概述

PowerZone交易策略是一种创新的自动化交易方法,专注于捕捉市场中强劲的价格运动。该策略通过识别特定的价格区域(称为”PowerZones”),为交易者提供明确的入场和出场信号,同时内置风险管理机制。

策略原理

策略的核心在于识别两种关键的PowerZone类型: 1. 牛市PowerZone(Bullish PowerZone): - 初始为一根熊市K线(收盘价低于开盘价) - 随后连续数根K线(默认5根)呈现上涨趋势 - 总体价格变动超过预设阈值(默认2%)

- 熊市PowerZone(Bearish PowerZone):

- 初始为一根牛市K线(收盘价高于开盘价)

- 随后连续数根K线呈现下跌趋势

- 总体价格变动超过预设阈值

策略优势

- 自动化识别趋势转折点

- 内置灵活的参数定制功能

- 清晰的可视化展示

- 自动风险管理(止盈止损)

- 适用于多种市场环境

- 代码精简,易于理解和修改

策略风险

- 参数设置不当可能导致过度交易

- 在震荡市场中可能产生错误信号

- 固定仓位可能增加单笔亏损风险

- 缺乏复杂的过滤机制

- 未考虑更广泛的市场趋势和周期

策略优化方向

引入附加过滤条件

- 结合趋势指标(如EMA)

- 整合动量指标(如RSI)

- 添加成交量确认机制

动态仓位管理

- 根据市场波动性调整仓位大小

- 实施风险百分比仓位控制

多时间框架验证

- 在不同时间周期交叉验证信号

- 提高信号的可靠性

总结

PowerZone交易策略通过系统化地识别价格强势区域,为交易者提供了一种结构化的交易方法。其核心优势在于自动化、可视化和灵活性,但同时需要谨慎调整参数,并持续优化风险管理机制。

策略源码

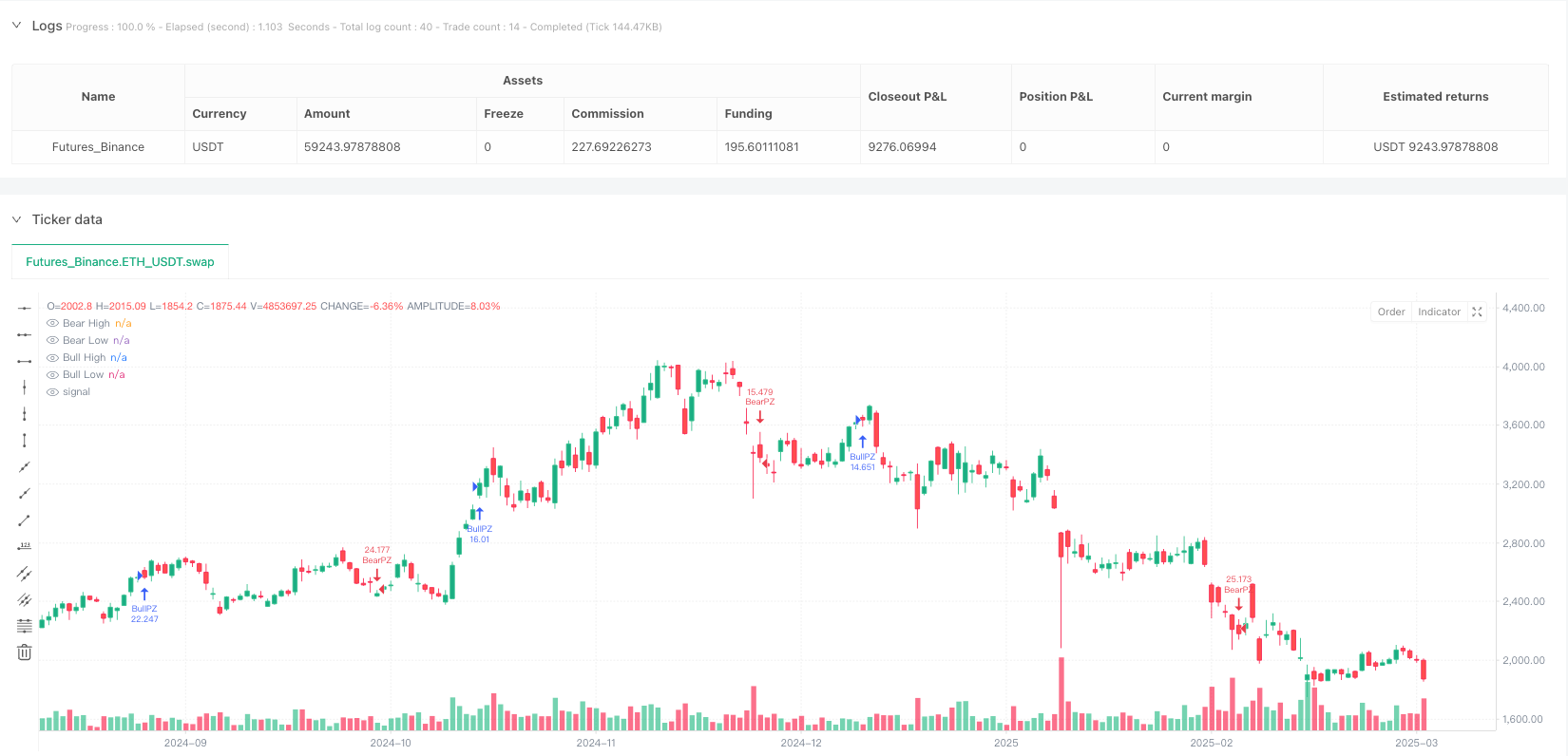

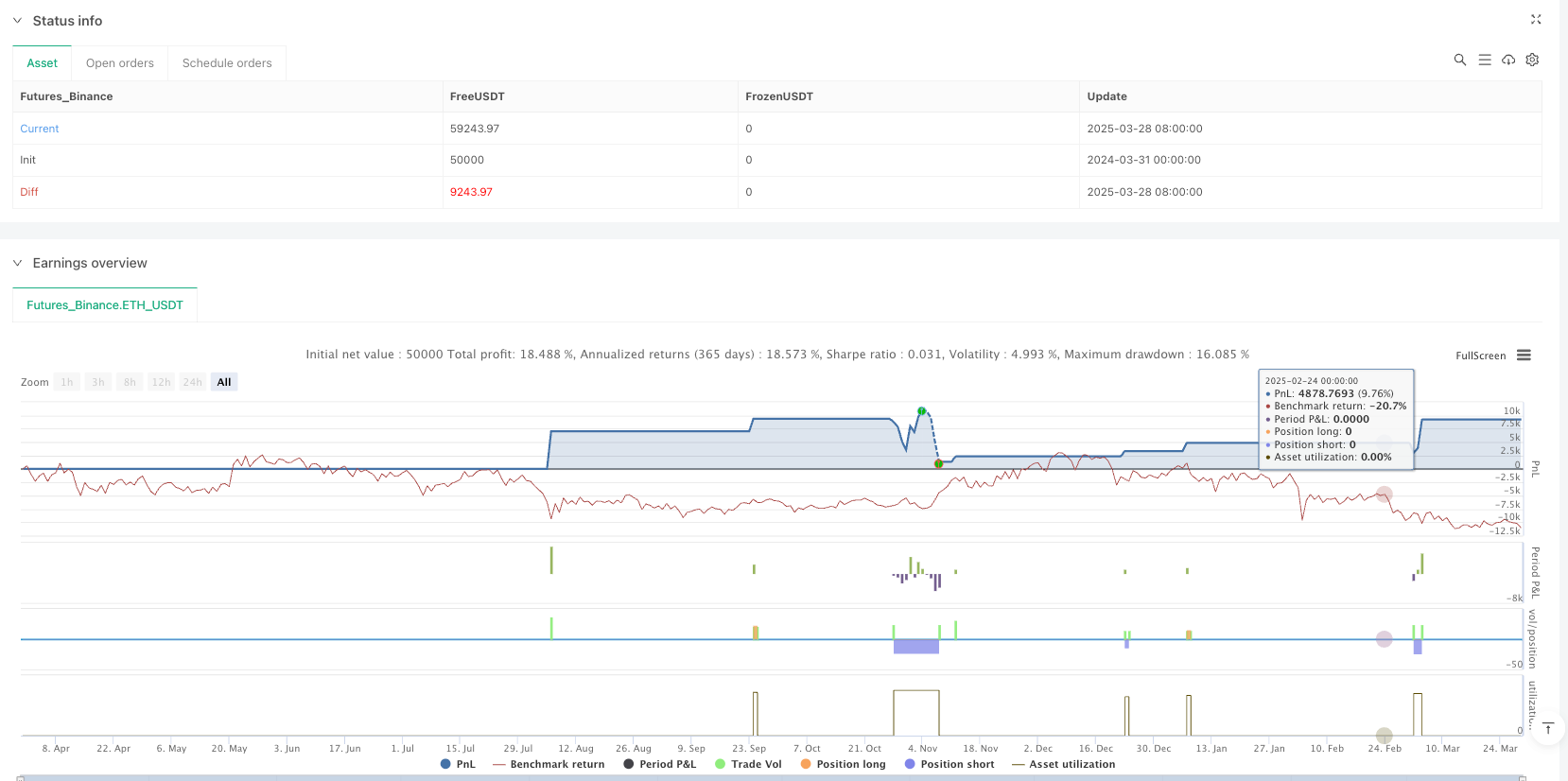

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tradingbauhaus

//@version=6

strategy("PowerZone Trading Strategy", overlay=true, shorttitle="PZStrat", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Inputs

periods = input.int(5, title="Periods for PowerZone", minval=1)

threshold = input.float(0.0, title="Min % Move for PowerZone", step=0.1, minval=0.0)

usewicks = input.bool(false, title="Use Full Range [High/Low]?")

tp_factor = input.float(1.5, title="Take Profit Factor", step=0.1, minval=0.5)

sl_factor = input.float(1.0, title="Stop Loss Factor", step=0.1, minval=0.5)

colors = input.string("DARK", title="Color Scheme", options=["DARK", "BRIGHT"])

showbull = input.bool(true, title="Show Bullish Channel?")

showbear = input.bool(true, title="Show Bearish Channel?")

showdocu = input.bool(false, title="Show Documentation?")

info_pan = input.bool(true, title="Show Info Panel?")

// Core Variables

bullcolor = colors == "DARK" ? color.white : color.green

bearcolor = colors == "DARK" ? color.blue : color.red

ob_period = periods + 1

// PowerZone Detection

absmove = math.abs((close[ob_period] - close[1]) / close[ob_period]) * 100

relmove = absmove >= threshold

// Bullish PowerZone

bullishPZ = close[ob_period] < open[ob_period]

upcandles = 0

for i = 0 to periods - 1

upcandles := upcandles + (close[i + 1] > open[i + 1] ? 1 : 0)

PZ_bull = bullishPZ and upcandles == periods and relmove

PZ_bull_high = PZ_bull ? (usewicks ? high[ob_period] : open[ob_period]) : na

PZ_bull_low = PZ_bull ? low[ob_period] : na

PZ_bull_avg = PZ_bull ? (PZ_bull_high + PZ_bull_low) / 2 : na

// Bearish PowerZone

bearishPZ = close[ob_period] > open[ob_period]

downcandles = 0

for i = 0 to periods - 1

downcandles := downcandles + (close[i + 1] < open[i + 1] ? 1 : 0)

PZ_bear = bearishPZ and downcandles == periods and relmove

PZ_bear_high = PZ_bear ? high[ob_period] : na

PZ_bear_low = PZ_bear ? (usewicks ? low[ob_period] : open[ob_period]) : na

PZ_bear_avg = PZ_bear ? (PZ_bear_high + PZ_bear_low) / 2 : na

// Strategy Logic

var float bull_entry = na

var float bull_tp = na

var float bull_sl = na

var float bear_entry = na

var float bear_tp = na

var float bear_sl = na

if PZ_bull and close > PZ_bull_high and strategy.position_size == 0

bull_entry := close

bull_tp := bull_entry + (PZ_bull_high - PZ_bull_low) * tp_factor

bull_sl := PZ_bull_low - (PZ_bull_high - PZ_bull_low) * sl_factor

strategy.entry("BullPZ", strategy.long)

strategy.exit("BullExit", "BullPZ", limit=bull_tp, stop=bull_sl)

if PZ_bear and close < PZ_bear_low and strategy.position_size == 0

bear_entry := close

bear_tp := bear_entry - (PZ_bear_high - PZ_bear_low) * tp_factor

bear_sl := PZ_bear_high + (PZ_bear_high - PZ_bear_low) * sl_factor

strategy.entry("BearPZ", strategy.short)

strategy.exit("BearExit", "BearPZ", limit=bear_tp, stop=bear_sl)

// Visualization

plot(PZ_bull_high, title="Bull High", color=bullcolor, style=plot.style_linebr, linewidth=2, offset=-ob_period)

plot(PZ_bull_low, title="Bull Low", color=bullcolor, style=plot.style_linebr, linewidth=2, offset=-ob_period)

plot(PZ_bear_high, title="Bear High", color=bearcolor, style=plot.style_linebr, linewidth=2, offset=-ob_period)

plot(PZ_bear_low, title="Bear Low", color=bearcolor, style=plot.style_linebr, linewidth=2, offset=-ob_period)

// Alerts

alertcondition(PZ_bull and close > PZ_bull_high, title="Bullish Entry", message="Bullish PowerZone Breakout - LONG!")

alertcondition(PZ_bear and close < PZ_bear_low, title="Bearish Entry", message="Bearish PowerZone Breakdown - SHORT!")

// Info Panel

var label info_panel = na

if info_pan

if not na(info_panel)

label.delete(info_panel)

panel_text = "POWERZONE STRATEGY\n" +

"Bull High: " + str.tostring(PZ_bull_high, "#.##") + " | TP: " + str.tostring(bull_tp, "#.##") + " | SL: " + str.tostring(bull_sl, "#.##") + "\n" +

"Bear High: " + str.tostring(PZ_bear_high, "#.##") + "\n" +

"Bear Low: " + str.tostring(PZ_bear_low, "#.##") + " | TP: " + str.tostring(bear_tp, "#.##") + " | SL: " + str.tostring(bear_sl, "#.##")

info_panel := label.new(x=bar_index, y=high, text=panel_text, xloc=xloc.bar_index, yloc=yloc.abovebar, color=color.gray, textcolor=color.white, size=size.normal)

// Documentation

if showdocu

label.new(x=bar_index, y=low, text="PowerZone Strategy\nLONG on breakout above Bull PZ High\nSHORT on breakdown below Bear PZ Low", xloc=xloc.bar_index, yloc=yloc.belowbar, color=color.gray, textcolor=color.white, size=size.tiny)

相关推荐