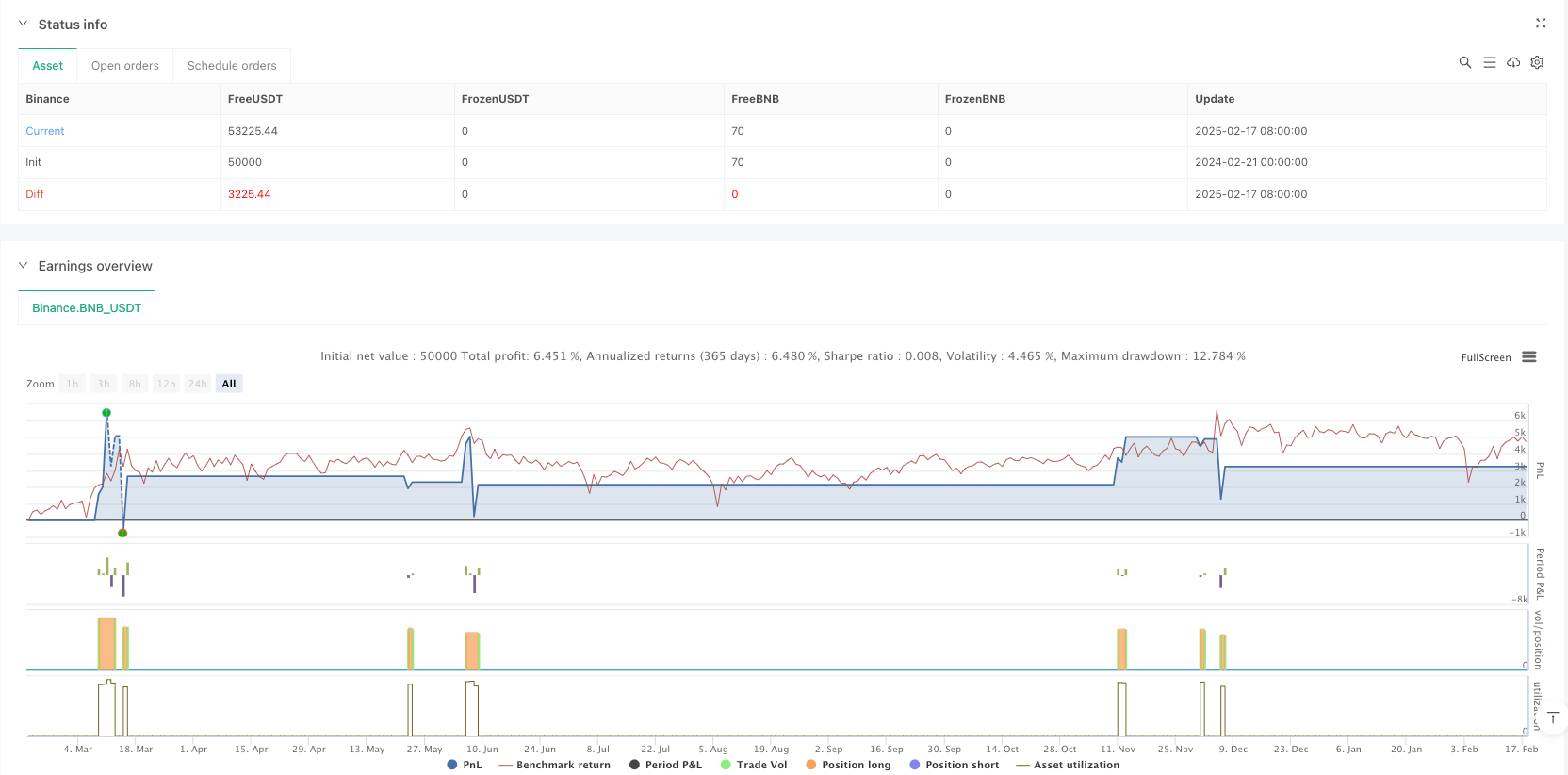

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("SAJJAD JAMSHIDI Channel with Stochastic RSI Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, process_orders_on_close=true)

// Gaussian Channel Inputs

lengthGC = input.int(20, "Gaussian Channel Length", minval=1)

multiplier = input.float(2.0, "Standard Deviation Multiplier", minval=0.1)

// Calculate Gaussian Channel

basis = ta.ema(close, lengthGC)

deviation = multiplier * ta.stdev(close, lengthGC)

upperChannel = basis + deviation

lowerChannel = basis - deviation

// Plot Gaussian Channel

plot(basis, "Basis", color=color.blue)

plot(upperChannel, "Upper Channel", color=color.green)

plot(lowerChannel, "Lower Channel", color=color.red)

// Stochastic RSI Inputs

rsiLength = input.int(14, "RSI Length", minval=1)

stochLength = input.int(14, "Stochastic Length", minval=1)

smoothK = input.int(3, "Smooth K", minval=1)

smoothD = input.int(3, "Smooth D", minval=1)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate Stochastic RSI

lowestRSI = ta.lowest(rsi, stochLength)

highestRSI = ta.highest(rsi, stochLength)

stochRSI = (rsi - lowestRSI) / (highestRSI - lowestRSI) * 100

k = ta.sma(stochRSI, smoothK)

d = ta.sma(k, smoothD)

// Trading Conditions

stochUp = k > d

priceAboveUpper = ta.crossover(close, upperChannel)

priceBelowUpper = ta.crossunder(close, upperChannel)

strategy.entry("Long", strategy.long, when=priceAboveUpper and stochUp)

strategy.close("Long", when=priceBelowUpper)

相关推荐