概述

该策略是一个基于MACD指标和移动平均线的多时区交易系统。它结合了1分钟和3分钟两个时间周期的MACD指标,同时使用200周期EMA作为趋势过滤器,通过捕捉市场趋势的持续性来进行交易。策略包含了风险管理机制,包括止损设置和移动到保本点的动态调整功能。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用1分钟和3分钟两个时间周期的MACD指标来确认趋势的持续性 2. 通过200周期EMA作为主要趋势判断依据 3. 结合价格与均线位置关系来过滤交易信号 4. 在交易时段过滤器的基础上进行交易

具体的交易信号生成规则如下: - 多头信号: MACD线在零线以上且向上穿越信号线,同时3分钟MACD确认趋势,价格在EMA200之上 - 空头信号: MACD线在零线以下且向下穿越信号线,同时3分钟MACD确认趋势,价格在EMA200之下

策略优势

- 多重时间周期确认提高了交易的准确性

- 结合趋势过滤器减少了假信号

- 包含了完善的风险控制机制

- 使用时间过滤器避免了非活跃时段的交易

- 动态的保本点调整保护了已获得的利润

- 策略逻辑清晰,便于调整和优化

策略风险

- 在高波动市场中可能面临滑点风险

- 多重确认机制可能导致错过部分交易机会

- 固定的止损点位可能在某些市场环境下不够灵活

- 需要考虑交易成本对策略收益的影响

- 在剧烈波动的市场中可能面临较大回撤

风险控制建议: - 根据市场波动调整止损距离 - 考虑增加利润目标来确保盈利 - 在重要经济数据公布期间暂停交易 - 定期评估和调整策略参数

策略优化方向

- 动态调整MACD参数:

- 根据市场波动率自适应调整

- 考虑使用自适应移动平均线

- 改进时间过滤器:

- 细化交易时段划分

- 结合成交量分析优化交易时间

- 优化止损机制:

- 引入动态止损

- 基于ATR设置止损距离

- 增强趋势过滤:

- 添加更多技术指标确认

- 考虑引入价格行为分析

总结

该策略通过多时间周期MACD指标和EMA趋势过滤器的结合,构建了一个相对完善的交易系统。它的优势在于多重确认机制和风险管理的完整性,但同时也需要注意在不同市场环境下的适应性问题。通过建议的优化方向,策略有望在保持其稳定性的同时进一步提高收益能力。

策略源码

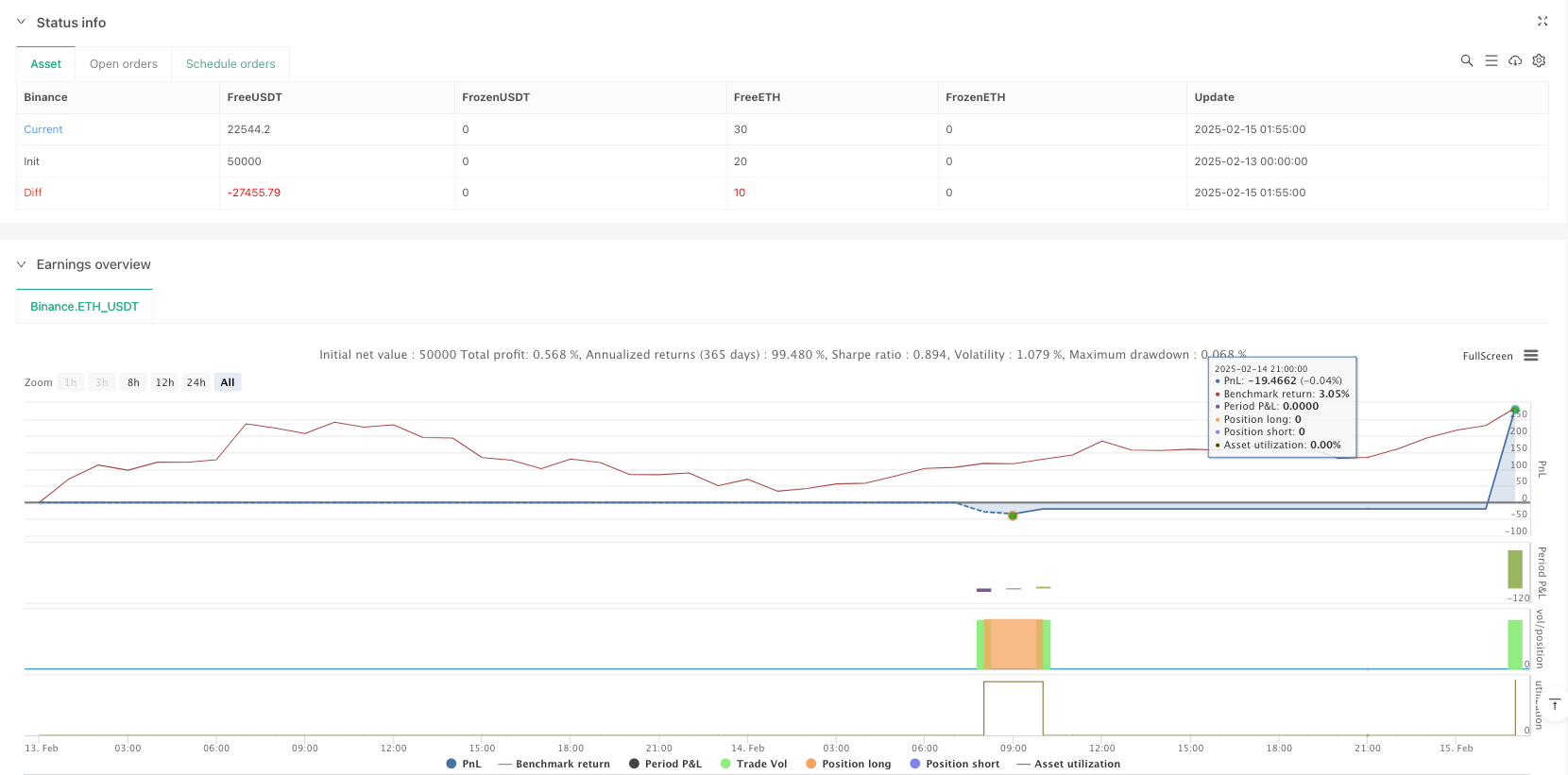

/*backtest

start: 2025-02-13 00:00:00

end: 2025-02-15 02:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("NQ MACD Continuation Backtest", overlay=true)

// MACD Settings

fastLength = 12

slowLength = 26

signalLength = 9

// 1-minute MACD

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// 3-minute MACD for trend filter

[htfMacd, htfSignal, _] = request.security(syminfo.tickerid, "3", ta.macd(close, fastLength, slowLength, signalLength), lookahead=barmerge.lookahead_on)

// 200 EMA

ema200 = ta.ema(close, 200)

// Time Filters

inSession = (hour(time, "America/New_York") >= 9 and (hour(time, "America/New_York") > 9 or minute(time, "America/New_York") >= 45)) and (hour(time, "America/New_York") < 22 or (hour(time, "America/New_York") == 22 and minute(time, "America/New_York") == 30))

notRestricted = (hour(time, "America/New_York") >= 6 and hour(time, "America/New_York") < 22)

// Track Previous MACD Crosses

var bool bullishCrossed = false

var bool bearishCrossed = false

if (ta.crossover(macdLine, signalLine) and macdLine > 0)

bullishCrossed := true

if (ta.crossunder(macdLine, signalLine) and macdLine < 0)

bearishCrossed := true

// Define Continuation Signals with EMA and 3-Min MACD Filter

bullishContinuation = (ta.crossover(macdLine, signalLine) and macdLine > 0 and signalLine > 0 and htfMacd > htfSignal and bullishCrossed and close > ema200)

bearishContinuation = (ta.crossunder(macdLine, signalLine) and macdLine < 0 and signalLine < 0 and htfMacd < htfSignal and bearishCrossed and close < ema200)

// Entry Conditions with SL and 10 Contracts

if (bullishContinuation and inSession and notRestricted)

strategy.entry("Long", strategy.long, qty=10, stop=close - 7 * syminfo.mintick)

if (bearishContinuation and inSession and notRestricted)

strategy.entry("Short", strategy.short, qty=10, stop=close + 7 * syminfo.mintick)

// Break-Even Adjustment

if (strategy.position_size > 0 and close >= strategy.position_avg_price + 5 * syminfo.mintick)

strategy.exit("BreakEvenLong", from_entry="Long", stop=strategy.position_avg_price)

if (strategy.position_size < 0 and close <= strategy.position_avg_price - 5 * syminfo.mintick)

strategy.exit("BreakEvenShort", from_entry="Short", stop=strategy.position_avg_price)

// Display Indicators on Chart

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

plot(ema200, color=color.red, title="200 EMA")

相关推荐