概述

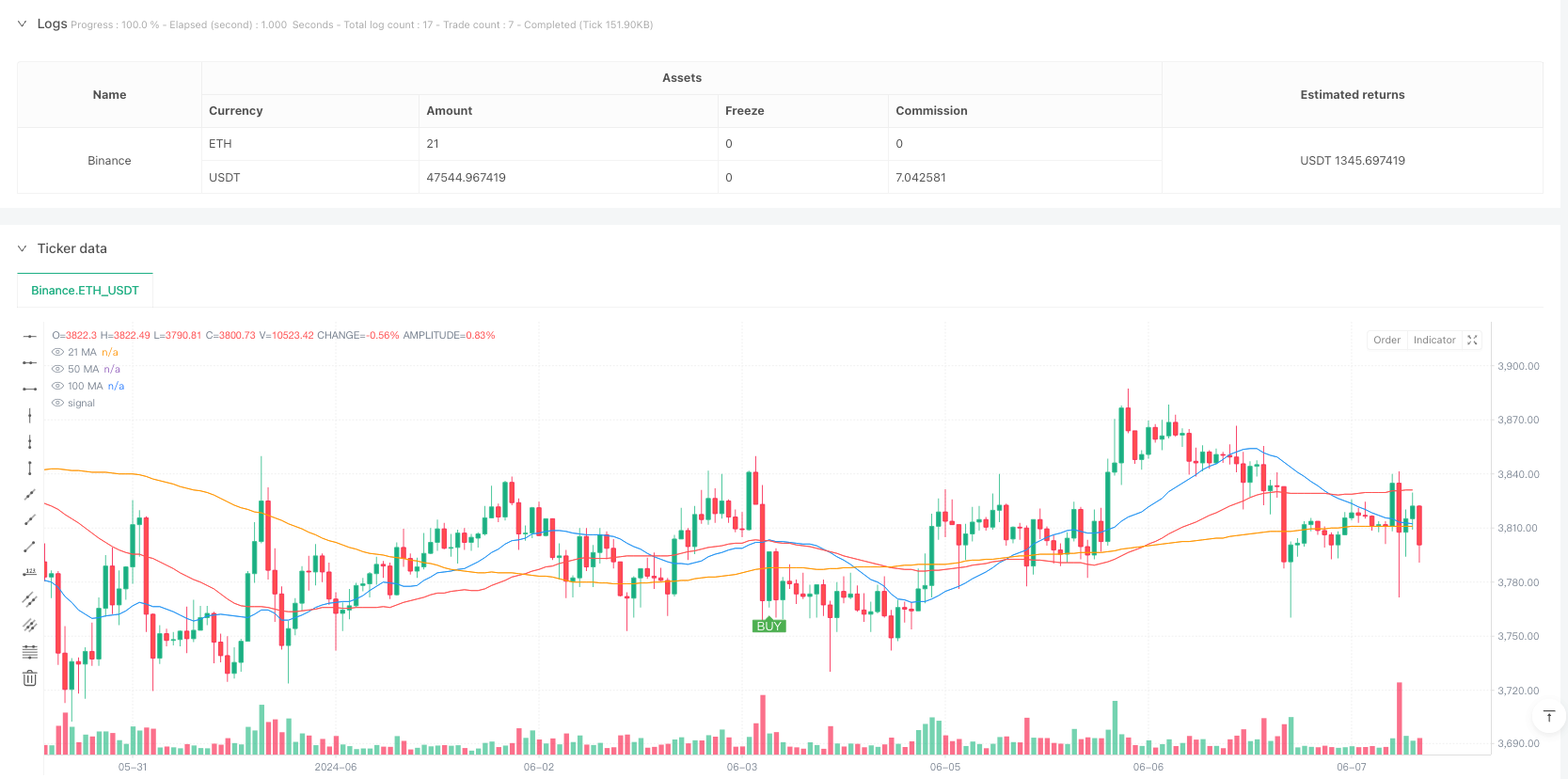

这是一个基于三条简单移动平均线(SMA)的趋势跟踪策略。该策略利用21、50和100周期移动平均线的交叉和位置关系来识别市场趋势,并在合适的时机进行交易。策略主要在5分钟时间框架上运行,同时建议参考30分钟图表进行趋势确认。

策略原理

策略使用三重过滤机制来确定交易信号: 1. 使用21周期均线作为快速均线,用于捕捉短期价格变动 2. 使用50周期均线作为中期均线,与快速均线形成交叉信号 3. 使用100周期均线作为趋势过滤器,确保交易方向与主趋势一致

买入条件需同时满足: - 21均线向上穿越50均线 - 21均线和50均线都位于100均线之上

卖出条件需同时满足: - 21均线向下穿越50均线 - 21均线和50均线都位于100均线之下

策略优势

- 多重确认机制降低虚假信号

- 趋势过滤提高交易成功率

- 清晰的进场和出场规则

- 可在多个时间框架上使用

- 风险回报比设定为1:2,有利于长期盈利

- 策略逻辑简单,易于理解和执行

策略风险

- 震荡市场可能产生频繁交易

- 均线滞后性可能导致入场和出场延迟

- 快速反转行情可能造成较大损失

- 不同市场环境需要调整参数

风险控制建议: - 设置止损位于最近的重要低点下方 - 结合更大时间周期确认趋势 - 避免在横盘震荡市场交易 - 定期评估和优化策略参数

策略优化方向

- 引入成交量指标确认趋势强度

- 增加动态止损机制

- 添加趋势强度过滤器

- 优化参数自适应机制

- 结合其他技术指标进行信号确认

- 增加市场波动率过滤器

总结

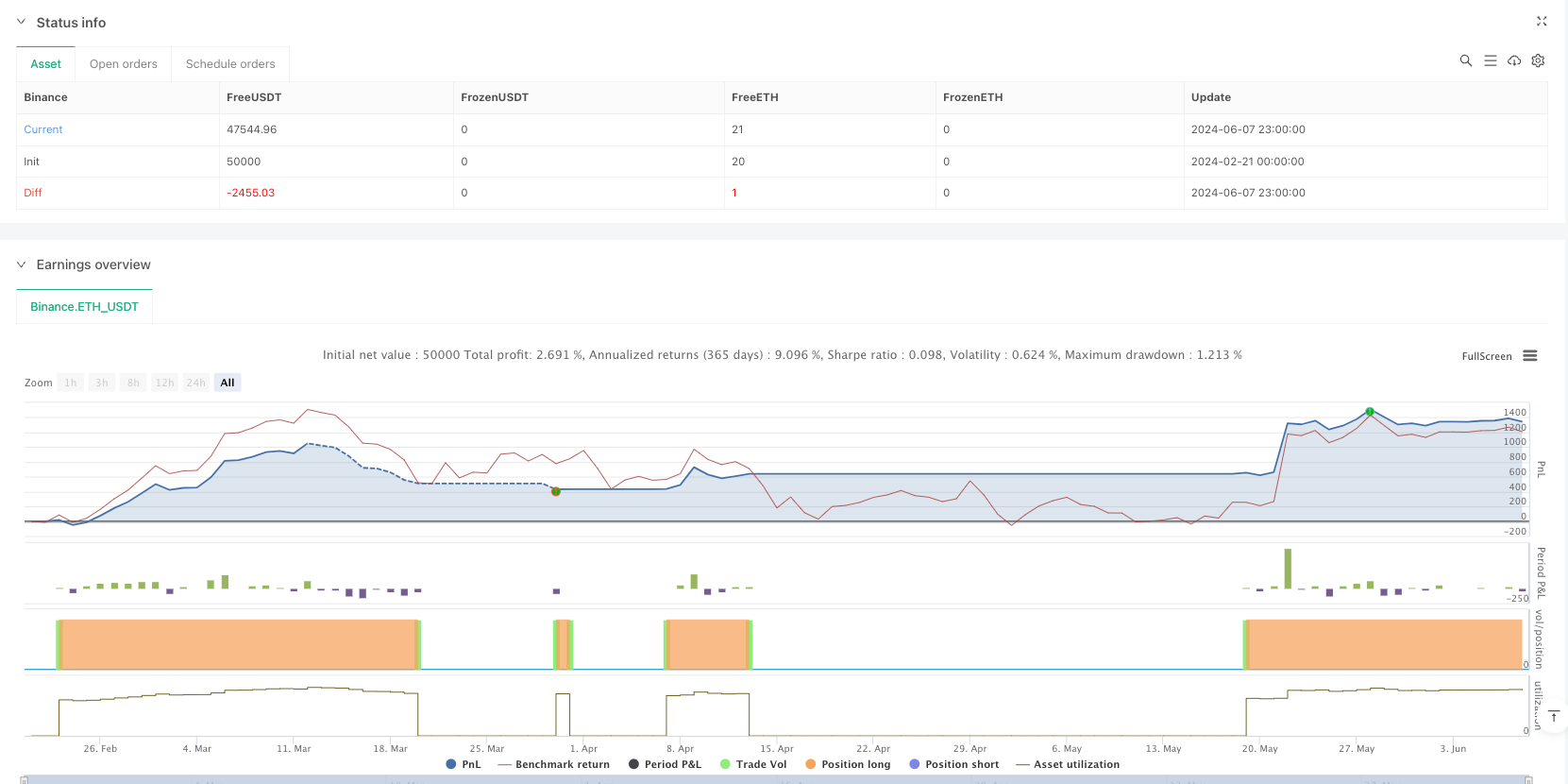

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过三重均线过滤和趋势确认机制,能够有效降低虚假信号,提高交易成功率。策略具有良好的可扩展性,可以根据不同市场环境进行优化调整。建议在实盘交易前进行充分的回测和参数优化。

策略源码

/*backtest

start: 2024-02-21 00:00:00

end: 2024-06-08 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Vezpa

//@version=5

strategy("Vezpa's Gold Strategy", overlay=true)

// ======================== MAIN STRATEGY ========================

// Input parameters for the main strategy

fast_length = input.int(21, title="Fast MA Length", minval=1)

slow_length = input.int(50, title="Slow MA Length", minval=1)

trend_filter_length = input.int(100, title="Trend Filter MA Length", minval=1)

// Calculate moving averages for the main strategy

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

trend_ma = ta.sma(close, trend_filter_length)

// Plot moving averages

plot(fast_ma, color=color.blue, title="21 MA")

plot(slow_ma, color=color.red, title="50 MA")

plot(trend_ma, color=color.orange, title="100 MA")

// Buy condition: 21 MA crosses above 50 MA AND both are above the 100 MA

if (ta.crossover(fast_ma, slow_ma) and fast_ma > trend_ma and slow_ma > trend_ma)

strategy.entry("Buy", strategy.long)

// Sell condition: 21 MA crosses below 50 MA AND both are below the 100 MA

if (ta.crossunder(fast_ma, slow_ma) and fast_ma < trend_ma and slow_ma < trend_ma)

strategy.close("Buy")

// Plot buy signals as green balloons

plotshape(series=ta.crossover(fast_ma, slow_ma) and fast_ma > trend_ma and slow_ma > trend_ma,

title="Buy Signal",

location=location.belowbar,

color=color.green,

style=shape.labelup,

text="BUY",

textcolor=color.white,

size=size.small,

transp=0)

// Plot sell signals as red balloons

plotshape(series=ta.crossunder(fast_ma, slow_ma) and fast_ma < trend_ma and slow_ma < trend_ma,

title="Sell Signal",

location=location.abovebar,

color=color.red,

style=shape.labeldown,

text="SELL",

textcolor=color.white,

size=size.small,

transp=0)

相关推荐