概述

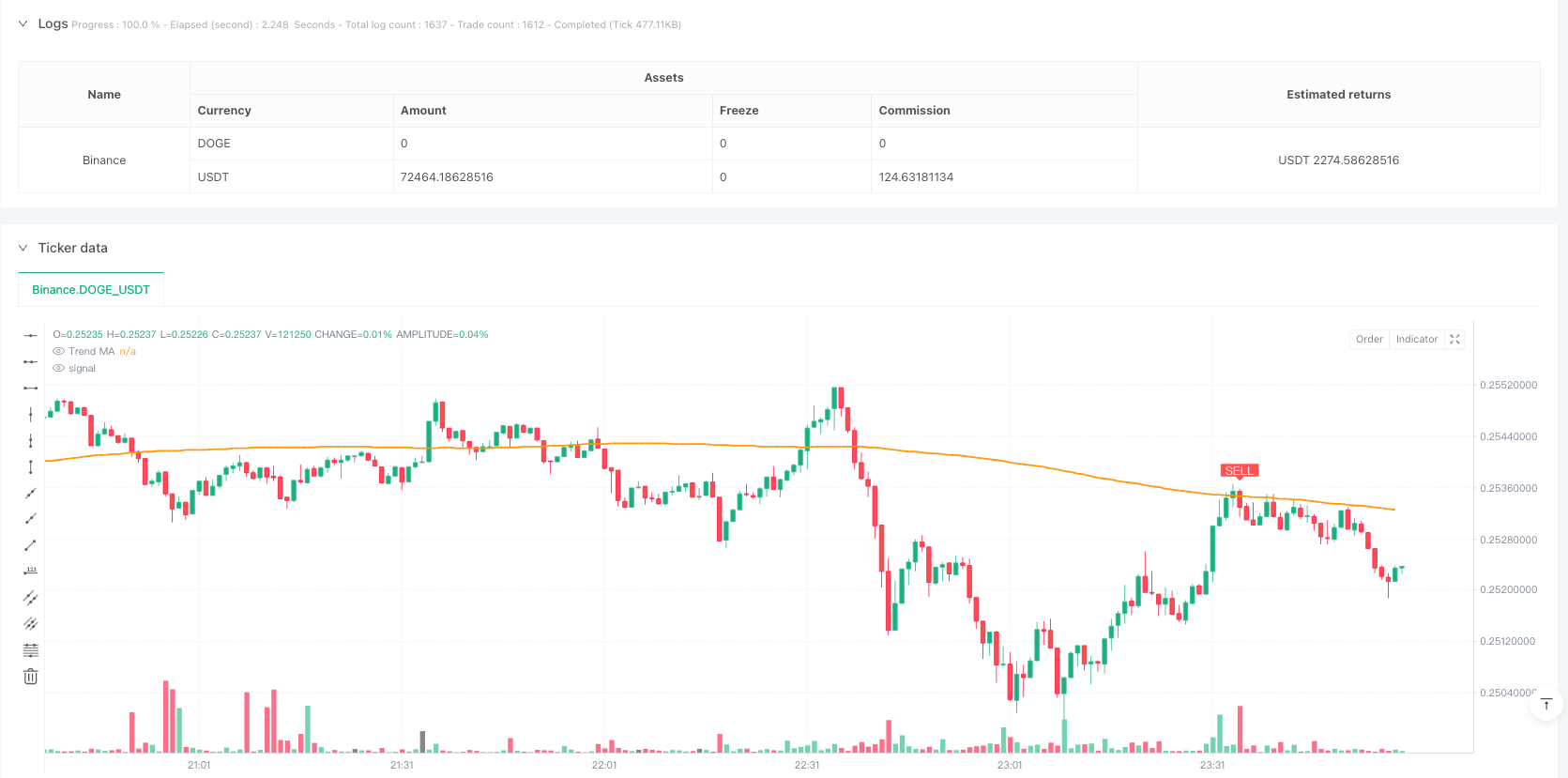

本策略是一个结合RSI(相对强弱指标)和趋势均线的双重过滤交易系统。该策略通过RSI的超买超卖信号与长期趋势均线相结合,在日线级别上进行交易。策略的核心是在传统RSI交易信号的基础上增加趋势过滤器,以提高交易的准确性和可靠性。

策略原理

策略主要基于以下核心组件: 1. RSI指标用于识别超买超卖区域,默认参数为14周期 2. 超买水平设置为70,超卖水平设置为30 3. 200周期简单移动平均线作为趋势过滤器 4. 买入条件:RSI从超卖区域向上突破且价格位于均线之上 5. 卖出条件:RSI从超买区域向下突破且价格位于均线之下 策略在每个信号出现时自动执行交易,并可配置提醒功能。

策略优势

- 双重确认机制显著提高了交易的可靠性

- 结合趋势和动量指标,降低假信号风险

- 完全自动化的交易执行系统

- 灵活的参数设置允许策略优化

- 集成了实时提醒功能,便于实际操作

- 可视化界面清晰展示交易信号

- 支持回测功能,便于策略验证

策略风险

- 震荡市场可能产生频繁交易信号

- 趋势转折点可能出现滞后

- 参数设置不当可能影响策略表现

- 市场极端波动时可能造成较大回撤 建议通过以下方式管理风险:

- 合理设置止损位置

- 适当调整仓位大小

- 定期优化策略参数

- 结合其他技术指标辅助判断

策略优化方向

- 增加波动率过滤器,在高波动率期间调整交易标准

- 引入自适应参数机制,根据市场状态动态调整参数

- 加入成交量确认机制,提高信号可靠性

- 开发更复杂的出场机制,优化获利了结时机

- 整合多时间周期分析,提供更全面的市场视角

总结

该策略通过结合RSI和趋势均线,构建了一个稳健的交易系统。策略设计合理,操作规则清晰,具有良好的实用性。通过合理的风险管理和持续优化,该策略有望在实际交易中取得稳定收益。

策略源码

/*backtest

start: 2025-02-13 00:00:00

end: 2025-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Leading Indicator Strategy – Daily Signals", overlay=true,

pyramiding=1, initial_capital=100000,

default_qty_type=strategy.percent_of_equity, default_qty_value=100)

/// **Inputs for Customization**

rsiLength = input.int(14, minval=1, title="RSI Period")

oversold = input.float(30.0, minval=1, maxval=50, title="Oversold Level")

overbought = input.float(70.0, minval=50, maxval=100, title="Overbought Level")

maLength = input.int(200, minval=1, title="Trend MA Period")

useTrendFilter = input.bool(true, title="Use Trend Filter (MA)",

tooltip="Require price above MA for buys and below MA for sells")

/// **Indicator Calculations**

rsiValue = ta.rsi(close, rsiLength) // RSI calculation

trendMA = ta.sma(close, maLength) // Long-term moving average

/// **Signal Conditions** (RSI crosses with optional trend filter)

buySignal = ta.crossover(rsiValue, oversold) // RSI crosses above oversold level

sellSignal = ta.crossunder(rsiValue, overbought) // RSI crosses below overbought level

bullCond = buySignal and (not useTrendFilter or close > trendMA) // final Buy condition

bearCond = sellSignal and (not useTrendFilter or close < trendMA) // final Sell condition

/// **Trade Execution** (entries and exits with alerts)

if bullCond

strategy.close("Short", alert_message="Buy Signal – Closing Short") // close short position if open

strategy.entry("Long", strategy.long, alert_message="Buy Signal – Enter Long") // go long

if bearCond

strategy.close("Long", alert_message="Sell Signal – Closing Long") // close long position if open

strategy.entry("Short", strategy.short, alert_message="Sell Signal – Enter Short") // go short

/// **Plotting** (MA and signal markers for clarity)

plot(trendMA, color=color.orange, linewidth=2, title="Trend MA")

plotshape(bullCond, title="Buy Signal", style=shape.labelup, location=location.belowbar,

color=color.green, text="BUY", textcolor=color.white)

plotshape(bearCond, title="Sell Signal", style=shape.labeldown, location=location.abovebar,

color=color.red, text="SELL", textcolor=color.white)

// (Optional) Plot RSI in a separate pane for reference:

// plot(rsiValue, title="RSI", color=color.blue)

// hline(oversold, title="Oversold", color=color.gray, linestyle=hline.style_dotted)

// hline(overbought, title="Overbought", color=color.gray, linestyle=hline.style_dotted)

相关推荐