概述

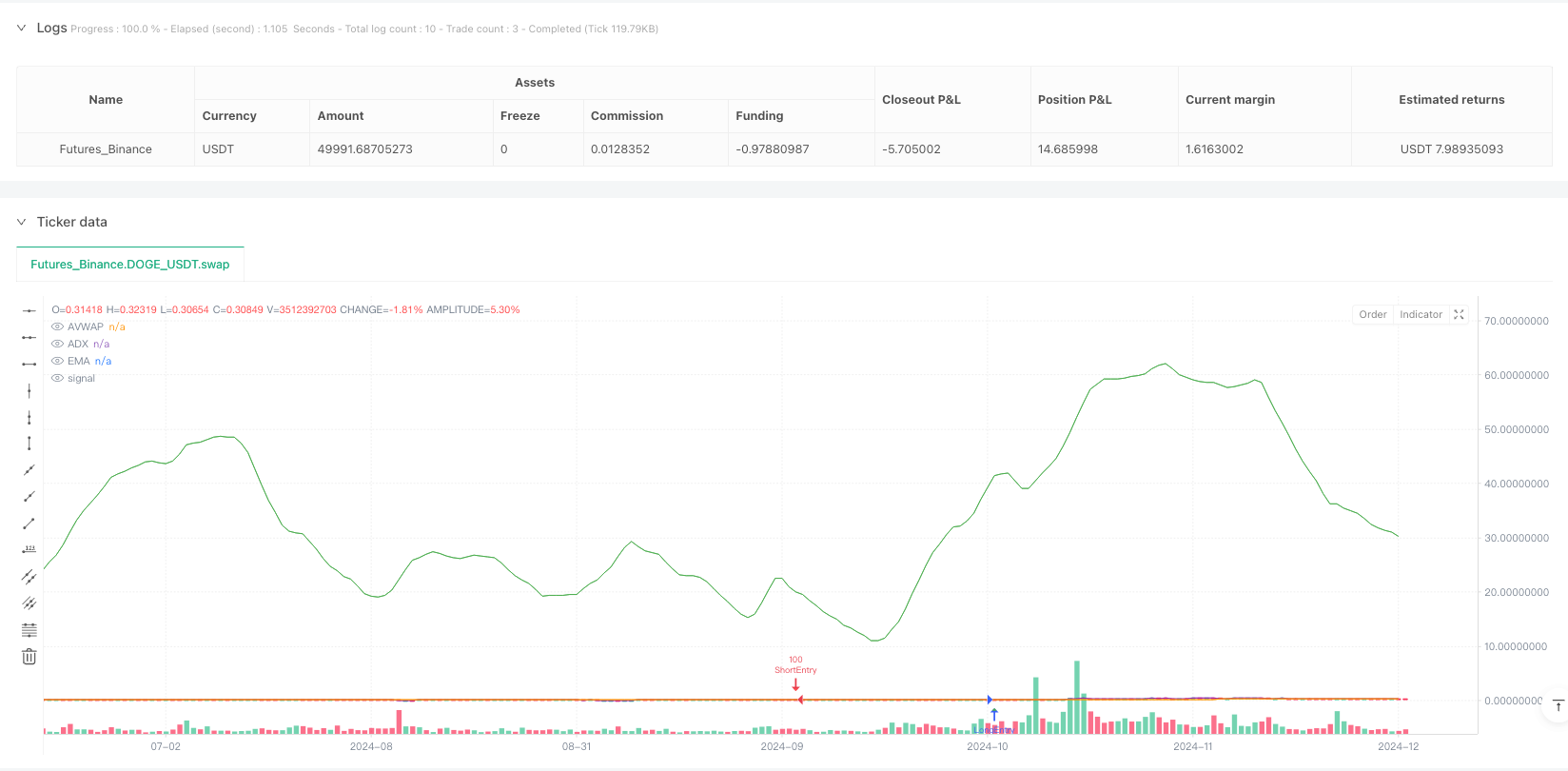

这是一种复杂的多指标交易策略,结合了成交量加权平均价格(AVWAP)、固定范围成交量分布(FRVP)、指数移动平均线(EMA)、相对强弱指数(RSI)、平均方向指数(ADX)和移动平均收敛散度(MACD)等多个技术分析工具,旨在通过指标聚合来识别高概率交易机会。

策略原理

策略通过多重条件来确定入场信号: 1. 价格与AVWAP的交叉 2. 价格相对EMA的位置 3. RSI的强度判断 4. MACD趋势动量 5. ADX趋势强度确认 6. 成交量过滤器

策略专注于亚洲、伦敦和纽约交易时段,这些时段通常流动性较好,交易信号更可靠。入场逻辑包括长仓和空仓两种模式,并设置了梯度止盈和止损机制。

策略优势

- 多指标组合,提高信号准确性

- 动态成交量过滤,避免低流动性交易

- 灵活的止盈止损策略

- 基于不同交易时段的策略优化

- 动态风险管理机制

- 可视化信号辅助决策

策略风险

- 多指标组合可能导致信号复杂性增加

- 回测数据可能存在过拟合风险

- 不同市场条件下性能可能不稳定

- 交易成本和滑点可能影响实际收益

策略优化方向

- 引入机器学习算法动态调整参数

- 增加更多交易时段适应性

- 优化止盈止损策略

- 引入更多过滤条件

- 开发跨品种通用性策略模型

总结

这是一个高度定制且多维度的交易策略,通过整合多个技术指标和交易时段特征,试图提高交易信号的质量和准确性。策略展示了量化交易中指标聚合和动态风险管理的复杂性。

策略源码

/*backtest

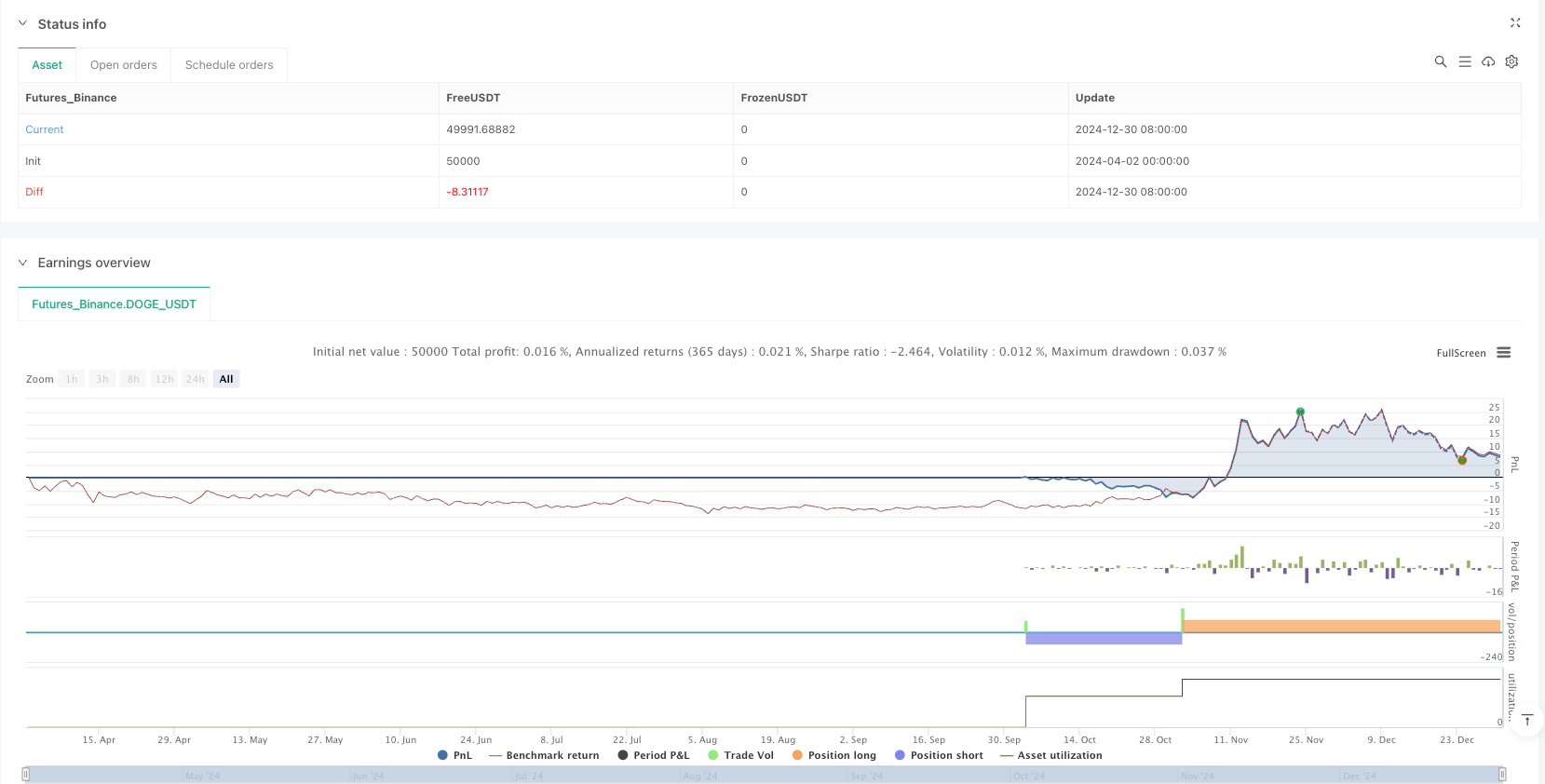

start: 2024-04-02 00:00:00

end: 2024-12-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("FRVP + AVWAP by Grok", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// User Inputs

frvpLength = input.int(20, title="FRVP Length", minval=1)

emaLength = input.int(75, title="EMA Length", minval=1) // Adjusted for stronger trend confirmation

rsiLength = input.int(14, title="RSI Length", minval=1)

adxThreshold = input.int(20, title="ADX Strength Threshold", minval=0, maxval=100)

volumeMultiplier = input.float(1.0, title="Volume Multiplier", minval=0.1)

// Stop Loss & Take Profit for XAUUSD

stopLossPips = 25 // 25 pips SL for Asian, London, NY Sessions

takeProfit1Pips = 35 // TP1 at 35 pips

takeProfit2Pips = 80 // Final TP at 80 pips

// Stop-Loss & Take-Profit Multipliers (XAUUSD: 1 pip = 0.1 points on most platforms)

stopMultiplier = float(stopLossPips) * 0.1

tp1Multiplier = float(takeProfit1Pips) * 0.1

tp2Multiplier = float(takeProfit2Pips) * 0.1

// Indicators

avwap = ta.vwap(close) // Volume Weighted Average Price (VWAP)

ema = ta.ema(close, emaLength) // Exponential Moving Average

rsi = ta.rsi(close, rsiLength) // Relative Strength Index

macdLine = ta.ema(close, 12) - ta.ema(close, 26) // MACD Line

signalLine = ta.ema(macdLine, 9) // MACD Signal Line

atr = ta.atr(14) // Average True Range

// Average Directional Index (ADX)

adxSmoothing = 14

[diplus, diminus, adx] = ta.dmi(14, adxSmoothing) // Corrected syntax for ta.dmi()

// Volume Profile (FRVP - Fixed Range Volume Profile Midpoint)

highestHigh = ta.highest(high, frvpLength)

lowestLow = ta.lowest(low, frvpLength)

frvpMid = (highestHigh + lowestLow) / 2 // Midpoint of the range

// Detect Trading Sessions

currentHour = hour(time, "UTC") // Renamed to avoid shadowing built-in 'hour'

isAsianSession = currentHour >= 0 and currentHour < 8

isLondonSession = currentHour >= 8 and currentHour < 16

isNYSession = currentHour >= 16 and currentHour < 23

// Entry Conditions

longCondition = ta.crossover(close, avwap) and close > ema and rsi > 30 and macdLine > signalLine and adx > adxThreshold

shortCondition = ta.crossunder(close, avwap) and close < ema and rsi < 70 and macdLine < signalLine and adx > adxThreshold

// Volume Filter

avgVolume = ta.sma(volume, 20) // 20-period Simple Moving Average of volume

volumeFilter = volume > avgVolume * volumeMultiplier // Trade only when volume exceeds its moving average

// Trade Execution with SL/TP for Sessions

if (longCondition and volumeFilter and (isAsianSession or isLondonSession or isNYSession))

strategy.entry("LongEntry", strategy.long, qty=100)

strategy.exit("LongTP1", from_entry="LongEntry", limit=close + tp1Multiplier)

strategy.exit("LongExit", from_entry="LongEntry", stop=close - stopMultiplier, limit=close + tp2Multiplier)

if (shortCondition and volumeFilter and (isAsianSession or isLondonSession or isNYSession))

strategy.entry("ShortEntry", strategy.short, qty=100)

strategy.exit("ShortTP1", from_entry="ShortEntry", limit=close - tp1Multiplier)

strategy.exit("ShortExit", from_entry="ShortEntry", stop=close + stopMultiplier, limit=close - tp2Multiplier)

// Plotting for Debugging and Visualization

plot(avwap, "AVWAP", color=color.purple, style=plot.style_line, offset=0)

plot(ema, "EMA", color=color.orange, style=plot.style_line, offset=0)

// plot(rsi, "RSI", color=color.yellow, style=plot.style_histogram, offset=0) // Better in a separate pane

// plot(macdLine, "MACD Line", color=color.blue, style=plot.style_histogram, offset=0) // Better in a separate pane

// plot(signalLine, "Signal Line", color=color.red, style=plot.style_histogram, offset=0) // Better in a separate pane

plot(adx, "ADX", color=color.green, style=plot.style_line, offset=0)

// Optional: Plot entry/exit signals for visualization

plotshape(longCondition and volumeFilter ? close : na, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.tiny)

plotshape(shortCondition and volumeFilter ? close : na, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.tiny)

相关推荐