策略概述

该策略是一个基于多重移动平均线(SMA)与相对强弱指标(RSI)交叉信号的自动化交易系统。它结合了短期与中期移动平均线的多重验证机制,并通过RSI指标进行趋势确认,同时采用动态ATR止损来控制风险,建立了一个完整的交易决策框架。该策略主要用于捕捉市场趋势转折点,通过多重技术指标的交叉确认来提高交易的准确性。

策略原理

策略的核心逻辑建立在五个关键条件的综合判断上: 1. 价格突破20周期高点移动平均线 2. 价格突破20周期低点移动平均线 3. 价格突破50周期高点移动平均线 4. 价格突破50周期低点移动平均线 5. RSI(7)指标向上突破50水平

只有当这五个条件同时满足时,策略才会产生买入信号。入场后,策略使用基于ATR的动态止损和止盈水平,其中止损设定为1.5倍ATR,止盈设定为2.5倍ATR,这种设计可以根据市场波动性自动调整风险管理参数。

策略优势

- 多重验证机制显著提高了交易信号的可靠性,通过要求多个技术指标同时确认来降低虚假信号的影响。

- 动态风险管理系统能够根据市场波动性自动调整止损和止盈水平,使策略具有良好的适应性。

- 结合了趋势跟踪和动量反转的特点,既可以捕捉强势突破,又能及时止损保护盈利。

- 策略参数可调节性强,交易者可以根据不同市场环境和个人风险偏好调整各项参数。

策略风险

- 多重条件同时满足的要求可能导致错过一些潜在的交易机会。

- 在震荡市场中,频繁的价格穿越均线可能触发过多的交易信号。

- 固定的ATR倍数可能在极端市场条件下不够灵活。

- 策略未考虑市场基本面因素,纯技术分析可能在重大消息面前失效。

策略优化方向

- 引入市场波动率过滤器,在高波动期间调整交易频率和仓位大小。

- 增加成交量确认机制,提高突破信号的可靠性。

- 开发自适应的ATR倍数调节机制,根据历史波动率动态调整止损和止盈水平。

- 加入趋势强度过滤器,避免在弱势行情中过度交易。

总结

这是一个设计合理的技术交易策略,通过多重技术指标的交叉确认来提高交易的准确性,并使用动态风险管理系统来保护盈利。虽然策略存在一定的局限性,但通过建议的优化方向可以进一步提升其性能。该策略适合风险承受能力较强、愿意进行长期策略优化的交易者使用。

策略源码

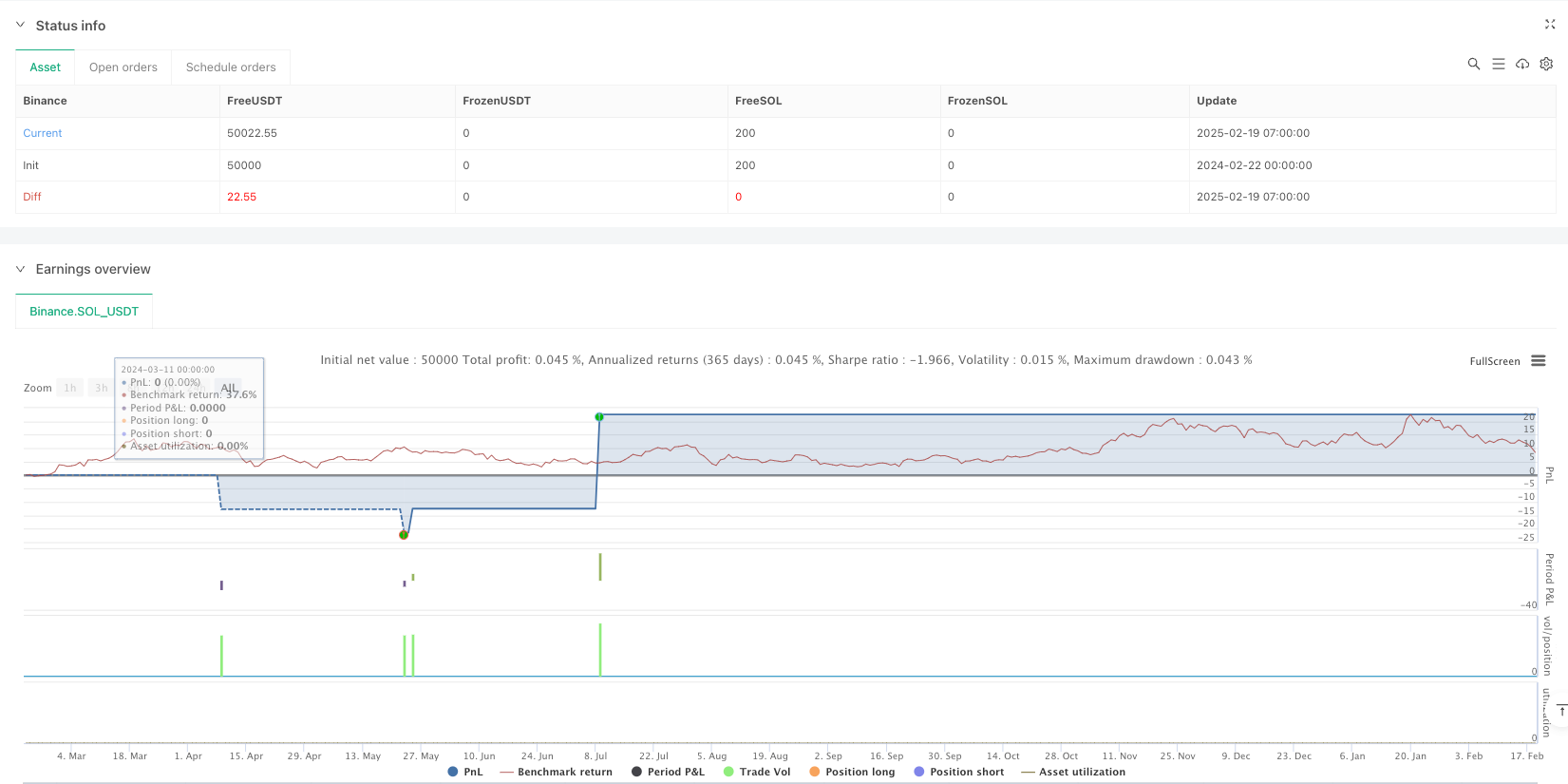

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Virat Bharat Auto Trade", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// **User-Defined Inputs for Customization**

smaLength20 = input(20, title="SMA High/Low 20 Length")

smaLength50 = input(50, title="SMA High/Low 50 Length")

rsiLength = input(7, title="RSI Length")

rsiLevel = input(50, title="RSI Crossover Level")

atrMultiplierSL = input(1.5, title="ATR Multiplier for Stop Loss")

atrMultiplierTP = input(2.5, title="ATR Multiplier for Target")

// **Defining the Indicators with Custom Inputs**

smaHigh20 = ta.sma(high, smaLength20)

smaLow20 = ta.sma(low, smaLength20)

smaHigh50 = ta.sma(high, smaLength50)

smaLow50 = ta.sma(low, smaLength50)

rsiValue = ta.rsi(close, rsiLength)

atrValue = ta.atr(14) // ATR for Dynamic Stop Loss & Target

// **Conditions for Buy Signal**

condition1 = ta.crossover(close, smaHigh20)

condition2 = ta.crossover(close, smaLow20)

condition3 = ta.crossover(close, smaHigh50)

condition4 = ta.crossover(close, smaLow50)

condition5 = ta.crossover(rsiValue, rsiLevel)

// **Final Buy Signal (Only when all conditions match)**

buySignal = condition1 and condition2 and condition3 and condition4 and condition5

// **Buy Price, Stop Loss & Target**

buyPrice = close

stopLoss = buyPrice - (atrValue * atrMultiplierSL) // Dynamic Stop Loss

target = buyPrice + (atrValue * atrMultiplierTP) // Dynamic Target

// **Plot Buy Signal on Chart**

plotshape(buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY", size=size.small, text="BUY")

// **Plot Labels for Buy, Stop Loss & Target**

if buySignal

label.new(x=bar_index, y=buyPrice, text="BUY @ " + str.tostring(buyPrice, format="#.##"), color=color.green, textcolor=color.white, size=size.small, style=label.style_label_down, yloc=yloc.price)

label.new(x=bar_index, y=stopLoss, text="STOP LOSS @ " + str.tostring(stopLoss, format="#.##"), color=color.red, textcolor=color.white, size=size.small, style=label.style_label_down, yloc=yloc.price)

label.new(x=bar_index, y=target, text="TARGET @ " + str.tostring(target, format="#.##"), color=color.blue, textcolor=color.white, size=size.small, style=label.style_label_up, yloc=yloc.price)

// **Strategy Trading Logic - Automated Entry & Exit**

if buySignal

strategy.entry("BUY", strategy.long)

strategy.exit("SELL", from_entry="BUY", loss=atrValue * atrMultiplierSL, profit=atrValue * atrMultiplierTP)

相关推荐