概述

交叉突破型双均线系统策略是一种基于32周期指数移动平均线(EMA)的高点和低点的技术分析策略。该策略核心思想是通过识别价格与32周期EMA的交叉点以及特殊的”无接触蜡烛”形态来确认趋势方向,并在关键价格突破确认后入场交易。该策略专为5分钟时间框架设计,通过严格的入场条件和明确的出场规则,使交易者能够捕捉短期趋势变化带来的机会。

策略原理

该策略的运作基于以下几个关键步骤:

- 计算32周期EMA的高点(ema_high_32)和低点(ema_low_32)作为主要参考线。

- 识别价格与EMA的关键交叉:当收盘价向上穿越高点EMA时,标记潜在的做多机会;当收盘价向下穿越低点EMA时,标记潜在的做空机会。

- 寻找”无接触蜡烛”形态:做多方向上,识别完全位于高点EMA之上的阳线;做空方向上,识别完全位于低点EMA之下的阴线。

- 记录第一个”无接触蜡烛”的高点或低点作为突破参考点。

- 当价格突破该参考点且下一根同向蜡烛出现时,触发入场信号。

- 出场策略:当价格收盘低于低点EMA时平仓多头;当价格收盘高于高点EMA时平仓空头。

该策略的核心逻辑在于,它不仅要求价格与EMA发生交叉,还需要通过”无接触蜡烛”和突破确认来过滤假信号,提高交易的准确性。这种多重确认机制有效减少了盘整市场中的误入场风险。

策略优势

通过深入分析代码,该策略具有以下显著优势:

- 双重确认机制:策略不仅需要价格与EMA交叉,还需要”无接触蜡烛”和价格突破的确认,大大降低了假突破的风险。

- 趋势跟踪与反转兼顾:虽然主要是趋势跟踪策略,但通过捕捉EMA交叉点,也能及时发现潜在的趋势反转。

- 明确的入场和出场规则:策略有严格定义的入场和出场条件,减少了主观判断,便于程序化实现和回测。

- 视觉辅助丰富:策略在图表上提供了多种视觉指示器,包括EMA线、突破点、各种交易信号标记,帮助交易者更直观地理解市场状况。

- 状态管理完善:代码中使用多个布尔变量严格跟踪交易状态,确保不会出现重复入场或混乱的信号。

- 适应短期波动:专为5分钟时间框架设计,能够有效捕捉短期市场波动带来的交易机会。

策略风险

尽管该策略设计精巧,但仍存在以下潜在风险:

- 反复横盘风险:在价格频繁穿越EMA的震荡市场中,可能导致频繁交易和连续亏损。解决方法是增加额外的市场环境过滤条件,如波动率指标或趋势强度指标。

- 参数敏感性:32周期EMA参数是策略的核心,不同市场或时间框架可能需要不同的参数设置。建议通过回测优化来确定最适合特定交易品种的参数。

- 延迟风险:由于策略需要多重确认,在快速趋势变化中可能出现入场延迟,错过部分行情。可以考虑在强趋势环境中适当放宽入场条件。

- 假突破风险:尽管有多重确认,市场仍可能出现假突破后迅速回撤的情况。可以考虑添加止损策略或使用更保守的仓位管理。

- 时间框架局限:策略专为5分钟框架设计,直接应用于其他时间框架可能效果不佳。在应用到其他时间框架时需要重新优化参数。

- 缺乏止盈机制:当前策略只有止损没有明确的止盈规则,可能导致在趋势结束前过早出场或错失利润。建议添加基于波动率或支撑阻力的动态止盈机制。

策略优化方向

基于代码分析,以下是该策略可以优化的几个主要方向:

- 动态EMA周期:可以考虑基于市场波动率动态调整EMA周期,在高波动市场使用较短的EMA,低波动市场使用较长的EMA,以适应不同市场环境。

- 加入趋势强度过滤:可以引入ADX等趋势强度指标,只在趋势强度足够的情况下开仓,避免在横盘市场频繁交易。

- 优化止盈策略:增加基于ATR或关键价格水平的动态止盈机制,在趋势有利发展时保护利润。

- 时间过滤:添加时间过滤条件,避免在市场开盘、收盘或低流动性时段交易。

- 多时间框架分析:整合更高时间框架的趋势方向作为过滤条件,只在多时间框架趋势一致时交易。

- 仓位管理优化:基于市场波动率或账户风险比例动态调整仓位大小,而不是固定仓位。

- 增加交易持续时间限制:如果交易在一定时间内未达到预期收益,自动平仓以避免长期套牢。

这些优化方向主要是为了提高策略的鲁棒性和适应性,减少在不利市场环境下的亏损。

总结

交叉突破型双均线系统策略是一个精心设计的技术分析交易系统,通过32周期EMA高低点、价格交叉、无接触蜡烛和突破确认等多重机制来识别高概率交易机会。该策略在趋势明确的市场中表现出色,通过严格的入场确认和清晰的出场规则,有效降低了误入场风险。

然而,任何交易策略都有其局限性,该策略在横盘或高波动市场中可能面临挑战。通过引入趋势强度过滤、动态参数调整、多时间框架分析等优化措施,可以进一步提升策略的稳定性和适应性。

作为一个5分钟时间框架的短线交易系统,该策略特别适合日内交易者和短线交易者。最后,良好的风险管理始终是成功应用任何交易策略的关键,建议交易者在实盘应用前进行充分的回测和模拟交易,并结合个人风险承受能力制定合理的仓位管理规则。

策略源码

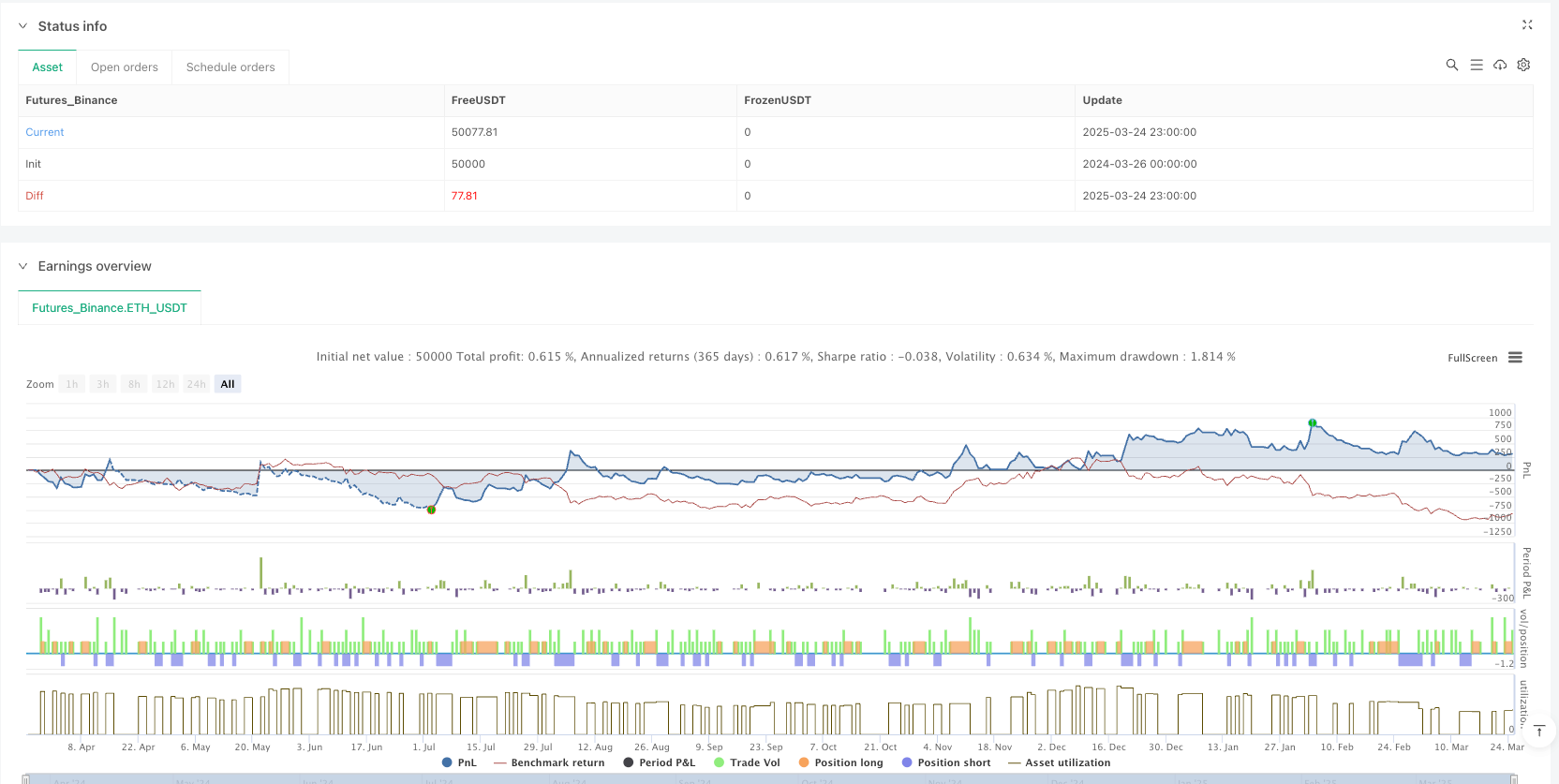

/*backtest

start: 2024-03-26 00:00:00

end: 2025-03-25 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("TrophyFighter 32 EMA HL", overlay=true)

// 32 EMA for high and low

ema_high_32 = ta.ema(high, 32)

ema_low_32 = ta.ema(low, 32)

// Detect crossover and crossunder

cross_above_high_ema = ta.crossover(close, ema_high_32)

cross_below_low_ema = ta.crossunder(close, ema_low_32)

// Identify no-touch candles

no_touch_green = close > open and low > ema_high_32

no_touch_red = close < open and high < ema_low_32

// Track the high and low of no-touch candles

var float first_green_high = na

var float first_red_low = na

var bool waiting_for_long = false

var bool waiting_for_short = false

var bool in_long_trade = false // Whether a long trade is active

var bool in_short_trade = false // Whether a short trade is active

var bool first_no_touch_green_shown = false // First green diamond shown

var bool first_no_touch_red_shown = false // First red diamond shown

if (cross_above_high_ema and not in_long_trade and not in_short_trade)

first_green_high := na

waiting_for_long := true

first_no_touch_green_shown := false // Reset

if (cross_below_low_ema and not in_long_trade and not in_short_trade)

first_red_low := na

waiting_for_short := true

first_no_touch_red_shown := false // Reset

if (no_touch_green and waiting_for_long and ta.valuewhen(cross_above_high_ema, bar_index, 0) > ta.valuewhen(no_touch_green, bar_index, 1))

first_green_high := high

first_no_touch_green_shown := true // Set first green diamond

if (no_touch_red and waiting_for_short and ta.valuewhen(cross_below_low_ema, bar_index, 0) > ta.valuewhen(no_touch_red, bar_index, 1))

first_red_low := low

first_no_touch_red_shown := true // Set first red diamond

// Identify breakout (on the previous candle) - using na() function

long_breakout_check = high > ta.valuewhen(not na(first_green_high), first_green_high, 0) and not na(first_green_high) and waiting_for_long

short_breakout_check = low < ta.valuewhen(not na(first_red_low), first_red_low, 0) and not na(first_red_low) and waiting_for_short

// Buy and sell conditions (on the next same-colored candle)

long_condition = long_breakout_check[1] and close > open and not in_long_trade and not in_short_trade // Next green candle

short_condition = short_breakout_check[1] and close < open and not in_long_trade and not in_short_trade // Next red candle

// Breakout check (only on the signal candle)

long_breakout = long_condition // Blue square only for signal

short_breakout = short_condition // White square only for signal

// Signal for the first no-touch candle

first_no_touch_green = no_touch_green and not first_no_touch_green_shown and waiting_for_long and ta.valuewhen(cross_above_high_ema, bar_index, 0) > ta.valuewhen(no_touch_green, bar_index, 1)

first_no_touch_red = no_touch_red and not first_no_touch_red_shown and waiting_for_short and ta.valuewhen(cross_below_low_ema, bar_index, 0) > ta.valuewhen(no_touch_red, bar_index, 1)

// When a trade starts

if (long_condition)

waiting_for_long := false

in_long_trade := true // Start long trade

if (short_condition)

waiting_for_short := false

in_short_trade := true // Start short trade

// New exit rules

long_exit = close < ema_low_32 and in_long_trade // Price drops below EMA low

short_exit = close > ema_high_32 and in_short_trade // Price rises above EMA high

// Reset when trade closes

if (long_exit)

in_long_trade := false

if (short_exit)

in_short_trade := false

// Plot EMA and levels (cross style)

plot(ema_high_32, color=color.green, title="EMA High 32")

plot(ema_low_32, color=color.red, title="EMA Low 32")

plot(first_green_high, color=color.yellow, style=plot.style_cross, linewidth=1, title="First Green High")

plot(first_red_low, color=color.orange, style=plot.style_cross, linewidth=1, title="First Red Low")

// Debugging signals

plotshape(cross_above_high_ema, title="Cross Above EMA", location=location.belowbar, color=color.yellow, style=shape.circle, size=size.tiny)

plotshape(cross_below_low_ema, title="Cross Below EMA", location=location.abovebar, color=color.orange, style=shape.circle, size=size.tiny)

plotshape(first_no_touch_green, title="No Touch Green", location=location.belowbar, color=color.lime, style=shape.diamond, size=size.tiny)

plotshape(first_no_touch_red, title="No Touch Red", location=location.abovebar, color=color.purple, style=shape.diamond, size=size.tiny)

plotshape(long_breakout, title="Long Breakout", location=location.belowbar, color=color.blue, style=shape.square, size=size.tiny)

plotshape(short_breakout, title="Short Breakout", location=location.abovebar, color=color.white, style=shape.square, size=size.tiny)

plotshape(long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Execute trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (long_exit)

strategy.close("Long", comment="Long Exit")

if (short_exit)

strategy.close("Short", comment="Short Exit")

相关推荐