概述

该策略是一个结合了动态反应器(Dynamic Reactor)和多核心回归(Multi-Kernel Regression)的趋势跟踪系统。它通过融合ATR通道、SMA均线以及高斯核回归与Epanechnikov核回归来捕捉市场趋势,并利用RSI指标进行信号过滤。该策略还包含了完整的仓位管理系统,包括动态止损、多重获利目标以及追踪止损等功能。

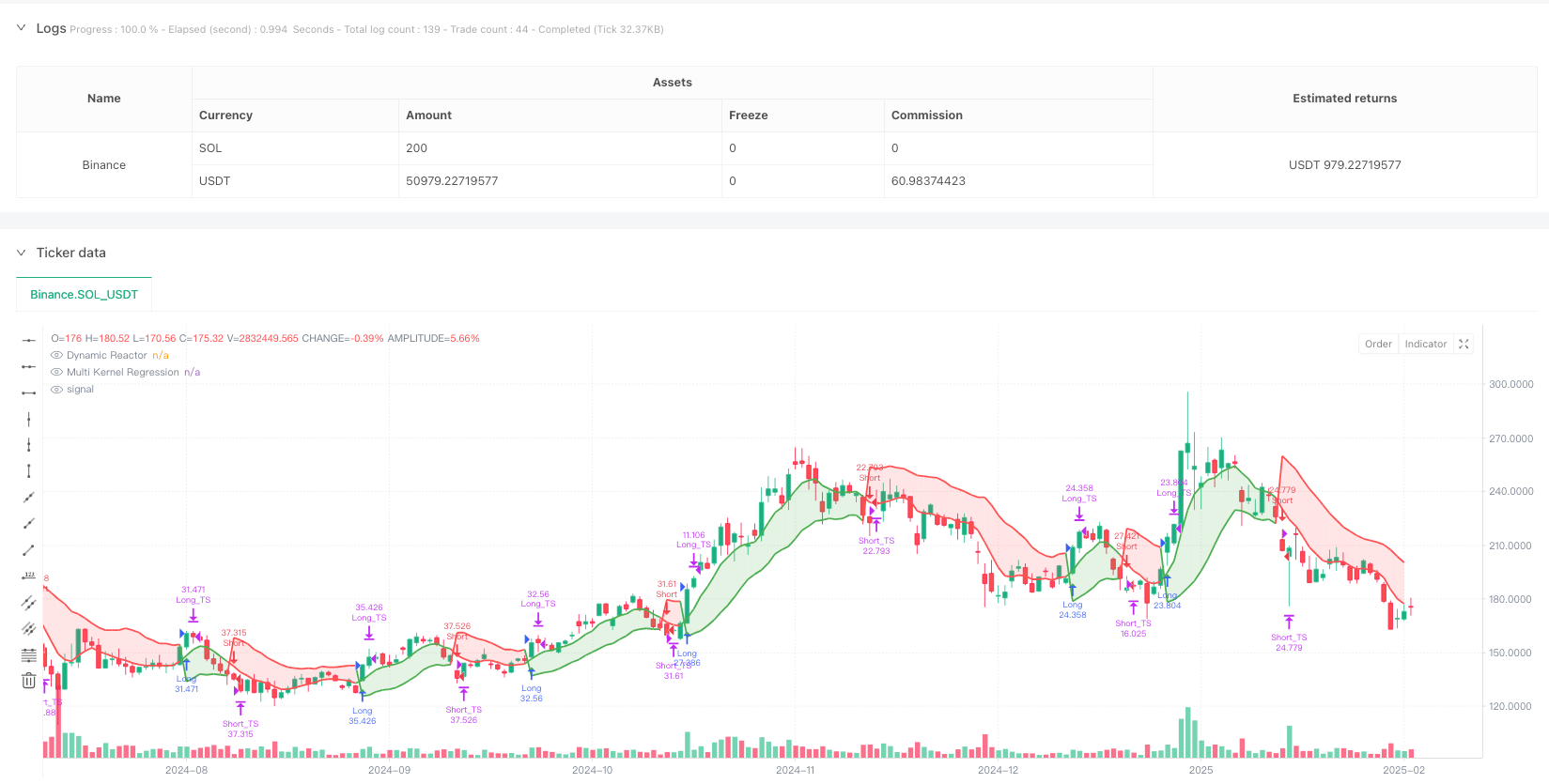

策略原理

策略的核心由两个主要部分组成。第一部分是动态反应器(DR),它基于ATR和SMA构建了一个自适应的价格通道。通道的宽度由ATR乘数决定,通道的位置则随着SMA的移动而调整。当价格突破通道时,系统会更新趋势方向。第二部分是多核心回归(MKR),它结合了高斯核回归和Epanechnikov核回归两种不同的核函数。通过设定不同的带宽参数和权重,系统能够更好地拟合价格走势。交易信号产生于MKR线与DR线的交叉,并由RSI指标进行过滤,以避免过买过卖区域的交易。

策略优势

- 适应性强:通过动态反应器和多核心回归的结合,策略能够自动适应不同的市场环境和波动条件。

- 风险管理完善:包含了动态止损、分批获利和追踪止损等多重风险控制机制。

- 信号质量高:通过RSI过滤和两条线的交叉确认,能够有效减少虚假信号。

- 计算效率高:虽然使用了复杂的核回归算法,但通过优化计算方法,保证了策略的实时性能。

策略风险

- 参数敏感性:策略效果高度依赖于ATR乘数、核函数带宽等参数的设置,不当的参数可能导致过度交易或错过机会。

- 滞后性:由于使用了移动平均和回归算法,在快速行情中可能存在一定的滞后。

- 市场适应性:策略在趋势市场表现较好,但在区间震荡市场可能频繁产生虚假信号。

- 计算复杂度:多核心回归部分的计算较为复杂,在高频交易环境下需要注意性能优化。

策略优化方向

- 参数自适应:可以引入自适应机制,根据市场波动情况动态调整ATR乘数和核函数带宽。

- 信号优化:考虑添加成交量、价格形态等辅助指标,提高信号的可靠性。

- 风险控制:可以根据市场波动率动态调整止损和获利目标的比例。

- 市场过滤:增加市场环境识别模块,在不同市场条件下使用不同的交易策略。

总结

这是一个融合了现代统计学方法和传统技术分析的完整交易系统。通过动态反应器和多核心回归的创新组合,以及完善的风险管理机制,该策略展现出较好的适应性和稳定性。虽然存在一些需要优化的地方,但通过持续改进和参数优化,该策略有望在不同市场环境下都能保持稳定的表现。

策略源码

/*backtest

start: 2024-07-20 00:00:00

end: 2025-07-19 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT","balance":2000000}]

*/

//@version=5

strategy("DR+MKR Signals – Band SL, Multiple TP & Trailing Stop", overlay=true, default_qty_value=10)

// =====================================================================

// PART 1: Optimized Dynamic Reactor

// =====================================================================

atrLength = input.int(10, "ATR Length", minval=1) // Lower value for increased sensitivity

smaLength = input.int(10, "SMA Length", minval=1) // Lower value for a faster response

multiplier = input.float(1.2, "ATR Multiplier", minval=0.1, step=0.1) // Adjusted for tighter bands

atrValue = ta.atr(atrLength)

smaValue = ta.sma(close, smaLength)

basicUpper = smaValue + atrValue * multiplier

basicLower = smaValue - atrValue * multiplier

var float finalUpper = basicUpper

var float finalLower = basicLower

if bar_index > 0

finalUpper := close[1] > finalUpper[1] ? math.max(basicUpper, finalUpper[1]) : basicUpper

if bar_index > 0

finalLower := close[1] < finalLower[1] ? math.min(basicLower, finalLower[1]) : basicLower

var int trend = 1

if bar_index > 0

trend := close > finalUpper[1] ? 1 : close < finalLower[1] ? -1 : nz(trend[1], 1)

drLine = trend == 1 ? finalLower : finalUpper

p_dr = plot(drLine, color = trend == 1 ? color.green : color.red, title="Dynamic Reactor", linewidth=2)

// =====================================================================

// PART 2: Optimized Multi Kernel Regression

// =====================================================================

regLength = input.int(30, "Regression Period", minval=1) // Lower value for increased sensitivity

h1 = input.float(5.0, "Gaussian Band (h1)", minval=0.1) // Adjusted for a better fit

h2 = input.float(5.0, "Epanechnikov Band (h2)", minval=0.1)

alpha = input.float(0.5, "Gaussian Kernel Weight", minval=0, maxval=1)

f_gaussian_regression(bw) =>

num = 0.0

den = 0.0

for i = 0 to regLength - 1

weight = math.exp(-0.5 * math.pow(i / bw, 2))

num += close[i] * weight

den += weight

num / (den == 0 ? 1 : den)

f_epanechnikov_regression(bw) =>

num = 0.0

den = 0.0

for i = 0 to regLength - 1

ratio = i / bw

weight = math.abs(ratio) <= 1 ? (1 - math.pow(ratio, 2)) : 0

num += close[i] * weight

den += weight

num / (den == 0 ? 1 : den)

regGauss = f_gaussian_regression(h1)

regEpan = f_epanechnikov_regression(h2)

multiKernelRegression = alpha * regGauss + (1 - alpha) * regEpan

p_mkr = plot(multiKernelRegression, color = trend == 1 ? color.green : color.red, title="Multi Kernel Regression", linewidth=2)

fill(p_dr, p_mkr, color = trend == 1 ? color.new(color.green, 80) : color.new(color.red, 80), title="Trend Fill")

// =====================================================================

// PART 3: Buy and Sell Signals + RSI Filter

// =====================================================================

rsi = ta.rsi(close, 14)

buySignal = ta.crossover(multiKernelRegression, drLine) and rsi < 70

sellSignal = ta.crossunder(multiKernelRegression, drLine) and rsi > 30

plotshape(buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Buy Signal")

plotshape(sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Sell Signal")

alertcondition(buySignal, title="Buy Alert", message="Buy Signal generated")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal generated")

// =====================================================================

// PART 4: Trade Management – Dynamic Stop Loss & Adaptive Take Profit

// =====================================================================

var float riskValue = na

if strategy.position_size == 0

riskValue := na

enterLong() =>

strategy.entry("Long", strategy.long,comment='开多仓')

close - finalLower

enterShort() =>

strategy.entry("Short", strategy.short,comment='开空仓')

finalUpper - close

if (buySignal)

riskValue := enterLong()

if (sellSignal)

riskValue := enterShort()

exitLongOrders() =>

entryPrice = strategy.position_avg_price

TP1 = entryPrice + riskValue

strategy.exit("Long_TP1", from_entry="Long", limit=TP1, qty_percent=50, comment="平多仓TP 1:1")

strategy.exit("Long_TS", from_entry="Long", trail_offset=riskValue * 0.8, trail_points=riskValue * 0.8, comment="平多仓Trailing Stop")

if (strategy.position_size > 0)

exitLongOrders()

exitShortOrders() =>

entryPrice = strategy.position_avg_price

TP1 = entryPrice - riskValue

strategy.exit("Short_TP1", from_entry="Short", limit=TP1, qty_percent=50, comment="平空仓TP 1:1")

strategy.exit("Short_TS", from_entry="Short", trail_offset=riskValue * 0.8, trail_points=riskValue * 0.8, comment="平空仓Trailing Stop")

if (strategy.position_size < 0)

exitShortOrders()

相关推荐