概述

这是一个基于支撑位和趋势EMA的多头策略。策略通过识别市场趋势和关键支撑位来寻找最佳入场机会,结合ATR动态止损和分段获利来实现风险管理。该策略主要关注价格在上升趋势中回调到支撑位的情况,通过设定合理的风险回报比来提高交易的成功率。

策略原理

策略使用100周期EMA作为趋势判断指标,当价格位于EMA之上时确认上升趋势。同时计算10个周期的最低价作为短期支撑位,当价格回调到支撑位附近(支撑位+0.5*ATR)时寻找入场机会。入场后采用分段获利方式,在5倍ATR处获利了结50%仓位,剩余仓位在10倍ATR处完全了结,同时设置1倍ATR作为动态止损。每笔交易风险控制在账户总值的3%以内,通过动态计算仓位大小来实现风险管理。

策略优势

- 趋势跟随特性:通过EMA判断趋势,避免逆势交易

- 动态支撑位:使用最近10周期低点作为支撑,能更好地反映市场当前状态

- 灵活的风险管理:基于ATR的动态止损和获利目标,适应市场波动

- 分段获利机制:在不同价格水平分批了结,既保证盈利又不错过大行情

- 精确的仓位控制:根据止损距离动态计算仓位,实现风险的量化管理

策略风险

- 假突破风险:支撑位附近可能出现假突破,建议增加确认指标

- 趋势反转风险:EMA指标存在滞后性,在趋势转折点容易造成损失

- 过度交易风险:频繁的支撑位触发可能导致过度交易

- 滑点风险:在剧烈波动时可能面临较大滑点 解决方案:

- 增加趋势确认指标

- 优化入场条件

- 设置交易间隔限制

- 调整止损范围

策略优化方向

- 多维度趋势判断:结合多个时间周期的趋势指标,提高趋势判断准确性

- 入场条件优化:增加成交量、波动率等辅助指标作为入场过滤条件

- 动态参数优化:根据市场状态自适应调整各项参数

- 增加市场情绪指标:引入VIX等市场情绪指标,优化交易时机

- 完善止盈机制:根据市场波动情况动态调整获利目标

总结

该策略通过结合趋势跟随和支撑位回调建立了一个完整的交易系统,并通过分段获利和动态止损实现了风险管理。策略的核心优势在于其完善的风险控制机制和清晰的交易逻辑,但仍需要在实践中不断优化参数和入场条件,以适应不同的市场环境。建议交易者在实盘使用时先进行充分的回测,并结合市场经验对策略进行个性化调整。

策略源码

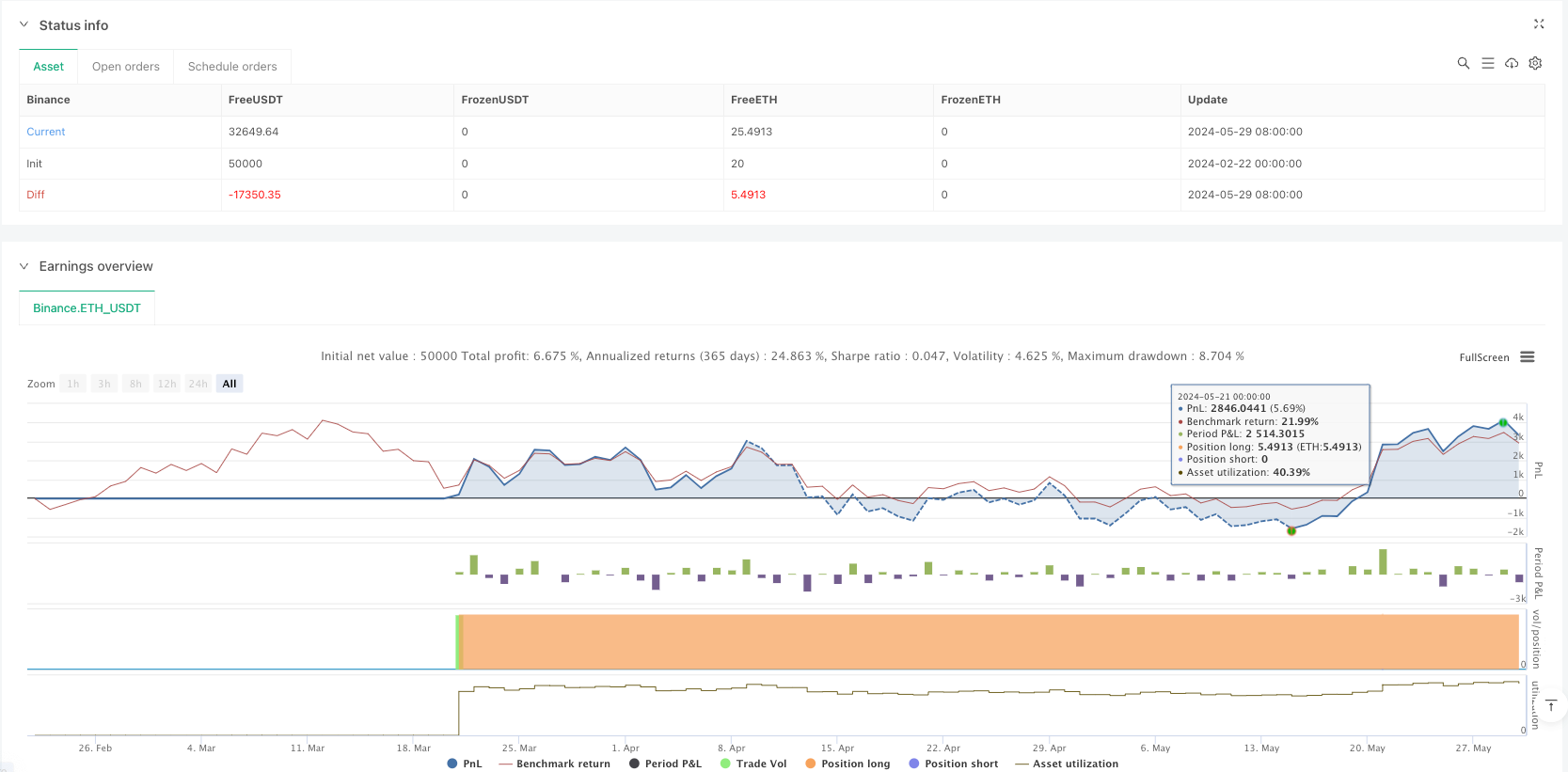

/*backtest

start: 2024-02-22 00:00:00

end: 2024-05-30 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Ultra-Profitable SMC Long-Only Strategy", shorttitle="Ultra_Profit_SMC", overlay=true)

// User Inputs

emaTrendLength = input.int(100, title="Trend EMA Length") // Faster EMA to align with aggressive trends

supportLookback = input.int(10, title="Support Lookback Period") // Short-term support zones

atrLength = input.int(14, title="ATR Length")

atrMultiplierSL = input.float(1.0, title="ATR Multiplier for Stop-Loss")

atrMultiplierTP1 = input.float(5.0, title="ATR Multiplier for TP1")

atrMultiplierTP2 = input.float(10.0, title="ATR Multiplier for TP2")

riskPercent = input.float(3.0, title="Risk per Trade (%)", step=0.1)

// Calculate Indicators

emaTrend = ta.ema(close, emaTrendLength) // Trend EMA

supportLevel = ta.lowest(low, supportLookback) // Support Level

atr = ta.atr(atrLength) // ATR

// Entry Conditions

isTrendingUp = close > emaTrend // Price above Trend EMA

nearSupport = close <= supportLevel + (atr * 0.5) // Price near support zone

longCondition = isTrendingUp and nearSupport

// Dynamic Stop-Loss and Take-Profit Levels

longStopLoss = supportLevel - (atr * atrMultiplierSL)

takeProfit1 = close + (atr * atrMultiplierTP1) // Partial Take-Profit at 5x ATR

takeProfit2 = close + (atr * atrMultiplierTP2) // Full Take-Profit at 10x ATR

// Position Sizing

capital = strategy.equity

tradeRisk = riskPercent / 100 * capital

positionSize = tradeRisk / (close - longStopLoss)

// Execute Long Trades

if (longCondition)

strategy.entry("Ultra Long", strategy.long, qty=positionSize)

// Exit Conditions

strategy.exit("Partial Exit", from_entry="Ultra Long", limit=takeProfit1, qty_percent=50) // Exit 50% at TP1

strategy.exit("Full Exit", from_entry="Ultra Long", limit=takeProfit2, qty_percent=100, stop=longStopLoss) // Exit the rest at TP2

// Plot Indicators

plot(emaTrend, color=color.blue, title="Trend EMA")

plot(supportLevel, color=color.green, title="Support Level", linewidth=2)

相关推荐