概述

这是一个基于成交量加权移动平均线(VWMA)的日内交易策略,通过合成期权组合实现多空双向操作。策略核心是在每个交易日重新计算的VWMA指标,根据价格与VWMA的相对位置产生交易信号,并在收盘前自动平仓。该策略具有良好的风险控制机制,包括仓位管理和交易频率限制。

策略原理

策略的核心逻辑基于以下几点: 1. 使用每日重置的VWMA作为动态趋势指标 2. 当价格突破VWMA上方时,构建看涨组合(买入看涨期权+卖出看跌期权) 3. 当价格跌破VWMA下方时,构建看跌组合(买入看跌期权+卖出看涨期权) 4. 在15:29(IST)强制平仓所有持仓 5. 引入hasExited变量控制加仓频率,避免过度交易 6. 支持在同向突破时的金字塔式加仓

策略优势

- 动态适应性强 - VWMA每日重置确保指标始终反映当前市场状况

- 风险收益平衡 - 通过合成期权组合既限制了风险又保持了盈利潜力

- 交易纪律严格 - 具有明确的入场、加仓和强制平仓机制

- position sizing灵活 - 支持百分比仓位管理

- 操作逻辑清晰 - 信号产生条件简单直观

策略风险

- 震荡市场风险 - VWMA突破在横盘市场可能产生频繁假信号

- 缺口风险 - 隔夜大幅波动可能导致较大损失

- 期权组合风险 - 合成期权存在Delta中性偏差

- 执行滑点 - 高频交易可能面临较大滑点

- 资金效率 - 每日强制平仓会增加交易成本

策略优化方向

- 引入波动率过滤器,在高波动率环境下调整策略参数

- 增加趋势确认指标,减少假突破带来的损失

- 优化期权组合结构,如考虑引入垂直价差策略

- 实现自适应的VWMA周期,根据市场状态动态调整

- 增加更多的风险控制指标,如最大回撤限制

总结

这是一个结构完整、逻辑严密的日内交易策略。通过VWMA指标捕捉短期趋势,结合合成期权组合进行交易,具有良好的风险控制机制。策略的优化空间主要在于减少假信号、提高执行效率和完善风险管理体系。虽然存在一定的局限性,但整体而言是一个具有实战价值的交易系统。

策略源码

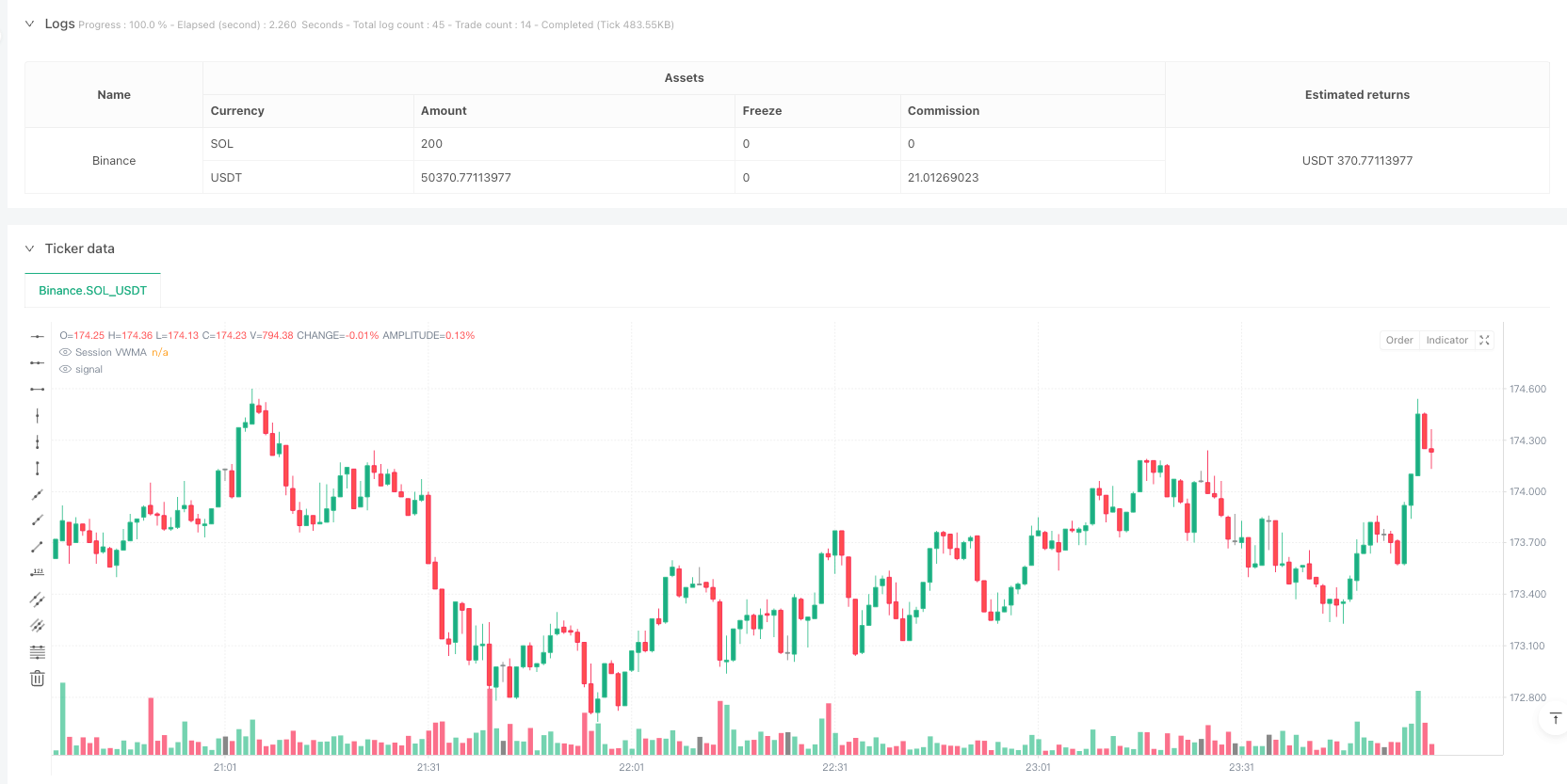

/*backtest

start: 2025-02-16 00:00:00

end: 2025-02-23 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Session VWMA Synthetic Options Strategy", overlay=true, initial_capital=100000,

default_qty_type=strategy.percent_of_equity, default_qty_value=10, pyramiding=10, calc_on_every_tick=true)

//──────────────────────────────

// Session VWMA Inputs

//──────────────────────────────

vwmaLen = input.int(55, title="VWMA Length", inline="VWMA", group="Session VWMA")

vwmaColor = input.color(color.orange, title="VWMA Color", inline="VWMA", group="Session VWMA", tooltip="VWMA resets at the start of each session (at the opening of the day).")

//──────────────────────────────

// Session VWMA Calculation Function

//──────────────────────────────

day_vwma(_start, s, l) =>

bs_nd = ta.barssince(_start)

v_len = math.max(1, bs_nd < l ? bs_nd : l)

ta.vwma(s, v_len)

//──────────────────────────────

// Determine Session Start

//──────────────────────────────

// newSession becomes true on the first bar of a new day.

newSession = ta.change(time("D")) != 0

//──────────────────────────────

// Compute Session VWMA

//──────────────────────────────

vwmaValue = day_vwma(newSession, close, vwmaLen)

plot(vwmaValue, color=vwmaColor, title="Session VWMA")

//──────────────────────────────

// Define Signal Conditions (only on transition)

//──────────────────────────────

bullCond = low > vwmaValue // Bullish: candle low above VWMA

bearCond = high < vwmaValue // Bearish: candle high below VWMA

// Trigger signal only on the bar where the condition first becomes true

bullSignal = bullCond and not bullCond[1]

bearSignal = bearCond and not bearCond[1]

//──────────────────────────────

// **Exit Condition at 15:29 IST**

//──────────────────────────────

sessionEnd = hour == 15 and minute == 29

// Exit all positions at 15:29 IST

if sessionEnd

strategy.close_all(comment="Closing all positions at session end")

//──────────────────────────────

// **Trade Control Logic**

//──────────────────────────────

var bool hasExited = true // Track if an exit has occurred since last entry

// Reset exit flag when a position is exited

if strategy.position_size == 0

hasExited := true

//──────────────────────────────

// **Position Management: Entry & Exit**

//──────────────────────────────

if newSession

hasExited := true // Allow first trade of the day

// On a bullish signal:

// • If currently short, close the short position and then enter long

// • Otherwise, add to any existing long position **only if an exit happened before**

if bullSignal and (hasExited or newSession)

if strategy.position_size < 0

strategy.close("Short", comment="Exit Short on Bull Signal")

strategy.entry("Long", strategy.long, comment="Enter Long: Buy Call & Sell Put at ATM")

else

strategy.entry("Long", strategy.long, comment="Add Long: Buy Call & Sell Put at ATM")

hasExited := false // Reset exit flag

// On a bearish signal:

// • If currently long, close the long position and then enter short

// • Otherwise, add to any existing short position **only if an exit happened before**

if bearSignal and (hasExited or newSession)

if strategy.position_size > 0

strategy.close("Long", comment="Exit Long on Bear Signal")

strategy.entry("Short", strategy.short, comment="Enter Short: Buy Put & Sell Call at ATM")

else

strategy.entry("Short", strategy.short, comment="Add Short: Buy Put & Sell Call at ATM")

hasExited := false // Reset exit flag

//──────────────────────────────

// **Updated Alert Conditions**

//──────────────────────────────

// Alerts for valid trade entries

alertcondition(bullSignal and (hasExited or newSession),

title="Long Entry Alert",

message="Bullish signal: BUY CALL & SELL PUT at ATM. Entry allowed.")

alertcondition(bearSignal and (hasExited or newSession),

title="Short Entry Alert",

message="Bearish signal: BUY PUT & SELL CALL at ATM. Entry allowed.")

相关推荐