概述

这是一个基于无影线平均K线(Heikin-Ashi)和成交量加权平均价格(VWAP)的自动交易系统。该策略通过识别特定的K线形态,结合VWAP作为动态支撑/阻力位,在设定的交易时间内执行买卖操作。系统采用固定止盈止损点位管理风险,并在每日特定时间强制平仓以避免隔夜风险。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用Heikin-Ashi K线代替传统K线,通过计算开盘价、最高价、最低价和收盘价的平均值,能更好地识别市场趋势。 2. 买入条件:绿色Heikin-Ashi K线(无下影线)形成且价格位于VWAP之上。 3. 卖出条件:红色Heikin-Ashi K线(无上影线)形成且价格位于VWAP之下。 4. 采用固定50点的止盈目标,触及成本价则平仓。 5. 在15:01时强制平仓所有未平仓位置。

策略优势

- 结合了Heikin-Ashi和VWAP两个强大的技术指标,提高了交易信号的可靠性。

- 无影线要求确保了更强的趋势确认信号。

- 固定止盈止损点位有助于严格的风险控制。

- 日内交易策略避免了隔夜风险。

- 系统完全自动化,减少了人为情绪干扰。

策略风险

- 固定止盈止损点位可能不适合所有市场条件,特别是在波动性变化时。

- 强制平仓时间可能导致错过延续性行情。

- 无影线的严格要求可能导致错过部分有效交易机会。

- 在横盘市场中可能产生频繁的假信号。

- VWAP在低交易量期间的参考价值可能降低。

策略优化方向

- 引入ATR动态调整止盈止损点位,使策略更好地适应市场波动性。

- 增加趋势过滤器,减少横盘市场中的假信号。

- 优化平仓时间,可根据市场特征动态调整。

- 添加交易量过滤器,提高VWAP指标的可靠性。

- 实现追踪止损功能,更好地保护盈利。

总结

该策略通过结合Heikin-Ashi和VWAP指标,构建了一个稳健的日内交易系统。虽然存在一些优化空间,但基本框架具有良好的实用性。通过提议的优化方向,策略有望在不同市场条件下取得更好的表现。重点是要根据具体交易品种的特点,对各项参数进行细致的调优。

策略源码

/*backtest

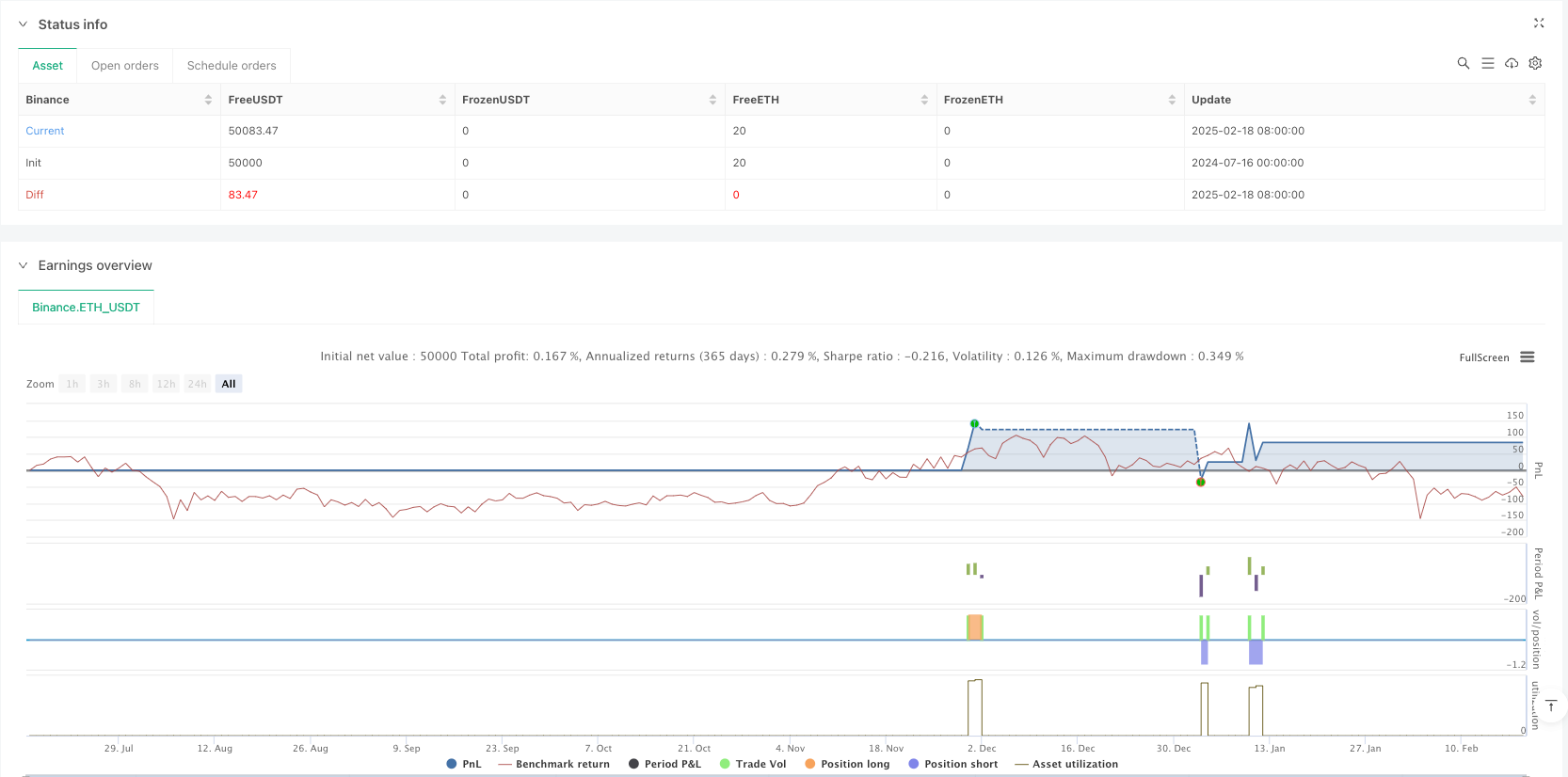

start: 2024-07-16 00:00:00

end: 2025-02-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Buy and Sell Signal with VWAP and Timed Exit", overlay=true)

// VWAP Calculation

vwap = ta.vwap(close)

// Heikin-Ashi Formula

var float heikin_open = na

var float heikin_close = na

heikin_open := na(heikin_open[1]) ? (open + close) / 2 : (heikin_open[1] + heikin_close[1]) / 2

heikin_close := (open + high + low + close) / 4

heikin_high = math.max(high, math.max(heikin_open, heikin_close))

heikin_low = math.min(low, math.min(heikin_open, heikin_close))

// Conditions for Sell (Red Heikin-Ashi with no upper shadow) and Buy (Green Heikin-Ashi with no lower shadow)

no_upper_shadow = heikin_high == math.max(heikin_open, heikin_close)

no_lower_shadow = heikin_low == math.min(heikin_open, heikin_close)

// Condition for red (sell) and green (buy) Heikin-Ashi candles

is_red_candle = heikin_close < heikin_open

is_green_candle = heikin_close > heikin_open

// Buy and Sell Signal Conditions

sell_signal = is_red_candle and no_upper_shadow and close < vwap

buy_signal = is_green_candle and no_lower_shadow and close > vwap

// Check current time (for 15:01 IST)

is_after_1501 = (hour == 15 and minute > 1) or (hour > 15)

// Check for open positions

open_sell_position = strategy.position_size < 0

open_buy_position = strategy.position_size > 0

// Trigger Sell order only if no open sell position exists and time is before 15:01, and price is below VWAP

if sell_signal and not open_sell_position and not is_after_1501

strategy.entry("Sell", strategy.short)

// Trigger Buy order only if no open buy position exists and time is before 15:01, and price is above VWAP

if buy_signal and not open_buy_position and not is_after_1501

strategy.entry("Buy", strategy.long)

// Define exit condition for Sell (opposite of Buy conditions)

exit_sell_condition = false

if open_sell_position

entry_price = strategy.position_avg_price // Get the average entry price for Sell

current_price = close // Current market price for Sell

// Exit conditions for Sell

exit_sell_condition := current_price > entry_price or entry_price - current_price >= 50

// Exit if conditions are met

if exit_sell_condition

strategy.close("Sell")

// Define exit condition for Buy (opposite of Sell conditions)

exit_buy_condition = false

if open_buy_position

entry_price = strategy.position_avg_price // Get the average entry price for Buy

current_price = close // Current market price for Buy

// Exit conditions for Buy

exit_buy_condition := current_price < entry_price or current_price - entry_price >= 50

// Exit if conditions are met

if exit_buy_condition

strategy.close("Buy")

// Exit at 15:01 IST for both Buy and Sell if not already exited

if (open_sell_position or open_buy_position) and (hour == 15 and minute == 1)

strategy.close("Sell")

strategy.close("Buy")

// Plot VWAP

plot(vwap, color=color.blue, linewidth=2, title="VWAP")

// Plot Heikin-Ashi Candles

plotcandle(heikin_open, heikin_high, heikin_low, heikin_close, color = is_red_candle ? color.red : (is_green_candle ? color.green : color.gray))

// Plot Sell signal on the chart

plotshape(sell_signal and not open_sell_position and not is_after_1501, style=shape.labeldown, location=location.abovebar, color=color.red, text="SELL", size=size.small)

// Plot Buy signal on the chart

plotshape(buy_signal and not open_buy_position and not is_after_1501, style=shape.labelup, location=location.belowbar, color=color.green, text="BUY", size=size.small)

// Plot Exit signals on the chart

plotshape(exit_sell_condition and open_sell_position, style=shape.labelup, location=location.belowbar, color=color.blue, text="EXIT SELL", size=size.small)

plotshape(exit_buy_condition and open_buy_position, style=shape.labeldown, location=location.abovebar, color=color.blue, text="EXIT BUY", size=size.small)

相关推荐