概述

本策略是一种创新的多时间框架交易方法,结合了智能资金概念(Smart Money Concepts)、指数移动平均线(EMA)和多时间框架趋势分析,旨在通过精准的支撑压力区域识别和动态市场信号捕捉交易机会。

策略原理

策略核心基于以下关键技术指标和分析方法:

- 多时间框架趋势确认:同时利用5分钟和15分钟时间框架的简单移动平均线(SMA)进行趋势判断。

- 支撑压力区域识别:通过50周期的最高价和最低价计算动态支撑压力线。

- 供需区域分析:评估20周期内的最低价和最高价作为供需关键区域。

- 智能资金概念(SMC)liquidity抓取:识别市场流动性陷阱和突破关键点。

- 交易信号生成:结合快慢EMA交叉、趋势方向、支撑压力区域和波动率过滤。

策略优势

- 多维度市场分析:综合考虑多时间框架趋势,提高信号准确性。

- 动态风险管理:固定止盈止损点(100个点),有效控制单笔交易风险。

- 智能资金概念应用:通过流动性抓取和突破区域识别更精准的入场时机。

- 波动率过滤:避免在高波动市场中进行交易,降低非理性交易风险。

- 灵活的交易信号生成:综合考虑趋势、动量和市场结构。

策略风险

- 固定止盈止损的局限性:在不同市场条件下可能无法适应最佳风险管理。

- 多重条件限制:复杂的信号生成条件可能导致交易机会减少。

- 时间框架局限:仅使用5分钟和15分钟可能错过更大趋势。

- 技术指标滞后性:EMA和SMA作为滞后指标可能延迟信号。

策略优化方向

- 动态止盈止损:引入基于波动率或支撑压力区域的自适应止盈止损机制。

- 增加时间框架:引入更多时间框架(如1小时、4小时)进行趋势确认。

- 机器学习优化:使用机器学习算法动态调整入场和出场参数。

- волатильность调整:开发更精细的波动率过滤算法。

- 风险评分系统:引入综合风险评分,动态调整仓位大小。

总结

该策略通过整合多时间框架分析、智能资金概念和先进的信号生成机制,为交易者提供了一种系统化和规范化的交易方法。尽管存在一些潜在风险,但其多维度分析和动态风险管理为交易者提供了显著优势。未来的优化将进一步提升策略的适应性和盈利潜力。

策略源码

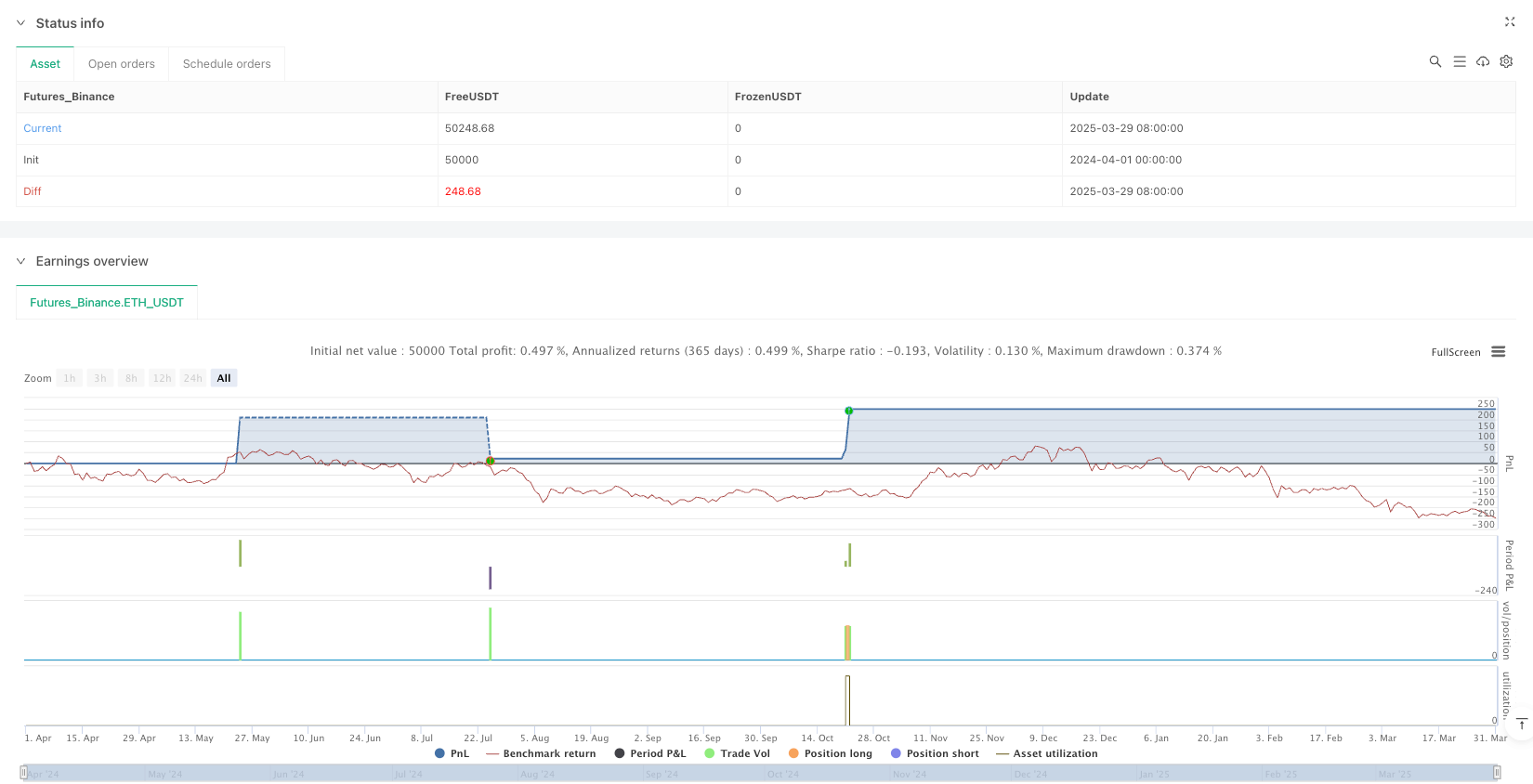

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maechelang

//@version=6

strategy("Optimized Trading Strategy v6", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Timeframe Confirmation (M5 & M15) ===

m5_trend = request.security(syminfo.tickerid, "5", ta.sma(close, 50))

m15_trend = request.security(syminfo.tickerid, "15", ta.sma(close, 50))

// === Support & Resistance (Swing High & Low) ===

swingHigh = ta.highest(high, 50)

swingLow = ta.lowest(low, 50)

plot(swingHigh, "Resistance", color=color.blue, linewidth=2, style=plot.style_stepline)

plot(swingLow, "Support", color=color.red, linewidth=2, style=plot.style_stepline)

// === Supply & Demand Zones ===

demand_zone = ta.lowest(low, 20)

supply_zone = ta.highest(high, 20)

bgcolor(close > demand_zone ? color.new(color.green, 85) : na)

bgcolor(close < supply_zone ? color.new(color.red, 85) : na)

// === Smart Money Concepts (SMC) - Liquidity Grab & Breaker Block ===

liqGrab = (ta.highest(high, 10) < ta.highest(high, 50)) and (ta.lowest(low, 10) > ta.lowest(low, 50))

breakerBlock = ta.crossover(close, ta.sma(close, 50)) or ta.crossunder(close, ta.sma(close, 50))

// === News Filter (Hindari Volatilitas Tinggi) ===

newsVolatility = ta.tr(true) > ta.sma(ta.tr(true), 20) * 1.5

// === Buy & Sell Signals (EMA + SMC + Multi-Timeframe) ===

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 21)

buySignal = ta.crossover(emaFast, emaSlow) and close > swingLow and not breakerBlock and close > m5_trend and close > m15_trend and not newsVolatility

sellSignal = ta.crossunder(emaFast, emaSlow) and close < swingHigh and not breakerBlock and close < m5_trend and close < m15_trend and not newsVolatility

// === TP & SL Fixed 100 Pips ===

pip = syminfo.mintick * 100

buyTP = close + 100 * pip

buySL = close - 100 * pip

sellTP = close - 100 * pip

sellSL = close + 100 * pip

// === Entry & Exit Orders ===

if buySignal

strategy.entry("BUY NOW", strategy.long)

strategy.exit("EXIT BUY", from_entry="BUY NOW", limit=buyTP, stop=buySL)

label.new(bar_index, low, "BUY NOW\nEntry: " + str.tostring(close, "#.##") + "\nTP: " + str.tostring(buyTP, "#.##") + "\nSL: " + str.tostring(buySL, "#.##"), color=color.blue, textcolor=color.white, size=size.small)

if sellSignal

strategy.entry("SELL NOW", strategy.short)

strategy.exit("EXIT SELL", from_entry="SELL NOW", limit=sellTP, stop=sellSL)

label.new(bar_index, high, "SELL NOW\nEntry: " + str.tostring(close, "#.##") + "\nTP: " + str.tostring(sellTP, "#.##") + "\nSL: " + str.tostring(sellSL, "#.##"), color=color.red, textcolor=color.white, size=size.small)

相关推荐