概述

该策略是一个基于双指数移动平均线(EMA)的趋势跟踪交易系统。策略使用44周期和200周期两条EMA线,结合价格突破信号来确定交易方向。同时整合了风险管理机制,包括动态仓位计算和移动止损。

策略原理

策略的核心逻辑基于价格与双EMA线的交互关系。使用44周期EMA分别应用于最高价和最低价形成上下通道,200周期EMA作为长期趋势过滤器。当收盘价突破上轨EMA且满足200EMA过滤条件时,系统生成做多信号;当收盘价跌破下轨EMA且满足200EMA过滤条件时,系统生成做空信号。策略采用基于账户权益的动态仓位管理,根据每笔交易的风险百分比自动计算开仓数量。止损设置为相应的EMA线位置。

策略优势

- 趋势跟踪逻辑清晰,通过双EMA通道和长期均线过滤提供可靠的趋势确认

- 灵活的交易方向选择,可以选择仅做多、仅做空或双向交易

- 完善的风险控制机制,包含动态仓位计算和移动止损

- 参数可调整性强,便于针对不同市场环境进行优化

- 计算过程简单高效,适合实时交易执行

策略风险

- EMA指标具有滞后性,可能在剧烈波动市场中产生延迟信号

- 横盘整理市场可能产生频繁的假突破信号

- 快速反转行情下止损位设置可能过宽,导致较大回撤

- 仓位计算依赖于价格波动率,高波动环境下可能产生过大仓位

策略优化方向

- 增加成交量确认指标,提高突破信号的可靠性

- 引入波动率自适应机制,动态调整EMA参数

- 优化止损机制,可考虑引入ATR动态止损

- 添加盈利目标管理,设置动态移动止盈

- 增加市场环境过滤器,识别不适合交易的市场状态

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过双EMA通道和长期趋势过滤提供交易信号,配合完善的风险管理机制,具有良好的实用性。策略的优化空间主要在于信号确认、动态参数调整和风险管理机制的完善。在实际应用中,建议充分测试参数敏感性,并结合具体交易品种的特性进行针对性优化。

策略源码

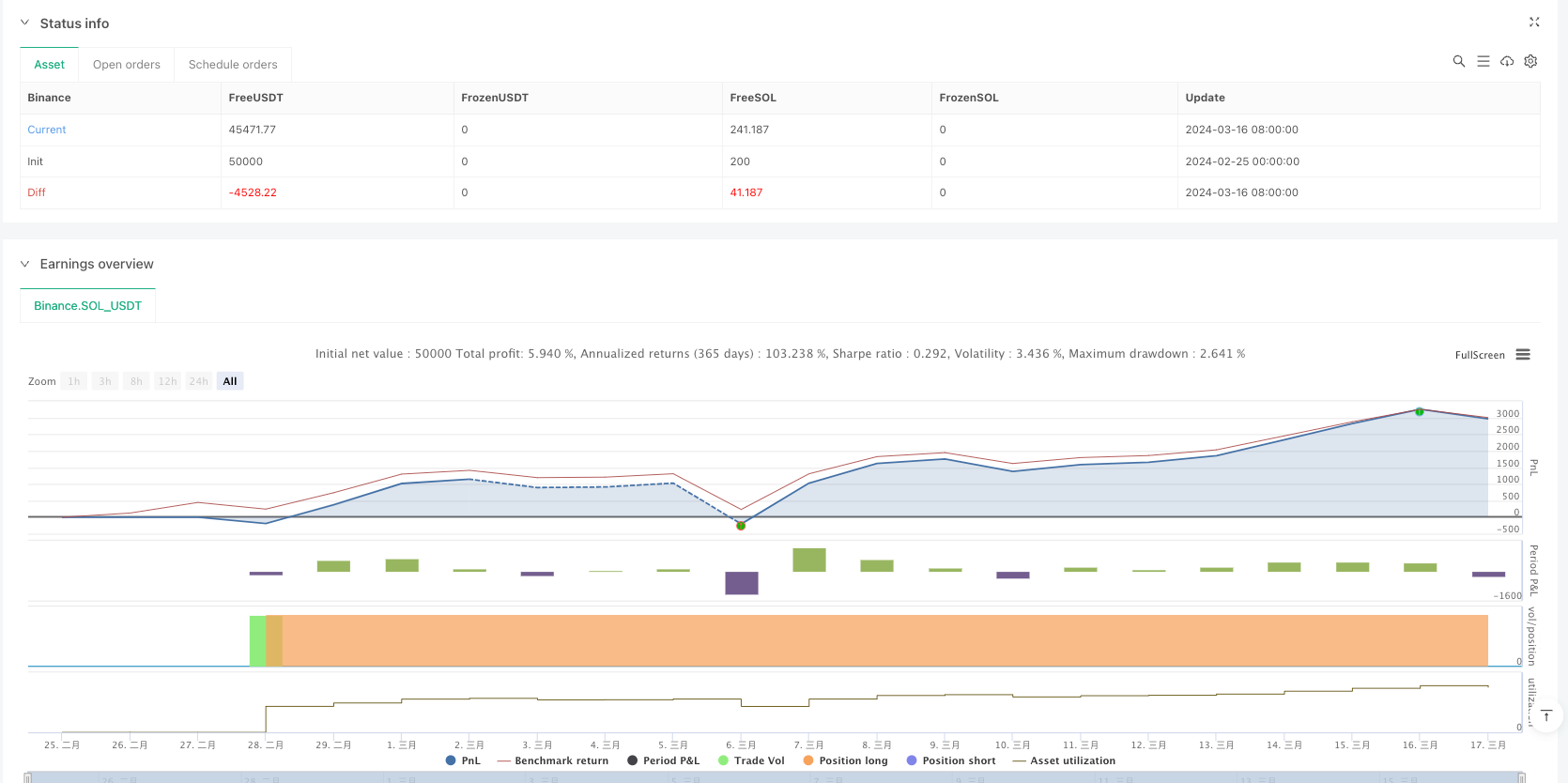

/*backtest

start: 2024-02-25 00:00:00

end: 2024-03-17 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("RENTABLE Dual EMA Breakout TSLA ", overlay=true)

// Inputs for EMA lengths and risk per trade

length = input(44, title="EMA Length")

longTermLength = input(200, title="Long-Term EMA Length")

riskPerTrade = input.float(1.0, title="Risk per Trade (%)", minval=0.1, maxval=10.0)

// Additional inputs for strategy customization

useFilter = input.bool(true, title="Use 200 EMA Filter")

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"])

// EMAs based on the high and low prices and long-term EMA

emaHigh = ta.ema(high, length)

emaLow = ta.ema(low, length)

ema200 = ta.ema(close, longTermLength)

// Plotting EMAs on the chart

plot(emaHigh, color=color.green, title="High EMA")

plot(emaLow, color=color.red, title="Low EMA")

plot(ema200, color=color.blue, title="200 EMA")

// Entry conditions with optional EMA filter

longCondition = close > emaHigh and (useFilter ? close > ema200 : true)

shortCondition = close < emaLow and (useFilter ? close < ema200 : true)

// Calculating stop-loss and position size

longStop = emaLow

shortStop = emaHigh

riskPerShareLong = close - longStop

riskPerShareShort = shortStop - close

equity = strategy.equity

// Ensure risk per share is positive for calculations

riskPerShareLong := riskPerShareLong > 0 ? riskPerShareLong : 0.01

riskPerShareShort := riskPerShareShort > 0 ? riskPerShareShort : 0.01

positionSizeLong = (equity * riskPerTrade / 100) / riskPerShareLong

positionSizeShort = (equity * riskPerTrade / 100) / riskPerShareShort

// Ensure position sizes are positive before entering trades

if (longCondition and (tradeDirection == "Long" or tradeDirection == "Both") and positionSizeLong > 0)

strategy.entry("Long", strategy.long, qty= positionSizeLong)

if (shortCondition and (tradeDirection == "Short" or tradeDirection == "Both") and positionSizeShort > 0)

strategy.entry("Short", strategy.short, qty=positionSizeShort)

// Applying the stop-loss to strategy

strategy.exit("Exit Long", "Long", stop=longStop)

strategy.exit("Exit Short", "Short", stop=shortStop)

////Usar en 1,2 3 4 HRS TSLA

相关推荐