动态均线交叉趋势跟踪组合策略

EMA SMA Moving Average CROSSOVER TREND FOLLOWING STOP LOSS TAKE PROFIT

创建日期:

2025-02-24 09:46:10

最后修改:

2025-02-24 09:46:10

复制:

2

点击次数:

398

概述

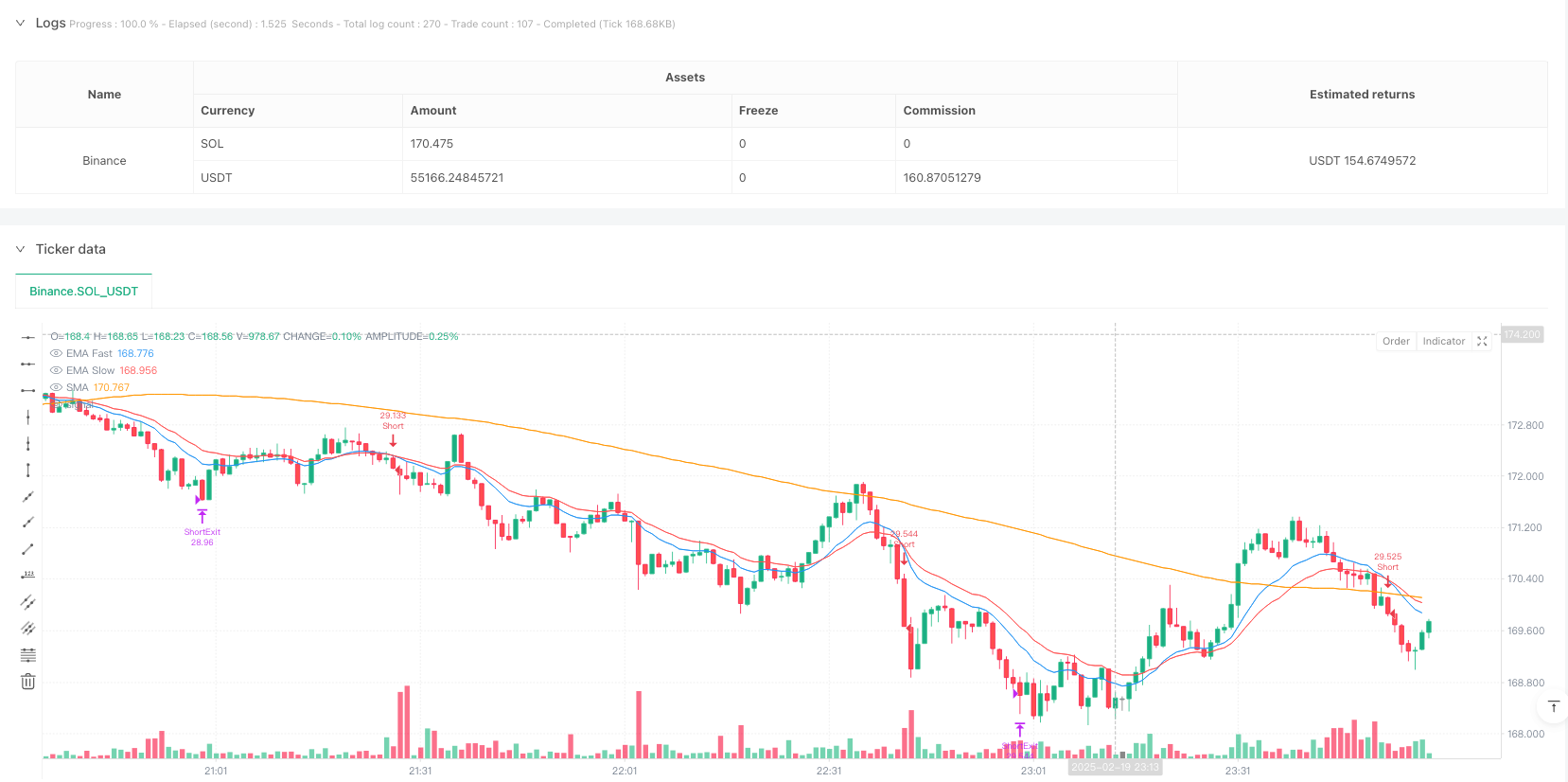

该策略是一个基于多重均线交叉的趋势跟踪系统,结合了SMA和EMA指标来捕捉市场趋势。策略通过自定义周期的简单移动平均线(SMA)和两条指数移动平均线(EMA)的配合使用,构建了一个完整的趋势跟踪交易系统。同时集成了动态止损和利润目标管理机制,有效地控制风险和锁定收益。

策略原理

策略主要基于三条均线的动态关系进行交易决策。系统通过监测价格与SMA的相对位置,以及快速EMA与慢速EMA的交叉来确定趋势方向。入场信号分为两种触发方式:其一是价格位于SMA之上(之下)且快速EMA上穿(下穿)慢速EMA;其二是价格突破SMA且前期价格持续保持在SMA上方(下方)。策略采用动态止损机制,初始止损基于EMA位置或固定百分比,随着盈利增加会相应调整止损位置。

策略优势

- 多重均线配合使用提高了趋势判断的准确性,减少了假突破带来的损失

- 双重入场条件的设计既能捕捉趋势初期的机会,又可以追踪已确立趋势的延续性

- 动态止损机制既保护了已有利润,又给予趋势充分发展的空间

- 止盈止损比例设置合理,在风险控制和收益空间之间取得了良好的平衡

- 均线交叉作为额外平仓条件,有助于及时规避趋势反转风险

策略风险

- 在震荡市场中可能频繁交易导致损失

- 多重均线系统可能在快速波动市场中产生滞后

- 固定的止损倍数可能不适合所有市场环境

- 在波动率较大的市场中,移动止损可能过早锁定利润

- 参数优化过度可能导致策略在实盘中表现不及回测结果

策略优化方向

- 引入波动率指标来动态调整止损和止盈倍数,使策略更好地适应不同市场环境

- 增加成交量指标作为辅助确认,提高入场信号的可靠性

- 根据市场波动特征动态调整均线周期,提高策略适应性

- 加入趋势强度过滤器,避免在弱趋势环境下频繁交易

- 开发自适应的移动止损机制,根据市场波动性动态调整止损距离

总结

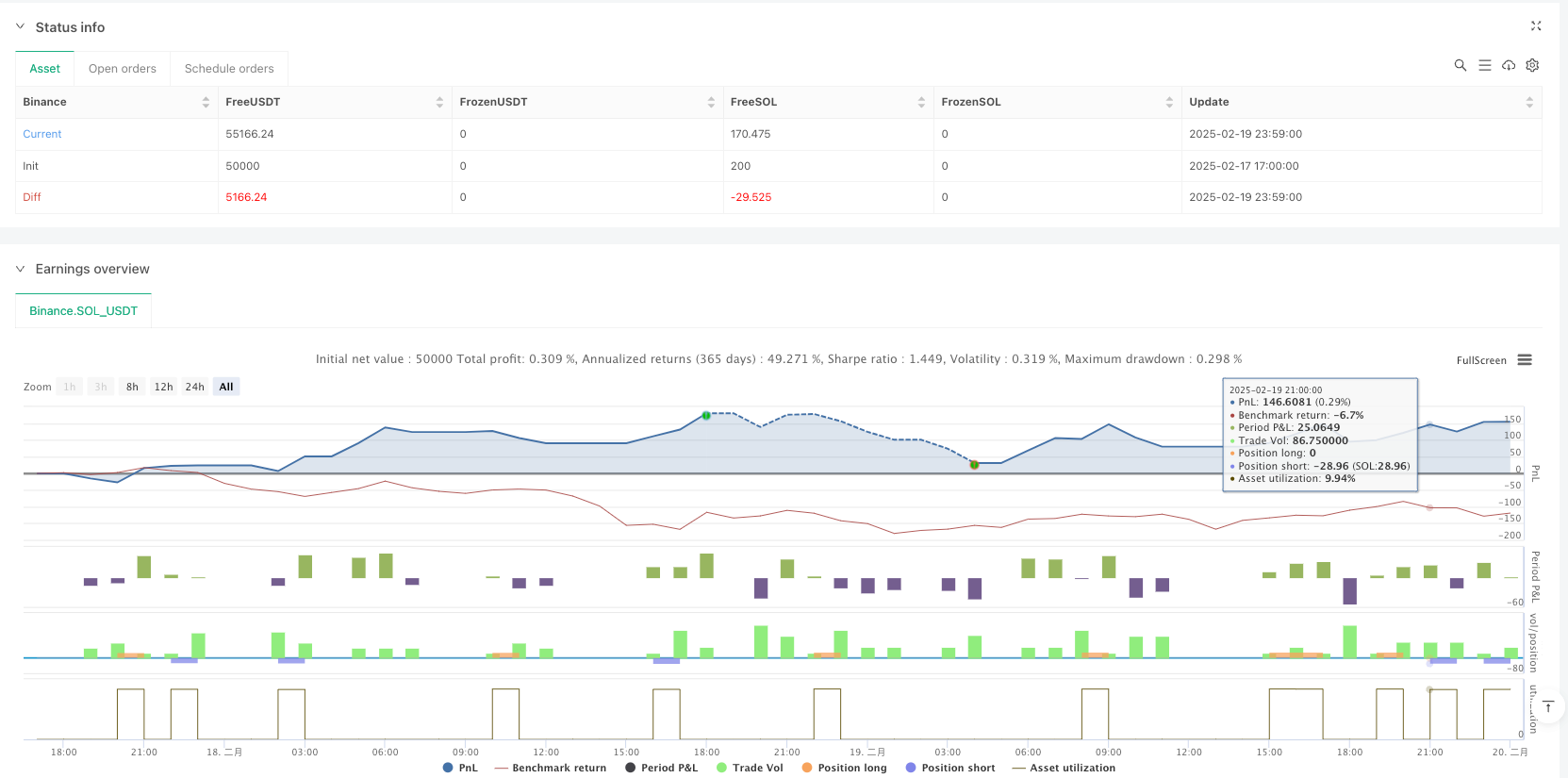

该策略通过多重均线的配合使用构建了一个完整的趋势跟踪系统,在入场、出场和风险管理等方面都有详细的规则设计。策略的优势在于能够有效识别和跟踪趋势,同时通过动态止损机制来保护利润。虽然存在一些固有的风险,但通过提出的优化方向可以进一步提升策略的稳定性和适应性。策略整体设计合理,具有较好的实用价值和优化空间。

策略源码

/*backtest

start: 2025-02-17 17:00:00

end: 2025-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("交易策略(自定义EMA/SMA参数)", overlay=true, initial_capital=100000, currency=currency.EUR, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// 输入参数:可调的 SMA 和 EMA 周期

smaLength = input.int(120, "SMA Length", minval=1, step=1)

emaFastPeriod = input.int(13, "EMA Fast Period", minval=1, step=1)

emaSlowPeriod = input.int(21, "EMA Slow Period", minval=1, step=1)

// 计算均线

smaVal = ta.sma(close, smaLength)

emaFast = ta.ema(close, emaFastPeriod)

emaSlow = ta.ema(close, emaSlowPeriod)

// 绘制均线

plot(smaVal, color=color.orange, title="SMA")

plot(emaFast, color=color.blue, title="EMA Fast")

plot(emaSlow, color=color.red, title="EMA Slow")

// 入场条件 - 做多

// 条件1:收盘价高于SMA 且 EMA Fast 向上穿越 EMA Slow

longTrigger1 = (close > smaVal) and ta.crossover(emaFast, emaSlow)

// 条件2:收盘价上穿SMA 且前5根K线的最低价均高于各自的SMA

longTrigger2 = ta.crossover(close, smaVal) and (low[1] > smaVal[1] and low[2] > smaVal[2] and low[3] > smaVal[3] and low[4] > smaVal[4] and low[5] > smaVal[5])

longCondition = longTrigger1 or longTrigger2

// 入场条件 - 做空

// 条件1:收盘价低于SMA 且 EMA Fast 向下穿越 EMA Slow

shortTrigger1 = (close < smaVal) and ta.crossunder(emaFast, emaSlow)

// 条件2:收盘价下穿SMA 且前5根K线的最高价均低于各自的SMA

shortTrigger2 = ta.crossunder(close, smaVal) and (high[1] < smaVal[1] and high[2] < smaVal[2] and high[3] < smaVal[3] and high[4] < smaVal[4] and high[5] < smaVal[5])

shortCondition = shortTrigger1 or shortTrigger2

// 定义变量记录入场时的价格与EMA Fast值,用于计算止损

var float entryPriceLong = na

var float entryEMA_Fast_Long = na

var float entryPriceShort = na

var float entryEMA_Fast_Short = na

// 入场与初始止盈止损设置 - 做多

// 止损取“开仓时的EMA Fast价格”与“0.2%止损”中较大者;止盈为止损的5倍

if (longCondition and strategy.position_size == 0)

entryPriceLong := close

entryEMA_Fast_Long := emaFast

strategy.entry("Long", strategy.long)

stopPercLong = math.max(0.002, (entryPriceLong - entryEMA_Fast_Long) / entryPriceLong)

stopLong = entryPriceLong * (1 - stopPercLong)

tpLong = entryPriceLong * (1 + 5 * stopPercLong)

strategy.exit("LongExit", "Long", stop=stopLong, limit=tpLong)

// 入场与初始止盈止损设置 - 做空

// 止损取“开仓时的EMA Fast价格”与“0.2%止损”中较大者;止盈为止损的5倍

if (shortCondition and strategy.position_size == 0)

entryPriceShort := close

entryEMA_Fast_Short := emaFast

strategy.entry("Short", strategy.short)

stopPercShort = math.max(0.002, (entryEMA_Fast_Short - entryPriceShort) / entryPriceShort)

stopShort = entryPriceShort * (1 + stopPercShort)

tpShort = entryPriceShort * (1 - 5 * stopPercShort)

strategy.exit("ShortExit", "Short", stop=stopShort, limit=tpShort)

// 移动止损逻辑

// 当持仓盈利达到0.8%时更新止损和止盈,保持止盈为止损的5倍

var float longHighest = na

if (strategy.position_size > 0)

longHighest := na(longHighest) ? high : math.max(longHighest, high)

if (high >= entryPriceLong * 1.008)

newLongStop = longHighest * (1 - 0.003)

newPerc = (entryPriceLong - newLongStop) / entryPriceLong

newLongTP = entryPriceLong * (1 + 5 * newPerc)

strategy.exit("LongExit", "Long", stop=newLongStop, limit=newLongTP)

else

longHighest := na

var float shortLowest = na

if (strategy.position_size < 0)

shortLowest := na(shortLowest) ? low : math.min(shortLowest, low)

if (low <= entryPriceShort * 0.992)

newShortStop = shortLowest * (1 + 0.003)

newPercShort = (newShortStop - entryPriceShort) / entryPriceShort

newShortTP = entryPriceShort * (1 - 5 * newPercShort)

strategy.exit("ShortExit", "Short", stop=newShortStop, limit=newShortTP)

else

shortLowest := na

// 额外平仓条件

// 如果持多仓时EMA Fast下穿EMA Slow,则立即平多

if (strategy.position_size > 0 and ta.crossunder(emaFast, emaSlow))

strategy.close("Long", comment="EMA下穿平多")

// 如果持空仓时EMA Fast上穿EMA Slow,则立即平空

if (strategy.position_size < 0 and ta.crossover(emaFast, emaSlow))

strategy.close("Short", comment="EMA上穿平空")

相关推荐