概述

这是一个基于多重技术指标的日内交易策略,主要利用EMA通道、RSI超买超卖、MACD趋势确认等多重信号进行交易。策略在3分钟周期上运行,通过EMA高低轨道结合RSI和MACD的交叉确认来捕捉市场趋势,并设置了基于ATR的动态止损止盈,以及固定的收盘平仓时间。

策略原理

策略使用20周期EMA对最高价和最低价分别计算形成通道,当价格突破通道且满足以下条件时入场: 1. 多头入场:收盘价上穿EMA高轨,RSI在50-70之间,MACD线上穿信号线 2. 空头入场:收盘价下穿EMA低轨,RSI在30-50之间,MACD线下穿信号线 3. 使用ATR动态计算止损位置,按照2.5倍风险收益比设置止盈 4. 每笔交易风险为账户1%,根据止损距离动态计算仓位大小 5. 在印度标准时间15:00强制平仓所有位置

策略优势

- 多重技术指标交叉验证,提高交易信号可靠性

- 动态止损基于ATR指标,更好地适应市场波动

- 固定风险比例和风险收益比,有效控制风险

- 考虑交易成本,包含手续费计算

- 禁止同向加仓,避免过度持仓风险

- 固定收盘时间,避免隔夜风险

策略风险

- 多重指标可能导致信号滞后,影响入场时机

- EMA通道在横盘市场可能产生频繁假突破

- 固定的风险收益比在不同市场环境下可能不够灵活

- RSI区间限制可能错过一些大趋势行情

- 收盘强制平仓可能在关键位置被迫退出

策略优化方向

- 考虑增加成交量指标作为辅助确认

- 可根据不同时段波动特征动态调整风险收益比

- 引入市场波动率指标动态调整RSI阈值

- 考虑增加趋势强度过滤器减少假突破

- 可以考虑根据日内不同时段特征调整参数

- 增加历史波动率分析来优化仓位管理

总结

该策略通过多重技术指标的配合使用,构建了一个相对完整的交易系统。策略的优势在于风险控制较为完善,包括动态止损、固定风险和收盘平仓等机制。虽然存在一定的滞后性风险,但通过参数优化和增加辅助指标可以进一步提升策略表现。策略特别适合波动较大的日内交易市场,通过严格的风险控制和多重信号确认来获取稳定收益。

策略源码

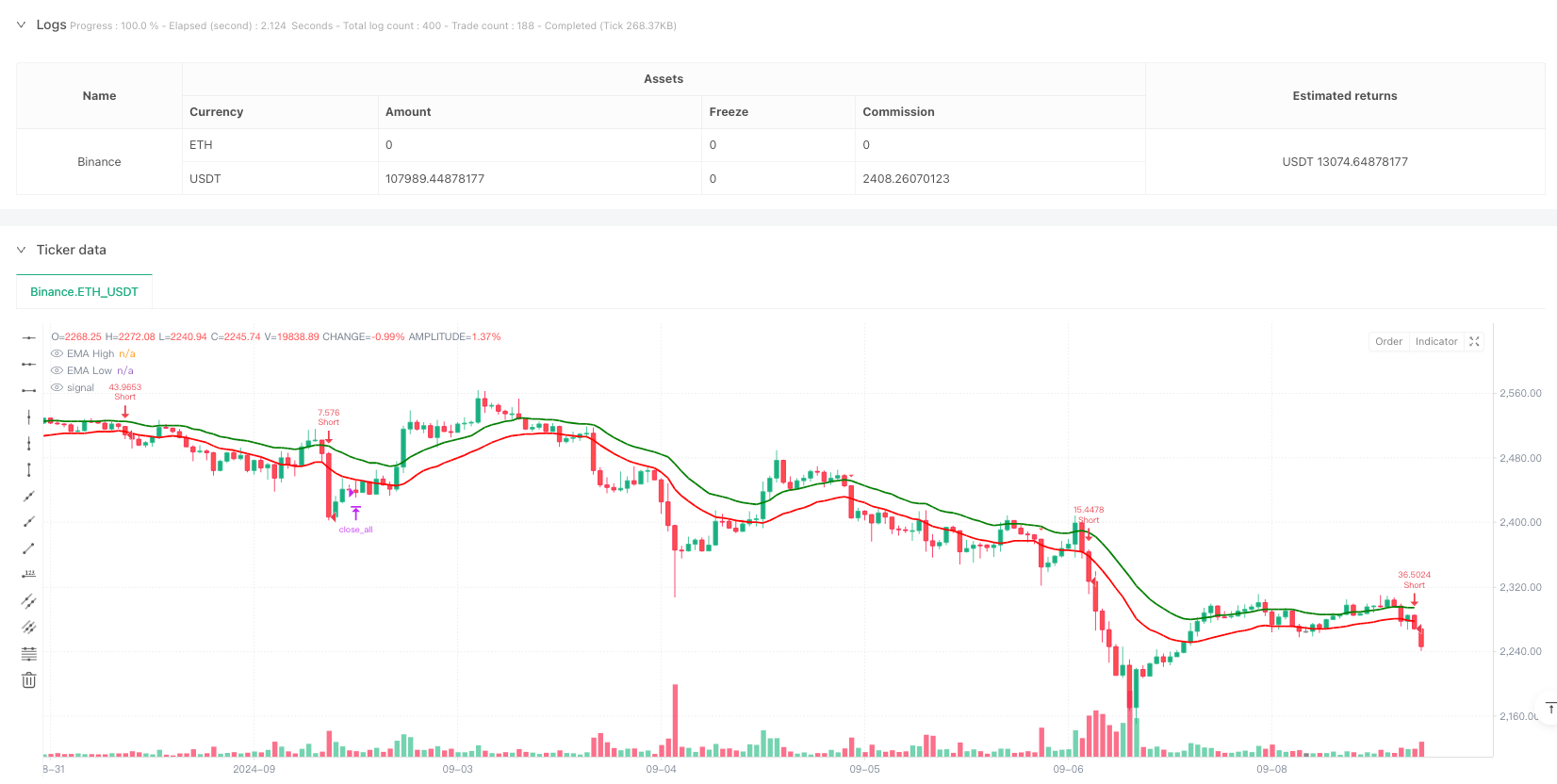

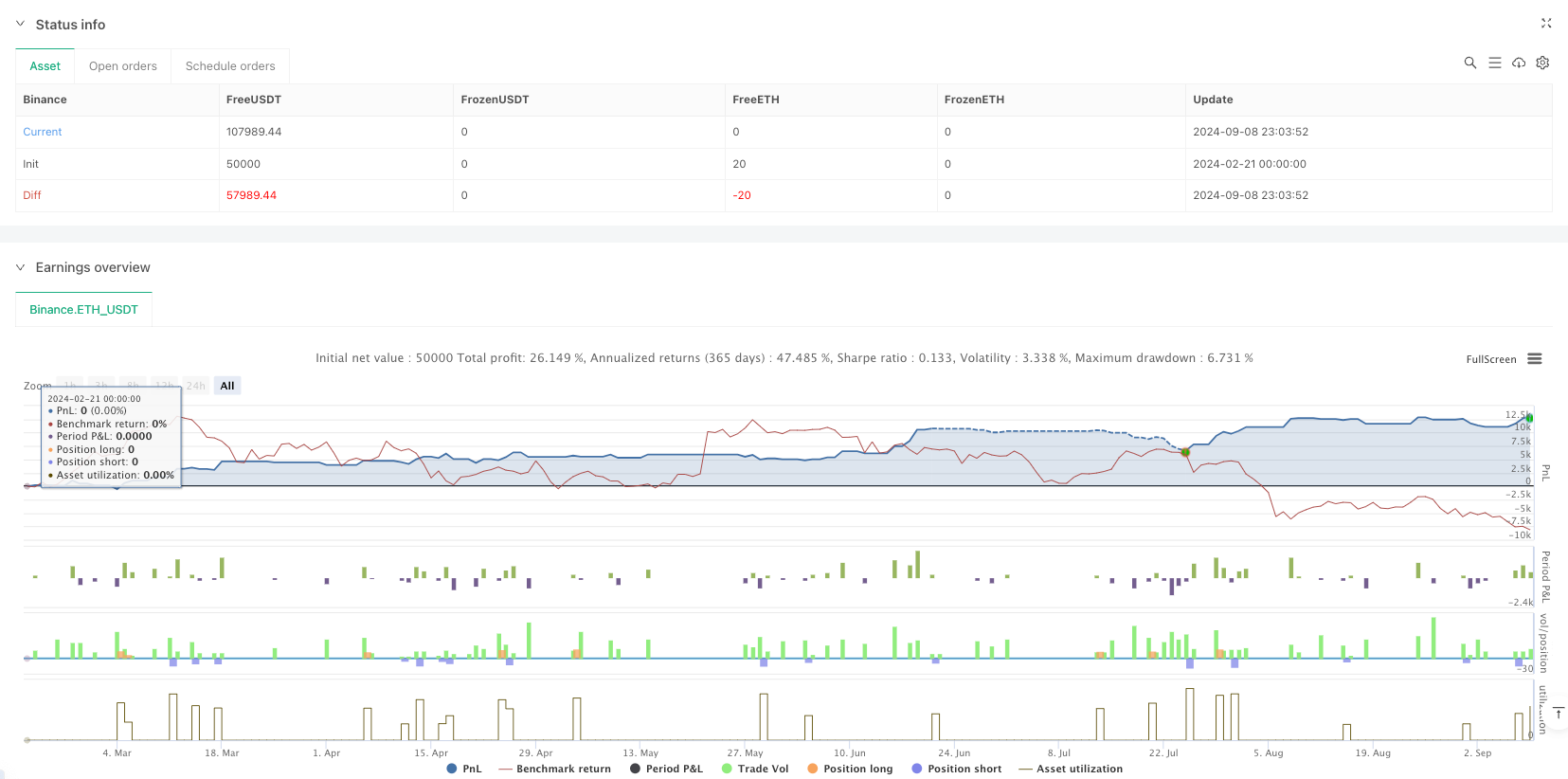

/*backtest

start: 2024-02-21 00:00:00

end: 2024-09-09 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Intraday 3min EMA HL Strategy v6",

overlay=true,

margin_long=100,

margin_short=100,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

commission_type=strategy.commission.percent,

commission_value=0.05,

calc_on_every_tick=false,

process_orders_on_close=true,

pyramiding=0)

// Input Parameters

i_emaLength = input.int(20, "EMA Length", minval=5, group="Strategy Parameters")

i_rsiLength = input.int(14, "RSI Length", minval=5, group="Strategy Parameters")

i_atrLength = input.int(14, "ATR Length", minval=5, group="Risk Management")

i_rrRatio = input.float(2.5, "Risk:Reward Ratio", minval=1, maxval=10, step=0.5, group="Risk Management")

i_riskPercent = input.float(1, "Risk % per Trade", minval=0.1, maxval=5, step=0.1, group="Risk Management")

// Time Exit Parameters (IST)

i_exitHour = input.int(15, "Exit Hour (IST)", minval=0, maxval=23, group="Session Rules")

i_exitMinute = input.int(0, "Exit Minute (IST)", minval=0, maxval=59, group="Session Rules")

// Indicator Calculations

emaHigh = ta.ema(high, i_emaLength)

emaLow = ta.ema(low, i_emaLength)

rsi = ta.rsi(close, i_rsiLength)

atr = ta.atr(i_atrLength)

fastMA = ta.ema(close, 12)

slowMA = ta.ema(close, 26)

macdLine = fastMA - slowMA

signalLine = ta.ema(macdLine, 9)

// Time Calculations (UTC to IST Conversion)

istHour = (hour(time) + 5) % 24 // UTC+5

istMinute = minute(time) + 30 // 30 minute offset

istHour += istMinute >= 60 ? 1 : 0

istMinute := istMinute % 60

// Exit Condition

timeExit = istHour > i_exitHour or (istHour == i_exitHour and istMinute >= i_exitMinute)

// Entry Conditions (Multi-line formatting fix)

longCondition = close > emaHigh and

rsi > 50 and

rsi < 70 and

ta.crossover(macdLine, signalLine)

shortCondition = close < emaLow and

rsi < 50 and

rsi > 30 and

ta.crossunder(macdLine, signalLine)

// Risk Calculations

var float entryPrice = na

var float stopLoss = na

var float takeProfit = na

var float posSize = na

// Strategy Logic

if longCondition and not timeExit and strategy.position_size == 0

entryPrice := close

stopLoss := math.min(low, entryPrice - atr)

takeProfit := entryPrice + (entryPrice - stopLoss) * i_rrRatio

posSize := strategy.equity * i_riskPercent / 100 / (entryPrice - stopLoss)

strategy.entry("Long", strategy.long, qty=posSize)

strategy.exit("Long Exit", "Long", stop=stopLoss, limit=takeProfit)

if shortCondition and not timeExit and strategy.position_size == 0

entryPrice := close

stopLoss := math.max(high, entryPrice + atr)

takeProfit := entryPrice - (stopLoss - entryPrice) * i_rrRatio

posSize := strategy.equity * i_riskPercent / 100 / (stopLoss - entryPrice)

strategy.entry("Short", strategy.short, qty=posSize)

strategy.exit("Short Exit", "Short", stop=stopLoss, limit=takeProfit)

// Force Close at Session End

if timeExit

strategy.close_all()

// Visual Components

plot(emaHigh, "EMA High", color=color.rgb(0, 128, 0), linewidth=2)

plot(emaLow, "EMA Low", color=color.rgb(255, 0, 0), linewidth=2)

plotshape(longCondition, "Long Signal", shape.triangleup,

location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown,

location.abovebar, color=color.red, size=size.small)

// Debugging Table

var table infoTable = table.new(position.top_right, 3, 3)

if barstate.islast

table.cell(infoTable, 0, 0, "EMA High: " + str.tostring(emaHigh, "#.00"))

table.cell(infoTable, 0, 1, "EMA Low: " + str.tostring(emaLow, "#.00"))

table.cell(infoTable, 0, 2, "Current RSI: " + str.tostring(rsi, "#.00"))

相关推荐