多层级RSI交叉回归增仓策略

RSI POSITION_SIZE PYRAMIDING

创建日期:

2025-02-20 17:33:36

最后修改:

2025-02-27 17:21:37

复制:

2

点击次数:

404

概述

该策略是一个基于相对强弱指标(RSI)的自动化交易系统,主要通过识别市场超卖条件来捕捉潜在的反弹机会。策略采用递进式建仓方式,在RSI低位交叉时逐步建立多个仓位,并通过设定盈利目标进行风险控制。系统设计了灵活的资金管理机制,每次交易使用账户总额的6.6%进行操作,最多允许15次金字塔式加仓。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 入场信号:当14周期RSI指标下穿28.5的超卖水平时触发买入信号 2. 仓位管理:单次建仓使用账户权益的6.6%,最多允许15次递进建仓 3. 获利了结:当价格达到建仓均价900%的涨幅时,平掉50%的持仓 4. 可视化展示:在图表上标注买卖信号、RSI曲线、入场价格和目标价格 策略通过观察RSI指标在超卖区域的表现来判断市场走势,当出现超卖信号时逐步建仓,以降低建仓成本。

策略优势

- 系统化建仓:通过预设的RSI参数自动识别交易机会,避免人为判断带来的主观偏差

- 风险分散:采用递进式建仓方式,在不同价位建立多个仓位,有效分散风险

- 灵活适应:策略参数可根据不同市场环境和个人风险偏好进行调整

- 收益保护:设置了明确的获利目标,在达到目标时自动减仓,锁定部分收益

- 资金效率:通过合理的仓位控制和加仓机制,提高资金使用效率

策略风险

- 趋势风险:在强势下跌趋势中可能频繁触发建仓信号,导致资金损失

- 参数敏感:RSI参数、建仓比例等设置不当可能影响策略表现

- 市场流动性:在流动性不足的市场中,可能难以按目标价格完成交易

- 资金管理:过度加仓可能导致风险敞口过大 解决方案:

- 增加趋势过滤器,在明确的下跌趋势中暂停建仓

- 通过回测优化参数设置

- 设置最大回撤限制

- 动态调整加仓阈值

策略优化方向

- 动态参数:根据市场波动率自动调整RSI参数和建仓条件

- 止损机制:增加移动止损功能,更好地控制风险

- 市场过滤:加入成交量、趋势等过滤条件,提高信号质量

- 出场优化:设计更灵活的获利了结机制,如分段减仓

- 风险控制:增加最大回撤限制和风险敞口控制

总结

该策略通过RSI指标识别超卖机会,结合金字塔式加仓和固定比例获利了结,构建了一个完整的交易系统。策略的优势在于系统化操作和风险分散,但需要注意市场趋势和参数设置对策略表现的影响。通过增加动态参数调整、止损机制和市场过滤等优化措施,可以进一步提升策略的稳定性和盈利能力。

策略源码

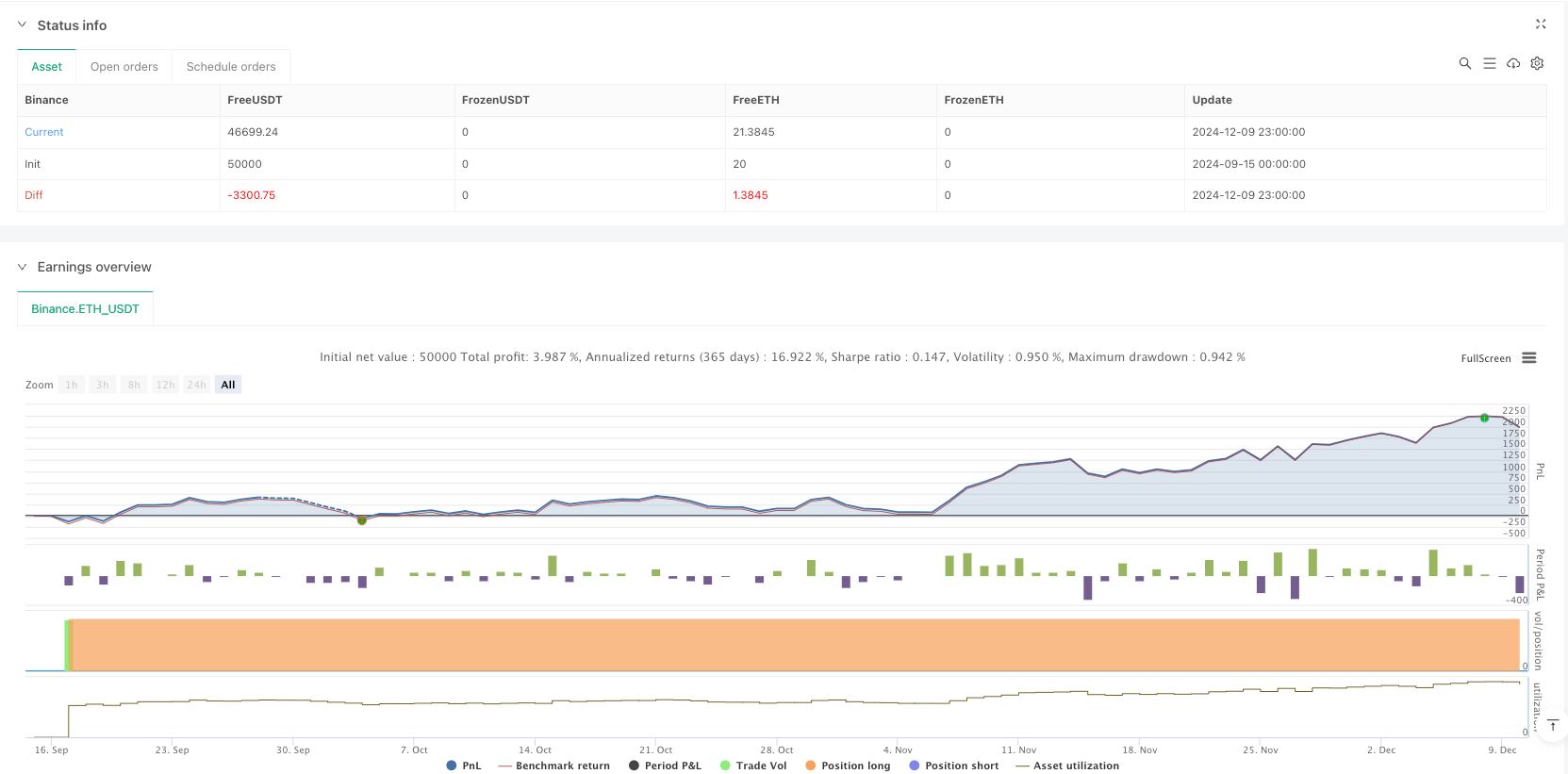

/*backtest

start: 2024-09-15 00:00:00

end: 2024-12-10 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("RSI Cross Under Strategy", overlay=true, initial_capital=1500, default_qty_type=strategy.percent_of_equity, default_qty_value=6.6)

// Input parameters

rsiLength = input(14, "RSI Length")

rsiOversold = input(28.5, "RSI Oversold Level")

profitTarget = input(900, "Profit Target (%)")

maxPyramiding = input(15, "Max Pyramiding")

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Detect RSI crossunder

rsiCrossunder = ta.crossunder(rsi, rsiOversold)

// Calculate the profit target price

entryPrice = strategy.position_avg_price

targetPrice = entryPrice * (1 + profitTarget / 100)

// Buy condition

if (rsiCrossunder and strategy.position_size <= maxPyramiding * strategy.equity * 0.066)

strategy.entry("Buy", strategy.long)

// Take profit condition

if (strategy.position_size > 0 and high >= targetPrice)

strategy.close("Buy", qty_percent = 50)

// Plot buy signals

plotshape(rsiCrossunder, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Plot sell signals (when position is partially closed)

plotshape(strategy.position_size > 0 and high >= targetPrice, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Plot RSI

plot(rsi, "RSI", color=color.blue, linewidth=2)

hline(rsiOversold, "RSI Oversold", color=color.red, linestyle=hline.style_dashed)

// Plot entry and target prices

plot(strategy.position_size > 0 ? entryPrice : na, "Entry Price", color=color.green, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size > 0 ? targetPrice : na, "Target Price", color=color.red, linewidth=2, style=plot.style_linebr)

// Display strategy information

var table infoTable = table.new(position.top_right, 3, 6, border_width=1)

table.cell(infoTable, 0, 0, "Strategy Info", bgcolor=color.blue, text_color=color.white)

table.cell(infoTable, 0, 1, "RSI Length: " + str.tostring(rsiLength))

table.cell(infoTable, 0, 2, "RSI Oversold: " + str.tostring(rsiOversold))

table.cell(infoTable, 0, 3, "Profit Target: " + str.tostring(profitTarget) + "%")

table.cell(infoTable, 0, 4, "Order Size: 6.6% of total")

table.cell(infoTable, 0, 5, "Max Pyramiding: " + str.tostring(maxPyramiding) + " times")

相关推荐