概述

该策略是一个基于MACD柱状图动量背离的趋势反转交易系统。它通过分析K线形态变化与MACD柱状图的动量变化之间的关系来捕捉市场反转信号。策略的核心思想是在市场出现动量衰减迹象时进行反向交易,从而在趋势即将反转时提前布局。

策略原理

策略的交易逻辑分为做空和做多两个方向: 做空条件:当出现较大的阳线(收盘价高于开盘价),且其实体大于前一根K线,同时MACD柱状图连续3个周期呈现下降趋势时,表明上涨动能在减弱,系统发出做空信号。 做多条件:当出现较大的阴线(收盘价低于开盘价),且其实体大于前一根K线,同时MACD柱状图连续3个周期呈现上升趋势时,表明下跌动能在减弱,系统发出做多信号。 持仓管理采用对手信号平仓机制,即当出现相反方向的交易信号时,平掉当前持仓。策略不设置止损和止盈,完全依靠信号来管理仓位。

策略优势

- 信号明确:策略同时考虑了K线形态和技术指标,提供了更可靠的交易信号。

- 反转捕捉:通过监测动量变化,能够较早发现市场转折点。

- 风险可控:采用对手信号平仓机制,避免了在趋势转变时继续持有不利头寸。

- 操作简单:交易规则清晰,容易执行和回测。

- 适应性强:策略可以应用于不同的市场和时间周期。

策略风险

- 假突破风险:市场可能出现假突破,导致错误信号。

- 震荡市风险:在横盘震荡市场中,频繁的趋势转换可能导致连续止损。

- 滑点风险:大额交易在流动性不足时可能面临显著滑点。

- 过度交易风险:信号较为频繁,可能产生较高交易成本。

- 市场环境依赖:策略在trending市场表现较好,但在其他市场环境中效果可能不佳。

策略优化方向

- 引入趋势过滤器:增加趋势判断指标,如均线系统,以过滤震荡市中的虚假信号。

- 优化止损机制:设置合理的止损位置,控制单笔风险。

- 完善止盈机制:根据市场波动性动态调整获利了结点位。

- 增加交易过滤条件:如成交量确认、波动率过滤等,提高信号质量。

- 优化仓位管理:引入动态仓位管理机制,根据市场状况调整持仓比例。

总结

该策略通过结合K线形态和MACD柱状图动量变化来捕捉市场反转机会,具有操作简单、信号明确的特点。虽然存在一定的风险,但通过合理的优化和风险管理措施,可以显著提升策略的稳定性和盈利能力。策略特别适合趋势明显的市场环境,可以作为交易系统的重要组成部分。

策略源码

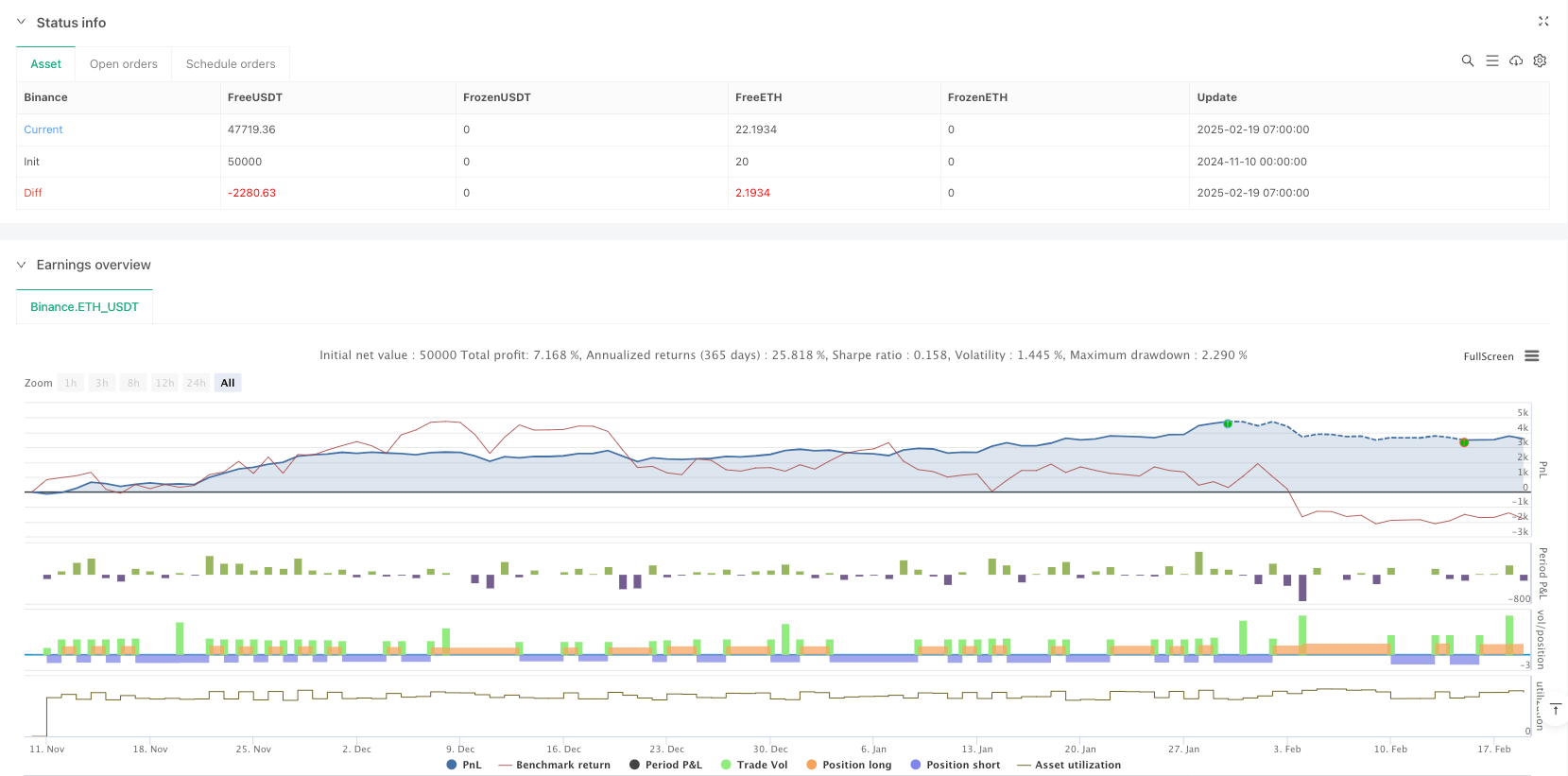

/*backtest

start: 2024-11-10 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("MACD Momentum Reversal Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === MACD Calculation ===

fastLength = input.int(12, "MACD Fast Length")

slowLength = input.int(26, "MACD Slow Length")

signalLength = input.int(9, "MACD Signal Length")

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

// === Candle Properties ===

bodySize = math.abs(close - open)

prevBodySize = math.abs(close[1] - open[1])

candleBigger = bodySize > prevBodySize

bullishCandle = close > open

bearishCandle = close < open

// === MACD Momentum Conditions ===

// For bullish candles: if the MACD histogram (normally positive) is decreasing over the last 3 bars,

// then the bullish momentum is fading – a potential short signal.

macdLossBullish = (histLine[2] > histLine[1]) and (histLine[1] > histLine[0])

// For bearish candles: if the MACD histogram (normally negative) is increasing (moving closer to zero)

// over the last 3 bars, then the bearish momentum is fading – a potential long signal.

macdLossBearish = (histLine[2] < histLine[1]) and (histLine[1] < histLine[0])

// === Entry Conditions ===

// Short entry: Occurs when the current candle is bullish and larger than the previous candle,

// while the MACD histogram shows fading bullish momentum.

enterShort = bullishCandle and candleBigger and macdLossBullish

// Long entry: Occurs when the current candle is bearish and larger than the previous candle,

// while the MACD histogram shows fading bearish momentum.

enterLong = bearishCandle and candleBigger and macdLossBearish

// === Plot the MACD Histogram for Reference ===

plot(histLine, title="MACD Histogram", color=color.blue, style=plot.style_histogram)

// === Strategy Execution ===

// Enter positions based on conditions. There is no stop loss or take profit defined;

// positions remain open until an opposite signal occurs.

if (enterShort)

strategy.entry("Short", strategy.short)

if (enterLong)

strategy.entry("Long", strategy.long)

// Exit conditions: close an existing position when the opposite signal appears.

if (strategy.position_size > 0 and enterShort)

strategy.close("Long")

if (strategy.position_size < 0 and enterLong)

strategy.close("Short")

相关推荐