概述

这是一个基于日内价格高低点突破的交易策略,结合了ATR指标来动态调整止损和获利目标。该策略通过监控前一交易日和当前交易日的最高价和最低价,在价格突破这些关键水平时进行交易。策略还引入了缓冲区概念,以减少虚假信号,并使用ATR倍数来设置动态的风险管理参数。

策略原理

策略的核心逻辑基于价格突破前期高低点进行交易。具体来说: 1. 每个交易日开始时记录前一日的最高价和最低价 2. 实时追踪当日最高价和最低价 3. 将前一日和当日的极值进行比较,选择最高值和最低值作为突破参考点 4. 当价格突破这些参考点(考虑缓冲区)时触发交易信号 5. 使用ATR的1.5倍作为止损距离,2倍作为获利目标 6. 系统自动在图表上绘制突破位置,并提供交易提醒功能

策略优势

- 动态适应性强 - 通过ATR动态调整止损和获利目标,使策略能够适应不同的市场波动环境

- 风险控制完善 - 设置了基于ATR的止损和获利目标,确保每笔交易的风险可控

- 信号过滤机制 - 使用缓冲区来减少虚假突破信号

- 可视化支持 - 在图表上清晰标注突破位置,便于交易者实时监控

- 自动化程度高 - 包含完整的入场、出场逻辑,可实现全自动交易

策略风险

- 横盘市场风险 - 在市场波动较小时可能产生频繁的虚假信号

- 跳空风险 - 夜间跳空可能导致止损失效

- 趋势延续风险 - 固定的ATR倍数可能在强趋势市场中过早平仓

- 参数敏感性 - 缓冲区和ATR倍数的设置对策略表现影响较大

- 市场环境依赖 - 策略在高波动市场中表现较好,但在低波动期可能表现欠佳

策略优化方向

- 引入趋势过滤器 - 可添加移动平均线等趋势指标,仅在趋势方向交易

- 动态缓冲区 - 根据市场波动率自动调整缓冲区大小

- 改进止盈机制 - 考虑使用追踪止损,避免在强趋势中过早离场

- 时间过滤 - 增加交易时间段过滤,避开波动较小的时段

- 成交量确认 - 添加成交量确认机制,提高突破的可靠性

总结

这是一个设计合理、逻辑清晰的突破交易策略。通过结合ATR指标和缓冲区概念,有效平衡了交易机会和风险控制。策略的可视化和自动化程度较高,适合日内交易者使用。但使用者需要注意市场环境的适应性,并根据实际交易效果调整参数设置。通过建议的优化方向,策略还有进一步提升的空间。

策略源码

/*backtest

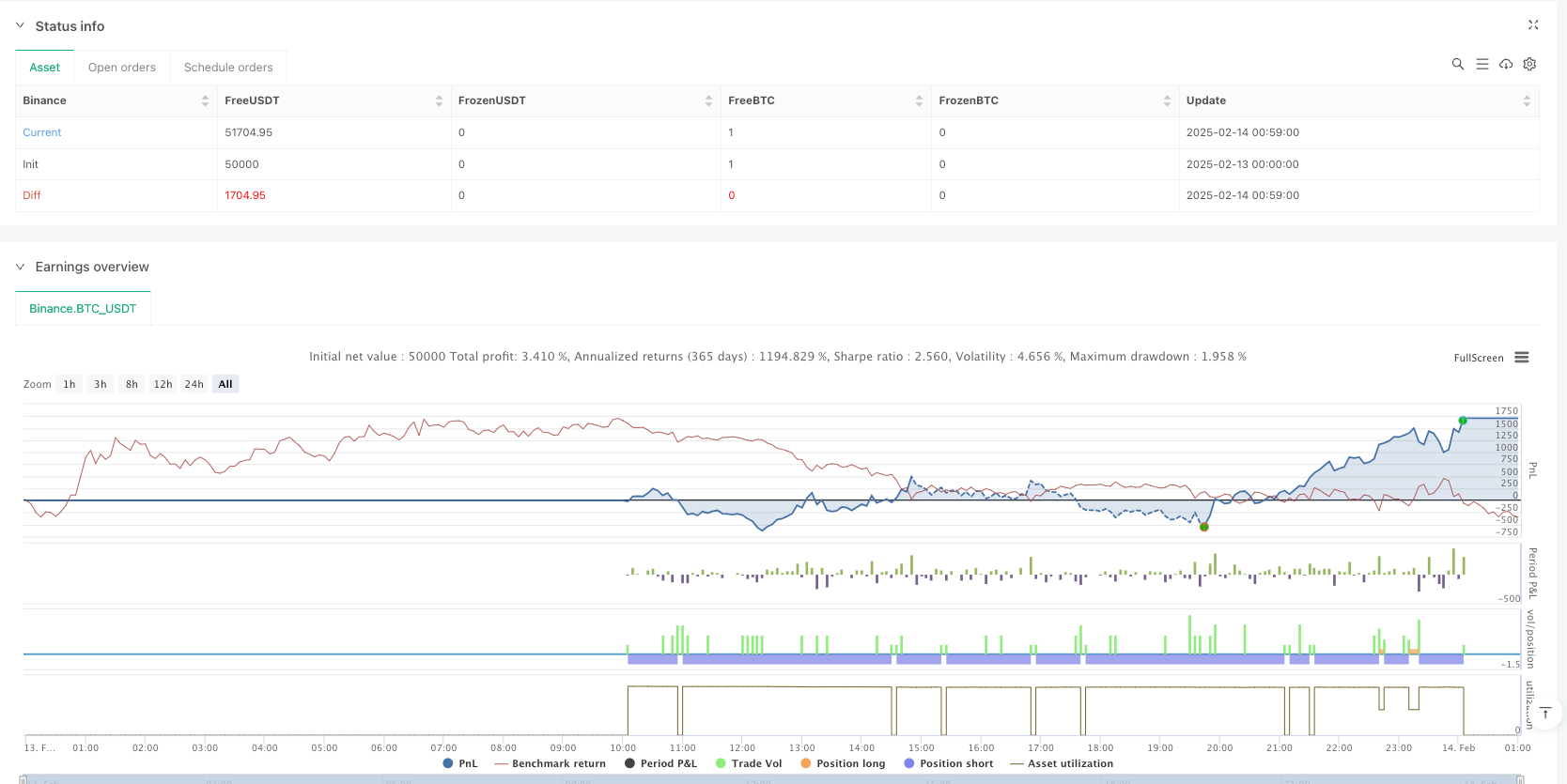

start: 2025-02-13 00:00:00

end: 2025-02-14 01:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Previous/Current Day High-Low Breakout Strategy", overlay=true)

// === INPUTS ===

buffer = input(10, title="Buffer Points Above/Below Day High/Low") // 0-10 point buffer

atrMultiplier = input.float(1.5, title="ATR Multiplier for SL/TP") // ATR-based SL & TP

// === DETECT A NEW DAY CORRECTLY ===

dayChange = ta.change(time("D")) != 0 // Returns true when a new day starts

// === FETCH PREVIOUS DAY HIGH & LOW CORRECTLY ===

var float prevDayHigh = na

var float prevDayLow = na

if dayChange

prevDayHigh := high[1] // Store previous day's high

prevDayLow := low[1] // Store previous day's low

// === TRACK CURRENT DAY HIGH & LOW ===

todayHigh = ta.highest(high, ta.barssince(dayChange)) // Highest price so far today

todayLow = ta.lowest(low, ta.barssince(dayChange)) // Lowest price so far today

// === FINAL HIGH/LOW SELECTION (Whichever Happens First) ===

finalHigh = math.max(prevDayHigh, todayHigh) // Use the highest value

finalLow = math.min(prevDayLow, todayLow) // Use the lowest value

// === ENTRY CONDITIONS ===

// 🔹 BUY (LONG) Condition: Closes below final low - buffer

longCondition = close <= (finalLow - buffer)

// 🔻 SELL (SHORT) Condition: Closes above final high + buffer

shortCondition = close >= (finalHigh + buffer)

// === ATR STOP-LOSS & TAKE-PROFIT ===

atr = ta.atr(14)

longSL = close - (atr * atrMultiplier) // Stop-Loss for Long

longTP = close + (atr * atrMultiplier * 2) // Take-Profit for Long

shortSL = close + (atr * atrMultiplier) // Stop-Loss for Short

shortTP = close - (atr * atrMultiplier * 2) // Take-Profit for Short

// === EXECUTE LONG (BUY) TRADE ===

if longCondition

strategy.entry("BUY", strategy.long, comment="🔹 BUY Signal")

strategy.exit("SELL TP", from_entry="BUY", stop=longSL, limit=longTP)

// === EXECUTE SHORT (SELL) TRADE ===

if shortCondition

strategy.entry("SELL", strategy.short, comment="🔻 SELL Signal")

strategy.exit("BUY TP", from_entry="SELL", stop=shortSL, limit=shortTP)

// === PLOT LINES FOR VISUALIZATION ===

plot(finalHigh, title="Breakout High (Prev/Today)", color=color.new(color.blue, 60), linewidth=2, style=plot.style_stepline)

plot(finalLow, title="Breakout Low (Prev/Today)", color=color.new(color.red, 60), linewidth=2, style=plot.style_stepline)

// === ALERT CONDITIONS ===

alertcondition(longCondition, title="🔔 Buy Signal", message="BUY triggered 🚀")

alertcondition(shortCondition, title="🔔 Sell Signal", message="SELL triggered 📉")

相关推荐