概述

这是一个结合了赫斯特指数(Hurst Exponent)和斐波那契回撤水平的创新型多时间周期交易策略。该策略通过计算不同时间周期的赫斯特指数来评估市场趋势特性,并结合斐波那契关键价格水平来识别潜在的交易机会。策略采用了严格的风险管理框架,包括固定风险比例、目标盈亏比以及每日和总体交易频率限制。

策略原理

策略的核心逻辑基于两个主要组成部分: 1. 通过计算当前和更高时间周期的赫斯特指数来评估市场趋势性质。赫斯特指数大于0.5表示市场具有趋势持续性,小于0.5则表示市场可能存在均值回归特性。 2. 利用每日高低点计算关键的斐波那契回撤水平,重点关注61.8%(黄金分割)和38.2%两个水平。当日线赫斯特指数大于0.5且价格突破61.8%水平时,触发做多信号;当日线赫斯特指数小于0.5且价格跌破38.2%水平时,触发做空信号。

策略优势

- 多维度分析: 通过结合不同时间周期的趋势分析和价格水平,提供更全面的市场视角

- 风险管理完善: 采用固定风险比例(2%)和目标盈亏比(1:2)的风险管理框架

- 交易频率控制: 设置每日最大交易次数和总交易次数限制,避免过度交易

- 可视化辅助: 提供实时的市场趋势背景颜色变化和关键指标信息表格

策略风险

- 市场环境依赖: 在趋势不明显的横盘市场中可能表现欠佳

- 参数敏感性: 赫斯特指数计算周期和斐波那契时间周期的选择会影响策略表现

- 滑点影响: 在流动性较差的市场条件下,可能面临较大的滑点风险

- 系统复杂性: 多个组件的组合增加了策略失效的可能性

策略优化方向

- 动态参数调整: 可以根据市场波动率自动调整赫斯特指数计算周期

- 增加过滤器: 引入额外的市场状态过滤器,提高信号质量

- 优化持仓管理: 实现基于波动率的动态仓位管理

- 改进出场机制: 开发更灵活的盈利目标设置方式

总结

这是一个将技术分析经典工具与现代量化方法相结合的创新策略。通过多时间周期分析和严格的风险管理,策略在保持理论基础的同时也注重实战可行性。虽然存在一定的优化空间,但总体框架具有良好的延展性和实用价值。

策略源码

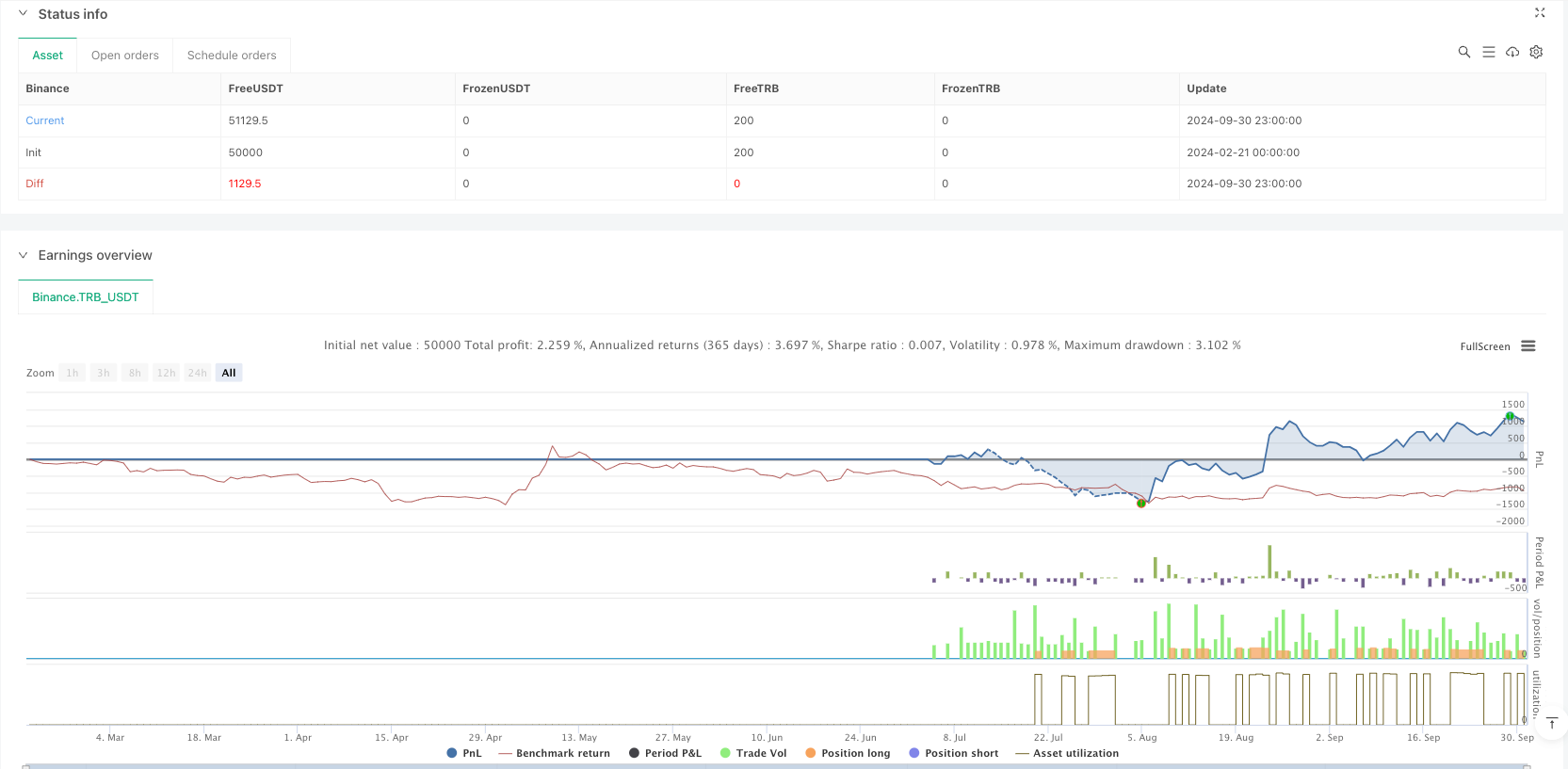

/*backtest

start: 2024-02-21 00:00:00

end: 2024-10-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"TRB_USDT"}]

*/

//@version=5

// Advanced Multi-Timeframe Trading System (Risk Managed)

//

// Description:

// This strategy combines an approximate measure of market trending via a Hurst exponent

// calculation with Fibonacci retracement levels derived from a higher timeframe (default: Daily)

// to identify potential reversal zones and trade opportunities. The Hurst exponent is calculated

// as a rough indicator of market persistence, while the Fibonacci retracement levels provide potential

// support and resistance areas.

//

// Signal Logic:

// - A long entry is signaled when the price crosses above the 61.8% Fibonacci level (Golden Ratio)

// and the daily Hurst exponent is above 0.5 (suggesting a trending market).

// - A short entry is signaled when the price crosses below the 38.2% Fibonacci level and the daily Hurst

// exponent is below 0.5.

//

// Risk Management:

// Each trade is risk-managed with a stop-loss set at 2% below (or above for shorts) the entry price,

// and a take profit order is set to achieve a 1:2 risk-reward ratio. Position sizing is fixed at 10% of

// equity per trade. Additionally, the strategy limits trading to a maximum of 5 trades per day and 510 trades

// overall (for backtesting since 2019) to ensure a realistic number of orders.

//

// Backtesting Parameters:

// - Initial Capital: $10,000

// - Commission: 0.1% per trade

// - Slippage: 1 tick per bar

// - Position Sizing: 10% of equity per trade

//

// Disclaimer:

// Past performance is not indicative of future results. This strategy is experimental and is provided solely

// for educational purposes. Use caution and perform your own testing before any live deployment.

//

// Author: [Your Name]

// Date: [Date]

strategy("Advanced Multi-Timeframe Trading System (Risk Managed)",

overlay=true,

max_bars_back=500,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, // 10% of equity per trade

commission_type=strategy.commission.percent,

commission_value=0.1, // 0.1% commission per trade

slippage=1, // 1 tick per bar

calc_on_order_fills=true,

calc_on_every_tick=true)

// ─── INPUTS ─────────────────────────────────────────────────────────────

hurstLen = input.int(50, title="Hurst Lookback Period", minval=10)

fibTF = input.timeframe("D", title="Fibonacci Retracement Timeframe")

maxTradesPerDay = input.int(5, title="Max Trades Per Day", minval=1)

maxTotalTrades = input.int(510, title="Max Total Trades since 2019", minval=1)

riskPerc = input.float(2.0, title="Risk Percent per Trade (%)", step=0.1) * 0.01 // 2% risk per trade

rrRatio = input.float(2.0, title="Risk-Reward Ratio", step=0.1) // Target profit = 2x risk

// ─── FUNCTION: Approximate Hurst Exponent Calculation ──────────────────────

// This function uses a simple rescaled range method to approximate the Hurst exponent.

// Note: This is an experimental calculation and should be interpreted as a rough gauge of market trending.

calcHurst(src, len) =>

mean = ta.sma(src, len)

dev = src - mean

cumDev = 0.0

for i = 0 to len - 1

cumDev := cumDev + dev[i]

R = ta.highest(cumDev, len) - ta.lowest(cumDev, len)

S = ta.stdev(src, len)

hurst = na(S) or S == 0 ? na : math.log(R / S) / math.log(len)

hurst

// Calculate the Hurst exponent on the current timeframe and from a higher timeframe (daily)

currHurst = calcHurst(close, hurstLen)

dailyHurst = request.security(syminfo.tickerid, "D", calcHurst(close, hurstLen))

// ─── FIBONACCI RETRACEMENT LEVELS (WITH GOLDEN RATIO) ──────────────────────────

// Retrieve the daily high/low from the selected timeframe (default: Daily)

dHigh = request.security(syminfo.tickerid, fibTF, high)

dLow = request.security(syminfo.tickerid, fibTF, low)

// Define Fibonacci levels between the daily low and high.

fib_0 = dLow

fib_100 = dHigh

fib_236 = dLow + 0.236 * (dHigh - dLow)

fib_382 = dLow + 0.382 * (dHigh - dLow)

fib_500 = dLow + 0.5 * (dHigh - dLow)

fib_618 = dLow + 0.618 * (dHigh - dLow) // Golden ratio level

// Plot the Fibonacci levels for reference.

pFib0 = plot(fib_0, color=color.gray, title="Fib 0%")

pFib236 = plot(fib_236, color=color.blue, title="Fib 23.6%")

pFib382 = plot(fib_382, color=color.orange, title="Fib 38.2%")

pFib500 = plot(fib_500, color=color.purple, title="Fib 50%")

pFib618 = plot(fib_618, color=color.green, title="Fib 61.8% (Golden Ratio)")

pFib100 = plot(fib_100, color=color.gray, title="Fib 100%")

// Fill the area between the 61.8% and 38.2% levels to highlight the key retracement zone.

fill(pFib618, pFib382, color=color.new(color.yellow, 80), title="Fibonacci Retracement Zone")

// ─── TRADE COUNT MANAGEMENT ─────────────────────────────────────────────────

// To simulate realistic trading frequency, the strategy limits trades to a maximum of 5 per day and 510 overall.

var int tradesToday = 0

var int globalTradeCount = 0

// Reset the daily trade counter at the start of a new day.

newDay = ta.change(time("D"))

if newDay

tradesToday := 0

// Allow new trades only if within the daily and overall trade limits.

canTrade = (tradesToday < maxTradesPerDay) and (globalTradeCount < maxTotalTrades)

// ─── TRADING SIGNALS ─────────────────────────────────────────────────────────

// Entry conditions based on Fibonacci levels and daily Hurst conditions:

// • Long: Price crosses above the 61.8% (Golden Ratio) level and daily Hurst > 0.5.

// • Short: Price crosses below the 38.2% level and daily Hurst < 0.5.

longCond = ta.crossover(close, fib_618) and (dailyHurst > 0.5)

shortCond = ta.crossunder(close, fib_382) and (dailyHurst < 0.5)

if longCond and canTrade

strategy.entry("Long", strategy.long)

tradesToday := tradesToday + 1

globalTradeCount := globalTradeCount + 1

if shortCond and canTrade

strategy.entry("Short", strategy.short)

tradesToday := tradesToday + 1

globalTradeCount := globalTradeCount + 1

// ─── RISK MANAGEMENT: STOP-LOSS & TAKE-PROFIT ──────────────────────────────

// For active positions, define stop-loss and take profit levels based on the entry price.

// This ensures that each trade risks approximately 2% of the entry price with a target

// of 2x the risk (1:2 risk-reward ratio).

if strategy.position_size > 0

longStop = strategy.position_avg_price * (1 - riskPerc)

longTarget = strategy.position_avg_price * (1 + rrRatio * riskPerc)

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTarget)

if strategy.position_size < 0

shortStop = strategy.position_avg_price * (1 + riskPerc)

shortTarget = strategy.position_avg_price * (1 - rrRatio * riskPerc)

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTarget)

// ─── CHART OVERLAYS & VISUAL AIDS ────────────────────────────────────────────

// Background color indicates the daily market trend:

// Green for trending conditions (dailyHurst > 0.5) and red for less trending conditions.

bgcolor(dailyHurst > 0.5 ? color.new(color.green, 90) : color.new(color.red, 90), title="Daily Trend Background")

// Display an information table in the top-right corner to help interpret key values.

var table infoTable = table.new(position.top_right, 2, 4, border_width=1, frame_color=color.gray)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Hurst", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 0, str.tostring(currHurst, "#.###"), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 1, "Daily Hurst", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 1, str.tostring(dailyHurst, "#.###"), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 2, "Trades Today", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 2, str.tostring(tradesToday), text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 0, 3, "Global Trades", text_color=color.white, bgcolor=color.black)

table.cell(infoTable, 1, 3, str.tostring(globalTradeCount), text_color=color.white, bgcolor=color.black)

// Optional: Add labels on the final bar to mark the key Fibonacci levels.

if barstate.islast

label.new(bar_index, fib_618, "61.8% (Golden Ratio)", style=label.style_label_left, color=color.green, textcolor=color.white, size=size.tiny)

label.new(bar_index, fib_382, "38.2%", style=label.style_label_left, color=color.orange, textcolor=color.white, size=size.tiny)

相关推荐