RSI MA 交叉摆动交易策略与追踪止损系统

RSI MA CROSSOVER TRAILING SL Swing Trading risk management

创建日期:

2025-04-24 16:51:14

最后修改:

2025-04-24 16:51:14

复制:

9

点击次数:

438

概述

该策略是一种基于RSI(相对强弱指数)与其移动平均线(MA)交叉的摆动交易策略,专为4小时图表设计。策略通过RSI与MA的金叉和死叉生成交易信号,并结合多种风险管理工具,包括固定止损/止盈、追踪止损和反转退出机制。策略还设置了连续亏损限制,当连续亏损超过两次时暂停交易,直到次日重置。

策略原理

- 时间框架限制:策略仅在4小时图表上运行,确保交易信号与设计的时间周期一致。

- 指标计算:使用RSI(默认长度14)和其移动平均线(SMA或EMA,默认长度14)生成信号。

- 金叉(RSI上穿MA)触发买入信号(做多)。

- 死叉(RSI下穿MA)触发卖出信号(做空)。

- 金叉(RSI上穿MA)触发买入信号(做多)。

- 仓位管理:根据每笔交易的资本分配和当前价格计算仓位大小。

- 退出机制:

- 固定止损/止盈:基于百分比设置止损(默认1.5%)和止盈(默认2.5%)。

- 追踪止损:当价格从最高点回撤指定点数(默认10点)时触发退出。

- 反转退出:当反向信号出现时平仓。

- 固定止损/止盈:基于百分比设置止损(默认1.5%)和止盈(默认2.5%)。

- 风险控制:

- 连续亏损两次后暂停交易,每日9:15重置亏损计数。

- 连续亏损两次后暂停交易,每日9:15重置亏损计数。

优势分析

- 多维度信号验证:结合RSI和MA的双重过滤,减少假信号。

- 动态风险管理:追踪止损锁定利润,固定止损限制亏损。

- 严格的资金管理:基于资本分配仓位,避免过度杠杆。

- 纪律性控制:连续亏损暂停机制防止情绪化交易。

- 可视化标记:清晰的图表标记帮助快速识别信号和退出点。

风险分析

- 参数敏感性:RSI和MA长度对信号质量影响较大,需优化适配市场波动。

- 趋势市场表现:在强趋势中,RSI可能长期超买/超卖,导致信号滞后。

- 时间框架限制:仅适用于4小时图表,其他周期需重新验证。

- 连续亏损风险:亏损计数重置前可能错过潜在盈利机会。

解决方案:

- 通过历史回测优化参数。

- 结合趋势指标(如ADX)过滤信号。

- 设置动态亏损计数阈值。

优化方向

- 多指标融合:引入MACD或布林带增强信号确认。

- 动态参数调整:根据市场波动率自适应调整RSI长度和止损比例。

- 时间框架扩展:测试策略在更高或更低周期(如日线/1小时)的表现。

- 机器学习优化:使用历史数据训练模型优化入场和退出条件。

- 资金管理升级:根据账户净值动态调整每笔交易资本比例。

总结

该策略通过RSI与MA的交叉信号实现摆动交易,结合多层次风险管理工具,平衡了盈利潜力和风险控制。其优势在于清晰的逻辑和严格的纪律性,但需进一步优化以适应不同市场环境。未来可通过多指标融合和动态参数提升稳健性。

策略源码

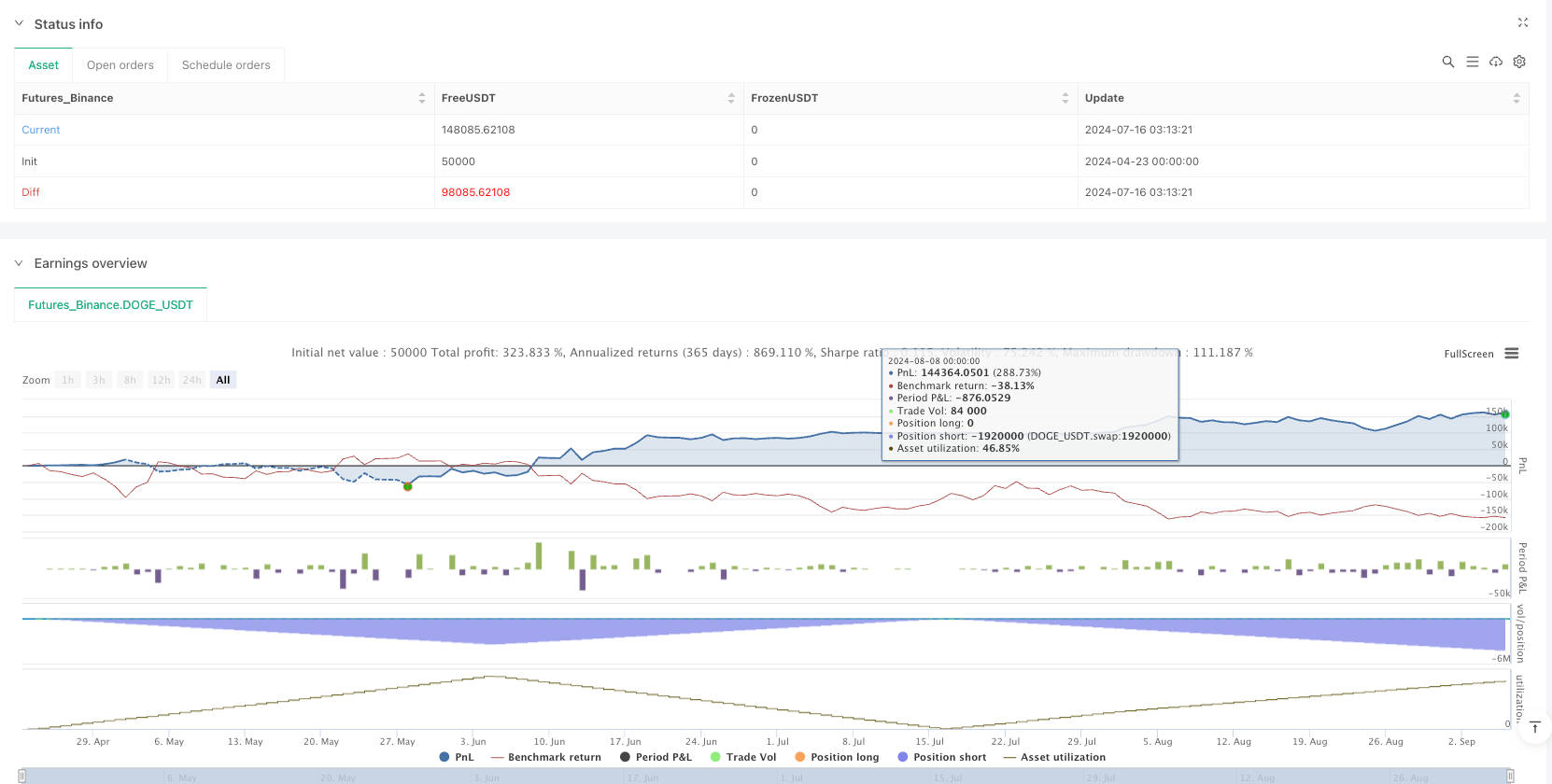

/*backtest

start: 2024-04-23 00:00:00

end: 2024-09-06 00:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("📈 RX Swing ", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// === INPUTS ===

rsiLength = input.int(14, title="RSI Length")

maLength = input.int(14, title="RSI MA Length")

maType = input.string("SMA", options=["SMA", "EMA"], title="MA Type for RSI")

sl_pct = input.float(1.5, title="Stop Loss %", minval=0.0)

tp_pct = input.float(2.5, title="Take Profit %", minval=0.0)

capitalPerTrade = input.float(15000, title="Capital Per Trade (INR)", minval=1)

lotSize = input.int(50, title="Lot Size (Nifty Options Lot)", minval=1)

trail_points = input.float(10, title="Trailing SL Points", minval=0.1)

// === CALCULATIONS ===

rsi = ta.rsi(close, rsiLength)

rsiMA = maType == "SMA" ? ta.sma(rsi, maLength) : ta.ema(rsi, maLength)

longSignal = ta.crossover(rsi, rsiMA)

shortSignal = ta.crossunder(rsi, rsiMA)

// === TRADING WINDOW ===

canTrade = true

exitTime = false

// === STATE VARIABLES ===

var float entryPrice = na

var bool inTrade = false

var string tradeDir = ""

var int lossCount = 0

var float trailHigh = na

var float trailLow = na

// === EXIT TRIGGER ===

exitNow = false

exitReason = ""

// === POSITION SIZE BASED ON CAPITAL ===

positionSize = (capitalPerTrade / close) * lotSize

// === ENTRY LOGIC (AFTER CLOSE OF CANDLE) ===

if (canTrade and lossCount < 2)

if (longSignal and not inTrade and barstate.isconfirmed) // Ensure the signal happens after candle close

strategy.entry("Buy Call", strategy.long, qty=positionSize)

entryPrice := close

trailHigh := close

inTrade := true

tradeDir := "CALL"

else if (shortSignal and not inTrade and barstate.isconfirmed) // Ensure the signal happens after candle close

strategy.entry("Buy Put", strategy.short, qty=positionSize)

entryPrice := close

trailLow := close

inTrade := true

tradeDir := "PUT"

// === TRAILING STOP-LOSS LOGIC ===

if (inTrade)

if (tradeDir == "CALL")

trailHigh := math.max(trailHigh, close)

if (close <= trailHigh - trail_points)

strategy.close("Buy Call", comment="CALL Trailing SL Hit")

exitNow := true

exitReason := "Trail SL"

inTrade := false

lossCount := lossCount + 1

if (tradeDir == "PUT")

trailLow := math.min(trailLow, close)

if (close >= trailLow + trail_points)

strategy.close("Buy Put", comment="PUT Trailing SL Hit")

exitNow := true

exitReason := "Trail SL"

inTrade := false

lossCount := lossCount + 1

// === REVERSAL EXIT LOGIC ===

if (inTrade)

if (tradeDir == "CALL" and shortSignal)

strategy.close("Buy Call", comment="CALL Exit on Reversal")

exitNow := true

exitReason := "Reversal"

inTrade := false

if (strategy.position_size < 0)

lossCount := lossCount + 1

if (tradeDir == "PUT" and longSignal)

strategy.close("Buy Put", comment="PUT Exit on Reversal")

exitNow := true

exitReason := "Reversal"

inTrade := false

if (strategy.position_size > 0)

lossCount := lossCount + 1

// === TP/SL EXIT LOGIC ===

if (inTrade)

tpLevel = entryPrice * (1 + tp_pct / 100)

slLevel = entryPrice * (1 - sl_pct / 100)

if (strategy.position_size > 0)

if (close >= tpLevel)

strategy.close("Buy Call", comment="CALL TP Hit")

exitNow := true

exitReason := "TP"

inTrade := false

else if (close <= slLevel)

strategy.close("Buy Call", comment="CALL SL Hit")

exitNow := true

exitReason := "SL"

inTrade := false

lossCount := lossCount + 1

if (strategy.position_size < 0)

tpLevel = entryPrice * (1 - tp_pct / 100)

slLevel = entryPrice * (1 + sl_pct / 100)

if (close <= tpLevel)

strategy.close("Buy Put", comment="PUT TP Hit")

exitNow := true

exitReason := "TP"

inTrade := false

else if (close >= slLevel)

strategy.close("Buy Put", comment="PUT SL Hit")

exitNow := true

exitReason := "SL"

inTrade := false

lossCount := lossCount + 1

// === RESET LOSS COUNT ON NEW DAY ===

if (hour == 9 and minute == 15)

lossCount := 0

// === MARKUPS ===

plotshape(longSignal and canTrade and lossCount < 2 and barstate.isconfirmed, title="📗 CALL Entry", location=location.belowbar, style=shape.triangleup, color=color.green, size=size.small, text="CALL")

plotshape(shortSignal and canTrade and lossCount < 2 and barstate.isconfirmed, title="📕 PUT Entry", location=location.abovebar, style=shape.triangledown, color=color.red, size=size.small, text="PUT")

plotshape(exitNow and exitReason == "TP", location=location.belowbar, style=shape.xcross, color=color.green, size=size.tiny, title="✅ TP Exit", text="TP")

plotshape(exitNow and exitReason == "SL", location=location.abovebar, style=shape.xcross, color=color.red, size=size.tiny, title="❌ SL Exit", text="SL")

plotshape(exitNow and exitReason == "Reversal", location=location.abovebar, style=shape.circle, color=color.fuchsia, size=size.tiny, title="🔁 Reversal Exit", text="REV")

plotshape(exitNow and exitReason == "Trail SL", location=location.abovebar, style=shape.square, color=color.yellow, size=size.tiny, title="🔂 Trailing SL Exit", text="Trail")

相关推荐