概述

该策略是一个融合了多个技术指标的自适应趋势跟踪交易系统。它结合了均线系统(EMA)、动量指标(RSI)、趋势指标(MACD)和SuperTrend进行信号确认,并配备了完善的风险管理机制,包括止损、止盈和移动止损等功能。策略设计充分考虑了市场波动性,通过多重信号过滤和风险控制来提高交易的稳定性和可靠性。

策略原理

策略采用多层信号确认机制: 1. 通过9周期和21周期EMA的交叉确定初步趋势方向 2. 使用RSI(14)进行超买超卖过滤,买入信号要求RSI>40且<70,卖出信号要求RSI<60且>30 3. MACD指标验证趋势动能,要求信号线与MACD线方向一致 4. SuperTrend指标提供额外的趋势确认 5. 风险控制采用5%止损、10%止盈、2%追踪止损和1%保本点位 当所有条件同时满足时才会触发交易信号,有效降低了假突破带来的风险。

策略优势

- 多重信号确认机制显著降低假信号干扰

- 完善的风险控制体系,包含固定止损、移动止损和保本止损

- 策略具有良好的自适应性,可以适应不同的市场环境

- 入场和出场逻辑清晰,易于理解和维护

- 交易逻辑具有良好的理论基础,每个指标都有其特定的功能

策略风险

- 多重信号确认可能导致错过一些重要的交易机会

- 在剧烈波动市场中,固定的止损位可能不够灵活

- 参数优化可能导致过度拟合历史数据

- 多个指标可能在横盘市场产生混淆信号 解决方案包括:动态调整止损参数、引入波动率指标、定期重新优化参数等。

策略优化方向

- 引入自适应参数机制,根据市场波动率动态调整各项参数

- 增加成交量指标作为辅助确认工具

- 优化止损机制,引入基于ATR的动态止损

- 加入市场环境识别模块,在不同市场条件下使用不同的参数组合

- 开发基于机器学习的参数优化系统

总结

该策略通过多维度技术指标的协同配合,构建了一个稳健的交易系统。完善的风险控制机制和清晰的交易逻辑使其具有良好的实用性。虽然存在一定的优化空间,但策略的基本框架具有扎实的理论基础,通过持续优化和改进,有望进一步提升其交易效果。

策略源码

/*backtest

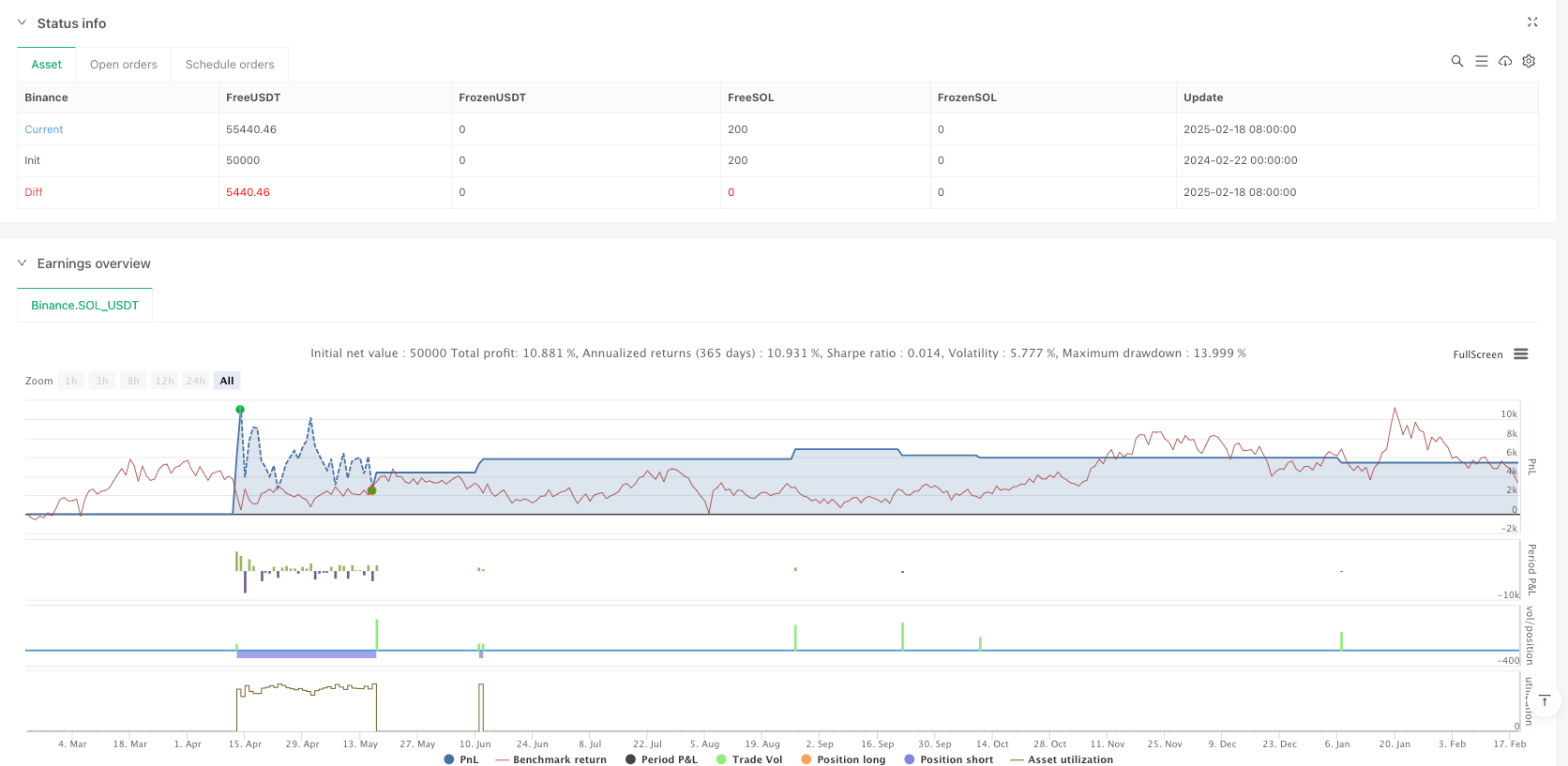

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Optimized BTC Trading Strategy v2", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// Input parameters

emaShort = ta.ema(close, 9)

emaLong = ta.ema(close, 21)

// RSI settings

rsi = ta.rsi(close, 14)

rsiBuyLevel = 40

rsiSellLevel = 60

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Supertrend settings

factor = input.float(3, title="Supertrend Factor")

atrLength = input.int(10, title="ATR Length")

[superTrend, superTrendDirection] = ta.supertrend(factor, atrLength)

// Risk Management (Stop Loss & Take Profit)

stopLossPercent = 0.05 // 5%

takeProfitPercent = 0.10 // 10%

trailingStopPercent = 0.02 // 2% trailing stop for additional security

breakevenBuffer = 0.01 // 1% breakeven buffer

// Fetching average price once to avoid repeated calculations

var float avgPrice = na

if strategy.position_size != 0

avgPrice := strategy.position_avg_price

// Stop Loss & Take Profit Levels

longSL = avgPrice * (1 - stopLossPercent)

longTP = avgPrice * (1 + takeProfitPercent)

shortSL = avgPrice * (1 + stopLossPercent)

shortTP = avgPrice * (1 - takeProfitPercent)

breakevenLevel = avgPrice * (1 + breakevenBuffer)

// Entry Conditions

buyCondition = ta.crossover(emaShort, emaLong) and rsi > rsiBuyLevel and rsi < 70 and (macdLine > signalLine) and superTrendDirection == 1

sellCondition = ta.crossunder(emaShort, emaLong) and rsi < rsiSellLevel and rsi > 30 and (macdLine < signalLine) and superTrendDirection == -1

// Ensure no conflicting trades

if buyCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTP, stop=longSL, trail_points=trailingStopPercent * avgPrice)

strategy.exit("Breakeven", from_entry="Long", stop=breakevenLevel)

if sellCondition and strategy.position_size >= 0

strategy.close("Long")

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTP, stop=shortSL, trail_points=trailingStopPercent * avgPrice)

strategy.exit("Breakeven", from_entry="Short", stop=breakevenLevel)

// Plot Buy & Sell signals with trend-based color indicators

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY", size=size.small)

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL", size=size.small)

// Trend Indicator (for better visualization)

plot(superTrend, color=superTrendDirection == 1 ? color.green : color.red, linewidth=2, title="Supertrend")

相关推荐