概述

这是一种复杂的多指标交易策略,结合指数移动平均线(EMA)、相对强弱指数(RSI)、移动平均线收敛divergence(MACD)和布林带(Bollinger Bands)四种技术分析工具,旨在通过多重信号验证的方式识别潜在的交易入场点。该策略专注于捕捉趋势性价格运动,并通过严格的信号过滤机制降低错误信号的可能性。

策略原理

策略的核心原理基于四个关键技术指标的综合分析: 1. 使用三条不同周期的指数移动平均线(50、100、200)判断整体趋势方向 2. 利用RSI指标评估市场动量和超买超卖情况 3. 通过MACD线和信号线的交叉判断趋势动量 4. 结合布林带上下轨作为额外的价格波动参考

具体入场逻辑包括: - 做多条件: - 收盘价上穿50日EMA - 50日EMA高于100日EMA,且100日EMA高于200日EMA - RSI介于50-70之间 - MACD线高于信号线

- 做空条件:

- 收盘价下穿50日EMA

- 50日EMA低于100日EMA,且100日EMA低于200日EMA

- RSI介于30-50之间

- MACD线低于信号线

策略优势

- 多指标验证:通过四种不同指标的综合,显著提高信号的可靠性

- 趋势追踪能力强:使用三重EMA结构有效识别市场主导趋势

- 动量判断精准:RSI和MACD结合提供更精确的入场时机

- 风险控制:严格的入场条件降低了错误交易的概率

- 可视化清晰:策略提供清晰的视觉入场信号和趋势指示

策略风险

- 多重指标复杂性可能导致信号延迟

- 在震荡市场中可能产生较多无效信号

- 固定参数可能不适应所有市场环境

- 未设置止损机制存在潜在较大回撤风险

策略优化方向

- 引入自适应参数调整机制

- 增加止损和止盈策略

- 根据不同市场周期动态调整入场阈值

- 结合波动率指标进一步验证入场信号

- 评估并优化指标参数的最佳组合

总结

这是一种高度系统化的多参数交叉趋势动量策略,通过四种技术指标的复合验证,旨在提供更加精准和可靠的交易信号。尽管策略具有显著优势,但仍需要持续优化和风险管理。

策略源码

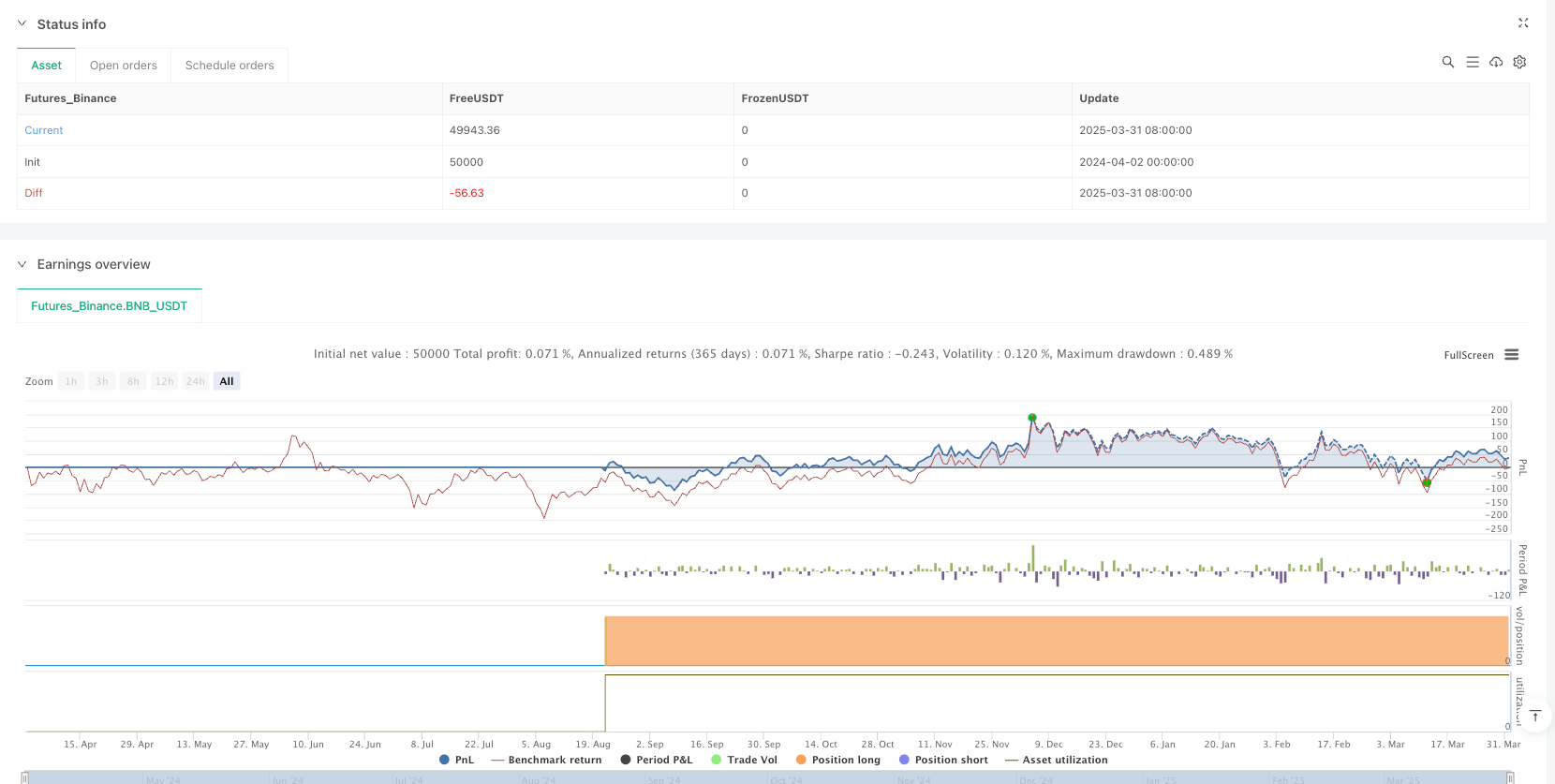

/*backtest

start: 2024-04-02 00:00:00

end: 2025-04-01 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("Multi-Indicator Trading Strategy", overlay=true)

// Input variables

len1 = input(50, "EMA 50")

len2 = input(100, "EMA 100")

len3 = input(200, "EMA 200")

rsiLength = input(14, "RSI Length")

rsiOverbought = input(70, "RSI Overbought")

rsiOversold = input(30, "RSI Oversold")

// Indicators

ema50 = ta.ema(close, len1)

ema100 = ta.ema(close, len2)

ema200 = ta.ema(close, len3)

rsi = ta.rsi(close, rsiLength)

[macdLine, signalLine, histLine] = ta.macd(close, 12, 26, 9)

[middle, upper, lower] = ta.bb(close, 20, 2)

// Trading signals

longCondition = ta.crossover(close, ema50) and ema50 > ema100 and ema100 > ema200 and rsi > 50 and rsi < rsiOverbought and macdLine > signalLine

shortCondition = ta.crossunder(close, ema50) and

ema50 < ema100 and

ema100 < ema200 and

rsi < 50 and

rsi > rsiOversold and

macdLine < signalLine

// Plots

plot(ema50, "EMA 50", color.blue)

plot(ema100, "EMA 100", color.yellow)

plot(ema200, "EMA 200", color.red)

plot(upper, "BB Upper", color.gray)

plot(middle, "BB Middle", color.gray)

plot(lower, "BB Lower", color.gray)

// Signals

plotshape(longCondition, "Long", shape.triangleup, location.belowbar, color.green)

plotshape(shortCondition, "Short", shape.triangledown, location.abovebar, color.red)

// Strategy

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

相关推荐