概述

该策略是一个结合了多个技术指标的趋势跟踪交易系统。它通过MACD捕捉趋势动量,使用RSI和StochRSI确认超买超卖状态,并利用成交量指标验证交易信号的有效性。策略采用了动态的成交量阈值机制,确保只在市场活跃度充足时执行交易。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. MACD指标用于识别价格趋势和动量变化,通过快线与慢线的交叉产生初始交易信号 2. RSI指标作为趋势确认工具,帮助判断市场是否处于强势(>50)或弱势(<50)状态 3. StochRSI通过对RSI进行随机指标计算,提供更敏感的市场动量信息 4. 成交量验证机制要求交易发生时的成交量必须高于14周期平均成交量的1.5倍

系统在满足以下条件时开仓做多: - MACD快线上穿慢线 - RSI位于50以上 - StochRSI的K线上穿D线 - 当前成交量高于阈值

系统在满足以下条件时开仓做空: - MACD快线下穿慢线 - RSI位于50以下 - StochRSI的K线下穿D线 - 当前成交量高于阈值

策略优势

- 多重技术指标的结合提供了更可靠的交易信号,降低了虚假信号的风险

- 成交量确认机制有效过滤了市场流动性不足的交易机会

- 策略参数可调节性强,便于根据不同市场环境进行优化

- 趋势跟踪与动量策略的结合,既能捕捉大趋势,又不错过短期机会

- 入场逻辑清晰,便于执行和回测验证

策略风险

- 多重指标过滤可能导致错过部分潜在的交易机会

- 在震荡市场中可能产生频繁的假突破信号

- 未设置止损和止盈机制,增加了资金管理的风险

- 依赖历史成交量作为参考,在异常行情下可能失效

- 多个技术指标的滞后性叠加可能导致入场时机偏后

风险控制建议: - 添加止损止盈机制 - 引入趋势过滤器 - 优化指标参数组合 - 设置最大持仓时间限制 - 实施分批建仓策略

策略优化方向

- 引入自适应的参数优化机制,使策略能够根据市场状态自动调整指标参数

- 增加市场波动率过滤器,在不同波动环境下采用不同的交易规则

- 完善资金管理系统,加入动态仓位管理和风险控制机制

- 开发智能过滤算法,减少震荡市场中的假信号

- 整合市场情绪指标,提高交易信号的准确性

总结

该策略通过多个技术指标的协同配合,构建了一个相对完整的交易系统。成交量确认机制的加入提高了交易信号的可靠性,但系统仍需要在风险控制和参数优化方面进行完善。策略的核心优势在于其逻辑清晰、可调节性强,适合作为基础框架进行进一步的优化和扩展。建议交易者在实盘使用前,充分进行历史数据回测和参数敏感性分析,并根据具体市场环境和个人风险偏好进行相应调整。

策略源码

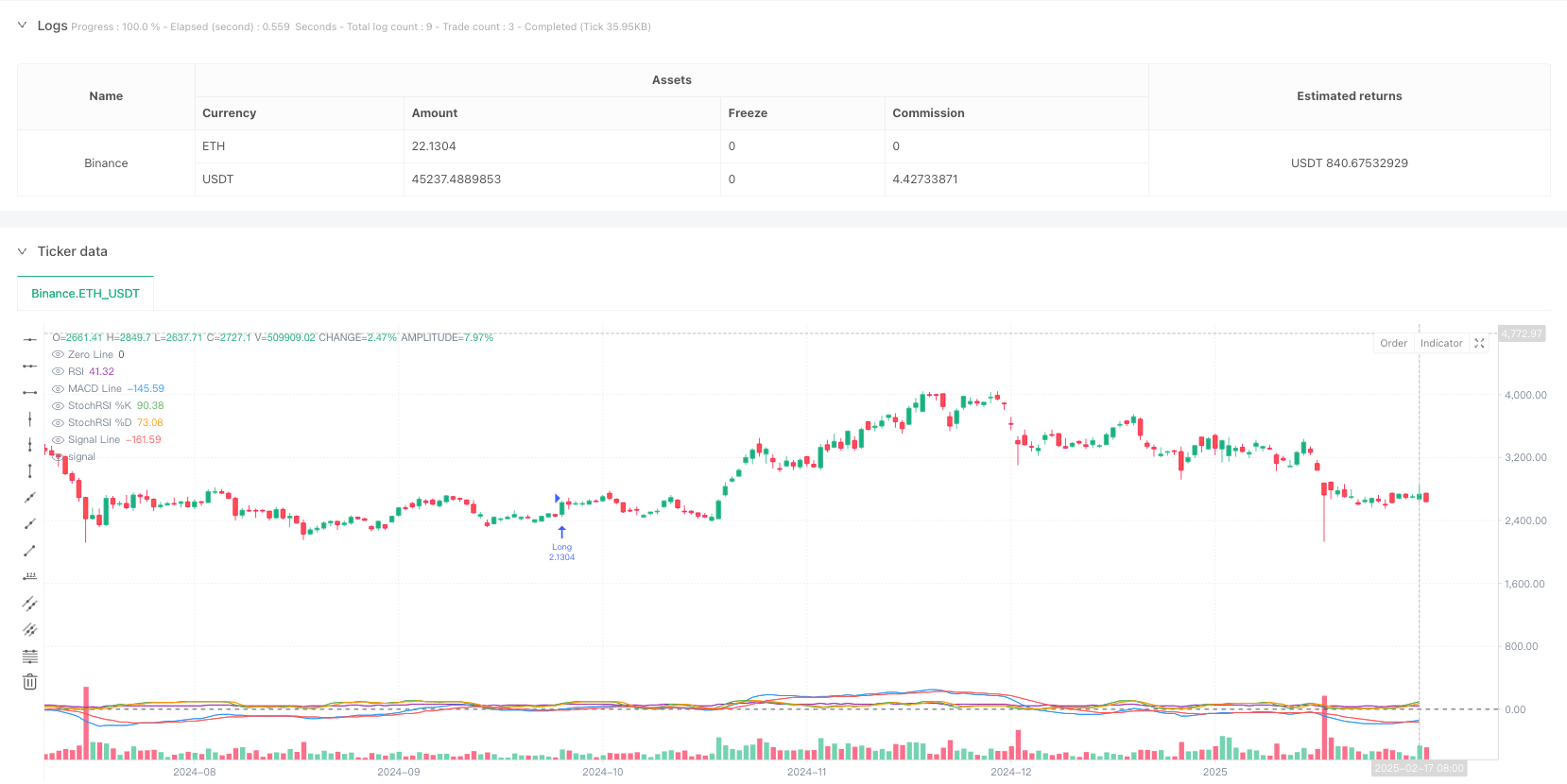

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("BTCUSDT Strategy with Volume, MACD, RSI, StochRSI", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

rsiLength = input.int(14, title="RSI Length")

stochRsiLength = input.int(14, title="StochRSI Length")

stochRsiSmoothing = input.int(3, title="StochRSI Smoothing")

stochRsiK = input.int(3, title="StochRSI %K")

stochRsiD = input.int(3, title="StochRSI %D")

volumeThreshold = input.float(1.5, title="Volume Threshold (Multiplier of Average Volume)")

// Calculate indicators

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

rsi = ta.rsi(close, rsiLength)

stochRsi = ta.stoch(rsi, rsi, rsi, stochRsiLength)

stochRsiKSmoothed = ta.sma(stochRsi, stochRsiK)

stochRsiDSmoothed = ta.sma(stochRsiKSmoothed, stochRsiD)

averageVolume = ta.sma(volume, 14)

volumeSpike = volume > averageVolume * volumeThreshold

// Entry conditions

longCondition = ta.crossover(macdLine, signalLine) and rsi > 50 and stochRsiKSmoothed > stochRsiDSmoothed and volumeSpike

shortCondition = ta.crossunder(macdLine, signalLine) and rsi < 50 and stochRsiKSmoothed < stochRsiDSmoothed and volumeSpike

// Execute trades

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Plot indicators for visualization

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.red, title="Signal Line")

hline(0, "Zero Line", color=color.black)

plot(rsi, color=color.purple, title="RSI")

plot(stochRsiKSmoothed, color=color.green, title="StochRSI %K")

plot(stochRsiDSmoothed, color=color.orange, title="StochRSI %D")

相关推荐