概述

该策略是一个结合ZigZag百分比反转和随机指标的自适应交易系统。它通过动态计算市场波动来识别关键反转点,并结合随机指标超买超卖信号来确定交易时机。策略集成了自动止盈止损机制,可以有效管理风险。

策略原理

策略的核心是通过百分比反转方法动态跟踪市场趋势。它允许用户选择手动设置反转百分比或基于不同周期(5-250天)的ATR动态计算。当价格突破反转线且随机指标K值低于30时产生做多信号;当价格跌破反转线且K值高于70时产生做空信号。系统自动设置止盈止损来保护盈利和控制风险。

策略优势

- 采用动态自适应的反转计算方法,能更好地适应不同市场环境

- 结合趋势反转和动量指标,提供更可靠的交易信号

- 内置止盈止损机制,帮助traders自动管理风险

- 灵活的参数设置允许traders根据个人交易风格进行优化

- 视觉化的交易信号展示,便于分析和决策

策略风险

- 在震荡市场可能产生频繁的假信号

- ATR周期的选择会影响策略表现

- 固定的止盈止损可能不适合所有市场环境

- 随机指标在某些市场条件下可能滞后

- 需要合理设置参数以避免过度交易

策略优化方向

- 引入多重时间框架分析,提高信号可靠性

- 动态调整止盈止损水平,更好地适应市场波动

- 添加交易量指标作为确认信号

- 开发自适应的随机指标参数

- 增加趋势强度过滤器减少假信号

总结

这是一个结合技术分析经典工具的现代化交易策略。通过将ZigZag反转、随机指标和风险管理整合在一起,为交易者提供了一个全面的交易系统。策略的可定制性强,适合不同风险偏好的交易者使用。持续优化和调整参数可以进一步提升策略的稳定性和盈利能力。

策略源码

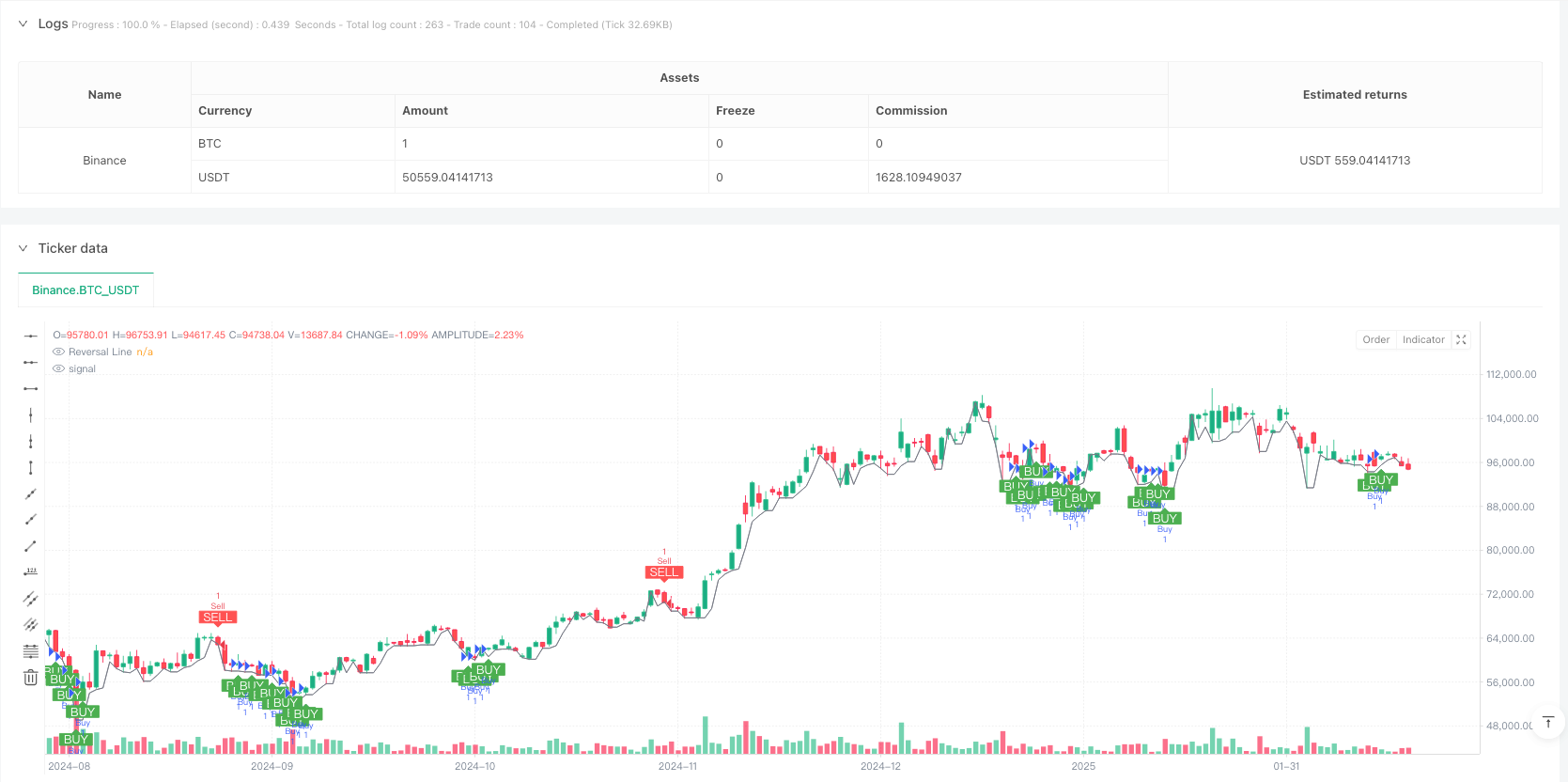

/*backtest

start: 2024-06-04 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("[RS]ZigZag Percent Reversal with Stochastic Strategy", overlay=true)

// ZigZag Settings

string percent_method = input.string(

defval="MANUAL",

title="Method to use for the zigzag reversal range:",

options=[

"MANUAL",

"ATR005 * X", "ATR010 * X", "ATR020 * X", "ATR050 * X", "ATR100 * X", "ATR250 * X"

]

)

var float percent = input.float(

defval=0.25,

title="Percent of last pivot price for zigzag reversal:",

minval=0.0, maxval=99.0

) / 100

float percent_multiplier = input.float(

defval=1.0,

title="Multiplier to apply to ATR if applicable:"

)

if percent_method == "ATR005 * X"

percent := ta.atr(5) / open * percent_multiplier

if percent_method == "ATR010 * X"

percent := ta.atr(10) / open * percent_multiplier

if percent_method == "ATR020 * X"

percent := ta.atr(20) / open * percent_multiplier

if percent_method == "ATR050 * X"

percent := ta.atr(50) / open * percent_multiplier

if percent_method == "ATR100 * X"

percent := ta.atr(100) / open * percent_multiplier

if percent_method == "ATR250 * X"

percent := ta.atr(250) / open * percent_multiplier

// Zigzag function

f_zz(_percent)=>

// Direction

var bool _is_direction_up = na

var float _htrack = na

var float _ltrack = na

var float _pivot = na

float _reverse_range = 0.0

var int _real_pivot_time = na

var int _htime = na

var int _ltime = na

var float _reverse_line = na

if bar_index >= 1

if na(_is_direction_up)

_is_direction_up := true

_reverse_range := nz(_pivot[1]) * _percent

if _is_direction_up

_ltrack := na

_ltime := time

if na(_htrack)

if high > high[1]

_htrack := high

_htime := time

else

_htrack := high[1]

_htime := time[1]

else

if high > _htrack

_htrack := high

_htime := time

_reverse_line := _htrack - _reverse_range

if close <= _reverse_line

_pivot := _htrack

_real_pivot_time := _htime

_is_direction_up := false

if not _is_direction_up

_htrack := na

_htime := na

if na(_ltrack)

if low < low[1]

_ltrack := low

_ltime := time

else

_ltrack := low[1]

_ltime := time[1]

else

if low < _ltrack

_ltrack := low

_ltime := time

_reverse_line := _ltrack + _reverse_range

if close >= _reverse_line

_pivot := _ltrack

_real_pivot_time := _ltime

_is_direction_up := true

[_pivot, _is_direction_up, _reverse_line, _real_pivot_time]

[pivot, direction_up, reverse_line, pivot_time] = f_zz(percent)

// Reversal line

var float static_reverse_line = na

if (not na(reverse_line))

static_reverse_line := reverse_line

plot(series=static_reverse_line, color=color.gray, style=plot.style_line, title="Reversal Line", trackprice=false)

// Stochastic Settings

K_length = input.int(9, title="Stochastic K Length", minval=1) // User input

K_smoothing = input.int(3, title="Stochastic K Smoothing", minval=1) // User input

stochK = ta.sma(ta.stoch(close, high, low, K_length), K_smoothing)

// User Input: Take Profit and Stop Loss Levels

stop_loss_pips = input.int(100, title="Stop Loss (pips)", minval=1) // Stop Loss

take_profit_pips = input.int(300, title="Take Profit (pips)", minval=1) // Take Profit

// Calculating levels

long_stop_loss = close - stop_loss_pips * syminfo.mintick

long_take_profit = close + take_profit_pips * syminfo.mintick

short_stop_loss = close + stop_loss_pips * syminfo.mintick

short_take_profit = close - take_profit_pips * syminfo.mintick

// Buy and Sell Conditions

buy_signal = close > static_reverse_line and stochK < 30 // K < 30 condition

sell_signal = close < static_reverse_line and stochK > 70 // K > 70 condition

if buy_signal

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", stop=long_stop_loss, limit=long_take_profit)

if sell_signal

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", stop=short_stop_loss, limit=short_take_profit)

// Signal Visualization

plotshape(series=buy_signal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY", textcolor=color.white)

plotshape(series=sell_signal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL", textcolor=color.white)

相关推荐