概述

该策略是一个结合了多重移动平均线、动量指标和动态风险控制的趋势跟踪系统。策略通过分析价格趋势、市场动量和波动率来识别交易机会,同时采用严格的仓位管理和止损机制来控制风险。核心逻辑围绕长短期指数移动平均线(EMA)的交叉和相对强弱指数(RSI)的配合使用,通过平均真实波幅(ATR)来动态调整止损位置。

策略原理

策略采用多层验证机制来确认交易信号: 1. 趋势确认:使用50日和200日两条指数移动平均线来判断中长期趋势,要求短期均线在长期均线之上持续10个周期以上。 2. 动量验证:使用RSI指标验证价格动量,当RSI值大于设定阈值(默认50)时确认上涨动量。 3. 趋势强度:引入平均趋向指数(ADX)来衡量趋势强度,ADX大于20表明趋势显著。 4. 动态风险控制:基于ATR设计动态止损,止损距离为ATR的2.5倍,同时设置跟踪止损机制。 5. 智能仓位管理:根据账户权益和预设风险比例,结合ATR动态计算开仓数量。

策略优势

- 多重信号验证:通过均线、动量和趋势强度等多个维度的指标验证,提高信号可靠性。

- 动态风险管理:采用基于波动率的动态止损和跟踪止损,能够根据市场状况自适应调整。

- 智能仓位控制:基于账户规模和市场波动率动态调整仓位,有效控制单笔交易风险。

- 趋势持续性要求:通过设置趋势持续时间要求,避免虚假突破。

- 系统化交易提示:集成了交易信号提醒功能,便于实时操作。

策略风险

- 趋势反转风险:在强趋势结束时可能出现较大回撤,建议结合市场宏观面进行调整。

- 震荡市场表现:在横盘震荡市场中可能产生频繁交易,增加交易成本。

- 参数敏感性:多个指标参数的设置会影响策略表现,需要通过回测优化。

- 滑点影响:在市场流动性不足时可能面临较大滑点,影响策略收益。

策略优化方向

- 市场环境适应:可引入波动率指标(如VIX)来动态调整策略参数,提高不同市场环境下的适应性。

- 信号过滤:考虑添加成交量指标验证,提高信号质量。

- 止盈机制:可设计基于行情波动的动态止盈机制,优化收益回撤比。

- 时间周期优化:考虑在不同时间周期上验证信号一致性,提高交易稳定性。

- 机器学习优化:可引入机器学习算法动态优化参数,提高策略适应性。

总结

该策略通过多重技术指标的综合运用,构建了一个完整的趋势跟踪交易系统。策略在风险控制方面表现出色,通过动态止损和仓位管理有效控制回撤。策略的可扩展性强,预留了多个优化方向。建议交易者在实盘使用时,根据具体市场特点和自身风险偏好进行参数调整。

Overview

This strategy is a trend following system that combines multiple moving averages, momentum indicators, and dynamic risk control. It identifies trading opportunities by analyzing price trends, market momentum, and volatility while implementing strict position management and stop-loss mechanisms. The core logic revolves around the crossover of long and short-term exponential moving averages (EMA) combined with the Relative Strength Index (RSI), using Average True Range (ATR) for dynamic stop-loss positioning.

Strategy Principles

The strategy employs a multi-layer verification mechanism to confirm trading signals: 1. Trend Confirmation: Uses 50-day and 200-day EMAs to judge medium and long-term trends, requiring the short-term average to remain above the long-term average for more than 10 periods. 2. Momentum Verification: Uses RSI to verify price momentum, confirming upward momentum when RSI exceeds the set threshold (default 50). 3. Trend Strength: Incorporates Average Directional Index (ADX) to measure trend strength, with ADX above 20 indicating significant trend. 4. Dynamic Risk Control: Designs dynamic stop-loss based on ATR, with stop-loss distance set at 2.5 times ATR, including trailing stop mechanism. 5. Intelligent Position Management: Dynamically calculates position size based on account equity and preset risk ratio in combination with ATR.

Strategy Advantages

- Multiple Signal Verification: Improves signal reliability through validation across multiple dimensions including moving averages, momentum, and trend strength.

- Dynamic Risk Management: Employs volatility-based dynamic and trailing stops that adapt to market conditions.

- Intelligent Position Control: Dynamically adjusts positions based on account size and market volatility, effectively controlling single trade risk.

- Trend Persistence Requirement: Avoids false breakouts by setting trend duration requirements.

- Systematic Trading Alerts: Integrates trading signal notifications for real-time operation.

Strategy Risks

- Trend Reversal Risk: May experience significant drawdowns at trend endings, suggesting adjustment based on macro market conditions.

- Sideways Market Performance: May generate frequent trades in range-bound markets, increasing transaction costs.

- Parameter Sensitivity: Strategy performance affected by multiple indicator parameters, requiring backtest optimization.

- Slippage Impact: May face significant slippage in low liquidity conditions, affecting strategy returns.

Optimization Directions

- Market Environment Adaptation: Consider introducing volatility indicators (like VIX) for dynamic parameter adjustment to improve adaptability across different market conditions.

- Signal Filtering: Consider adding volume indicator verification to improve signal quality.

- Profit-Taking Mechanism: Design dynamic profit-taking mechanisms based on market volatility to optimize return-to-drawdown ratio.

- Timeframe Optimization: Consider validating signal consistency across different timeframes to improve trading stability.

- Machine Learning Optimization: Consider introducing machine learning algorithms for dynamic parameter optimization to enhance strategy adaptability.

Summary

This strategy constructs a complete trend following trading system through the comprehensive use of multiple technical indicators. It shows excellent performance in risk control through dynamic stop-loss and position management. The strategy demonstrates strong extensibility with multiple optimization directions reserved. Traders are advised to adjust parameters according to specific market characteristics and their own risk preferences when implementing in live trading.

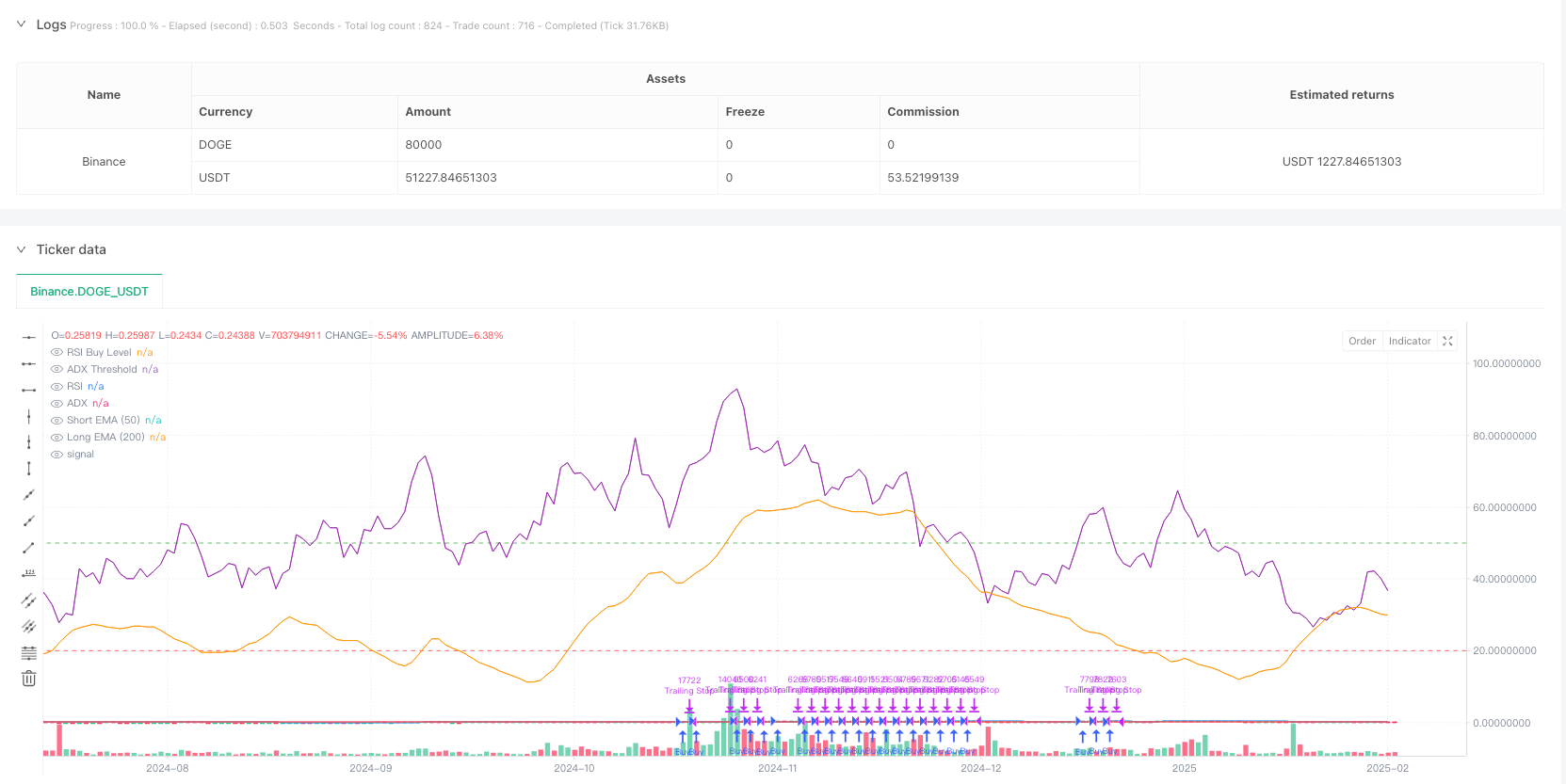

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("High-Return Trend Strategy (Final)", overlay=true)

// === Inputs ===

longEmaLength = input(200, title="Long EMA Length")

shortEmaLength = input(50, title="Short EMA Length")

rsiLength = input(14, title="RSI Length")

rsiBuyLevel = input(50, title="RSI Buy Level")

atrLength = input(14, title="ATR Length")

atrMultiplier = input(2.5, title="ATR Multiplier") // Adjusted for lower drawdown

riskPerTrade = input.float(1.0, title="Risk % per Trade", minval=0.1, maxval=5.0, step=0.1) // Risk % of equity

// === Indicators ===

longEma = ta.ema(close, longEmaLength)

shortEma = ta.ema(close, shortEmaLength)

rsi = ta.rsi(close, rsiLength)

atr = ta.atr(atrLength)

[plusDI, minusDI, adx] = ta.dmi(14, 14) // DI and ADX smoothing set to 14

// === Position Sizing ===

// Calculate position size based on risk per trade

riskAmount = strategy.equity * (riskPerTrade / 100) // Risk % of account equity

positionSize = riskAmount / (atr * atrMultiplier) // ATR-based stop-loss distance

// === Entry Conditions ===

trendConfirmed = ta.barssince(shortEma <= longEma) > 10 // Persistent trend above long EMA

longCondition = shortEma > longEma and rsi > rsiBuyLevel and adx > 20 and trendConfirmed

// === Exit Conditions ===

longStopLoss = close - atr * atrMultiplier // Dynamic stop-loss

strategy.exit("Trailing Stop", from_entry="Buy", trail_points=atr * 1.5, trail_offset=atr * 1.5) // Trailing stop

// === Strategy Logic ===

if (longCondition)

strategy.entry("Buy", strategy.long, qty=positionSize)

// === Alerts ===

alertcondition(longCondition, title="Buy Signal", message="Buy Signal Triggered!")

alertcondition(strategy.closedtrades > 0, title="Trade Closed", message="Trade Closed!")

// === Debugging and Visualization ===

plot(longEma, color=color.red, title="Long EMA (200)")

plot(shortEma, color=color.blue, title="Short EMA (50)")

plot(rsi, color=color.purple, title="RSI")

hline(rsiBuyLevel, "RSI Buy Level", color=color.green)

plot(adx, color=color.orange, title="ADX")

hline(20, "ADX Threshold", color=color.red)