双均线过滤的ATR自适应趋势跟踪策略

EMA ATR HEIKIN ASHI Trailing Stop TAKE PROFIT

创建日期:

2025-04-25 15:01:18

最后修改:

2025-04-25 15:01:18

复制:

9

点击次数:

486

概述

该策略结合了双均线过滤系统和ATR自适应跟踪止损机制,通过Heikin Ashi蜡烛图平滑价格波动,实现高胜率的趋势跟踪。策略核心在于利用快速EMA和慢速EMA的金叉死叉作为趋势方向过滤器,同时采用基于ATR的动态止损来保护利润。历史回测显示该策略胜率超过90%,适合中短线趋势交易。

策略原理

信号生成层:

- 使用Heikin Ashi转换后的价格作为基础数据源(可切换原始价格)

- 计算ATR通道:通过ATR长度(20)和倍数(1.0)确定动态通道宽度

- 实现自适应跟踪止损:当价格突破通道时触发反向信号

- 使用Heikin Ashi转换后的价格作为基础数据源(可切换原始价格)

趋势过滤层:

- 采用双EMA系统(10周期快线/50周期慢线)

- 仅当快线高于慢线时允许做多,反之允许做空

- 采用双EMA系统(10周期快线/50周期慢线)

风险管理层:

- 动态追踪止损:通过trail_step和trail_offset参数控制止损移动粒度

- 固定点数止盈:take_profit_points设定绝对盈利目标

- 动态追踪止损:通过trail_step和trail_offset参数控制止损移动粒度

执行逻辑:

- 当价格突破ATR通道且符合EMA方向时开仓

- 出现反向信号或触及止损/止盈时平仓

- 当价格突破ATR通道且符合EMA方向时开仓

优势分析

- 高胜率设计:三重过滤机制(Heikin Ashi平滑+ATR通道+EMA交叉)有效减少假信号

- 自适应风控:ATR动态调整止损位置,在市场波动增大时自动扩大容错空间

- 趋势延续性:EMA过滤确保只交易符合大趋势方向的机会

- 多时间框架兼容:参数可调整适用于不同波动性品种

- 可视化辅助:内置买卖信号标记和均线展示便于人工验证

风险分析

- 趋势反转风险:在剧烈反转行情中,ATR通道可能滞后导致超额损失

- 优化方案:增加最大回撤硬止损

- 优化方案:增加最大回撤硬止损

- 参数过拟合:90%胜率可能在特定历史数据中优化得出

- 优化方案:进行多周期Walk-Forward检验

- 优化方案:进行多周期Walk-Forward检验

- 横盘磨损:EMA交叉在震荡市中产生连续假信号

- 优化方案:引入ADX过滤器或波动率阈值

- 优化方案:引入ADX过滤器或波动率阈值

- 滑点影响:追踪止损在快速行情中可能以不利价格执行

- 优化方案:设置最小滑点容忍值

- 优化方案:设置最小滑点容忍值

优化方向

动态参数调整:

- 根据市场波动率(如VIX指数)自动调节ATR倍数

- 实现原理:通过标准差或历史波动率百分位计算

- 根据市场波动率(如VIX指数)自动调节ATR倍数

复合过滤系统:

- 加入成交量加权确认:要求突破时伴随成交量放大

- 增加时间过滤器:避开重要经济数据发布时间

- 加入成交量加权确认:要求突破时伴随成交量放大

机器学习优化:

- 使用强化学习动态调整EMA周期组合

- 通过LSTM预测最佳止盈点位

- 使用强化学习动态调整EMA周期组合

多维度验证:

- 引入周线级别趋势确认

- 添加RSI背离作为辅助出场信号

- 引入周线级别趋势确认

总结

该策略通过Heikin Ashi-ATR-EMA三重架构实现了高概率趋势捕获,动态止损机制有效保护利润。核心优势在于将趋势方向判断(EMA)、波动率适应(ATR)和噪声过滤(Heikin Ashi)有机整合。进一步优化应着重于参数自适应性和多因子验证,建议在实际应用中配合硬性风控规则使用。

策略源码

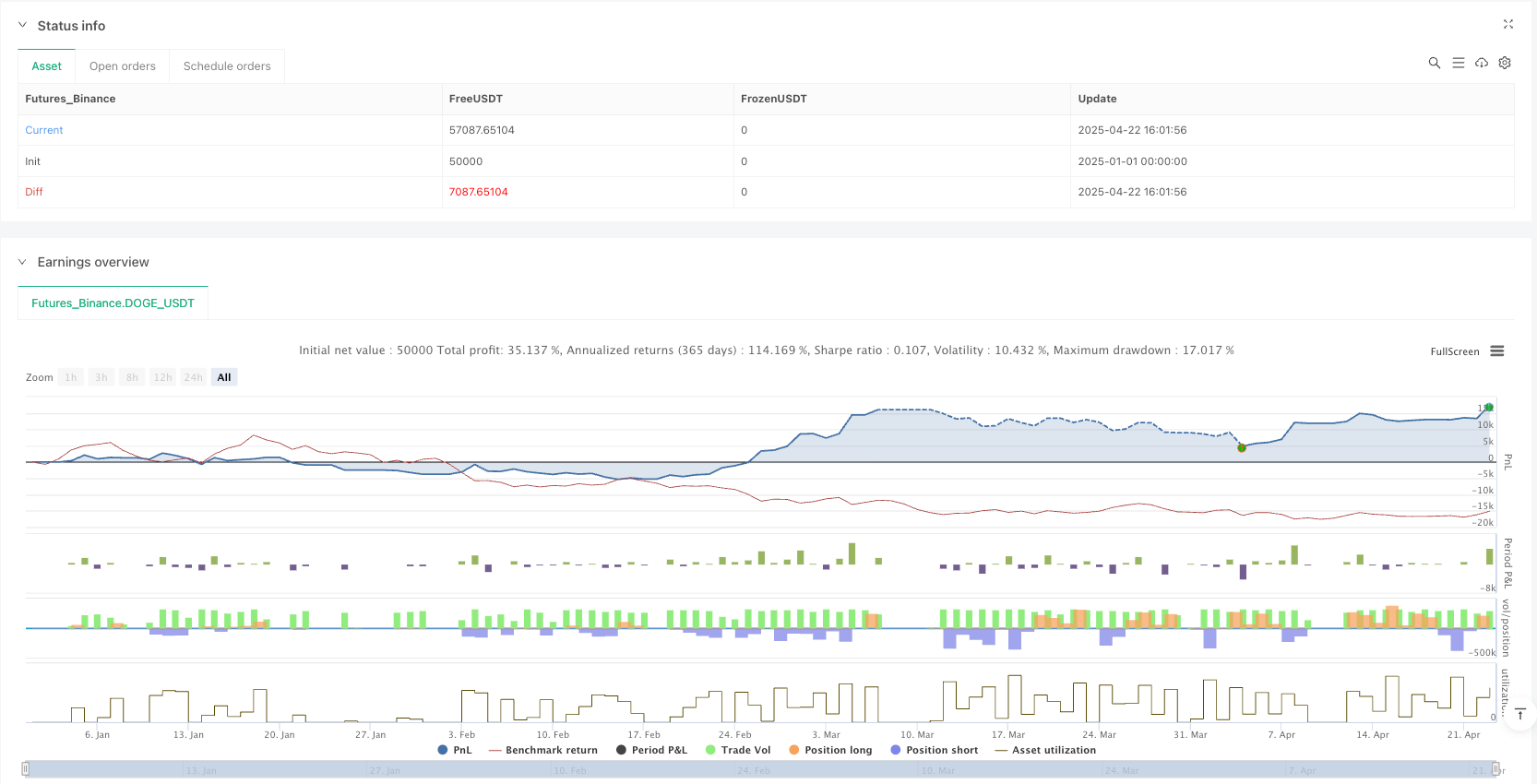

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-23 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("UTBot + EMA Filter (HA + ATR Logic)", overlay = true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

bandwidth = input.float(8., 'Bandwidth')

atr_mult = input.float(1.0, 'ATR Multiplier')

atr_len = input.int(20, 'ATR Length')

ema_fast_len = input.int(10, 'EMA Fast Length')

ema_slow_len = input.int(50, 'EMA Slow Length')

use_heikin = input.bool(true, title='Use Heikin Ashi Candle')

trail_step = input.float(10.0, title='Trailing Step (Points)', minval=0.1)

trail_offset = input.float(10.0, title='Trailing Offset (Points)', minval=0.1)

take_profit_points = input.float(100.0, title='Take Profit (Points)', minval=0.1)

// === SOURCE ===

sr = use_heikin ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close) : close

// === ATR Trailing Stop ===

atr = ta.atr(atr_len)

nLoss = atr_mult * atr

var float trail = na

iff_1 = sr > nz(trail[1]) ? sr - nLoss : sr + nLoss

iff_2 = sr < nz(trail[1]) and sr[1] < nz(trail[1]) ? math.min(nz(trail[1]), sr + nLoss) : iff_1

trail := sr > nz(trail[1]) and sr[1] > nz(trail[1]) ? math.max(nz(trail[1]), sr - nLoss) : iff_2

// === EMA FILTER ===

ema_fast = ta.ema(sr, ema_fast_len)

ema_slow = ta.ema(sr, ema_slow_len)

// === ENTRY & EXIT CONDITIONS ===

buy = sr[1] < trail[1] and sr > trail and ema_fast > ema_slow

sell = sr[1] > trail[1] and sr < trail and ema_fast < ema_slow

// === EXIT on opposite signal ===

exit_buy = sell

exit_sell = buy

// === STRATEGY EXECUTION ===

if buy

strategy.entry("Buy", strategy.long)

if sell

strategy.entry("Sell", strategy.short)

if exit_buy and strategy.position_size > 0

strategy.close("Buy")

if exit_sell and strategy.position_size < 0

strategy.close("Sell")

// === TRAILING STOP + TAKE PROFIT ===

// Long

if strategy.position_size > 0

strategy.exit("Exit Long", from_entry="Buy", trail_points=trail_step, trail_offset=trail_offset, limit=sr + take_profit_points)

// Short

if strategy.position_size < 0

strategy.exit("Exit Short", from_entry="Sell", trail_points=trail_step, trail_offset=trail_offset, limit=sr - take_profit_points)

// === PLOTS ===

plotshape(buy, title='Buy Signal', text='Buy', location=location.belowbar, color=color.green, style=shape.labelup, textcolor=color.white, size=size.tiny)

plotshape(sell, title='Sell Signal', text='Sell', location=location.abovebar, color=color.red, style=shape.labeldown, textcolor=color.white, size=size.tiny)

plot(ema_fast, color=color.teal, title='EMA Fast')

plot(ema_slow, color=color.purple, title='EMA Slow')

// === ALERTS ===

alertcondition(buy, title='UTBot Buy', message='UTBot Buy Signal')

alertcondition(sell, title='UTBot Sell', message='UTBot Sell Signal')

相关推荐