概述

这是一种创新的量化交易策略,通过整合流动性区域入场、ATR波动阈值和动态风险管理,为交易者提供了一个结构化的交易方法。该策略结合了多个技术分析指标,旨在识别高概率的交易机会,并自动计算止盈和止损水平。

策略原理

策略的核心原理基于以下关键要素:

- 流动性区域分析:通过计算特定周期内的最低点和最高点,识别潜在的支撑和阻力区域。

- ATR波动率过滤:使用平均真实波动范围(ATR)作为入场和风险管理的动态阈值。

- 趋势过滤:结合50周期指数移动平均线(EMA)和相对强弱指数(RSI)来确认市场趋势和动量。

- 动态风险管理:根据ATR自动计算止盈和止损水平,并允许灵活调整风险/回报比率。

策略优势

- 多维度信号生成:结合流动性、波动率和趋势过滤,提高信号质量。

- 自适应风险管理:动态调整止盈止损,有效控制交易风险。

- 灵活的参数配置:可自定义ATR长度、流动性周期和交易时段。

- 可视化支持:提供流动性线和首个K线水平的可视化显示。

- 性能追踪:内置交易统计表,直接在图表上展示胜率和输赢情况。

策略风险

- 参数敏感性:策略性能高度依赖于参数选择,需要不断回测和优化。

- 市场适应性:在趋势不明显或高度波动的市场中表现可能不稳定。

- 假突破风险:流动性区域突破可能存在误报的可能性。

- 交易频率:会话过滤和多重条件可能导致交易机会减少。

- 回测偏存:历史数据的64%胜率可能不完全代表未来表现。

策略优化方向

- 机器学习集成:引入机器学习算法动态调整参数和信号生成。

- 多市场适应性:开发更通用的参数设置,适用于不同市场和品种。

- 深度风险管理:引入更复杂的仓位规模和风险分配算法。

- 信号确认机制:增加额外的确认指标,如成交量或其他技术指标。

- 实时性能监控:开发实时性能评估和自适应调整模块。

总结

ThinkTech AI交易策略通过创新的多因子方法,为交易者提供了一个强大的量化交易工具。通过流动性分析、波动率过滤和动态风险管理,该策略旨在识别高质量的交易机会。然而,交易者需要持续回测、优化和谨慎应用,以充分发挥策略潜力。

策略源码

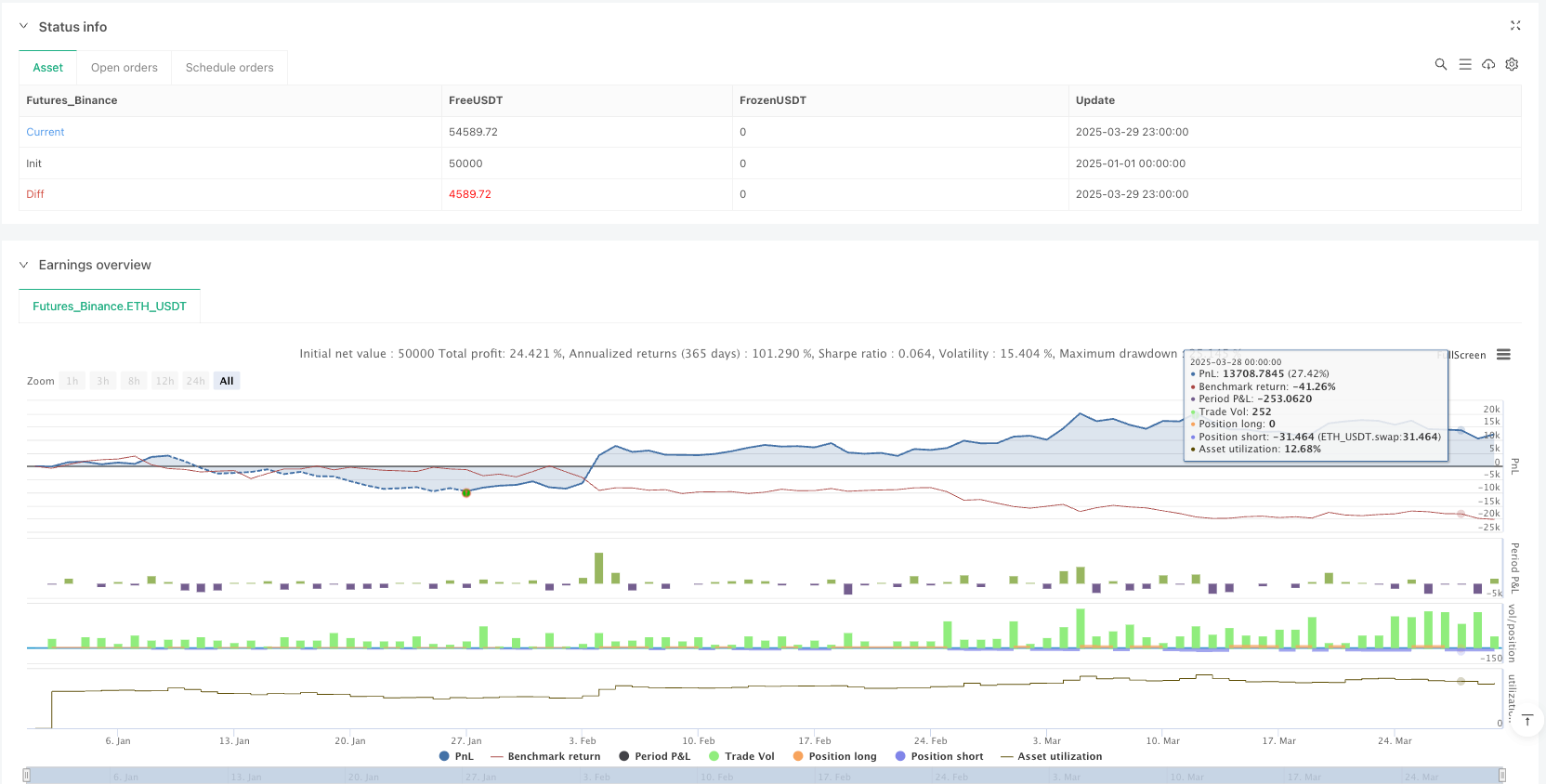

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-30 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

if high > ta.highest(high[1], 5)

strategy.entry("Enter Long", strategy.long)

else if low < ta.lowest(low[1], 5)

strategy.entry("Enter Short", strategy.short)//@version=6

strategy("ThinkTech AI Signals", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//──────────────────────────────

// Input Settings

//──────────────────────────────

riskRewardRatio = input.float(title="Risk/Reward Ratio", defval=2.0, minval=1.0, step=0.1)

// Inputs from second script

liquidity_period = input.int(20, title="Liquidity Base Period")

atr_length = input.int(14, title="ATR Length")

atr_threshold = input.float(0.3, title="ATR Breakout Threshold")

take_profit_mult = input.float(0.25, title="Take-Profit Multiplier")

stop_loss_mult = input.float(0.75, title="Stop-Loss Multiplier")

vol_filter = input.bool(true, title="Enable Volume Filter")

session_filter = input.bool(true, title="Limit to Trading Session")

// Additional inputs for further filtering and settings

atrMultiplier = input.float(title="ATR Multiplier for Stop Loss", defval=1.5, minval=0.1, step=0.1)

retestCushionLong = input.float(title="Retest Cushion Factor for BUY", defval=1.0, minval=1.0, step=0.001)

retestCushionShort = input.float(title="Retest Cushion Factor for SELL", defval=1.0, minval=0.0, maxval=1.0, step=0.001)

useTrendFilter = input.bool(title="Use 50 EMA Trend Filter", defval=true)

useRSIFilter = input.bool(title="Use RSI Filter", defval=false)

rsiPeriod = input.int(title="RSI Period", defval=14, minval=1)

rsiOversold = input.float(title="RSI Oversold Level", defval=30.0, minval=1, maxval=50)

rsiOverbought = input.float(title="RSI Overbought Level", defval=70.0, minval=50, maxval=100)

// Option to remove plotted lines

showLiquidityLines = input.bool(true, title="Show Liquidity Lines")

showFirstCandleLines = input.bool(true, title="Show First Candle Level Lines")

//──────────────────────────────

// Calculations & Variables (Liquidity & ATR Based)

//──────────────────────────────

price = close

atr = ta.atr(atr_length)

vol_condition = volume > ta.sma(volume, 20)

// Define Liquidity Base and Apex for support/resistance

liquidity_base = ta.lowest(low, liquidity_period)

apex = ta.highest(high, liquidity_period)

// Track recent highs and lows for filtering

hh = ta.highest(high, 30)

ll = ta.lowest(low, 30)

//──────────────────────────────

// Trade Stats Variables

//──────────────────────────────

var float take_profit = na

var float stop_loss = na

var bool in_trade = false

var int win_count = 0

var int loss_count = 0

//──────────────────────────────

// ENTRY LOGIC (BUY) Based on Liquidity & ATR

//──────────────────────────────

breakout_up = price > liquidity_base + (atr * atr_threshold)

point_of_release = ta.crossover(price, liquidity_base) and breakout_up

retest_buy = price > liquidity_base and price < hh and not in_trade

// Session condition (e.g. trading between 9AM–12PM)

session_condition = (hour >= 9 and hour <= 12) or not session_filter

if (point_of_release or retest_buy) and (vol_condition or not vol_filter) and session_condition

strategy.entry("Buy", strategy.long)

take_profit := price + (atr * take_profit_mult)

stop_loss := liquidity_base - (atr * stop_loss_mult)

in_trade := true

alert("Buy Signal - Price: " + str.tostring(price), alert.freq_once_per_bar)

//──────────────────────────────

// ENTRY LOGIC (SELL) Based on Liquidity & ATR

//──────────────────────────────

breakout_down = price < apex - (atr * atr_threshold)

clean_break = ta.crossunder(price, apex) and breakout_down

retest_sell = price < apex and price > ll and not in_trade

if (clean_break or retest_sell) and (vol_condition or not vol_filter) and session_condition

strategy.entry("Sell", strategy.short)

take_profit := price - (atr * take_profit_mult)

stop_loss := apex + (atr * stop_loss_mult)

in_trade := true

alert("Sell Signal - Price: " + str.tostring(price), alert.freq_once_per_bar)

//──────────────────────────────

// EXIT LOGIC (For BUY & SELL)

//──────────────────────────────

if strategy.position_size > 0

if price >= take_profit

strategy.close("Buy", comment="Take Profit")

win_count += 1

in_trade := false

if price <= stop_loss

strategy.close("Buy", comment="Stop Loss")

loss_count += 1

in_trade := false

if strategy.position_size < 0

if price <= take_profit

strategy.close("Sell", comment="Take Profit")

win_count += 1

in_trade := false

if price >= stop_loss

strategy.close("Sell", comment="Stop Loss")

loss_count += 1

in_trade := false

//──────────────────────────────

// Plot Liquidity Lines (Support/Resistance)

//──────────────────────────────

plot(showLiquidityLines ? liquidity_base : na, color=color.green, title="Liquidity Base (Support)")

plot(showLiquidityLines ? apex : na, color=color.red, title="Apex (Resistance)")

//──────────────────────────────

// Debugging Signal Shapes

//──────────────────────────────

plotshape(series=point_of_release, location=location.belowbar, color=color.green, style=shape.triangleup, title="Buy Signal")

plotshape(series=clean_break, location=location.abovebar, color=color.red, style=shape.triangledown, title="Sell Signal")

//──────────────────────────────

// Win/Loss Table Display

//──────────────────────────────

var table t = table.new(position.top_right, 1, 2)

if bar_index == last_bar_index

table.cell(t, 0, 0, "Wins: " + str.tostring(win_count), bgcolor=color.new(color.green, 80))

table.cell(t, 0, 1, "Losses: " + str.tostring(loss_count), bgcolor=color.new(color.red, 80))

//──────────────────────────────

// Alert Conditions for Entries and Exits

//──────────────────────────────

alertcondition(point_of_release, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(clean_break, title="Sell Alert", message="Sell Signal Triggered")

var int lastClosedTrades = 0

var bool exitSignal = false

if strategy.closedtrades > lastClosedTrades

exitSignal := true

lastClosedTrades := strategy.closedtrades

alertcondition(exitSignal, title="EXIT Signal", message="EXIT signal triggered: Trade has closed (TP or SL reached).")

//──────────────────────────────

// FIRST 15-MINUTE CANDLE CAPTURE (9:30–9:45 AM EST)

//──────────────────────────────

newDay = dayofmonth != dayofmonth[1]

var float fHigh = na

var float fLow = na

var bool firstCandleCaptured = false

if newDay

fHigh := high

fLow := low

firstCandleCaptured := true

//──────────────────────────────

// Additional Filters & Calculations

//──────────────────────────────

// Trend Filter: 50 EMA

ema50 = ta.ema(close, 50)

longFilter = not useTrendFilter or (close > ema50)

shortFilter = not useTrendFilter or (close < ema50)

// ATR-Based Stop Loss Buffer

atrValue = ta.atr(14)

stopLossBuffer = atrValue * atrMultiplier

// RSI Calculation (if enabled)

rsiValue = ta.rsi(close, rsiPeriod)

//──────────────────────────────

// ENTRY CONDITIONS (15-Minute Candle Retest)

//──────────────────────────────

// Breakout/Breakdown based on the first candle levels

buyBreakout = firstCandleCaptured and ta.crossover(close, fHigh)

sellBreakdown = firstCandleCaptured and ta.crossunder(close, fLow)

// Retest conditions: price must retest the level after the breakout/breakdown

buyRetest = firstCandleCaptured and (low <= fHigh) and (close > fHigh)

sellRetest = firstCandleCaptured and (high >= fLow) and (close < fLow)

// Final entry signals (with optional RSI filter)

buySignal = buyBreakout and buyRetest and longFilter and (strategy.position_size == 0) and (not useRSIFilter or (rsiValue < rsiOversold))

sellSignal = sellBreakdown and sellRetest and shortFilter and (strategy.position_size == 0) and (not useRSIFilter or (rsiValue > rsiOverbought))

//──────────────────────────────

// Trade Parameters for 15-Minute Candle Retest

//──────────────────────────────

candleRange = fHigh - fLow

stopLossBuy = fLow - stopLossBuffer

takeProfitBuy = fHigh + (candleRange * riskRewardRatio)

stopLossSell = fHigh + stopLossBuffer

takeProfitSell = fLow - (candleRange * riskRewardRatio)

//──────────────────────────────

// Execute Trades for 15-Minute Candle Retest

//──────────────────────────────

if buySignal

strategy.entry("BUY", strategy.long)

strategy.exit("TP/SL BUY", "BUY", stop=stopLossBuy, limit=takeProfitBuy)

if sellSignal

strategy.entry("SELL", strategy.short)

strategy.exit("TP/SL SELL", "SELL", stop=stopLossSell, limit=takeProfitSell)

//──────────────────────────────

// Plot First Candle Level Lines (Optional)

//──────────────────────────────

plot(showFirstCandleLines and firstCandleCaptured ? fHigh : na, title="First Candle High", color=color.blue, linewidth=2)

plot(showFirstCandleLines and firstCandleCaptured ? fLow : na, title="First Candle Low", color=color.red, linewidth=2)

相关推荐