概述

该策略是一个基于多重技术指标的趋势跟踪交易系统,整合了移动平均线(MA)、相对强弱指标(RSI)、布林带(BB)、移动平均线趋散指标(MACD)和随机指标(Stochastic)等多个技术指标,通过指标间的交叉确认来识别市场趋势和交易机会。策略采用百分比仓位管理方式,默认使用1%的资金进行每次交易。

策略原理

策略通过以下几个维度来确定交易信号: 1. 使用14周期简单移动平均线(SMA)作为趋势指示基准 2. RSI指标用于判断超买超卖,设定30和70为关键阈值 3. 布林带通道用于确定价格波动区间,期间为20 4. MACD指标(12,26,9)用于趋势确认 5. 随机指标(14,3)用于动量判断

做多条件需同时满足: - RSI低于30(超卖) - MACD线上穿信号线 - 随机K值低于20 - 收盘价高于布林带中轨 - 前一根收盘价低于布林带下轨

做空条件需同时满足: - RSI高于70(超买) - MACD线下穿信号线 - 随机K值高于80 - 收盘价低于布林带中轨 - 前一根收盘价高于布林带上轨

策略优势

- 多重技术指标交叉确认,能有效过滤虚假信号

- 结合趋势跟踪和震荡指标,兼顾趋势和反转行情

- 采用百分比持仓管理,有效控制风险

- 指标参数可调,具有良好的适应性

- 交易信号清晰,易于执行和回测

策略风险

- 多重指标可能导致信号滞后,影响入场时机

- 震荡市中可能频繁交易,增加成本

- 固定参数在不同市场环境下表现不一

- 技术指标之间可能相互矛盾,造成信号混乱 建议采取以下措施规避风险:

- 根据不同市场特征动态调整参数

- 设置止损止盈以控制风险

- 结合成交量等其他指标进行信号确认

- 定期评估策略表现并及时调整

策略优化方向

- 引入自适应参数机制,根据市场波动性动态调整指标参数

- 加入成交量指标作为辅助确认

- 优化持仓管理,考虑分批建仓和减仓

- 增加市场环境识别模块,在不同行情下采用不同策略

- 引入机器学习算法优化信号生成逻辑

总结

该策略通过多重技术指标的综合运用,建立了一个相对完整的趋势跟踪交易系统。策略具有信号可靠、风险可控的特点,但仍需要在实盘中根据市场情况不断优化参数和逻辑。通过持续改进和完善,该策略有望在不同市场环境下都能获得稳定收益。

策略源码

/*backtest

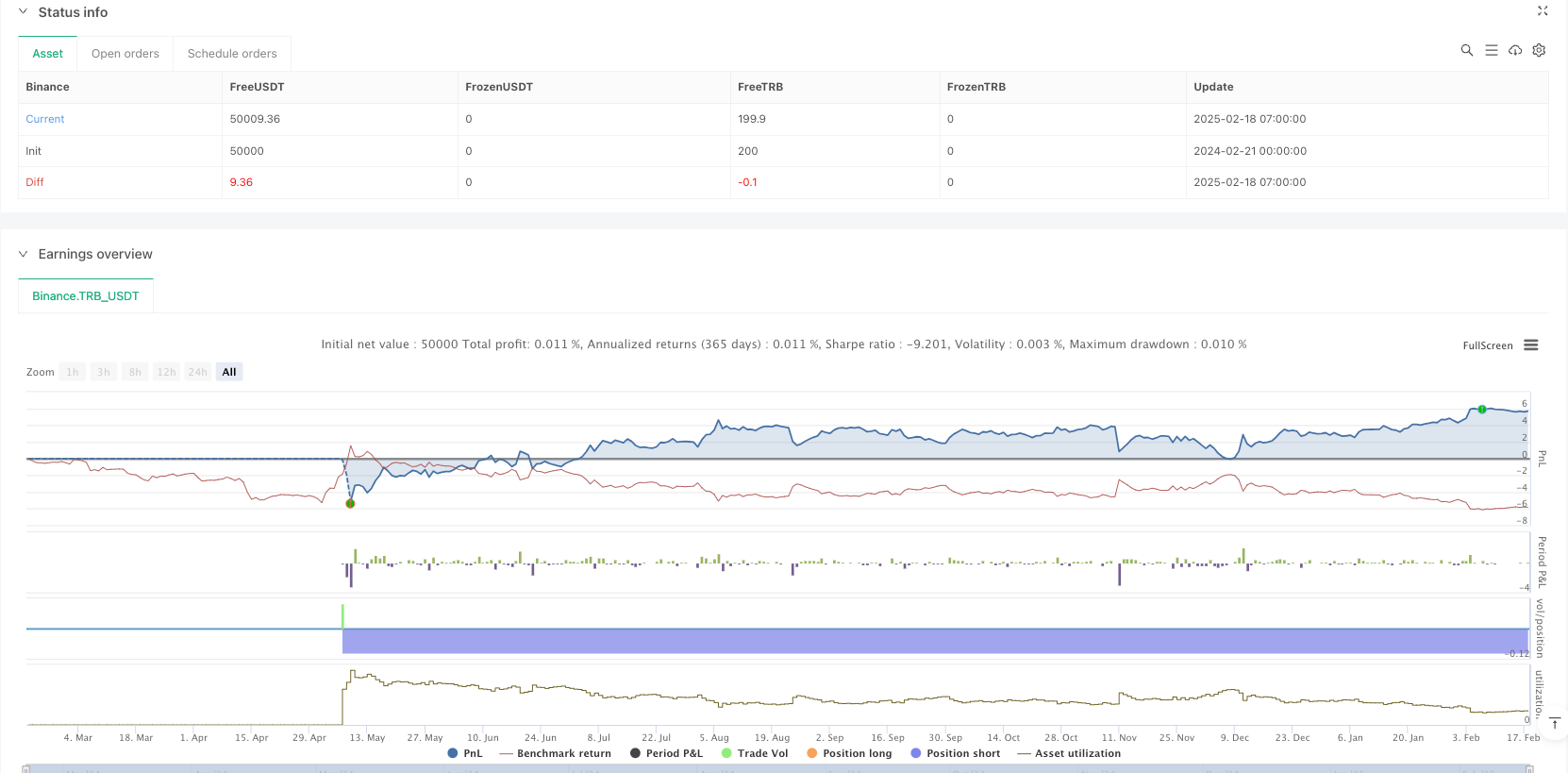

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

strategy("TradingBot Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// Input parameters

lotSize = input.float(0.1, title="Lot Size")

maPeriod = input.int(14, title="MA Period")

rsiPeriod = input.int(14, title="RSI Period")

bbPeriod = input.int(20, title="Bollinger Bands Period")

macdFast = input.int(12, title="MACD Fast EMA")

macdSlow = input.int(26, title="MACD Slow EMA")

macdSignal = input.int(9, title="MACD Signal SMA")

stochK = input.int(14, title="Stochastic %K")

stochD = input.int(3, title="Stochastic %D")

// Indicators

ma = ta.sma(close, maPeriod)

rsi = ta.rsi(close, rsiPeriod)

[bbUpper, bbMiddle, bbLower] = ta.bb(close, bbPeriod, 2)

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

k = ta.stoch(close, high, low, stochK)

d = ta.sma(k, stochD)

// Plot indicators

plot(ma, color=color.blue, title="MA", linewidth=1)

hline(70, "RSI Overbought", color=color.red)

hline(30, "RSI Oversold", color=color.green)

plot(rsi, color=color.purple, title="RSI", linewidth=1)

plot(bbUpper, color=color.orange, title="Bollinger Bands Upper", linewidth=1)

plot(bbMiddle, color=color.gray, title="Bollinger Bands Middle", linewidth=1)

plot(bbLower, color=color.orange, title="Bollinger Bands Lower", linewidth=1)

hline(0, "MACD Zero", color=color.gray)

plot(macdLine, color=color.blue, title="MACD Line", linewidth=1)

plot(signalLine, color=color.red, title="MACD Signal Line", linewidth=1)

hline(80, "Stochastic Overbought", color=color.red)

hline(20, "Stochastic Oversold", color=color.green)

plot(k, color=color.blue, title="Stochastic %K", linewidth=1)

plot(d, color=color.red, title="Stochastic %D", linewidth=1)

// Trading logic

longCondition = rsi < 30 and macdLine > signalLine and k < 20 and close > bbMiddle and close[1] < bbLower

shortCondition = rsi > 70 and macdLine < signalLine and k > 80 and close < bbMiddle and close[1] > bbUpper

if (longCondition)

strategy.entry("Buy", strategy.long, qty=lotSize)

label.new(bar_index, low, text="BUY", style=label.style_label_up, color=color.green, textcolor=color.white, size=size.small, yloc=yloc.belowbar)

if (shortCondition)

strategy.entry("Sell", strategy.short, qty=lotSize)

label.new(bar_index, high, text="SELL", style=label.style_label_down, color=color.red, textcolor=color.white, size=size.small, yloc=yloc.abovebar)

相关推荐