使用RSI和MACD双重过滤的动态止损趋势跟踪策略

RSI MACD SL (Stop Loss) TA (Technical Analysis)

创建日期:

2025-02-20 16:50:43

最后修改:

2025-02-20 16:50:43

复制:

2

点击次数:

360

概述

本策略是一个基于MACD和RSI双重指标过滤的趋势跟踪系统,集成了动态止损机制。该策略主要通过MACD的交叉信号产生交易机会,并使用RSI作为二次确认,同时引入了百分比止损来控制风险。策略的核心在于通过技术指标的配合使用来提高交易信号的可靠性,并通过动态止损来保护盈利。

策略原理

策略采用MACD(12,26,9)和RSI(14)作为主要指标。入场信号需同时满足两个条件:MACD金叉且RSI处于超卖区域(默认40以下)时做多,MACD死叉且RSI处于超买区域(默认59以上)时做空。系统还设置了3%的动态止损,当价格向不利方向移动超过设定百分比时,会自动平仓以控制风险。此外,策略还包含了时间过滤器,允许用户设定特定的交易时间范围。

策略优势

- 双重指标过滤提高了交易信号的可靠性,减少了虚假信号。

- 动态止损机制有效控制了每笔交易的风险。

- 策略参数可根据不同市场条件灵活调整。

- 时间过滤功能允许在特定时间段内执行交易。

- 采用资金百分比持仓,有利于资金管理。

策略风险

- 在震荡市场中可能产生频繁的交易信号,增加交易成本。

- 固定百分比止损可能在高波动性市场中导致过早平仓。

- MACD作为滞后指标可能在快速市场中错过重要价格走势。

- RSI阈值的设置需要针对不同市场进行优化。

- 交易成本和滑点可能影响策略的实际表现。

策略优化方向

- 引入波动率指标来动态调整止损百分比。

- 增加趋势强度过滤器,避免在震荡市场中过度交易。

- 考虑添加移动止损来保护盈利。

- 优化RSI和MACD的参数设置,使其更适应不同的市场周期。

- 增加交易量分析,提高信号可靠性。

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过MACD和RSI的组合使用,有效提高了交易信号的质量。动态止损的设计帮助控制风险,使策略具有良好的风险管理特性。该策略适合在趋势明确的市场中使用,但需要根据具体市场特征调整参数设置。通过建议的优化方向,策略的稳定性和可靠性还可以进一步提升。

策略源码

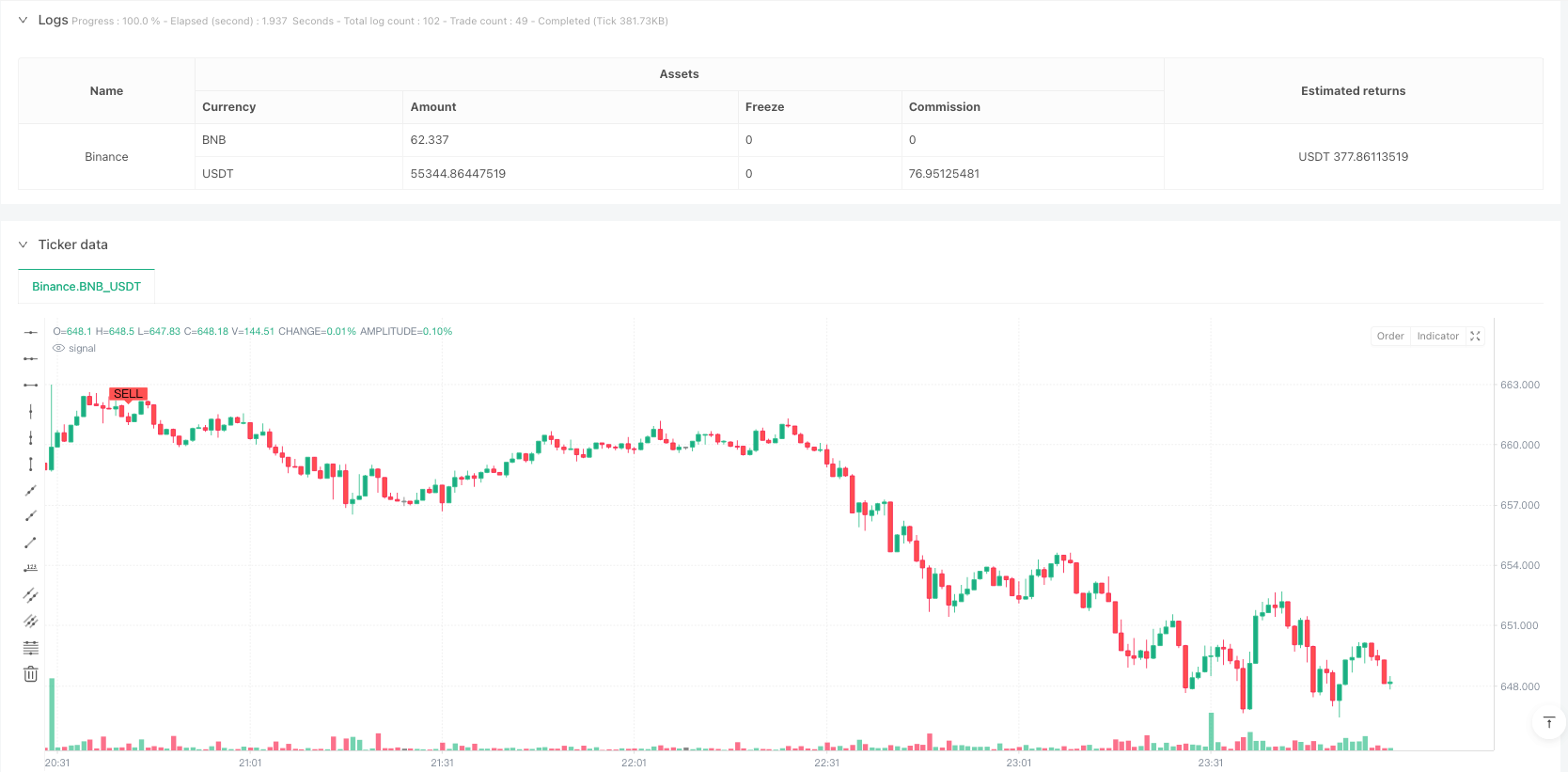

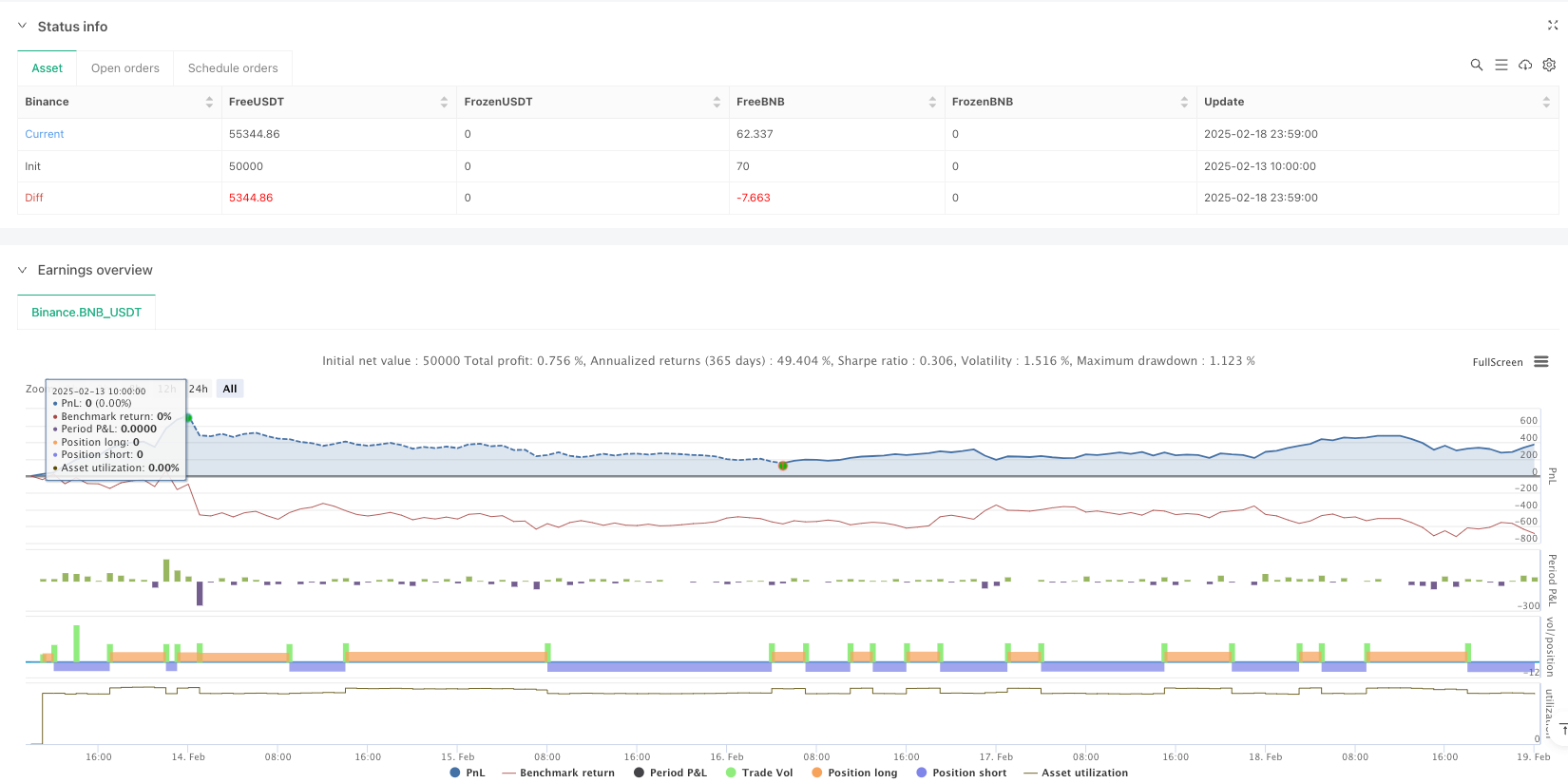

/*backtest

start: 2025-02-13 10:00:00

end: 2025-02-19 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © eagle916

//@version=5

strategy("EAG MACD + RSI Strategy",overlay=true, initial_capital = 300, default_qty_value = 10, default_qty_type = "percent_of_equity", commission_type=strategy.commission.percent, commission_value=0.1)

// Input para el RSI

rsi_length = input.int(14, title="RSI Length", minval=1)

rsi_overbought = input.int(59, title="RSI Overbought Level", minval=1, maxval=100)

rsi_oversold = input.int(40, title="RSI Oversold Level", minval=1, maxval=100)

// Input para el MACD

macd_length = input.int(12, title="MACD Length", minval=1)

macd_overbought = input.int(26, title="MACD Overbought Level", minval=1, maxval=100)

macd_signal = input.int(9, title="MACD Signal Level", minval=1, maxval=100)

// Input para el porcentaje de pérdida (stop loss)

stop_loss_percent = input.float(3.0, title="Porcentaje de Stop Loss (%)", minval=0.1, step=0.1)

// Calcular RSI

rsi_value = ta.rsi(close, rsi_length)

// Calcular MACD

[macdLine, signalLine, _] = ta.macd(close, macd_length, macd_overbought, macd_signal)

macd_crossup = ta.crossover(macdLine, signalLine) // Cruce al alza del MACD

macd_crossdown = ta.crossunder(macdLine, signalLine) // Cruce a la baja del MACD

// Condiciones de compra y venta

buy_condition = macd_crossup and rsi_value <= rsi_oversold

sell_condition = macd_crossdown and rsi_value >= rsi_overbought

// Registrar precio de entrada

var float entry_price = na

if strategy.position_size == 0

entry_price := na

// Mostrar señales de compra y venta en la gráfica principal

plotshape(series=buy_condition, title="Señal de Compra", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY") // Compra debajo de la vela

plotshape(series=sell_condition, title="Señal de Venta", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL") // Venta encima de la vela

// Órdenes de estrategia

if buy_condition

strategy.entry("Compra", strategy.long)

entry_price := close

if sell_condition

strategy.entry("Venta", strategy.short)

entry_price := close

// Calcular el precio de stop loss

long_stop_loss = entry_price * (1 - stop_loss_percent / 100)

short_stop_loss = entry_price * (1 + stop_loss_percent / 100)

// Cerrar posición si el precio va en contra el porcentaje definido por el usuario

if strategy.position_size > 0 and close < long_stop_loss

strategy.close("Compra", comment="Stop Loss Compra")

if strategy.position_size < 0 and close > short_stop_loss

strategy.close("Venta", comment="Stop Loss Venta")

相关推荐