গতিশীল মুভিং এভারেজ গ্রিড ট্রেডিং কৌশল

ওভারভিউ

এই কৌশলটি একটি গতিশীল গ্রিড ট্রেডিং কৌশল যা একটি চলমান গড় লাইন ব্যবহার করে। এটি একটি গতিশীল গ্রিড ট্রেডিং কৌশল তৈরি করে যা একটি গড় লাইন এবং অস্থিরতার পরিমাণের উপর ভিত্তি করে গড় লাইনের নীচে একাধিক ক্রয়-বিক্রয় অঞ্চল এবং বিক্রয় অঞ্চলকে চিহ্নিত করে। যখন দাম বিভিন্ন ক্রয়-বিক্রয় অঞ্চলে প্রবেশ করে তখন বিভিন্ন সংখ্যক ক্রয়-বিক্রয় সংকেত প্রেরণ করা হয়; যখন দাম পুনরায় বিক্রয় অঞ্চলে প্রবেশ করে তখন ক্রমানুসারে প্লেইন করা হয়। এইভাবে একটি গতিশীল সমন্বয়যুক্ত গ্রিড ট্রেডিং কৌশল গঠন করা হয়।

কৌশল নীতি

- ব্যবহারকারীর দ্বারা সেট করা চলমান গড় লাইন প্যারামিটার, যা মূল ট্রেডিংয়ের মধ্যম অক্ষ নির্ধারণ করে;

- এটিআর এবং সেটিং প্যারামিটারগুলির উপর ভিত্তি করে, সমান্তরালভাবে একাধিক ক্রয় অঞ্চল এবং বিক্রয় অঞ্চলকে বিভক্ত করুন;

- যখন একটি মূল্য একটি ভিন্ন ক্রয় অঞ্চলে প্রবেশ করে, তখন এটি একটি অনুরূপ পরিমাণের জন্য একটি মাল্টিপল সিগন্যাল ট্রিগার করে;

- যখন দাম সংশ্লিষ্ট বিক্রয় অঞ্চলে ফিরে আসে, তখন ক্রমানুসারে প্লেইন করা হয়;

- একটি গতিশীলভাবে সমন্বিত গ্রিড ট্রেডিং প্রক্রিয়া গঠন করা।

কৌশলগত সুবিধা

- গড় রেখার সাহায্যে ট্রেন্ডের দিকনির্দেশনা বের করা এবং বিপরীতমুখী অবস্থার সৃষ্টি করা এড়ানো।

- এটিআর প্যারামিটারগুলি বাজারের অস্থিরতাকে সামগ্রিকভাবে বিবেচনা করে এবং গ্রিডকে আরও গতিশীল করে তোলে;

- মাল্টি-লেভেল স্টকিং, যা ঝুঁকি নিয়ন্ত্রণ করতে পারে;

- ধারাবাহিকভাবে ক্ষতি বন্ধ করুন, ঝর্ণাধারার ক্ষতি এড়াতে;

- সহজ প্যারামিটার সেটআপ, সহজ অপারেশন

কৌশলগত ঝুঁকি

- এই ধরনের ঝড়ের ফলে নেটওয়ার্কগুলি প্রায়ই ক্ষতিগ্রস্ত হতে পারে।

- একটি শক্তিশালী প্রবণতার মধ্যে, স্টপ পয়েন্টগুলি খুব কাছাকাছি হতে পারে, যা টানতে দ্রুত স্টপ ক্ষতির কারণ হতে পারে;

- মাল্টিপ্লেক্স স্টোরেজের ফলে লেনদেনের সংখ্যা বৃদ্ধি পায় এবং লেনদেনের খরচ বেড়ে যায়।

- এটি কোন প্রবণতাহীন বা অস্থির বাজারগুলির ক্ষেত্রে প্রযোজ্য নয়।

গ্রিডের ব্যবধান যথাযথভাবে প্রশস্ত করা, এটিআর প্যারামিটারগুলি অনুকূলিতকরণ, পজিশনের সংখ্যা হ্রাস করা ইত্যাদি পদ্ধতির মাধ্যমে ঝুঁকি হ্রাস করা যেতে পারে। ট্রেন্ড ট্রেডিং এবং ঝড়ের ব্যবসায়ের দুটি প্যারামিটার সমন্বয়ও বিভিন্ন বাজারের উপর ভিত্তি করে সেট করা যেতে পারে।

অপ্টিমাইজেশান দিক

- এই সূচকগুলিকে বড় বাজারগুলির গতিবিধি নির্ধারণের জন্য ব্যবহার করা যেতে পারে, যার ফলে খোলা বাজারগুলি আলাদা করা যায়।

- কৌশলগত ব্যবহারের জন্য প্রবণতাযুক্ত জাতের উপর পরিমাপযোগ্য পরিমাপক যুক্ত করা যেতে পারে;

- এটিআর প্যারামিটার বা গ্রিড স্পেসিফিকেশনকে রিয়েল-টাইমে ওভাররাইডের সাথে সামঞ্জস্য করতে পারে;

- আপনি স্টপ-অফ কৌশল যোগ করতে পারেন, ট্রেন্ড অনুসরণ করতে পারেন এবং আরো মুনাফা পেতে পারেন।

এটি আরও উন্নত করা যেতে পারে, যাতে কৌশলগুলি আরও গতিশীল এবং স্থানীয়ভাবে শক্তিশালী হয়।

সারসংক্ষেপ

এই কৌশলটি সামগ্রিকভাবে একটি পরিপক্ক এবং সহজ প্রবণতা ট্র্যাকিং গ্রিড কৌশল। এটি বড় প্রবণতা নির্ধারণের জন্য গড় লাইন ব্যবহার করে এবং তারপরে একটি গতিশীল গ্রিড তৈরি করে। এটির কিছু ঝুঁকি নিয়ন্ত্রণ ক্ষমতা রয়েছে। এটি আরও পরিমাণগত অপ্টিমাইজেশনের মাধ্যমে একটি খুব কার্যকর পরিমাণগত সরঞ্জাম হতে পারে।

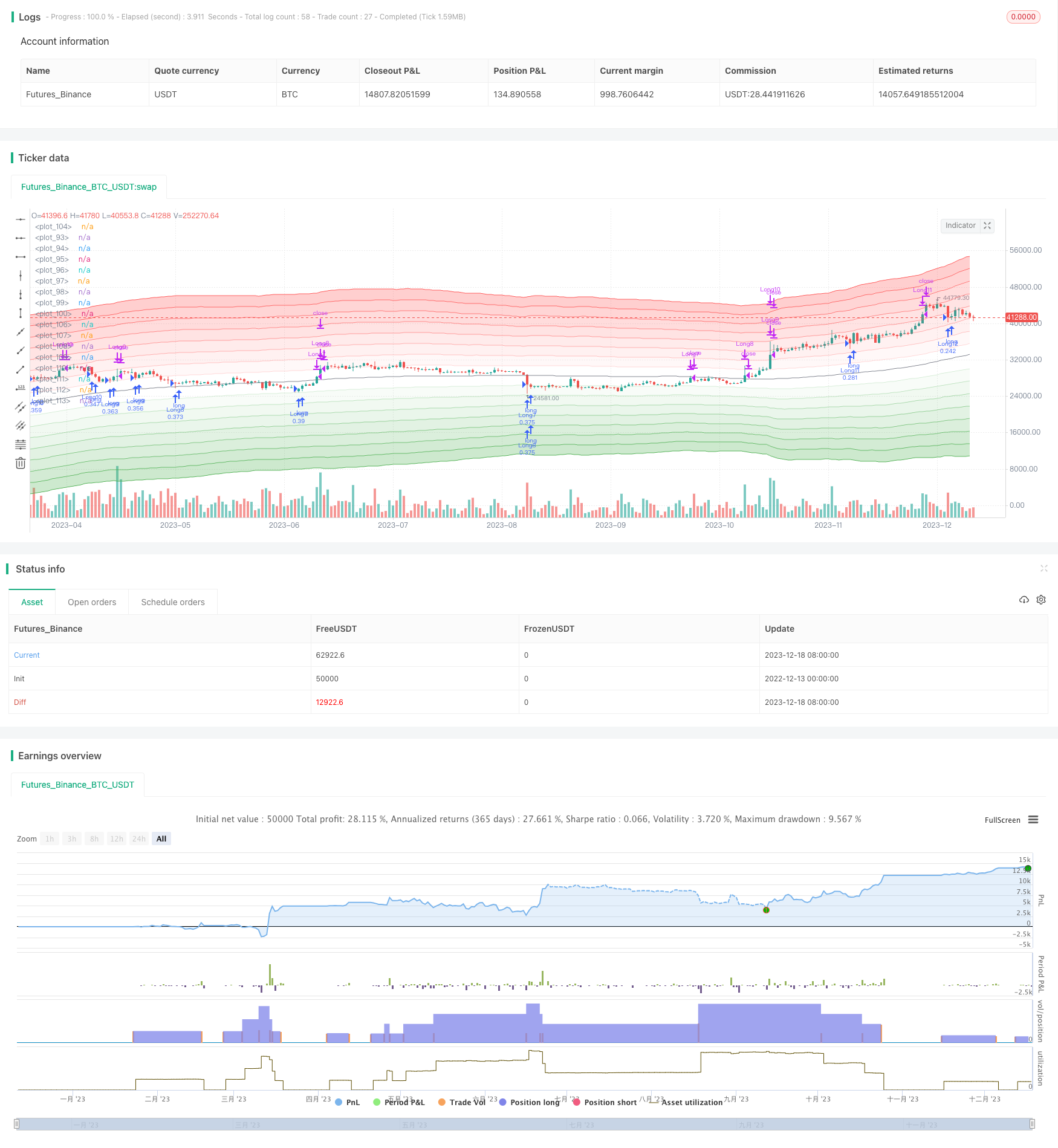

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Seungdori_

//@version=5

strategy("Grid Strategy with MA", overlay=true, initial_capital = 100000, default_qty_type = strategy.cash, default_qty_value = 10000, pyramiding = 10, process_orders_on_close = true, commission_type = strategy.commission.percent, commission_value = 0.04)

//Inputs//

length = input.int(defval = 100, title = 'MA Length', group = 'MA')

MA_Type = input.string("SMA", title="MA Type", options=['EMA', 'HMA', 'LSMA', 'RMA', 'SMA', 'WMA'],group = 'MA')

logic = input.string(defval='ATR', title ='Grid Logic', options = ['ATR', 'Percent'])

band_mult = input.float(2.5, step = 0.1, title = 'Band Multiplier/Percent', group = 'Parameter')

atr_len = input.int(defval=100, title = 'ATR Length', group ='parameter')

//Var//

var int order_cond = 0

var bool order_1 = false

var bool order_2 = false

var bool order_3 = false

var bool order_4 = false

var bool order_5 = false

var bool order_6 = false

var bool order_7 = false

var bool order_8 = false

var bool order_9 = false

var bool order_10 = false

var bool order_11 = false

var bool order_12 = false

var bool order_13 = false

var bool order_14 = false

var bool order_15 = false

/////////////////////

//Region : Function//

/////////////////////

getMA(source ,ma_type, length) =>

maPrice = ta.ema(source, length)

ema = ta.ema(source, length)

sma = ta.sma(source, length)

if ma_type == 'SMA'

maPrice := ta.sma(source, length)

maPrice

if ma_type == 'HMA'

maPrice := ta.hma(source, length)

maPrice

if ma_type == 'WMA'

maPrice := ta.wma(source, length)

maPrice

if ma_type == "RMA"

maPrice := ta.rma(source, length)

if ma_type == "LSMA"

maPrice := ta.linreg(source, length, 0)

maPrice

main_plot = getMA(ohlc4, MA_Type, length)

atr = ta.atr(length)

premium_zone_1 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*1), 5) : ta.ema((main_plot*(1+band_mult*0.01*1)), 5)

premium_zone_2 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*2), 5) : ta.ema((main_plot*(1+band_mult*0.01*2)), 5)

premium_zone_3 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*3), 5) : ta.ema((main_plot*(1+band_mult*0.01*3)), 5)

premium_zone_4 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*4), 5) : ta.ema((main_plot*(1+band_mult*0.01*4)), 5)

premium_zone_5 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*5), 5) : ta.ema((main_plot*(1+band_mult*0.01*5)), 5)

premium_zone_6 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*6), 5) : ta.ema((main_plot*(1+band_mult*0.01*6)), 5)

premium_zone_7 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*7), 5) : ta.ema((main_plot*(1+band_mult*0.01*7)), 5)

premium_zone_8 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*8), 5) : ta.ema((main_plot*(1+band_mult*0.01*8)), 5)

//premium_zone_9 = ta.rma(main_plot + atr*(band_mult*9), 5)

//premium_zone_10 = ta.rma(main_plot + atr*(band_mult*10), 5)

discount_zone_1 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*1), 5) : ta.ema((main_plot*(1-band_mult*0.01*1)), 5)

discount_zone_2 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*2), 5) : ta.ema((main_plot*(1-band_mult*0.01*2)), 5)

discount_zone_3 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*3), 5) : ta.ema((main_plot*(1-band_mult*0.01*3)), 5)

discount_zone_4 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*4), 5) : ta.ema((main_plot*(1-band_mult*0.01*4)), 5)

discount_zone_5 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*5), 5) : ta.ema((main_plot*(1-band_mult*0.01*5)), 5)

discount_zone_6 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*6), 5) : ta.ema((main_plot*(1-band_mult*0.01*6)), 5)

discount_zone_7 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*7), 5) : ta.ema((main_plot*(1-band_mult*0.01*7)), 5)

discount_zone_8 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*8), 5) : ta.ema((main_plot*(1-band_mult*0.01*8)), 5)

//discount_zon_9 = ta.sma(main_plot - atr*(band_mult*9), 5)

//discount_zone_10 =ta.sma( main_plot - atr*(band_mult*10), 5)

//Region End//

////////////////////

// Region : Plots//

///////////////////

dis_low1 = plot(discount_zone_1, color=color.new(color.green, 80))

dis_low2 = plot(discount_zone_2, color=color.new(color.green, 70))

dis_low3 = plot(discount_zone_3, color=color.new(color.green, 60))

dis_low4 = plot(discount_zone_4, color=color.new(color.green, 50))

dis_low5 = plot(discount_zone_5, color=color.new(color.green, 40))

dis_low6 = plot(discount_zone_6, color=color.new(color.green, 30))

dis_low7 = plot(discount_zone_7, color=color.new(color.green, 20))

dis_low8 = plot(discount_zone_8, color=color.new(color.green, 10))

//dis_low9 = plot(discount_zone_9, color=color.new(color.green, 0))

//dis_low10 = plot(discount_zone_10, color=color.new(color.green, 0))

plot(main_plot, color =color.new(color.gray, 10))

pre_up1 = plot(premium_zone_1, color=color.new(color.red, 80))

pre_up2 = plot(premium_zone_2, color=color.new(color.red, 70))

pre_up3 = plot(premium_zone_3, color=color.new(color.red, 60))

pre_up4 = plot(premium_zone_4, color=color.new(color.red, 50))

pre_up5 = plot(premium_zone_5, color=color.new(color.red, 40))

pre_up6 = plot(premium_zone_6, color=color.new(color.red, 30))

pre_up7 = plot(premium_zone_7, color=color.new(color.red, 20))

pre_up8 = plot(premium_zone_8, color=color.new(color.red, 10))

//pre_up9 = plot(premium_zone_9, color=color.new(color.red, 0))

//pre_up10 = plot(premium_zone_10, color=color.new(color.red, 0))

fill(dis_low1, dis_low2, color=color.new(color.green, 95))

fill(dis_low2, dis_low3, color=color.new(color.green, 90))

fill(dis_low3, dis_low4, color=color.new(color.green, 85))

fill(dis_low4, dis_low5, color=color.new(color.green, 80))

fill(dis_low5, dis_low6, color=color.new(color.green, 75))

fill(dis_low6, dis_low7, color=color.new(color.green, 70))

fill(dis_low7, dis_low8, color=color.new(color.green, 65))

//fill(dis_low8, dis_low9, color=color.new(color.green, 60))

//fill(dis_low9, dis_low10, color=color.new(color.green, 55))

fill(pre_up1, pre_up2, color=color.new(color.red, 95))

fill(pre_up2, pre_up3, color=color.new(color.red, 90))

fill(pre_up3, pre_up4, color=color.new(color.red, 85))

fill(pre_up4, pre_up5, color=color.new(color.red, 80))

fill(pre_up5, pre_up6, color=color.new(color.red, 75))

fill(pre_up6, pre_up7, color=color.new(color.red, 70))

fill(pre_up7, pre_up8, color=color.new(color.red, 65))

//fill(pre_up8, pre_up9, color=color.new(color.red, 60))

//fill(pre_up9, pre_up10, color=color.new(color.red, 55))

//Region End//

///////////////////////

//Region : Strategies//

///////////////////////

//Longs//

longCondition1 = ta.crossunder(low, discount_zone_7)

longCondition2 = ta.crossunder(low, discount_zone_6)

longCondition3 = ta.crossunder(low, discount_zone_5)

longCondition4 = ta.crossunder(low, discount_zone_4)

longCondition5 = ta.crossunder(low, discount_zone_3)

longCondition6 = ta.crossunder(low, discount_zone_2)

longCondition7 = ta.crossunder(low, discount_zone_1)

longCondition8 = ta.crossunder(low, main_plot)

longCondition9 = ta.crossunder(low, premium_zone_1)

longCondition10 = ta.crossunder(low, premium_zone_2)

longCondition11 = ta.crossunder(low, premium_zone_3)

longCondition12 = ta.crossunder(low, premium_zone_4)

longCondition13 = ta.crossunder(low, premium_zone_5)

longCondition14 = ta.crossunder(low, premium_zone_6)

longCondition15 = ta.crossunder(low, premium_zone_7)

if (longCondition1) and order_1 == false

strategy.entry("Long1", strategy.long)

order_1 := true

if (longCondition2) and order_2 == false

strategy.entry("Long2", strategy.long)

order_2 := true

if (longCondition3) and order_3 == false

strategy.entry("Long3", strategy.long)

order_3 := true

if (longCondition4) and order_4 == false

strategy.entry("Long4", strategy.long)

order_4 := true

if (longCondition5) and order_5 == false

strategy.entry("Long5", strategy.long)

order_5 := true

if (longCondition6) and order_6 == false

strategy.entry("Long6", strategy.long)

order_6 := true

if (longCondition7) and order_7 == false

strategy.entry("Long7", strategy.long)

order_7 := true

if (longCondition8) and order_8 == false

strategy.entry("Long8", strategy.long)

order_8 := true

if (longCondition9) and order_9 == false

strategy.entry("Long9", strategy.long)

order_9 := true

if (longCondition10) and order_10 == false

strategy.entry("Long10", strategy.long)

order_10 := true

if (longCondition11) and order_11 == false

strategy.entry("Long11", strategy.long)

order_11 := true

if (longCondition12) and order_12 == false

strategy.entry("Long12", strategy.long)

order_12 := true

if (longCondition13) and order_13 == false

strategy.entry("Long13", strategy.long)

order_13 := true

if (longCondition14) and order_14 == false

strategy.entry("Long14", strategy.long)

order_14 := true

if (longCondition15) and order_15 == false

strategy.entry("Long14", strategy.long)

order_15 := true

//Close//

shortCondition1 = ta.crossover(high, discount_zone_6)

shortCondition2 = ta.crossover(high, discount_zone_5)

shortCondition3 = ta.crossover(high, discount_zone_4)

shortCondition4 = ta.crossover(high, discount_zone_3)

shortCondition5 = ta.crossover(high, discount_zone_2)

shortCondition6 = ta.crossover(high, discount_zone_1)

shortCondition7 = ta.crossover(high, main_plot)

shortCondition8 = ta.crossover(high, premium_zone_1)

shortCondition9 = ta.crossover(high, premium_zone_2)

shortCondition10 = ta.crossover(high, premium_zone_3)

shortCondition11 = ta.crossover(high, premium_zone_4)

shortCondition12 = ta.crossover(high, premium_zone_5)

shortCondition13 = ta.crossover(high, premium_zone_6)

shortCondition14 = ta.crossover(high, premium_zone_7)

shortCondition15 = ta.crossover(high, premium_zone_8)

if (shortCondition1) and order_1 == true

strategy.close("Long1")

order_1 := false

if (shortCondition2) and order_2 == true

strategy.close("Long2")

order_2 := false

if (shortCondition3) and order_3 == true

strategy.close("Long3")

order_3 := false

if (shortCondition4) and order_4 == true

strategy.close("Long4")

order_4 := false

if (shortCondition5) and order_5 == true

strategy.close("Long5")

order_5 := false

if (shortCondition6) and order_6 == true

strategy.close("Long6")

order_6 := false

if (shortCondition7) and order_7 == true

strategy.close("Long7")

order_7 := false

if (shortCondition8) and order_8 == true

strategy.close("Long8")

order_8 := false

if (shortCondition9) and order_9 == true

strategy.close("Long9")

order_9 := false

if (shortCondition10) and order_10 == true

strategy.close("Long10")

order_10 := false

if (shortCondition11) and order_11 == true

strategy.close("Long11")

order_11 := false

if (shortCondition12) and order_12 == true

strategy.close("Long12")

order_12 := false

if (shortCondition13) and order_13 == true

strategy.close("Long13")

order_13 := false

if (shortCondition14) and order_14 == true

strategy.close("Long14")

order_14 := false

if (shortCondition15) and order_15 == true

strategy.close("Long15")

order_15 := false