概述

该策略是一个结合动量指标和资金流量指标的综合交易系统,通过三重指数移动平均线(EMA)对动量指标进行平滑处理,有效降低了市场噪音。策略使用变化率(ROC)计算原始动量,并结合货币流量指标(MFI)来确认交易信号,可以适用于各种时间周期的交易。

策略原理

策略的核心原理基于两个主要技术指标:动量指标和资金流量指标(MFI)。首先使用ROC计算原始动量,然后通过三重EMA平滑处理获得更稳定的动量信号线。交易信号的产生需要同时满足动量和MFI的条件:当平滑后的动量为正且MFI高于中位水平时产生做多信号;当平滑后的动量为负且MFI低于中位水平时产生做空信号。策略还设计了基于动量和MFI拐点的退出机制,有助于及时止损和锁定利润。

策略优势

- 信号平滑性强: 通过三重EMA处理显著减少了虚假信号,提高了交易的可靠性

- 双重确认机制: 结合动量和资金流量两个维度,降低了单一指标的局限性

- 适应性广: 可以应用于不同的时间周期,具有较强的普适性

- 风险控制完善: 设有明确的入场和出场条件,包含止损机制

- 参数可调整性强: 提供多个可调参数,便于根据不同市场情况进行优化

策略风险

- 趋势转折风险: 在剧烈波动市场中可能出现信号滞后

- 参数敏感性: 不同参数设置可能导致策略表现差异较大

- 市场环境依赖: 在横盘市场中可能产生频繁的虚假信号

- 资金管理风险: 需要合理设置仓位规模以控制风险

- 技术指标局限: 基于技术指标的策略在基本面变化时可能失效

策略优化方向

- 引入波动率过滤器: 增加ATR指标来过滤低波动期的信号

- 优化退出机制: 增加移动止损和利润目标

- 增加时间过滤: 避开重要经济数据发布时段

- 加入成交量确认: 结合成交量分析提高信号可靠性

- 开发自适应参数: 根据市场状态动态调整参数

总结

这是一个设计合理、逻辑清晰的综合交易策略。通过动量和资金流量指标的结合,以及三重EMA平滑处理,有效平衡了信号的及时性和可靠性。策略具有较强的实用性和可扩展性,适合进一步优化和实盘应用。建议交易者在实际应用中注意风险控制,合理设置参数,并根据具体市场情况进行优化调整。

策略源码

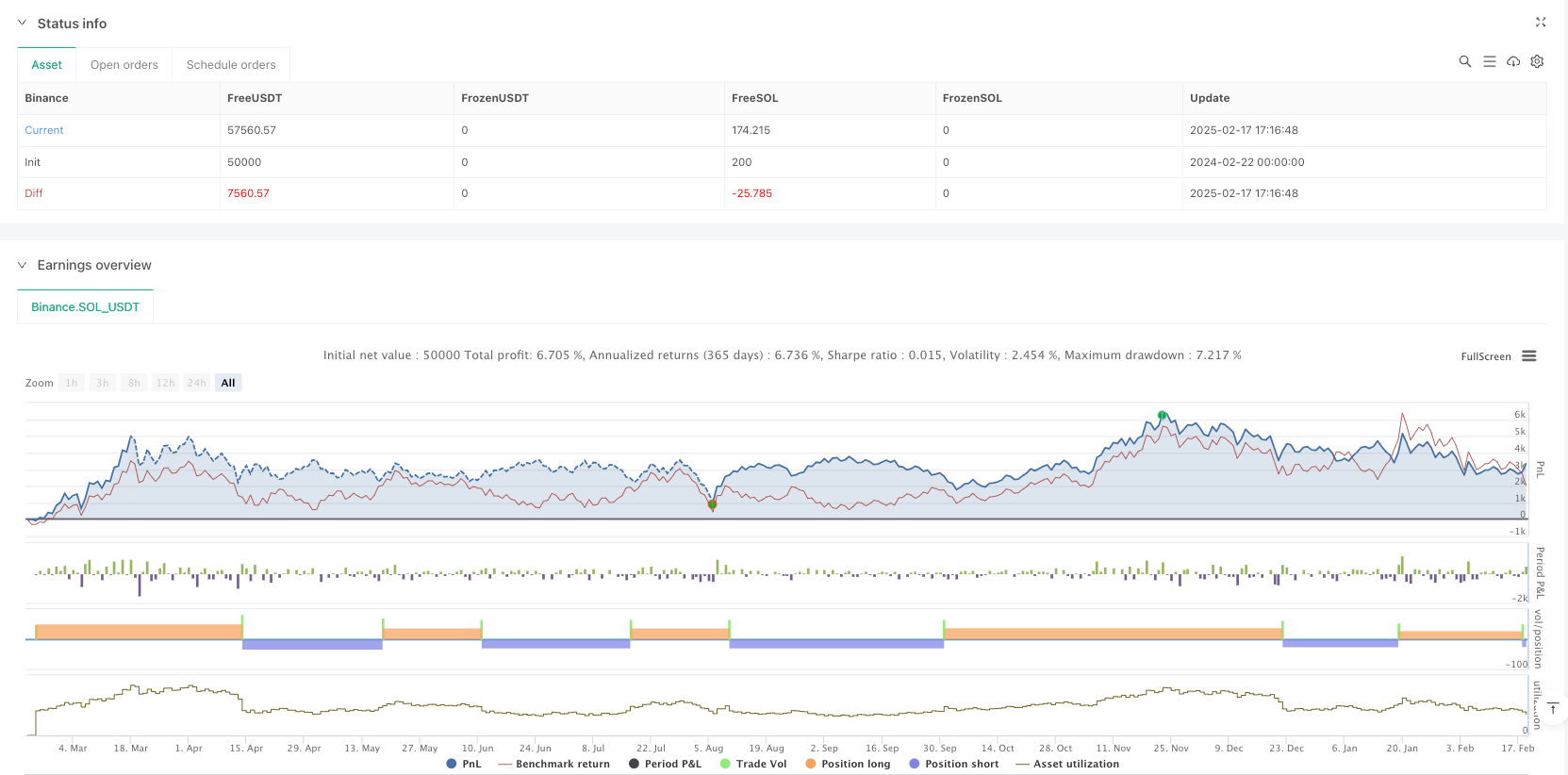

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Momentum & Money Flow Strategy with Triple EMA Smoothing", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

momentumPeriod = input.int(7, title="Momentum Period", minval=1)

smoothingPeriod = input.int(3, title="Momentum Smoothing Period", minval=1)

mfiPeriod = input.int(14, title="MFI Period", minval=1)

mfiMiddleLevel = input.int(50, title="MFI Middle Level", minval=1, maxval=100)

mfiOverbought = input.int(80, title="MFI Overbought Level", minval=1, maxval=100)

mfiOversold = input.int(20, title="MFI Oversold Level", minval=1, maxval=100)

// Calculate raw momentum oscillator using rate-of-change (ROC)

rawMomentum = ta.roc(close, momentumPeriod)

// Apply triple EMA smoothing for a much smoother momentum line

smoothedMomentum = ta.ema(ta.ema(ta.ema(rawMomentum, smoothingPeriod), smoothingPeriod), smoothingPeriod)

// Calculate Money Flow Index (MFI) using the typical price (hlc3)

typicalPrice = hlc3

mfiValue = ta.mfi(typicalPrice, mfiPeriod)

// Define conditions for filtering signals based on smoothed momentum and MFI

longCondition = (smoothedMomentum > 0) and (mfiValue > mfiMiddleLevel)

shortCondition = (smoothedMomentum < 0) and (mfiValue < mfiMiddleLevel)

// Define exit conditions for capturing turning points

exitLongCondition = (smoothedMomentum < 0) and (mfiValue < mfiOversold)

exitShortCondition = (smoothedMomentum > 0) and (mfiValue > mfiOverbought)

// Execute entries based on defined conditions

if (longCondition and strategy.position_size <= 0)

strategy.entry("Long", strategy.long)

if (shortCondition and strategy.position_size >= 0)

strategy.entry("Short", strategy.short)

// Exit positions based on turning point conditions

if (strategy.position_size > 0 and exitLongCondition)

strategy.close("Long")

if (strategy.position_size < 0 and exitShortCondition)

strategy.close("Short")

// Plot the triple EMA smoothed momentum oscillator and MFI for visual reference

plot(smoothedMomentum, title="Smoothed Momentum (Triple EMA ROC)", color=color.blue)

hline(0, color=color.gray)

plot(mfiValue, title="Money Flow Index (MFI)", color=color.orange)

hline(mfiMiddleLevel, color=color.green, linestyle=hline.style_dotted, title="MFI Middle Level")

相关推荐