概述

本策略是一个结合简单移动平均线(SMA)与相对强弱指标(RSI)的趋势跟踪交易系统。它通过短期和长期移动平均线的交叉来识别趋势方向,并利用RSI进行动量确认,从而在市场中寻找高概率的交易机会。该策略还包含了完整的风险管理模块,可以有效控制每笔交易的风险。

策略原理

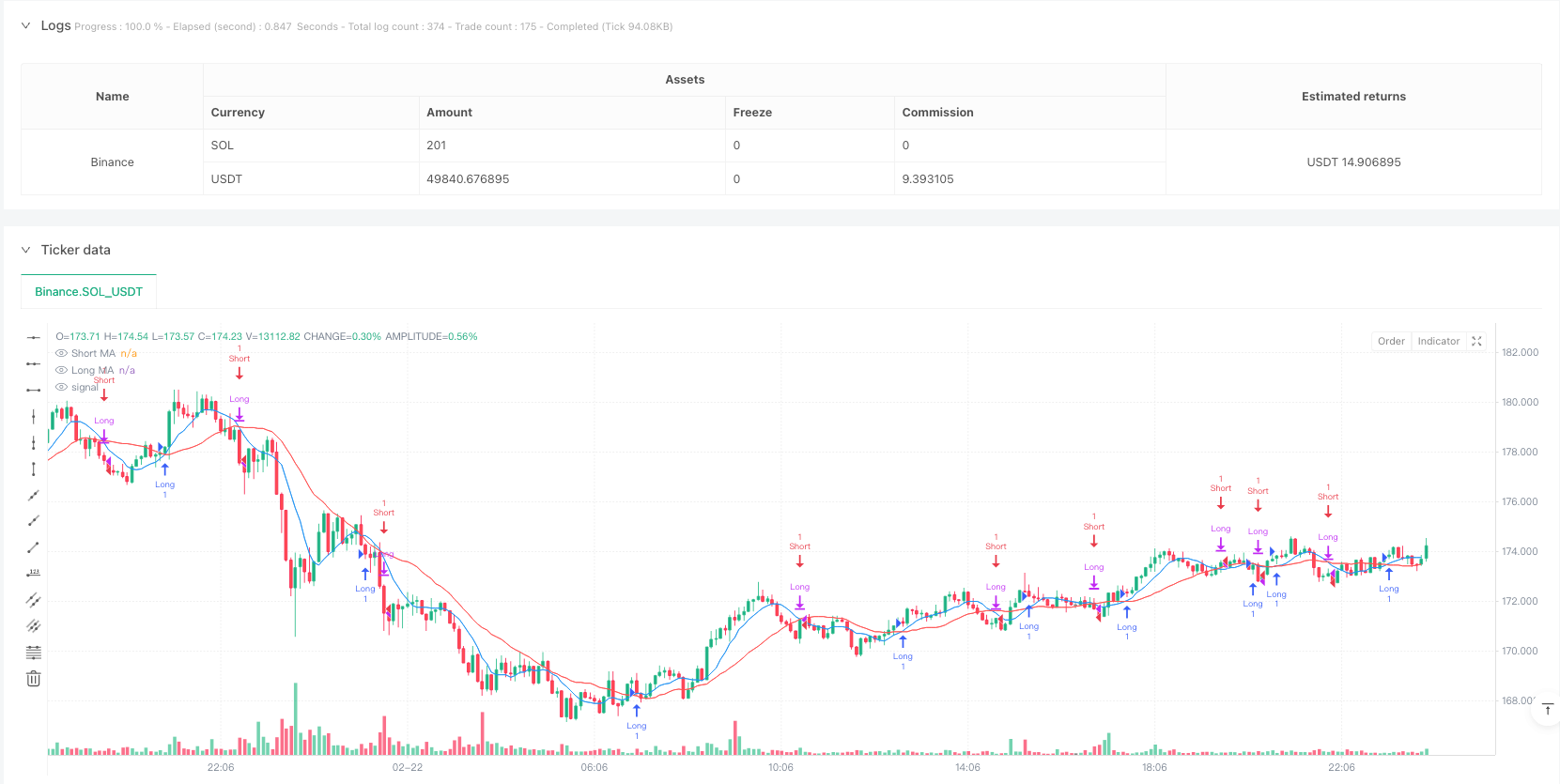

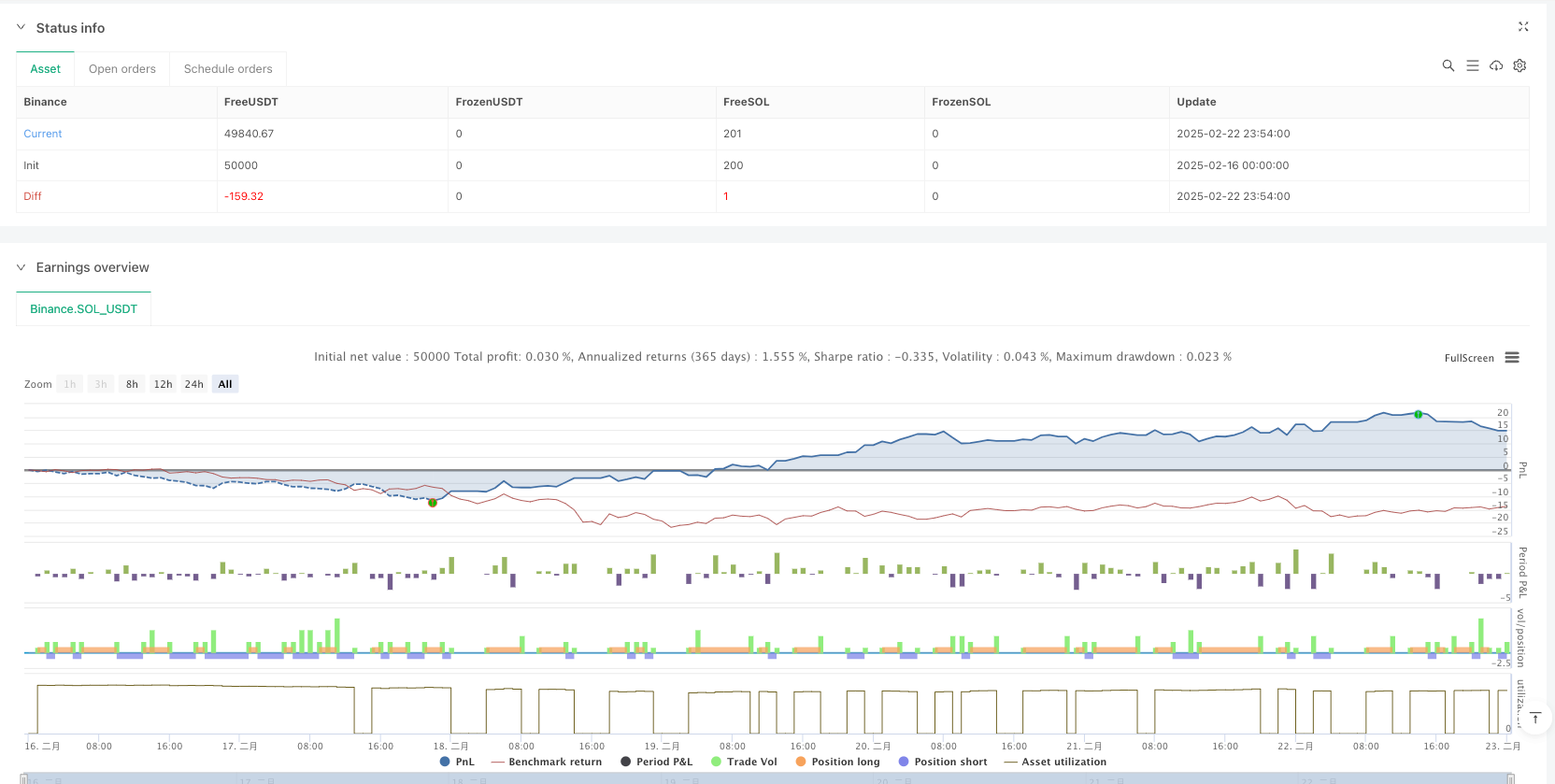

策略的核心逻辑基于两个技术指标的配合使用: 1. 双均线系统: 采用8周期和21周期的简单移动平均线,通过均线交叉识别趋势变化。当短期均线向上穿越长期均线时产生做多信号,向下穿越时产生做空信号。 2. RSI过滤器: 使用14周期的RSI指标进行动量确认。只有当RSI低于70时才执行做多,高于30时才执行做空,以避免在过度买入或卖出的区域进行交易。 3. 风险控制: 每笔交易都设置了1%的止损和2%的止盈水平,以保护资金安全和锁定利润。

策略优势

- 指标组合优势: 结合了趋势跟踪和动量指标,能够更准确地识别市场转折点。

- 风险管理完善: 内置止损和止盈机制,可以有效控制风险。

- 参数灵活可调: 所有关键参数都可以根据不同市场环境进行优化。

- 适用性广泛: 可应用于多个市场和多个时间周期。

- 逻辑清晰简单: 策略规则明确,易于理解和执行。

策略风险

- 震荡市场风险: 在横盘震荡市场中可能产生频繁假信号。

- 滞后性风险: 移动平均线本身具有滞后性,可能错过部分盈利机会。

- 参数敏感性: 不同市场环境下可能需要调整参数以保持策略有效性。

- 趋势依赖性: 策略在强趋势市场表现较好,但在其他市场环境下效果可能不佳。

策略优化方向

- 引入市场环境识别机制,在不同市场条件下使用不同的参数组合。

- 增加成交量指标作为辅助确认信号。

- 优化止损止盈机制,可考虑使用动态止损方案。

- 添加趋势强度过滤器,只在强趋势市场下交易。

- 开发自适应参数调整机制,提高策略的适应性。

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过结合SMA和RSI,既能捕捉趋势,又能避免在过度买卖区域交易。内置的风险管理机制确保了策略的稳定性。虽然存在一些固有的局限性,但通过建议的优化方向可以进一步提升策略的性能。该策略特别适合追求稳健收益的交易者使用。

策略源码

/*backtest

start: 2025-02-16 00:00:00

end: 2025-02-23 00:00:00

period: 6m

basePeriod: 6m

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=6

strategy("WEN - SMA with RSI Strategy", overlay=true)

// Define input parameters

// SMA Inputs

shortLength = input(8, title="Short MA Length")

longLength = input(21, title="Long MA Length")

// RSI Inputs

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(70, title="RSI Overbought")

rsiOversold = input(30, title="RSI Oversold")

// Calculate indicators

// Moving Averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// RSI

rsi = ta.rsi(close, rsiLength)

// Plot indicators

plot(shortMA, title="Short MA", color=color.blue)

plot(longMA, title="Long MA", color=color.red)

// RSI is typically plotted in a separate panel in trading platforms

// Entry conditions with RSI confirmation

smaLongCondition = ta.crossover(shortMA, longMA)

smaShortCondition = ta.crossunder(shortMA, longMA)

rsiLongCondition = rsi < rsiOverbought // Not overbought for long entry

rsiShortCondition = rsi > rsiOversold // Not oversold for short entry

// Combined entry conditions

longCondition = smaLongCondition and rsiLongCondition

shortCondition = smaShortCondition and rsiShortCondition

// Execute trades

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long")

strategy.entry("Short", strategy.short)

// Set stop loss and take profit

stopLoss = input(1, title="Stop Loss (%)") / 100

takeProfit = input(2, title="Take Profit (%)") / 100

longStopLossPrice = strategy.position_avg_price * (1 - stopLoss)

longTakeProfitPrice = strategy.position_avg_price * (1 + takeProfit)

shortStopLossPrice = strategy.position_avg_price * (1 + stopLoss)

shortTakeProfitPrice = strategy.position_avg_price * (1 - takeProfit)

strategy.exit("Take Profit / Stop Loss", from_entry="Long", stop=longStopLossPrice, limit=longTakeProfitPrice)

strategy.exit("Take Profit / Stop Loss", from_entry="Short", stop=shortStopLossPrice, limit=shortTakeProfitPrice)

相关推荐