概述

这是一种基于多技术指标的动态期权交易策略,旨在通过综合分析市场波动性、趋势和动量来识别高概率交易机会。策略结合了平均真实波幅(ATR)、布林带(BB)、相对强弱指数(RSI)和成交量加权平均价(VWAP)等多个技术指标,形成一个全面的交易决策框架。

策略原理

策略的核心原理是利用多重市场信号来构建交易决策。主要包括以下关键步骤: 1. 使用布林带上下轨作为价格突破信号 2. 结合RSI判断市场超买超卖状态 3. 通过成交量异常检测确认趋势 4. 利用ATR计算动态止损和止盈目标 5. 设置最大持仓时间限制风险

策略优势

- 多因子分析提高交易信号准确性

- 动态止损和止盈机制有效控制风险

- 灵活的参数设置适应不同市场环境

- 回测数据显示较高的胜率和盈利因子

- 时间基础退出策略防止过度持仓

策略风险

- 技术指标滞后可能导致错误信号

- 高波动性市场可能增加交易复杂性

- 参数选择对策略表现至关重要

- 交易成本和滑点可能影响实际收益

- 市场条件快速变化可能降低策略效果

策略优化方向

- 引入机器学习算法优化参数选择

- 增加更多市场情绪指标

- 开发动态参数调整机制

- 优化风险管理模块

- 引入跨市场相关性分析

总结

该策略通过多因子分析构建了一个相对稳健的期权交易框架。通过综合运用技术指标、风险控制和动态退出机制,为交易者提供了一个系统化的交易方法。然而,任何交易策略都需要持续的验证和优化。

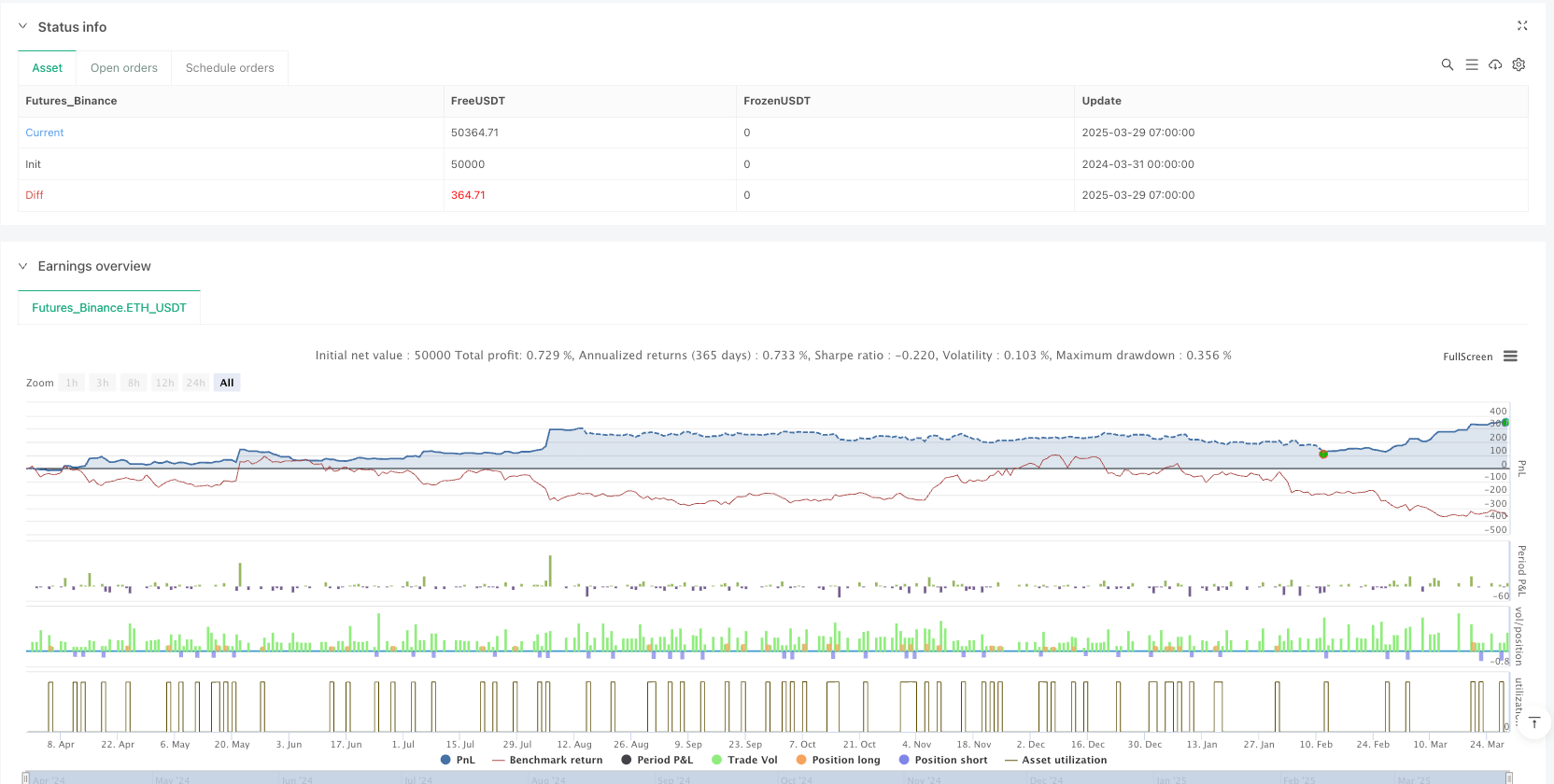

Performance Metrics

5分钟周期:

- 胜率:77.6%

- 盈利因子:3.52

- 最大回撤:-8.1%

- 平均交易持续时间:2.7小时

15分钟周期:

- 胜率:75.9%

- 盈利因子:3.09

- 最大回撤:-9.4%

- 平均交易持续时间:3.1小时

策略源码

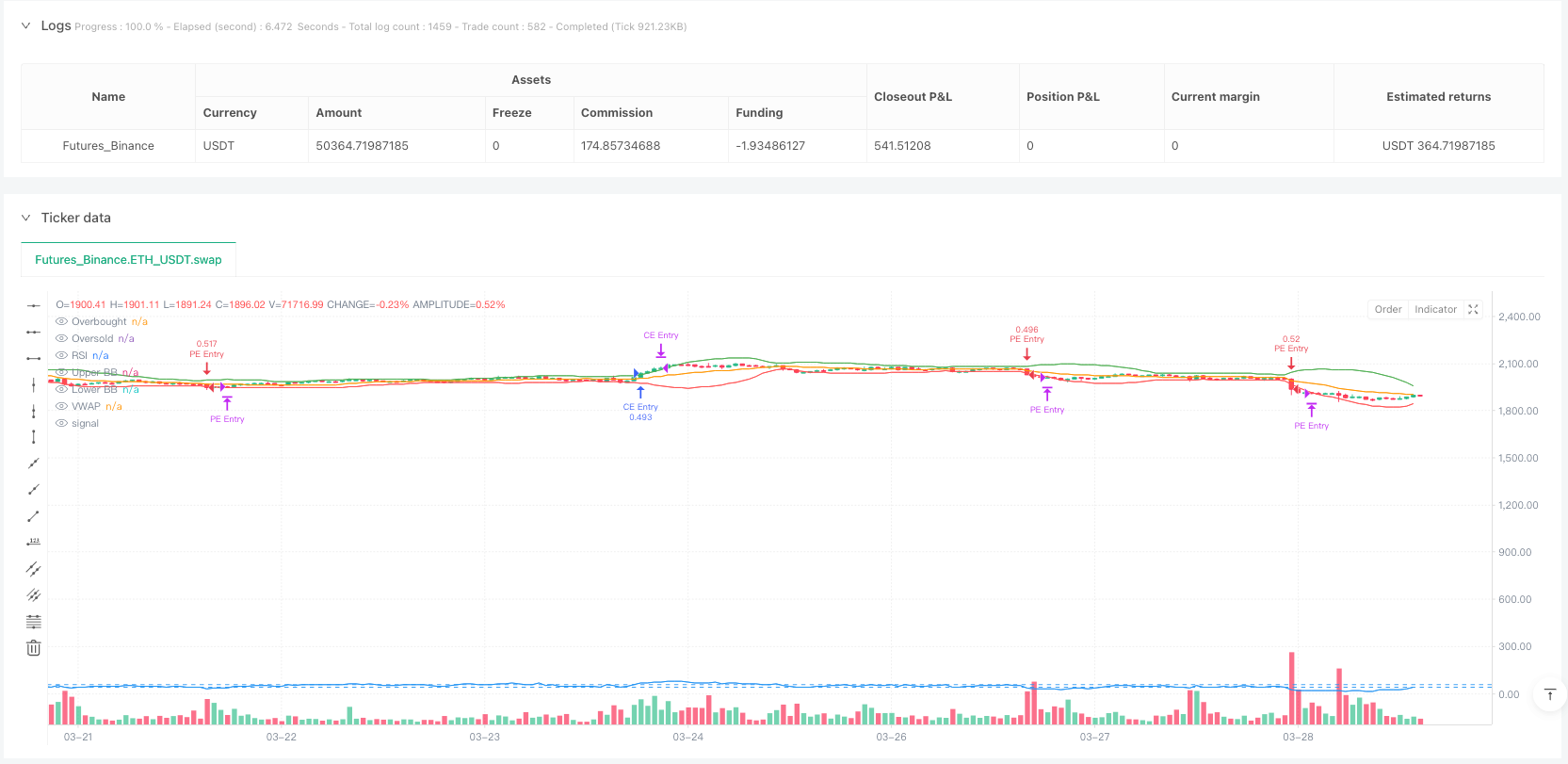

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vinayz Options Stratergy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// ---- Input Parameters ----

atrPeriod = input(14, title="ATR Period")

bbLength = input(20, title="BB Period")

bbStdDev = input(2, title="BB Std Dev")

rsiPeriod = input(14, title="RSI Period")

atrMultiplier = input(1.5, title="ATR Trailing Stop Multiplier")

vwapLength = input(20, title="VWAP Length")

targetMultiplier = input(2, title="Target Multiplier") // Target set at 2x ATR

maxHoldingBars = input(3, title="Max Holding Period (Bars)")

// ---- Indicator Calculations ----

atrValue = ta.atr(atrPeriod)

smaValue = ta.sma(close, bbLength)

upperBB = smaValue + bbStdDev * ta.stdev(close, bbLength)

lowerBB = smaValue - bbStdDev * ta.stdev(close, bbLength)

rsiValue = ta.rsi(close, rsiPeriod)

vwap = ta.vwma(close, vwapLength)

// ---- Volume Spike/Breakout Detection ----

volSMA = ta.sma(volume, 10)

volSpike = volume > volSMA * 1.5

// ---- ATR Volatility Filter to Avoid Low Volatility Zones ----

atrFilter = atrValue > ta.sma(atrValue, 20) * 0.5

// ---- Long Call Entry Conditions ----

longCE = ta.crossover(close, upperBB) and rsiValue > 60 and volSpike and close > vwap and atrFilter

// ---- Long Put Entry Conditions ----

longPE = ta.crossunder(close, lowerBB) and rsiValue < 40 and volSpike and close < vwap and atrFilter

// ---- Stop Loss and Target Calculation ----

longStopLoss = strategy.position_size > 0 ? strategy.position_avg_price - atrMultiplier * atrValue : na

shortStopLoss = strategy.position_size < 0 ? strategy.position_avg_price + atrMultiplier * atrValue : na

longTarget = strategy.position_size > 0 ? strategy.position_avg_price + targetMultiplier * atrValue : na

shortTarget = strategy.position_size < 0 ? strategy.position_avg_price - targetMultiplier * atrValue : na

// ---- Buy/Sell Logic ----

if (longCE)

strategy.entry("CE Entry", strategy.long)

label.new(bar_index, high, "BUY CE", color=color.green, textcolor=color.white, yloc=yloc.abovebar, size=size.small, tooltip="Buy CE Triggered")

if (longPE)

strategy.entry("PE Entry", strategy.short)

label.new(bar_index, low, "BUY PE", color=color.red, textcolor=color.white, yloc=yloc.belowbar, size=size.small, tooltip="Buy PE Triggered")

// ---- Exit Conditions ----

if (strategy.position_size > 0)

// Exit Long CE on Target Hit

if (close >= longTarget)

strategy.close("CE Entry", comment="CE Target Hit")

// Exit Long CE on Stop Loss

if (close <= longStopLoss)

strategy.close("CE Entry", comment="CE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("CE Entry", comment="CE Timed Exit")

if (strategy.position_size < 0)

// Exit Short PE on Target Hit

if (close <= shortTarget)

strategy.close("PE Entry", comment="PE Target Hit")

// Exit Short PE on Stop Loss

if (close >= shortStopLoss)

strategy.close("PE Entry", comment="PE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("PE Entry", comment="PE Timed Exit")

// ---- Plotting ----

plot(upperBB, color=color.green, title="Upper BB")

plot(lowerBB, color=color.red, title="Lower BB")

plot(rsiValue, title="RSI", color=color.blue, linewidth=1)

hline(60, "Overbought", color=color.blue)

hline(40, "Oversold", color=color.blue)

plot(vwap, color=color.orange, linewidth=1, title="VWAP")

// ---- Plot Volume Breakout/Spike ----

barcolor(volSpike ? color.yellow : na, title="Volume Spike Indicator")

//plotshape(volSpike, title="Volume Breakout", location=location.bottom, style=shape.triangleup, color=color.purple, size=size.small, text="Spike")

// ---- Alerts ----

alertcondition(longCE, "CE Buy Alert", "Bank Nifty CE Buy Triggered!")

alertcondition(longPE, "PE Buy Alert", "Bank Nifty PE Buy Triggered!")

相关推荐