概述

本策略是一种多因子趋势追踪动态风险管理股票交易策略,通过综合运用多个技术指标,旨在提高交易信号的准确性和策略的整体表现。策略核心围绕趋势判断、动量确认、波动率过滤和风险控制展开,为投资者提供一个系统化的交易方法。

策略原理

策略原理基于六个关键指标的综合分析:

- G-Channel指标:使用20日和50日指数移动平均线(EMA)判断市场趋势方向。

- Fantel可变移动平均线(VMA)确认:比较14日和28日简单移动平均线(SMA)来验证趋势动量。

- Coral趋势确认:通过10日和20日SMA判断短期趋势方向。

- ADX波动率确认:评估市场趋势强度和波动性。

- 成交量确认:检查成交量是否显著高于20日平均成交量。

- 价格相对50日SMA:判断价格在长期趋势中的位置。

策略优势

- 多因子验证:通过六个不同维度的指标交叉验证,显著降低假信号概率。

- 动态风险管理:使用ATR(平均真实波动范围)动态调整止损和止盈。

- 灵活的入场和出场机制:结合趋势、动量、波动率和成交量多重条件。

- 风险收益比优化:采用2:1的风险收益比设计。

- 低频交易:减少交易次数,降低交易成本。

策略风险

- 多空判断复杂:多因子验证可能导致信号产生滞后。

- 参数敏感性:不同市场环境下,固定参数可能表现不佳。

- 成交量限制:低成交量可能增加交易误判风险。

- RSI极值限制:可能错过部分交易机会。

策略优化方向

- 参数自适应:开发动态参数调整机制。

- 机器学习优化:引入机器学习算法优化入场和出场时机。

- 多市场适应性:针对不同品种和市场环境定制参数。

- 结合情绪指标:引入市场情绪指标提高策略稳定性。

总结

本策略通过多因子、多维度的交易信号验证,构建了一个相对稳健的股票交易系统。其核心优势在于降低交易风险,但仍需持续优化和适应市场变化。

策略源码

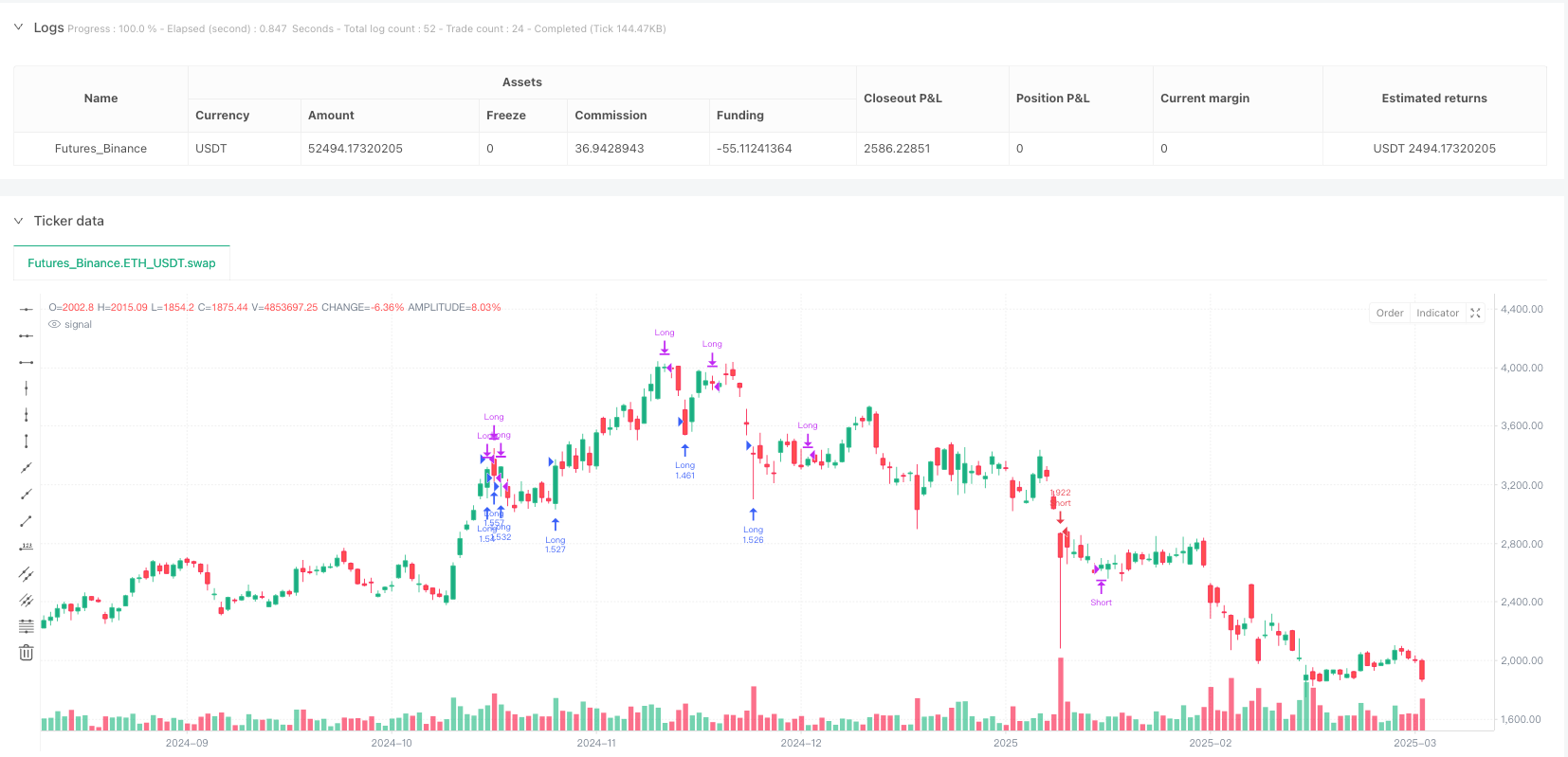

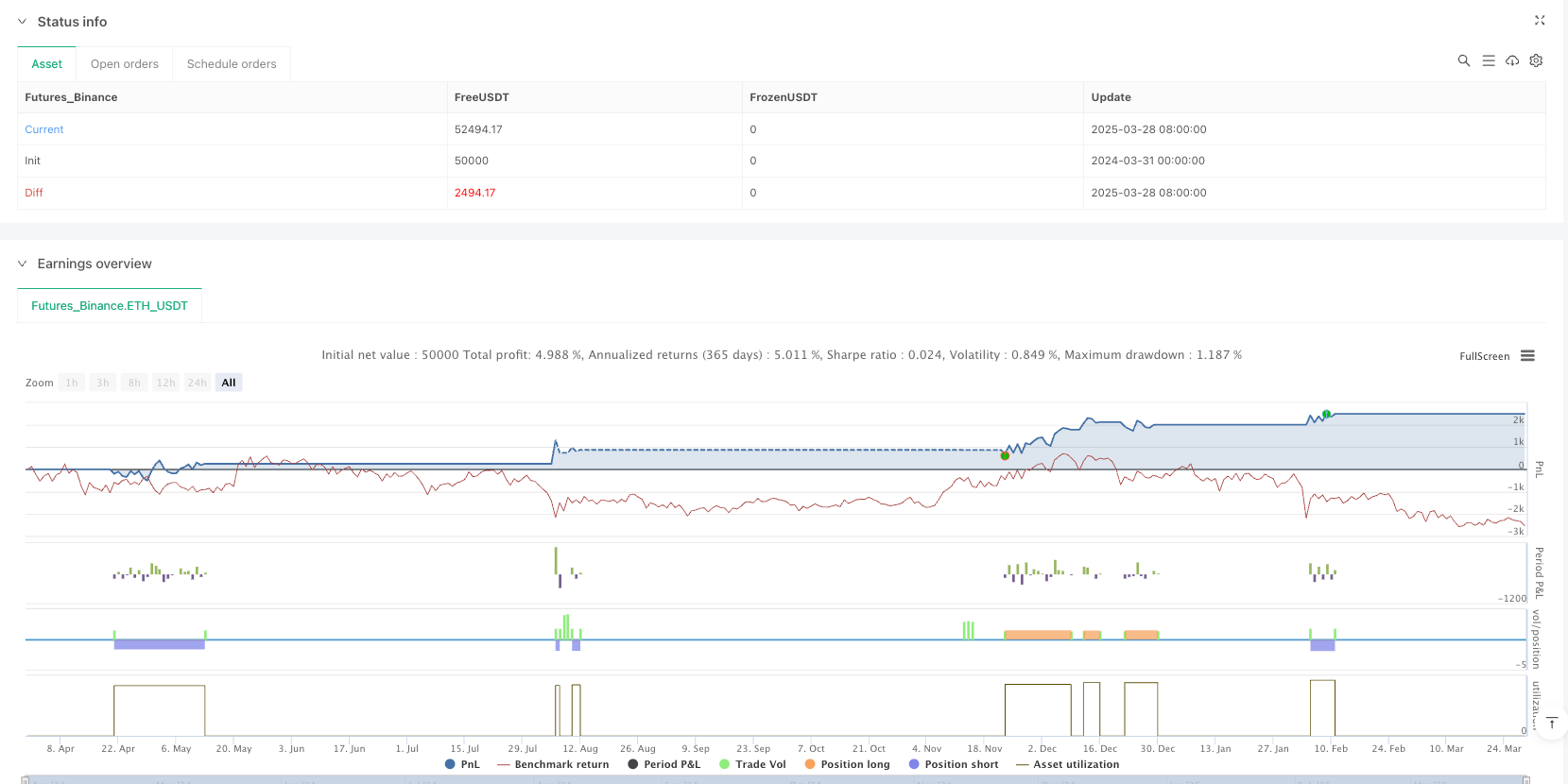

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("G-Channel Strategy for Stocks", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === 1️⃣ G-Channel Indicator ===

gChannel = ta.ema(close, 20) > ta.ema(close, 50) ? 1 : 0

// === 2️⃣ Fantel VMA Confirmation ===

fvma = ta.sma(close, 14) > ta.sma(close, 28) ? 1 : 0

// === 3️⃣ Coral Trend Confirmation ===

coral = ta.sma(close, 10) > ta.sma(close, 20) ? 1 : 0

// === 4️⃣ ADX Confirmation (Volatility) ===

adx = ta.ema(ta.rma(ta.atr(14), 14), 14)

adxMa = ta.sma(adx, 14)

adxConfirmed = adx > adxMa ? 1 : 0

// === 5️⃣ Volume Confirmation ===

volConfirm = volume > ta.sma(volume, 20) * 1.3 ? 1 : 0

// === 6️⃣ Price Above 50-Day SMA ===

sma50 = ta.sma(close, 50)

priceAboveSMA = close > sma50 ? 1 : 0

// === 📌 ENTRY CONDITIONS (LONG & SHORT) ===

longCondition = gChannel and fvma and coral and adxConfirmed and volConfirm and priceAboveSMA

shortCondition = not gChannel and not fvma and not coral and adxConfirmed and volConfirm and close < sma50

// === 7️⃣ ATR Stop-Loss (Lower Than Crypto) ===

atr = ta.atr(14)

stopLoss = close - (atr * 2.0) // Adjusted for stocks

takeProfit = close + (atr * 4.0) // 2:1 Risk/Reward Ratio

// === 📌 EXECUTE TRADES ===

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", from_entry="Long", limit=takeProfit, stop=stopLoss)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", from_entry="Short", limit=close - (atr * 4.0), stop=close + (atr * 2.0))

// === 8️⃣ RSI EXIT (Stocks Exit Earlier) ===

rsi = ta.rsi(close, 14)

if (rsi > 75) // Lower exit threshold for stocks

strategy.close("Long")

if (rsi < 25)

strategy.close("Short")

// === 9️⃣ Volume-Based Exit ===

if (volume < ta.sma(volume, 20) * 0.5)

strategy.close("Long")

strategy.close("Short")

相关推荐