概述

这是一个基于日内动量的全自动化交易策略,结合了严格的风险管理和精确的头寸管理系统。该策略主要在伦敦交易时段运行,通过识别市场动量变化和排除Doji形态来寻找交易机会,同时实施每日止盈规则以控制风险。策略采用动态仓位管理方法,根据账户权益自动调整交易规模,确保资金使用的最优化。

策略原理

策略的核心逻辑建立在多个关键组件之上。首先,交易时间限制在伦敦时段(排除0点和19点后的时间),以确保充足的市场流动性。入场信号基于价格动量的突破,具体要求当前蜡烛线的高点突破前一根的高点(做多)或低点突破前一根的低点(做空),同时需要满足方向一致性要求。为避免假突破,策略明确排除了Doji蜡烛线。策略还实施了每日止盈规则,一旦达到目标利润,当天将不再开启新仓位。

策略优势

- 风险管理全面: 包含固定止损止盈、每日止盈规则和动态仓位管理

- 自适应性强: 交易规模根据账户权益自动调整,适应不同资金规模

- 流动性保障: 严格限制在伦敦交易时段执行交易,避免低流动性风险

- 假信号过滤: 通过排除Doji形态和连续信号,减少假突破带来的损失

- 执行逻辑清晰: 入场和出场条件明确,便于监控和优化

策略风险

- 市场波动风险: 在高波动期间,固定止损可能不够灵活

- 价格滑点风险: 在市场快速波动时可能面临较大滑点

- 趋势依赖性: 策略在震荡市场中可能产生较多虚假信号

- 参数敏感性: 止损止盈设置对策略表现影响较大 解决方案包括:采用动态止损机制、增加市场波动率过滤器、引入趋势确认指标等。

策略优化方向

- 引入自适应止损机制: 基于ATR或波动率动态调整止损范围

- 增加市场环境过滤: 添加趋势强度指标,在明确趋势时增加持仓时间

- 优化信号确认机制: 结合成交量和其他技术指标提高信号可靠性

- 完善资金管理: 引入复合风险管理系统,考虑回撤控制

- 增加市场微观结构分析: 整合订单流数据提高入场精确度

总结

该策略通过结合动量突破、严格的风险管理和自动化执行系统,构建了一个完整的交易框架。策略的主要优势在于其全面的风险控制体系和自适应性设计,但仍需要在市场环境识别和信号过滤方面进行优化。通过持续改进和参数优化,该策略有望在不同市场环境下保持稳定表现。

策略源码

/*backtest

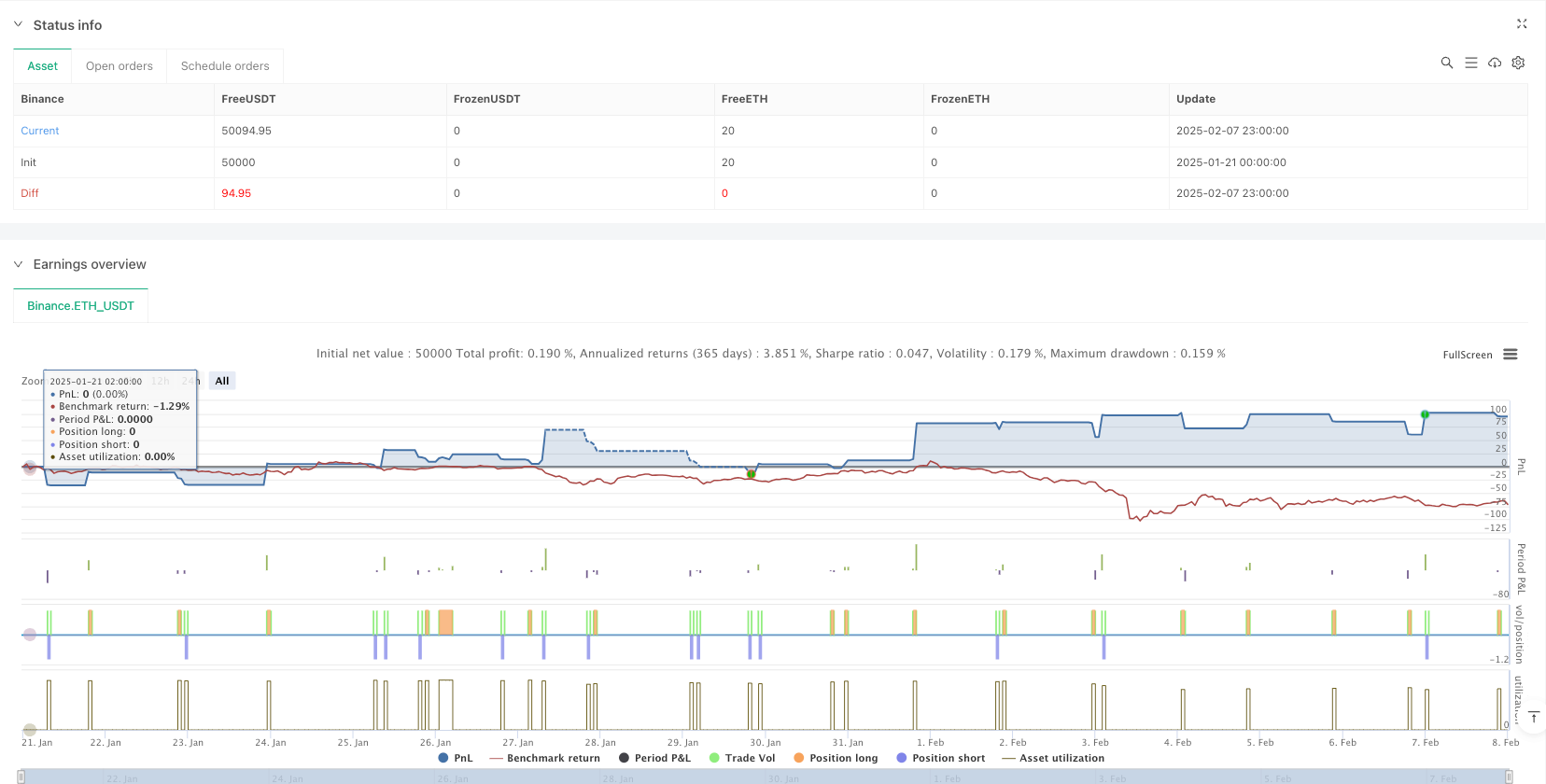

start: 2025-01-21 00:00:00

end: 2025-02-08 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Trading Strategy for XAUUSD (Gold) – Automated Execution Plan", overlay=true, initial_capital=10000, currency=currency.USD)

//────────────────────────────

// 1. RISK MANAGEMENT & POSITION SIZING

//────────────────────────────

// Configurable inputs for Stop Loss and Take Profit

sl = input.float(title="Stop Loss ($)", defval=5, step=0.1)

tp = input.float(title="Take Profit ($)", defval=15, step=0.1)

// Volume: 0.01 lots per $100 of equity → lotSize = equity / 10000

lotSize = strategy.equity / strategy.initial_capital

//────────────────────────────

// 2. TRADING HOURS (London Time)

//────────────────────────────

// Get the current bar's timestamp in London time.

londonTime = time(timeframe.period, "", "Europe/London")

londonHour = hour(londonTime)

tradingAllowed = (londonHour != 0) and (londonHour < 19)

//────────────────────────────

// 3. DOJI CANDLE DEFINITION

//────────────────────────────

// A candle is considered a doji if the sum of its upper and lower shadows is greater than its body.

upperShadow = high - math.max(open, close)

lowerShadow = math.min(open, close) - low

bodySize = math.abs(close - open)

isDoji = (upperShadow + lowerShadow) > bodySize

//────────────────────────────

// 4. ENTRY CONDITIONS

//────────────────────────────

// Buy Signal:

// • Current candle’s high > previous candle’s high.

// • Current candle’s low is not below previous candle’s low.

// • Bullish candle (close > open) and not a doji.

// • Skip if previous candle already qualified.

buyRaw = (high > high[1]) and (low >= low[1]) and (close > open) and (not isDoji)

buySignal = buyRaw and not (buyRaw[1] ? true : false)

// Sell Signal:

// • Current candle’s low < previous candle’s low.

// • Current candle’s high is not above previous candle’s high.

// • Bearish candle (close < open) and not a doji.

// • Skip if previous candle already qualified.

sellRaw = (low < low[1]) and (high <= high[1]) and (close < open) and (not isDoji)

sellSignal = sellRaw and not (sellRaw[1] ? true : false)

//────────────────────────────

// 5. DAILY TAKE PROFIT (TP) RULE

//────────────────────────────

// Create a day-string (year-month-day) using London time.

// This flag will block new trades for the rest of the day if a TP is hit.

var string lastDay = ""

currentDay = str.tostring(year(londonTime)) + "-" + str.tostring(month(londonTime)) + "-" + str.tostring(dayofmonth(londonTime))

var bool dailyTPHit = false

if lastDay != currentDay

dailyTPHit := false

lastDay := currentDay

//────────────────────────────

// 6. TRACK TRADE ENTRY & EXIT FOR TP DETECTION

//────────────────────────────

// We record the TP target when a new trade is entered.

// Then, when a trade closes, if the bar’s high (for long) or low (for short) reached the TP target,

// we assume the TP was hit and block new trades for the day.

var float currentTP = na

var int currentTradeType = 0 // 1 for long, -1 for short

// Detect a new trade entry (transition from no position to a position).

tradeEntered = (strategy.position_size != 0 and strategy.position_size[1] == 0)

if tradeEntered

if strategy.position_size > 0

currentTP := strategy.position_avg_price + tp

currentTradeType := 1

else if strategy.position_size < 0

currentTP := strategy.position_avg_price - tp

currentTradeType := -1

// Detect trade closure (transition from position to flat).

tradeClosed = (strategy.position_size == 0 and strategy.position_size[1] != 0)

if tradeClosed and not na(currentTP)

// For a long trade, if the bar's high reached the TP target;

// for a short trade, if the bar's low reached the TP target,

// mark the daily TP flag.

if (currentTradeType == 1 and high >= currentTP) or (currentTradeType == -1 and low <= currentTP)

dailyTPHit := true

currentTP := na

currentTradeType := 0

//────────────────────────────

// 7. ORDER EXECUTION

//────────────────────────────

// Only open a new position if no position is open, trading is allowed, and daily TP rule is not active.

if (strategy.position_size == 0) and tradingAllowed and (not dailyTPHit)

if buySignal

strategy.entry("Long", strategy.long, qty=lotSize)

if sellSignal

strategy.entry("Short", strategy.short, qty=lotSize)

//────────────────────────────

// 8. EXIT ORDERS (Risk Management)

//────────────────────────────

// For long positions: SL = entry price - Stop Loss, TP = entry price + Take Profit.

// For short positions: SL = entry price + Stop Loss, TP = entry price - Take Profit.

if strategy.position_size > 0

longSL = strategy.position_avg_price - sl

longTP = strategy.position_avg_price + tp

strategy.exit("Exit Long", from_entry="Long", stop=longSL, limit=longTP)

if strategy.position_size < 0

shortSL = strategy.position_avg_price + sl

shortTP = strategy.position_avg_price - tp

strategy.exit("Exit Short", from_entry="Short", stop=shortSL, limit=shortTP)

//────────────────────────────

// 9. VISUALIZATION

//────────────────────────────

plotshape(buySignal and tradingAllowed and (not dailyTPHit) and (strategy.position_size == 0), title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(sellSignal and tradingAllowed and (not dailyTPHit) and (strategy.position_size == 0), title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

相关推荐