概述

该策略是一个基于威廉指标(%R)、移动平均线趋势指标(MACD)和指数移动平均线(EMA)的多重指标组合策略。通过判断市场超买超卖状态,结合动量指标的变化趋势和均线支撑,构建了一个完整的趋势跟踪交易系统。该策略不仅包含了入场信号的生成,还设计了完善的风险管理机制。

策略原理

策略主要基于以下三个核心指标的协同配合: 1. 威廉指标(%R)用于识别市场的超买超卖状态,当指标从超卖区(-80以下)向上突破时,表明可能出现看涨反转信号 2. MACD指标通过快线与慢线的交叉确认动量变化,当MACD线上穿信号线时,进一步确认上涨动能 3. 55周期EMA作为趋势过滤器,只有当价格位于EMA之上时才考虑做多,反之考虑做空

策略在同时满足以上三个条件时才会开仓。此外,策略还incorporates了基于风险收益比的止盈止损机制,通过设定固定的止损百分比和风险收益比来控制每笔交易的风险。

策略优势

- 多重指标交叉验证:通过威廉指标、MACD和EMA三重指标的配合使用,大大降低了假信号的出现概率

- 完善的风险控制:设计了基于风险收益比的动态止盈止损机制,每笔交易都有明确的风险控制目标

- 趋势跟踪与反转结合:既能捕捉超买超卖反转机会,又通过EMA确保顺应主趋势方向

- 参数可调节性强:主要指标的周期参数都可以根据不同市场特征进行优化调整

策略风险

- 震荡市场风险:在横盘震荡市场中可能频繁出现假突破信号,导致连续止损

- 滑点风险:在市场波动剧烈时,实际成交价格可能与信号产生价格存在较大偏差

- 参数敏感性:策略效果对参数设置较为敏感,不同市场环境可能需要不同的参数组合

- 信号滞后性:因为使用了多重指标确认,可能会错过一些行情的最佳入场点

策略优化方向

- 动态参数优化:可以根据市场波动率自动调整各个指标的参数,提高策略适应性

- 市场环境分类:增加市场环境识别模块,在不同市场状态下使用不同的参数组合

- 入场时机优化:可以增加成交量等辅助指标,提高入场时机的准确性

- 风险管理完善:可以考虑加入动态止损机制,根据市场波动情况自动调整止损距离

总结

该策略通过多重技术指标的协同配合,构建了一个较为完善的趋势跟踪交易系统。策略的主要特点是信号可靠性高、风险控制明确,但也存在一定的滞后性和参数敏感性问题。通过建议的优化方向,策略还有进一步提升的空间。在实盘应用时,建议先通过回测充分验证参数组合,并结合市场特征进行针对性优化。

策略源码

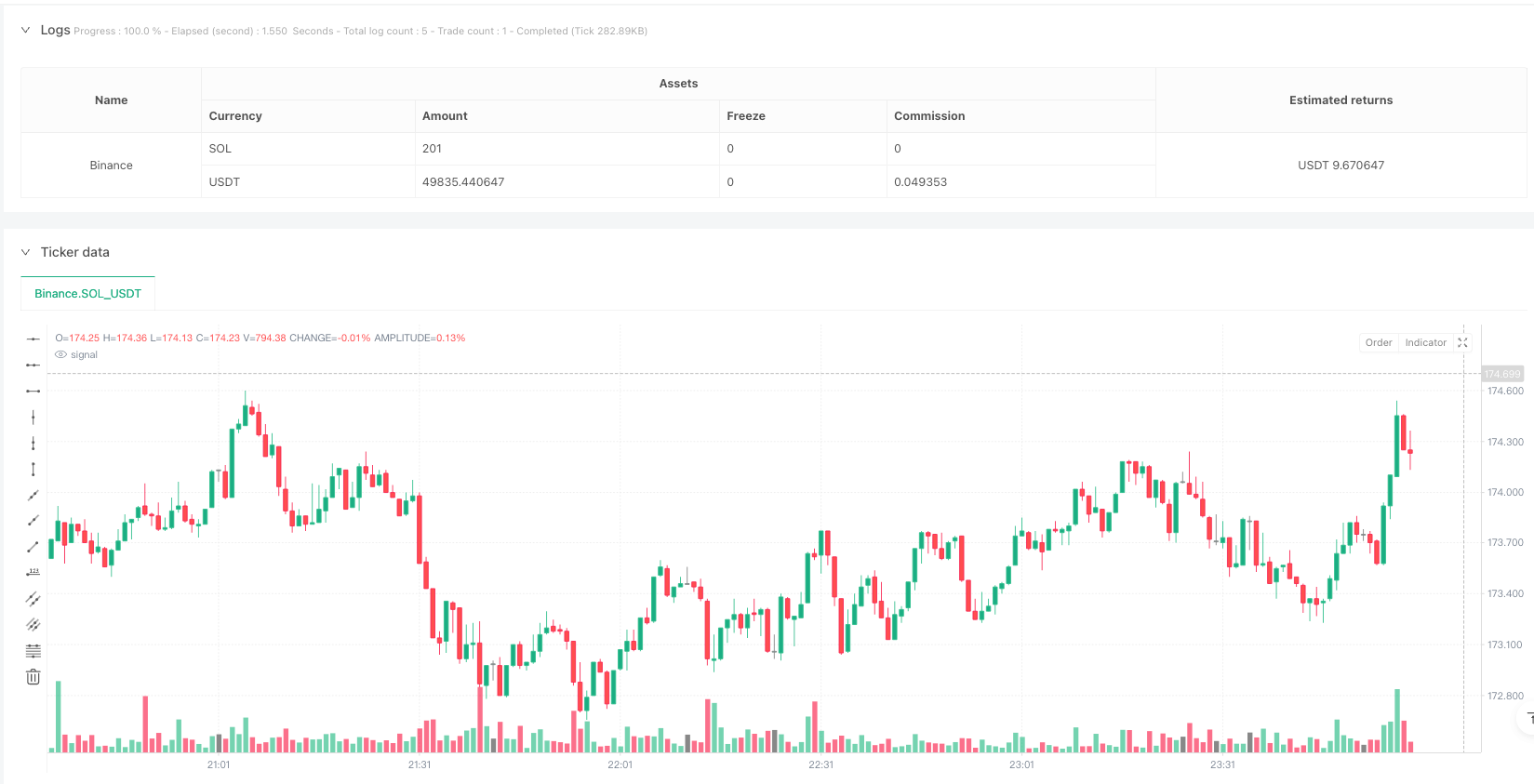

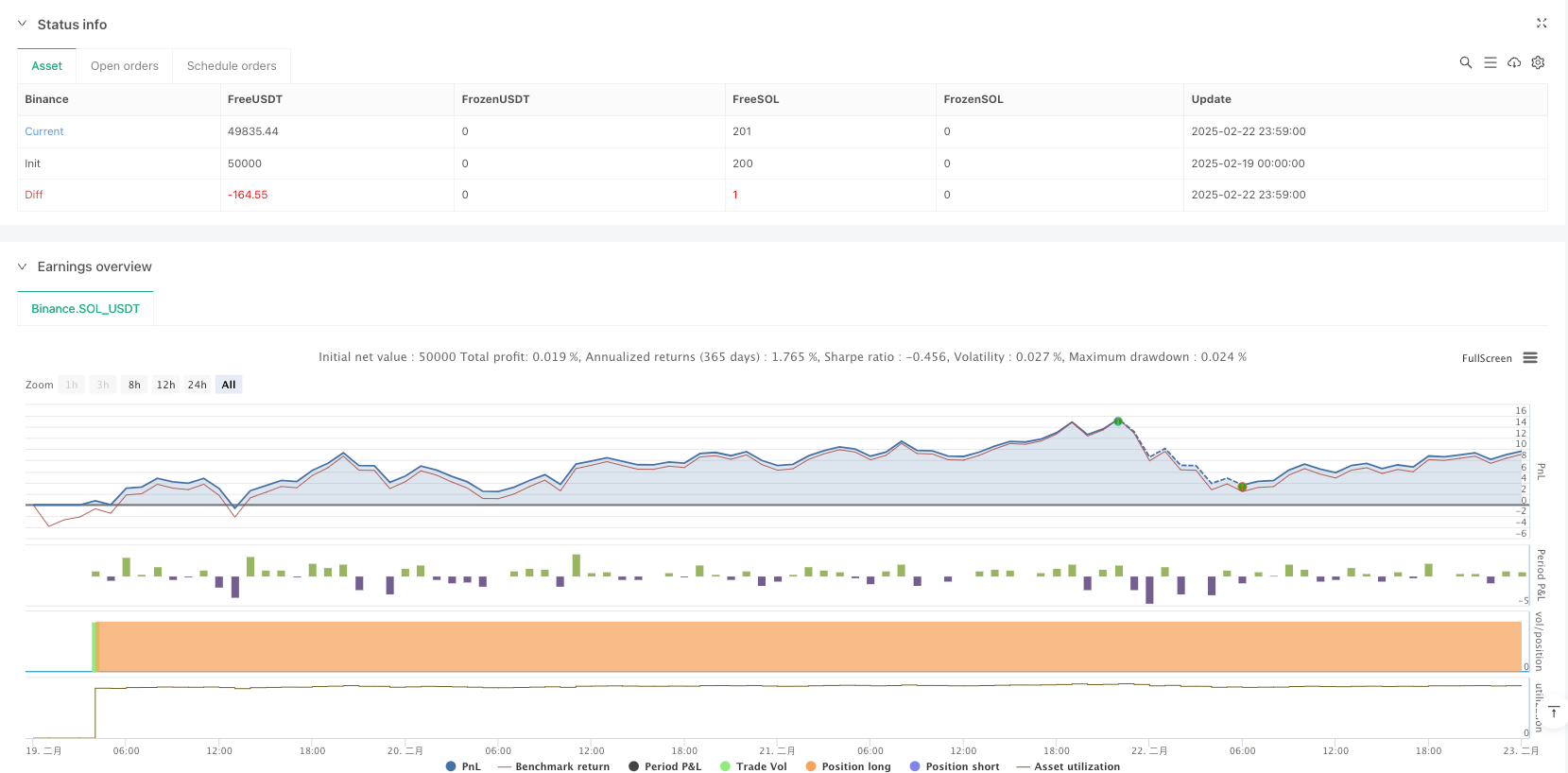

/*backtest

start: 2025-02-19 00:00:00

end: 2025-02-23 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Williams %R & MACD Swing Strategy", overlay=true)

// INPUTS

length_wpr = input(14, title="Williams %R Length")

overbought = input(-20, title="Overbought Level")

oversold = input(-80, title="Oversold Level")

// MACD Inputs

fastLength = input(12, title="MACD Fast Length")

slowLength = input(26, title="MACD Slow Length")

signalSmoothing = input(9, title="MACD Signal Smoothing")

// EMA for Trend Confirmation

ema_length = input(55, title="EMA Length")

ema55 = ta.ema(close, ema_length)

// INDICATORS

wpr = ta.wpr(length_wpr)

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// LONG ENTRY CONDITIONS

longCondition = ta.crossover(wpr, oversold) and ta.crossover(macdLine, signalLine) and close > ema55

if longCondition

strategy.entry("Long", strategy.long)

// SHORT ENTRY CONDITIONS

shortCondition = ta.crossunder(wpr, overbought) and ta.crossunder(macdLine, signalLine) and close < ema55

if shortCondition

strategy.entry("Short", strategy.short)

// RISK MANAGEMENT

riskRewardRatio = input(1.5, title="Risk-Reward Ratio")

stopLossPerc = input(2, title="Stop Loss %") / 100

takeProfitPerc = stopLossPerc * riskRewardRatio

longSL = strategy.position_avg_price * (1 - stopLossPerc)

longTP = strategy.position_avg_price * (1 + takeProfitPerc)

shortSL = strategy.position_avg_price * (1 + stopLossPerc)

shortTP = strategy.position_avg_price * (1 - takeProfitPerc)

strategy.exit("Take Profit / Stop Loss", from_entry="Long", loss=longSL, profit=longTP)

strategy.exit("Take Profit / Stop Loss", from_entry="Short", loss=shortSL, profit=shortTP)

相关推荐