首个蜡烛突破-动态追踪止损与收盘平仓策略是一种日内交易策略,它利用市场开盘后第一根蜡烛线的价格区间作为重要的支撑和阻力位。该策略在第一根蜡烛形成后,等待价格突破其高点或低点后再入场,同时采用基于第一根蜡烛价格区间的动态追踪止损机制,并在每日特定时间强制平仓,以规避隔夜风险。

策略原理

该策略基于市场开盘后第一根蜡烛线所形成的价格区间往往具有重要的技术意义这一市场观察。策略的核心逻辑如下:

- 在用户设定的特定时间点(默认为9:15)识别并记录当日第一根蜡烛线的最高价和最低价。

- 计算第一根蜡烛线的价格区间(最高价减最低价)。

- 当价格在第一根蜡烛形成后突破第一根蜡烛的最高价时,策略触发做多信号。

- 当价格在第一根蜡烛形成后突破第一根蜡烛的最低价时,策略触发做空信号。

- 入场后设置动态追踪止损,止损距离为第一根蜡烛价格区间的1.5倍(可通过参数调整)。

- 对于多头仓位,随着价格上涨,止损水平也相应提高,保持与当前价格的距离为固定的止损距离。

- 对于空头仓位,随着价格下跌,止损水平也相应降低,保持与当前价格的距离为固定的止损距离。

- 在每日特定时间点(默认为15:30)强制平仓所有持仓,规避隔夜风险。

该策略采用了确认后入场的机制,即在价格真正突破第一根蜡烛的高点或低点后才入场交易,而不是在价格刚触及这些水平时就立即入场,这有助于减少假突破带来的风险。

策略优势

- 明确的入场信号:该策略基于明确的价格突破信号入场,规则简单明了,易于理解和执行。

- 动态风险管理:采用基于市场波动的动态追踪止损机制,止损距离根据当日第一根蜡烛的波动范围自动调整,使风险管理更具适应性。

- 避免假突破:通过等待价格收盘突破第一根蜡烛的高点或低点再入场,而不是价格刚触及这些水平就入场,有助于过滤部分假突破信号。

- 规避隔夜风险:每日固定时间强制平仓,避免了持仓过夜可能面临的缺口风险和不确定性。

- 适应市场波动:策略的入场点和止损水平会根据当日的市场波动程度自动调整,在波动大的日子止损距离更宽,在波动小的日子止损距离更窄,从而更好地适应不同市场环境。

- 只交易一次:每日仅允许一次交易,避免过度交易,降低交易成本。

- 完全自动化:策略完全可以自动化执行,无需人工干预,适合没有时间实时监控市场的交易者。

##, 策略风险

尽管该策略拥有多项优势,但仍然存在一些潜在风险:

- 虚假突破风险:尽管策略等待价格收盘突破再入场,但仍然可能遇到虚假突破的情况,即价格突破后迅速回撤,导致止损被触发。解决方法是可以考虑增加额外的确认指标,如成交量确认或趋势确认。

- 止损距离过大:在波动较大的日子里,第一根蜡烛区间可能较宽,导致止损距离过大,单笔亏损较多。解决方法是可以设置最大止损距离的绝对值上限。

- 止损距离过小:相反,在波动较小的日子里,第一根蜡烛区间可能很窄,导致止损距离过小,容易被市场噪音触发。解决方法是可以设置最小止损距离的绝对值下限。

- 错过大行情:由于策略每天只允许一次交易,且在固定时间强制平仓,可能会错过持续性的大行情。解决方法是可以考虑在特定条件下允许持仓过夜。

- 时间依赖性:策略对第一根蜡烛的形成时间和强制平仓时间都有严格要求,对时间的依赖性较强,不同市场或不同时区可能需要调整参数。解决方法是根据特定市场的交易时间调整参数。

- 无盈利目标:策略没有设定明确的盈利目标,完全依赖追踪止损或日终平仓来结束交易,可能无法在最佳位置获利了结。解决方法是可以考虑增加基于支撑/阻力位或技术指标的获利了结机制。

- 参数敏感性:策略的表现可能对参数设置(如开始时间、结束时间、追踪止损乘数等)非常敏感,需要进行彻底的回测和优化。

策略优化方向

针对上述风险,该策略可以从以下几个方向进行优化:

- 增加过滤条件:结合市场趋势指标或成交量指标,仅在趋势方向一致或成交量确认的情况下入场,以减少虚假突破的风险。例如,可以添加移动平均线作为趋势过滤器,或者要求突破时成交量明显放大。

- 优化止损机制:为止损距离设置绝对值的上下限,即使在极端波动的日子里也能保持合理的风险水平。可以考虑结合ATR(真实波动幅度均值)指标来设置更加动态的止损距离。

- 引入部分获利机制:在价格达到某个目标(如第一根蜡烛区间的2倍或3倍)时,可以考虑部分平仓获利,剩余仓位继续使用追踪止损管理。

- 增加持仓过夜条件:在特定条件下(如趋势强劲或价格远离入场点)允许部分或全部仓位持仓过夜,以把握大趋势行情。

- 添加时间过滤:避免在市场波动性较低或不确定性较高的时段交易,如可以避免在重要经济数据发布前后入场。

- 优化参数自适应机制:让策略能够根据近期市场状况自动调整参数,如根据近期几天的平均波动性来调整追踪止损乘数。

- 加入市场环境识别:在不同市场环境(如震荡市、趋势市)下采用不同的交易参数或甚至不同的交易逻辑,提高策略的适应性。

- 考虑多时间框架分析:结合更大时间框架的市场结构,在主趋势方向一致的情况下交易,避免逆势交易。

- 添加资金管理模块:根据市场波动性和历史绩效动态调整仓位大小,在不确定性高的时期减少仓位,在策略表现良好的时期增加仓位。

总结

首个蜡烛突破-动态追踪止损与收盘平仓策略是一种基于市场开盘后第一根蜡烛线价格区间的日内交易策略。它利用确认后的价格突破信号入场,采用基于市场波动的动态追踪止损机制管理风险,并在每日固定时间强制平仓以规避隔夜风险。

该策略的优势在于入场信号明确、风险管理动态化、避免假突破和隔夜风险、适应市场波动、限制过度交易并且可完全自动化执行。然而,它也面临虚假突破风险、止损距离不合理、错过大行情、时间依赖性强、缺乏盈利目标以及参数敏感性等挑战。

通过增加过滤条件、优化止损机制、引入部分获利机制、增加持仓过夜条件、添加时间过滤、优化参数自适应机制、加入市场环境识别、考虑多时间框架分析和添加资金管理模块等方式,可以进一步提升策略的稳定性和盈利能力。

总的来说,这是一个结构清晰、逻辑合理的日内交易策略,适合那些希望通过自动化系统进行日内交易,并严格控制风险的交易者。通过针对性的优化和适当的参数调整,该策略有望在不同市场环境下取得稳定的表现。

策略源码

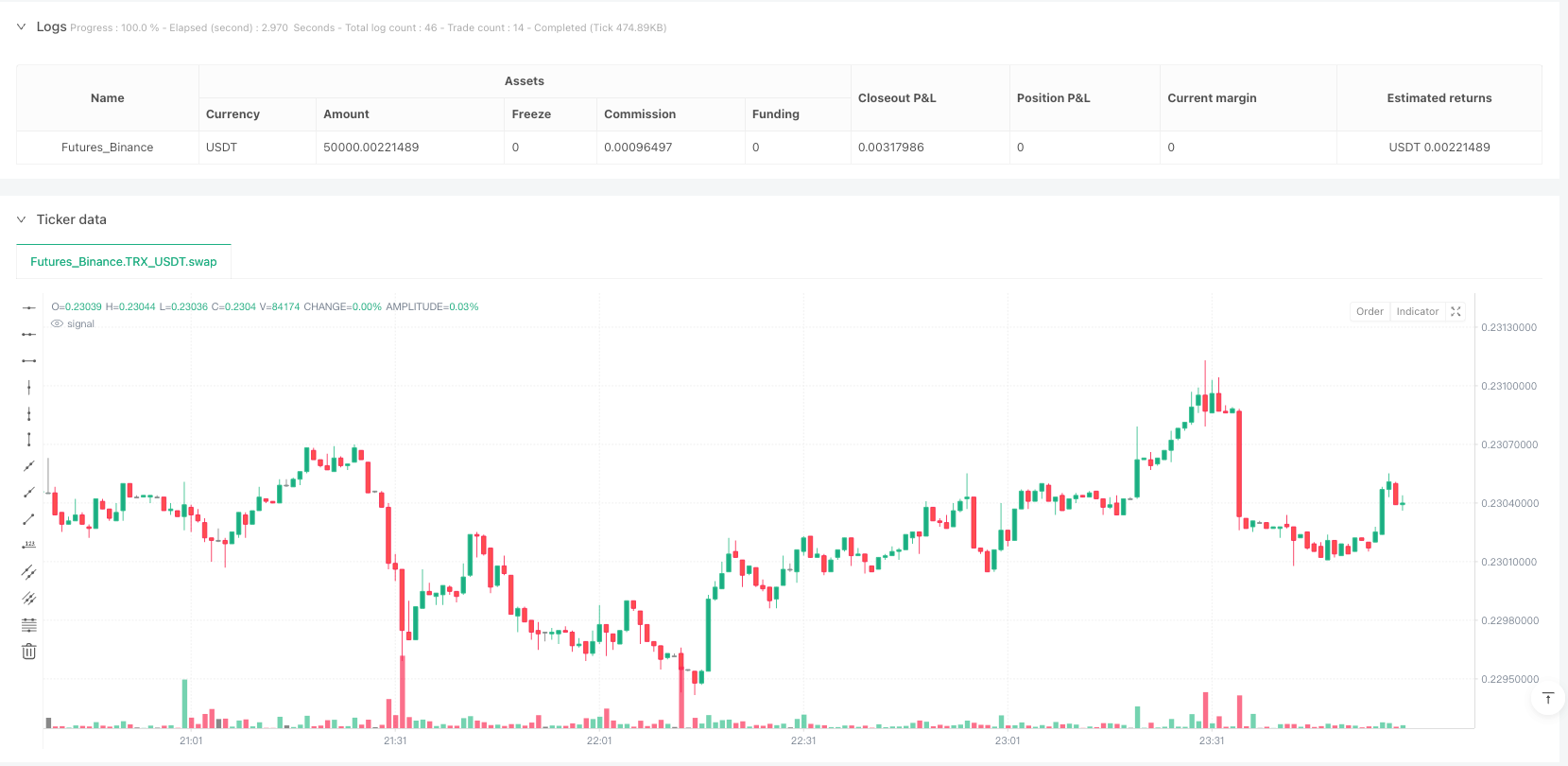

/*backtest

start: 2025-03-24 00:00:00

end: 2025-03-31 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"TRX_USDT"}]

*/

//@version=5

strategy("First Candle Breakout - Trailing Stop & EOD Close", overlay=true)

// User Inputs

startHour = input(9, "Start Hour (Exchange Time)")

startMinute = input(15, "Start Minute (Exchange Time)")

endHour = input(15, "End Hour (Exchange Time)") // Market closing hour

endMinute = input(30, "End Minute (Exchange Time)")

trailStopMultiplier = input(1.5, "Trailing Stop Multiplier") // 1.5x first candle range

// Variables to store the first candle's high & low

var float firstCandleHigh = na

var float firstCandleLow = na

var bool tradeTaken = false // Ensures only one trade per day

var int tradeDirection = 0 // 1 for long, -1 for short

var float trailStopLevel = na // Trailing stop level

// Identify first candle's high & low

if (hour == startHour and minute == startMinute and bar_index > 1)

firstCandleHigh := high

firstCandleLow := low

tradeTaken := false // Reset trade flag at start of day

tradeDirection := 0 // Reset trade direction

trailStopLevel := na // Reset trailing stop

// Calculate first candle range

firstCandleRange = firstCandleHigh - firstCandleLow

trailStopDistance = firstCandleRange * trailStopMultiplier

// Buy condition: Close above first candle high AFTER the first candle closes

longCondition = not na(firstCandleHigh) and close > firstCandleHigh and not tradeTaken and hour > startHour

if (longCondition)

strategy.entry("Buy", strategy.long, comment="Buy")

trailStopLevel := close - trailStopDistance // Set initial trailing stop

tradeTaken := true

tradeDirection := 1

// Sell condition: Close below first candle low AFTER the first candle closes

shortCondition = not na(firstCandleLow) and close < firstCandleLow and not tradeTaken and hour > startHour

if (shortCondition)

strategy.entry("Sell", strategy.short, comment="Sell")

trailStopLevel := close + trailStopDistance // Set initial trailing stop

tradeTaken := true

tradeDirection := -1

// Update trailing stop for long trades

if (tradeDirection == 1 and not na(trailStopLevel))

trailStopLevel := nz(trailStopLevel, close - trailStopDistance) // Initialize if na

trailStopLevel := math.max(trailStopLevel, close - trailStopDistance) // Adjust trailing stop up

if (close <= trailStopLevel) // Stop loss hit

strategy.close("Buy", comment="Trailing SL Hit")

// Update trailing stop for short trades

if (tradeDirection == -1 and not na(trailStopLevel))

trailStopLevel := nz(trailStopLevel, close + trailStopDistance) // Initialize if na

trailStopLevel := math.min(trailStopLevel, close + trailStopDistance) // Adjust trailing stop down

if (close >= trailStopLevel) // Stop loss hit

strategy.close("Sell", comment="Trailing SL Hit")

// Close trade at end of day if still open

if (tradeTaken and hour == endHour and minute == endMinute)

strategy.close_all(comment="EOD Close")

相关推荐