概述

这是一种基于平均真实范围(ATR)的趋势跟踪策略,旨在通过结合多种技术指标来捕捉高概率交易。该策略融合了ATR过滤、超级趋势指标、指数移动平均线(EMA)和简单移动平均线(SMMA)趋势带、相对强弱指数(RSI)确认以及动态止损系统,旨在提供一个全面且灵活的交易方法。

策略原理

策略的核心原理基于多重技术指标的协同作用:

趋势识别:使用超级趋势指标(参数:因子2,长度5)和50日EMA与8日SMMA趋势带来定义市场趋势方向。趋势以颜色编码:

- 绿色:看涨趋势

- 红色:看跌趋势

- 灰色:中性阶段

ATR智能过滤:通过14周期ATR和50周期简单移动平均线检测波动性扩张,仅在ATR上升或高于其SMA 101%时进行交易,确保仅在强势趋势中入场。

入场条件:

- 做多入场:价格高于50日EMA,超级趋势看涨,RSI > 45,ATR确认趋势强度

- 做空入场:价格低于50日EMA,超级趋势看跌,RSI < 45,ATR确认趋势强度

动态止损与止盈:

- 止盈:基于5倍ATR的自适应止盈

- 止损:3.5倍ATR的跟踪止损

- 保本止损:价格移动2倍ATR后启动

- 固定止损:使用0.8倍ATR乘数进行风险管理

策略优势

- 有效过滤波动市场,避免在低波动区域交易

- 防止过度交易,通过止盈锁定机制避免过早重新入场

- 捕捉强势趋势,跟踪止损允许盈利持续

- 降低回撤,ATR基础止损防止大额损失

- 参数可调,可针对不同市场微调ATR乘数、止损、止盈和RSI过滤器

策略风险

- 过度依赖技术指标可能导致假信号

- 在震荡市场中可能表现不佳

- 参数设置不当可能增加交易成本

- RSI确认可能错过快速趋势变化

策略优化方向

- 引入机器学习算法,动态调整参数

- 增加额外过滤器,如成交量确认

- 探索不同市场和时间框架的最优参数组合

- 开发多时间框架验证机制

总结

这是一种先进的趋势跟踪策略,通过多指标协同和动态风险管理,为交易者提供了一个灵活且强大的交易工具。持续的回测和优化是成功应用此策略的关键。

策略源码

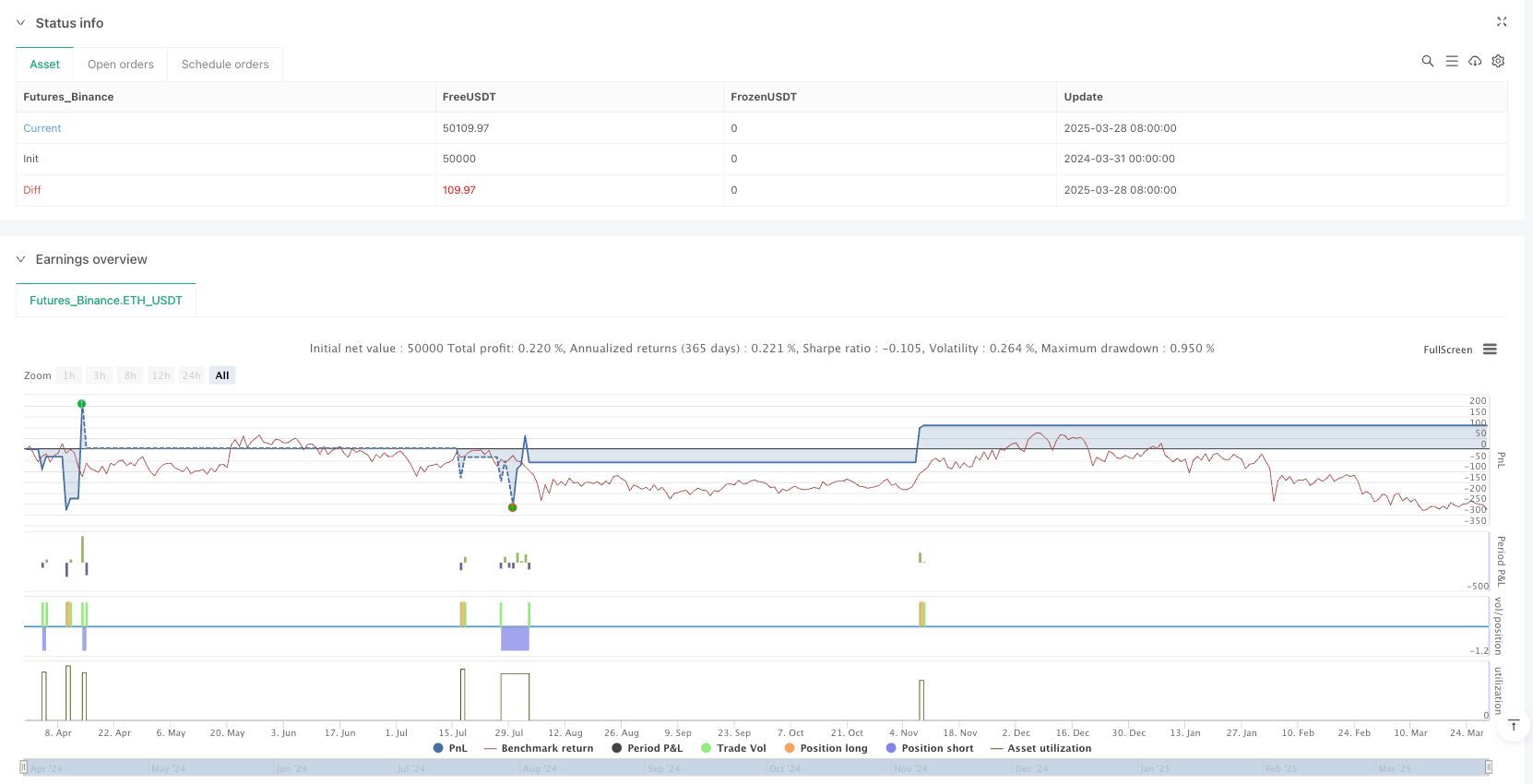

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Optimized ATR-Based Trend Strategy v6 (Fixed Trend Capture)", overlay=true)

// 🔹 Input parameters

lengthSMMA = input(8, title="SMMA Length")

lengthEMA = input(50, title="EMA Length")

supertrendFactor = input(2.0, title="Supertrend Factor")

supertrendLength = input(5, title="Supertrend Length")

atrLength = input(14, title="ATR Length")

atrSmoothing = input(50, title="ATR Moving Average Length")

atrMultiplierTP = input.float(5.0, title="ATR Multiplier for Take-Profit", minval=1.0, step=0.5)

atrMultiplierTSL = input.float(3.5, title="ATR Multiplier for Trailing Stop-Loss", minval=1.0, step=0.5) // 🔹 Increased to ride trends

atrStopMultiplier = input.float(0.8, title="ATR Stop Multiplier", minval=0.5, step=0.1)

breakEvenMultiplier = input.float(2.0, title="Break-Even Trigger ATR Multiplier", minval=1.0, step=0.1)

rsiLength = input(14, title="RSI Length")

// 🔹 Indicator calculations

smma8 = ta.sma(ta.sma(close, lengthSMMA), lengthSMMA)

ema50 = ta.ema(close, lengthEMA)

// 🔹 Supertrend Calculation

[superTrend, _] = ta.supertrend(supertrendFactor, supertrendLength)

// 🔹 Supertrend Conditions

isBullishSupertrend = close > superTrend

isBearishSupertrend = close < superTrend

// 🔹 ATR Calculation for Smarter Filtering

atrValue = ta.atr(atrLength)

atrMA = ta.sma(atrValue, atrSmoothing)

atrRising = ta.rising(atrValue, 3) // 🔹 More sensitive ATR detection

isTrending = atrValue > atrMA * 1.01 or atrRising // 🔹 Loosened ATR filter

// 🔹 RSI Calculation

rsi = ta.rsi(close, rsiLength)

// 🔹 RSI Conditions (More Flexible)

isRSIBullish = rsi > 45 // 🔹 Lowered to capture early trends

isRSIBearish = rsi < 45

// 🔹 TP Lock Mechanism

var bool tpHit = false

if strategy.position_size == 0 and strategy.closedtrades > 0

tpHit := true

// 🔹 Supertrend Flip Detection (Resumes Trading After Trend Change)

trendFlip = (isBullishSupertrend and not isBullishSupertrend[1]) or (isBearishSupertrend and not isBearishSupertrend[1])

if trendFlip

tpHit := false

// 🔹 Entry Conditions

bullishEntry = close > ema50 and isBullishSupertrend and isRSIBullish and isTrending and not tpHit

bearishEntry = close < ema50 and isBearishSupertrend and isRSIBearish and isTrending and not tpHit

// 🔹 Dynamic Take-Profit, Stop-Loss, and Break-Even Stop

longTakeProfit = close + (atrValue * atrMultiplierTP)

shortTakeProfit = close - (atrValue * atrMultiplierTP)

longTrailStop = atrValue * atrMultiplierTSL

shortTrailStop = atrValue * atrMultiplierTSL

// ✅ Adjusted SL to Reduce Drawdown

longStopLoss = close - (atrValue * atrMultiplierTSL * atrStopMultiplier)

shortStopLoss = close + (atrValue * atrMultiplierTSL * atrStopMultiplier)

// ✅ Break-Even Stop Trigger (More Room for Trends)

longBreakEven = strategy.position_avg_price + (atrValue * breakEvenMultiplier)

shortBreakEven = strategy.position_avg_price - (atrValue * breakEvenMultiplier)

// 🔹 Strategy Execution (Fixed Take-Profit & Stop-Loss)

if (bullishEntry)

strategy.entry("Buy", strategy.long)

strategy.exit("TSL/TP", from_entry="Buy", stop=longStopLoss, trail_offset=longTrailStop, limit=longTakeProfit)

strategy.exit("BreakEven", from_entry="Buy", stop=longBreakEven)

if (bearishEntry)

strategy.entry("Sell", strategy.short)

strategy.exit("TSL/TP", from_entry="Sell", stop=shortStopLoss, trail_offset=shortTrailStop, limit=shortTakeProfit)

strategy.exit("BreakEven", from_entry="Sell", stop=shortBreakEven)

// 🔹 Trend Band

trendColor = isBullishSupertrend and smma8 > ema50 and close > ema50 ? color.green :

isBearishSupertrend and smma8 < ema50 and close < ema50 ? color.red : color.gray

fill(plot(smma8, color=color.new(trendColor, 60), title="8 SMMA Band"),

plot(ema50, color=color.new(trendColor, 60), title="50 EMA Band"),

color=color.new(trendColor, 80), title="Trend Band")

// 🔹 Supertrend Line

plot(superTrend, color=color.gray, title="Supertrend", style=plot.style_line)

相关推荐