概述

这是一个基于RSI指标和成交量的反转交易策略。该策略通过识别市场中的超买超卖状态,结合成交量确认,在价格出现极端状态时采取反向交易。策略的核心思想是在RSI指标出现超买或超卖信号,且成交量高于平均水平时进行交易,通过RSI中线(50)作为退出信号。

策略原理

策略主要基于以下核心组件: 1. RSI指标计算:使用14周期的RSI指标监测价格动量 2. 成交量确认:使用20周期的成交量移动平均线(SMA) 3. 入场逻辑: - 多头入场:当RSI低于30(超卖)且成交量大于其移动平均线时 - 空头入场:当RSI高于70(超买)且成交量大于其移动平均线时 4. 出场逻辑: - 多头出场:RSI上穿50 - 空头出场:RSI下穿50

策略优势

- 系统化的交易决策:通过明确的技术指标组合建立客观的交易系统

- 多重确认机制:结合RSI和成交量两个维度,提高信号可靠性

- 风险控制完善:使用百分比资金管理,并禁止重复建仓

- 可视化支持:包含完整的图表展示功能,便于分析和监控

- 适应性强:主要参数均可自定义,适应不同市场环境

策略风险

- 趋势延续风险:在强趋势市场中,反转策略可能频繁亏损

- 假突破风险:高成交量不一定意味着真实的市场转折

- 参数敏感性:RSI周期和超买超卖阈值的选择对策略表现影响显著

- 滑点影响:在剧烈波动时期,成交价格可能显著偏离预期

- 资金管理风险:固定比例仓位可能在某些市况下过于激进

策略优化方向

- 趋势过滤:引入趋势判断指标,在强趋势期间避免反向交易

- 动态参数:基于市场波动率动态调整RSI的超买超卖阈值

- 出场优化:增加止损和追踪止损机制,提高风险控制能力

- 成交量分析增强:加入成交量形态分析,提高信号质量

- 时间过滤:添加交易时间窗口,避开低效率的交易时段

总结

该策略通过结合RSI指标和成交量分析,构建了一个完整的反转交易系统。策略设计合理,具有良好的可操作性和灵活性。通过建议的优化方向,策略还有进一步提升的空间。在实盘应用时,建议充分测试参数并结合市场特征进行针对性优化。

策略源码

/*backtest

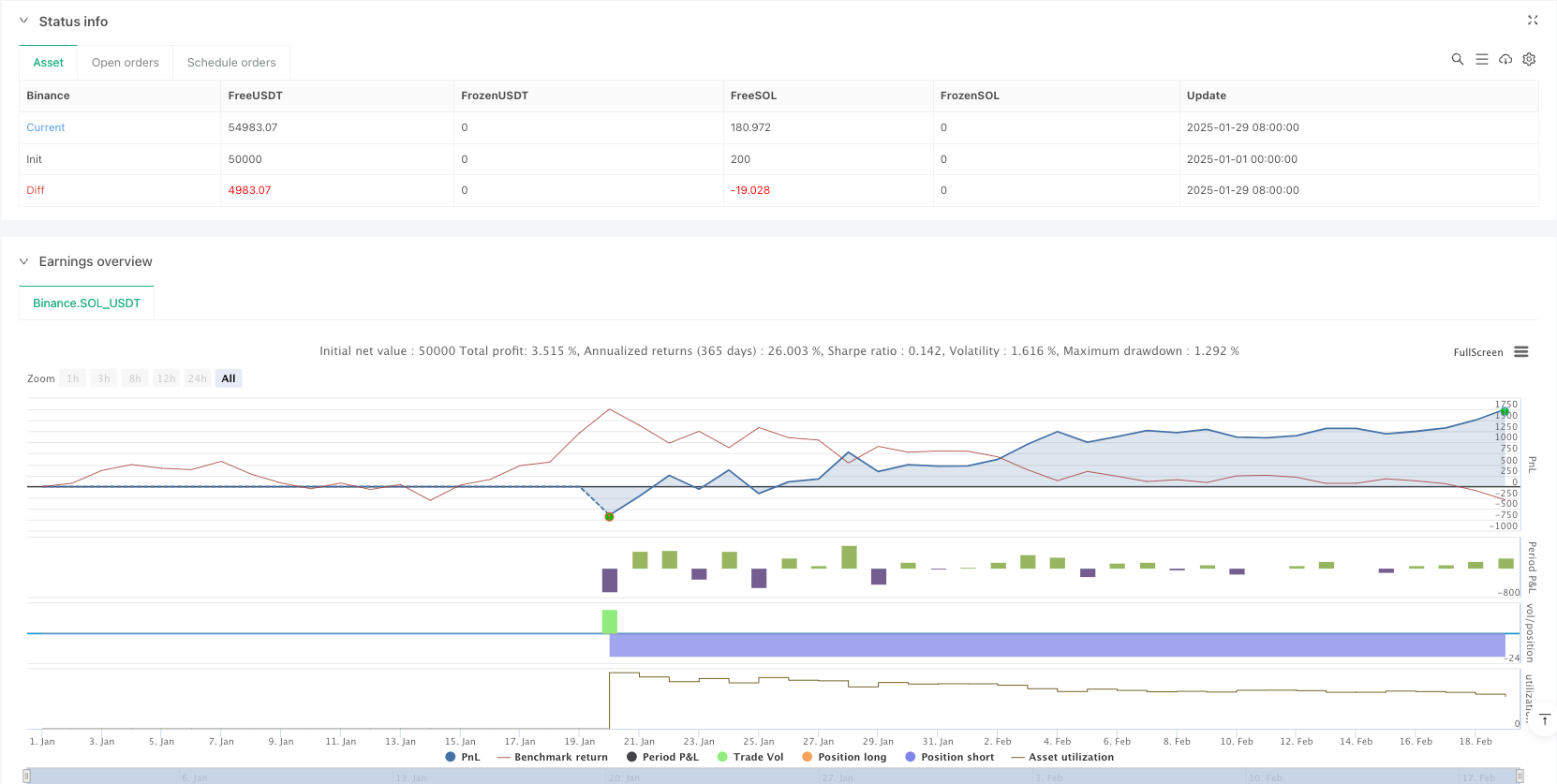

start: 2025-01-01 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RSI & Volume Contrarian Strategy", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=0)

//---------------------------

// Inputs and Parameters

//---------------------------

rsiPeriod = input.int(14, title="RSI Period", minval=1)

oversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=50)

overbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

volMAPeriod = input.int(20, title="Volume MA Period", minval=1)

//---------------------------

// Indicator Calculations

//---------------------------

rsiValue = ta.rsi(close, rsiPeriod)

volMA = ta.sma(volume, volMAPeriod)

//---------------------------

// Trade Logic

//---------------------------

// Long Entry: Look for oversold conditions (RSI < oversold)

// accompanied by above-average volume (volume > volMA)

// In an uptrend, oversold conditions with high volume may signal a strong reversal opportunity.

longCondition = (rsiValue < oversold) and (volume > volMA)

// Short Entry: When RSI > overbought and volume is above its moving average,

// the temporary strength in a downtrend can be exploited contrarily.

shortCondition = (rsiValue > overbought) and (volume > volMA)

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// Exit Logic:

// Use a simple RSI midline crossover as an exit trigger.

// For longs, if RSI crosses above 50 (indicating a recovery), exit the long.

// For shorts, if RSI crosses below 50, exit the short.

exitLong = ta.crossover(rsiValue, 50)

exitShort = ta.crossunder(rsiValue, 50)

if strategy.position_size > 0 and exitLong

strategy.close("Long", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

if strategy.position_size < 0 and exitShort

strategy.close("Short", comment="RSI midline exit")

log.info("strategy.position_size > 0 and exitLong")

//---------------------------

// Visualization

//---------------------------

// Plot the RSI on a separate pane for reference

plot(rsiValue, title="RSI", color=color.blue, linewidth=2)

hline(oversold, title="Oversold", color=color.green)

hline(overbought, title="Overbought", color=color.red)

hline(50, title="Midline", color=color.gray, linestyle=hline.style_dotted)

// Optionally, you may plot the volume moving average on a hidden pane

plot(volMA, title="Volume MA", color=color.purple, display=display.none)

相关推荐