概述

该策略是一个基于相对强弱指数(RSI)的动量交易系统,通过识别市场超买超卖状态来进行交易。策略采用固定百分比的止损和获利目标,实现风险收益的自动管理。系统在15分钟时间周期上运行,适用于具有良好流动性的交易品种。

策略原理

策略的核心是利用RSI指标来识别市场的超买超卖状态。当RSI低于30时,表明市场可能过度卖出,系统会开立多头仓位;当RSI高于70时,表明市场可能过度买入,系统会开立空头仓位。每笔交易都设置了基于入场价格的固定百分比止损(0.2%)和获利目标(0.6%),以实现风险管理的自动化。

策略优势

- 操作规则明确:使用广受认可的RSI指标,交易信号清晰,便于理解和执行

- 风险管理完善:采用固定比例的止损和获利设置,有效控制每笔交易的风险

- 自动化程度高:从入场到出场的整个交易过程都是自动化的,减少人为干预

- 适应性强:策略可以适用于不同的交易品种,具有良好的普适性

- 计算效率高:使用基本的技术指标,计算负担小,适合实时交易

策略风险

- 震荡市场风险:在横盘震荡市场中,可能产生频繁的假信号

- 趋势突破风险:固定的止损位可能在强趋势中被轻易触及

- 参数敏感性:RSI周期和阈值的设置对策略性能影响较大

- 滑点风险:在市场波动较大时,实际执行价格可能与预期有偏差

- 系统性风险:在市场剧烈波动时可能遭受较大损失

策略优化方向

- 引入趋势过滤器:结合移动平均线等趋势指标,降低假信号

- 动态止损设置:根据市场波动性自动调整止损幅度

- 优化入场时机:增加成交量等辅助指标,提高入场准确性

- 资金管理优化:引入动态仓位管理,根据账户净值和市场波动调整交易规模

- 增加时间过滤:避免在重要新闻发布等高波动时期交易

总结

这是一个结构完整、逻辑清晰的自动化交易策略。通过RSI指标捕捉市场超买超卖机会,配合固定比例的风险管理方案,实现了交易过程的完全自动化。策略的主要优势在于操作规则清晰、风险可控,但也需要注意市场环境对策略表现的影响。通过建议的优化方向,策略还有进一步提升的空间。

策略源码

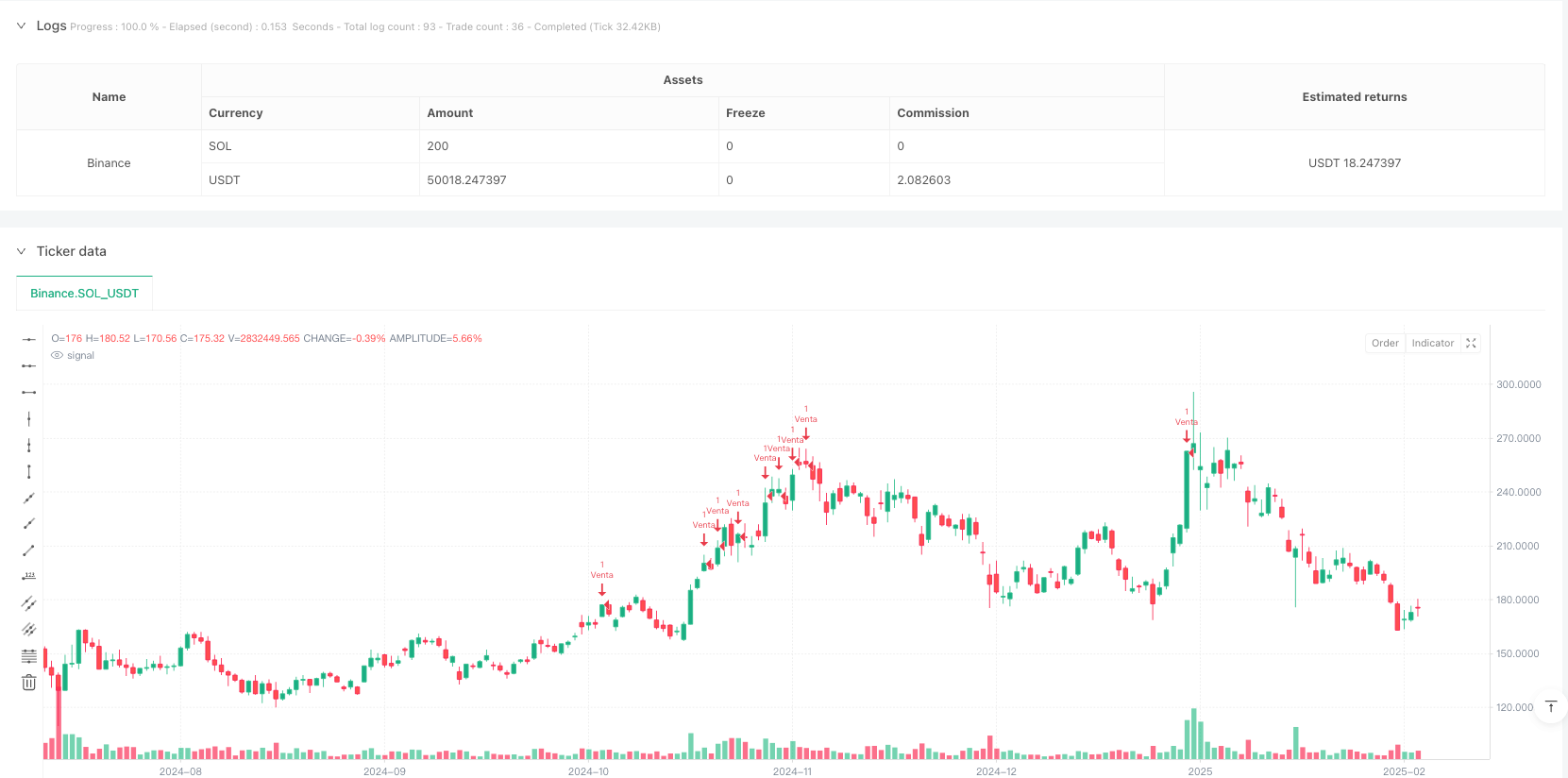

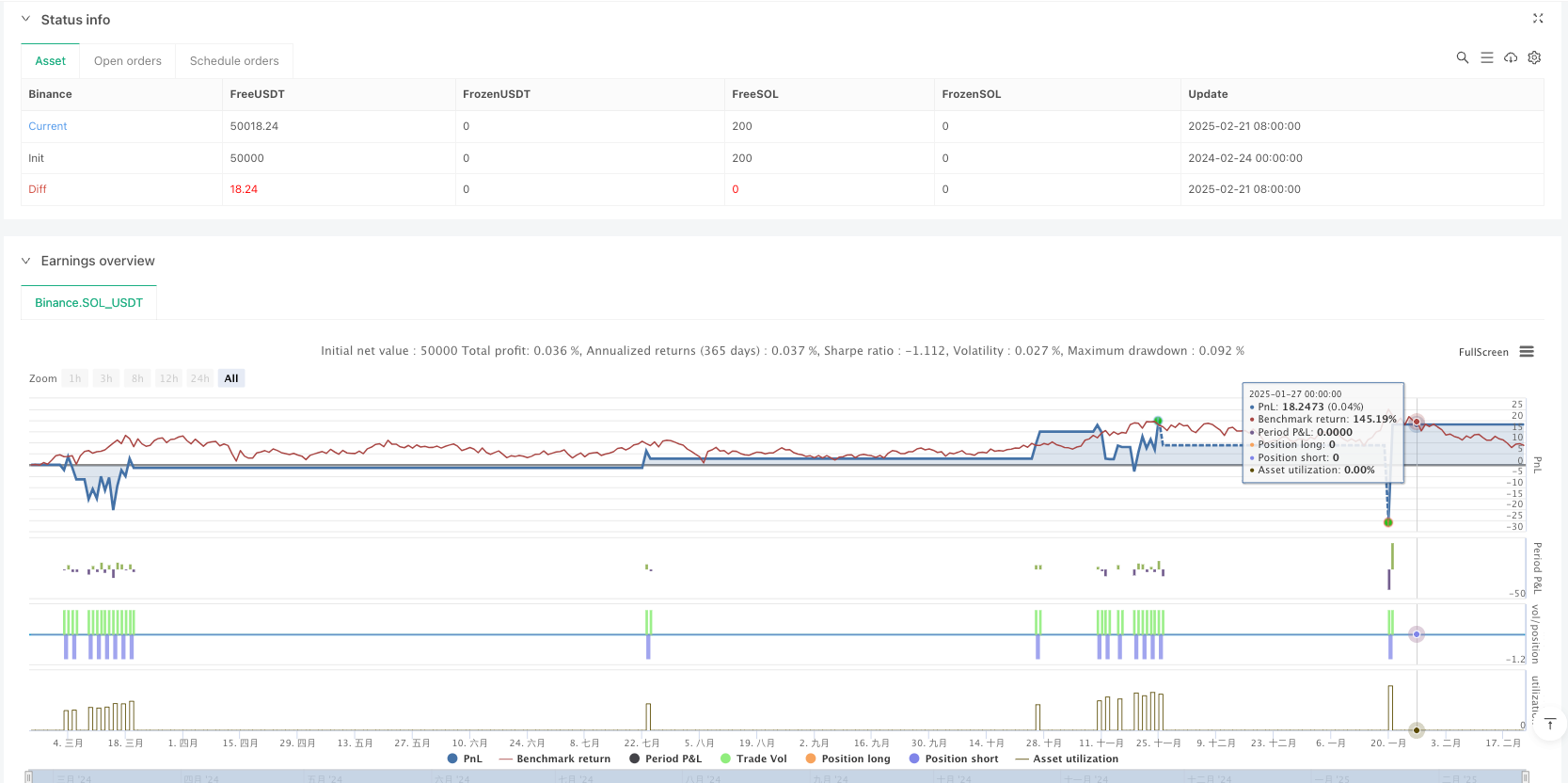

/*backtest

start: 2024-02-24 00:00:00

end: 2025-02-22 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("MultiSymbol Smart Money EA without Lot Sizes or Pairs", overlay=true)

// Strategy Parameters for RSI

RSI_Period = input.int(14, title="RSI Period", minval=1)

RSI_Overbought = input.float(70, title="RSI Overbought")

RSI_Oversold = input.float(30, title="RSI Oversold")

// Fixed values for Stop Loss and Take Profit in percentage

FIXED_SL = input.float(0.2, title="Stop Loss in %", minval=0.0) / 100

FIXED_TP = input.float(0.6, title="Take Profit in %", minval=0.0) / 100

// RSI Calculation

rsi = ta.rsi(close, RSI_Period)

// Buy and Sell Conditions based on RSI

longCondition = rsi <= RSI_Oversold

shortCondition = rsi >= RSI_Overbought

// Entry Price

longPrice = close

shortPrice = close

// Execute the trades

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Set Stop Loss and Take Profit based on entry price and percentage

if (strategy.position_size > 0) // If there is a long position

longStopLoss = longPrice * (1 - FIXED_SL)

longTakeProfit = longPrice * (1 + FIXED_TP)

strategy.exit("Exit Buy", from_entry="Buy", stop=longStopLoss, limit=longTakeProfit)

if (strategy.position_size < 0) // If there is a short position

shortStopLoss = shortPrice * (1 + FIXED_SL)

shortTakeProfit = shortPrice * (1 - FIXED_TP)

strategy.exit("Exit Sell", from_entry="Sell", stop=shortStopLoss, limit=shortTakeProfit)

相关推荐