শক লাভজনক ব্যান্ড গ্রিড কৌশল

ওভারভিউ

ঝাঁকুনি লাভের সময়কাল গ্রিড কৌশল একটি প্রবণতা অনুসরণ কৌশল যা স্বয়ংক্রিয়ভাবে মূল্যের ওঠানামার উপর ভিত্তি করে গ্রিড তৈরি করে, যখন দামের ওঠানামার সময় লাভজনক হতে পারে।

কৌশল নীতি

এই কৌশলটির মূল ধারণা হল একটি মূল্য ব্যাপ্তি গ্রিড তৈরি করা, যখন দাম বিভিন্ন ব্যাপ্তিতে প্রবেশ করে তখন নতুন ট্রেডিং সিগন্যাল তৈরি হয়। উদাহরণস্বরূপ, যদি গ্রিডের ব্যবধানটি 500 ডলারে সেট করা হয়, তবে যখন দাম 500 ডলারের বেশি হয় তখন নতুন ডোডো সিগন্যাল তৈরি হয়।

বিশেষ করে, এই কৌশলটি নতুন উচ্চ বা নতুন নিম্ন মূল্যের উপর নজর রেখে নতুন গ্রিড তৈরি করে। কোডের মধ্যে, আমরা একটি পরিবর্তনশীল সংজ্ঞায়িত করিre_gridবর্তমান গ্রিডের দাম সংরক্ষণ করুন। এই গ্রিডের দামটি যদি সেট করা গ্রিডের ব্যবধানের চেয়ে বেশি হয় তবে পরবর্তী গ্রিডের দাম পুনরায় গণনা করা হবে।

এইভাবে, যখন দাম যথেষ্ট পরিমাণে ওঠানামা করে, তখন নতুন ট্রেডিং সিগন্যাল তৈরি হয়, এবং আমরা লস বা শূন্য করে মুনাফা অর্জন করতে পারি। মূল অবস্থানটি বন্ধ হয়ে যায় যখন দাম গ্রিডের ব্যবধানের বাইরে বিপরীত দিকে যেতে শুরু করে।

সামর্থ্য বিশ্লেষণ

এই কৌশলটির সবচেয়ে বড় সুবিধা হল যে এটি স্বয়ংক্রিয়ভাবে মূল্যের প্রবণতা অনুসরণ করে এবং স্থায়ীভাবে মুনাফা অর্জন করে। যতক্ষণ দাম যথেষ্ট পরিমাণে ওঠানামা করে, আমাদের অবস্থানের আকার ক্রমবর্ধমান হয় এবং আমাদের মুনাফা ক্রমবর্ধমান হয়।

এছাড়াও, যুক্তিসঙ্গতভাবে গ্রিডের প্যারামিটারগুলি সেট করে ঝুঁকিগুলি কার্যকরভাবে নিয়ন্ত্রণ করা যায়। এছাড়াও, ইচিমোকু ক্লাউড ডায়াগ্রামের মতো প্রযুক্তিগত সূচকগুলির সাথে সংযুক্ত করে ফিল্টারিং সংকেতগুলি কৌশলগত স্থায়িত্বকে উন্নত করতে পারে।

ঝুঁকি বিশ্লেষণ

এই কৌশলটির প্রধান ঝুঁকি হল যে দামের হঠাৎ বিপর্যয় ঘটতে পারে, যার ফলে স্টপ লস ঘটে। এই সময়ে পূর্বে সংগৃহীত মুনাফা হ্রাস বা ক্ষতি হতে পারে।

এই ঝুঁকি নিয়ন্ত্রণের জন্য, আমরা স্টপ লিনার সেট করতে পারি, গ্রিডের প্যারামিটারগুলি যুক্তিসঙ্গতভাবে সামঞ্জস্য করতে পারি, প্রবণতাযুক্ত ট্রেডিং জাতগুলি বেছে নিতে পারি এবং একাধিক প্রযুক্তিগত সূচকগুলির সাথে সংযুক্ত সংকেত ফিল্টারিংয়ের মতো পদ্ধতি ব্যবহার করতে পারি।

অপ্টিমাইজেশান দিক

আমরা এই কৌশলটি আরও উন্নত করতে পারিঃ

গ্রিড প্যারামিটার অপ্টিমাইজ করুন, সর্বোত্তম গ্রিড স্পেস, পজিশনের আকার ইত্যাদি প্যারামিটার সমন্বয় খুঁজে বের করুন

ঝুঁকি নিয়ন্ত্রণের জন্য ক্ষতিপূরণ ব্যবস্থা বাড়ানো বা সংশোধন করা

বিভিন্ন ট্রেডিং প্রজাতি পরীক্ষা করুন, এবং আরো উদ্বায়ী, আরো প্রবণতা প্রজাতি চয়ন করুন

আরও প্রযুক্তিগত পরিমাপ এবং কৌশলগত স্থিতিশীলতা

সারসংক্ষেপ

এই অস্থির মুনাফা ব্যাপ্তি গ্রিড কৌশলটি প্রবণতা অনুসরণ করে স্বয়ংক্রিয়ভাবে মূল্য গ্রিড স্থাপন করে কার্যকরভাবে স্থায়ী লাভ অর্জন করতে পারে। তবে কিছুটা প্রত্যাহারের ঝুঁকিও রয়েছে। প্যারামিটার অপ্টিমাইজেশন, স্টপ লস সেটিং এবং জাতের পছন্দ ইত্যাদির মাধ্যমে কৌশলটির স্থায়িত্ব বাড়ানোর জন্য ঝুঁকি কার্যকরভাবে নিয়ন্ত্রণ করা যেতে পারে।

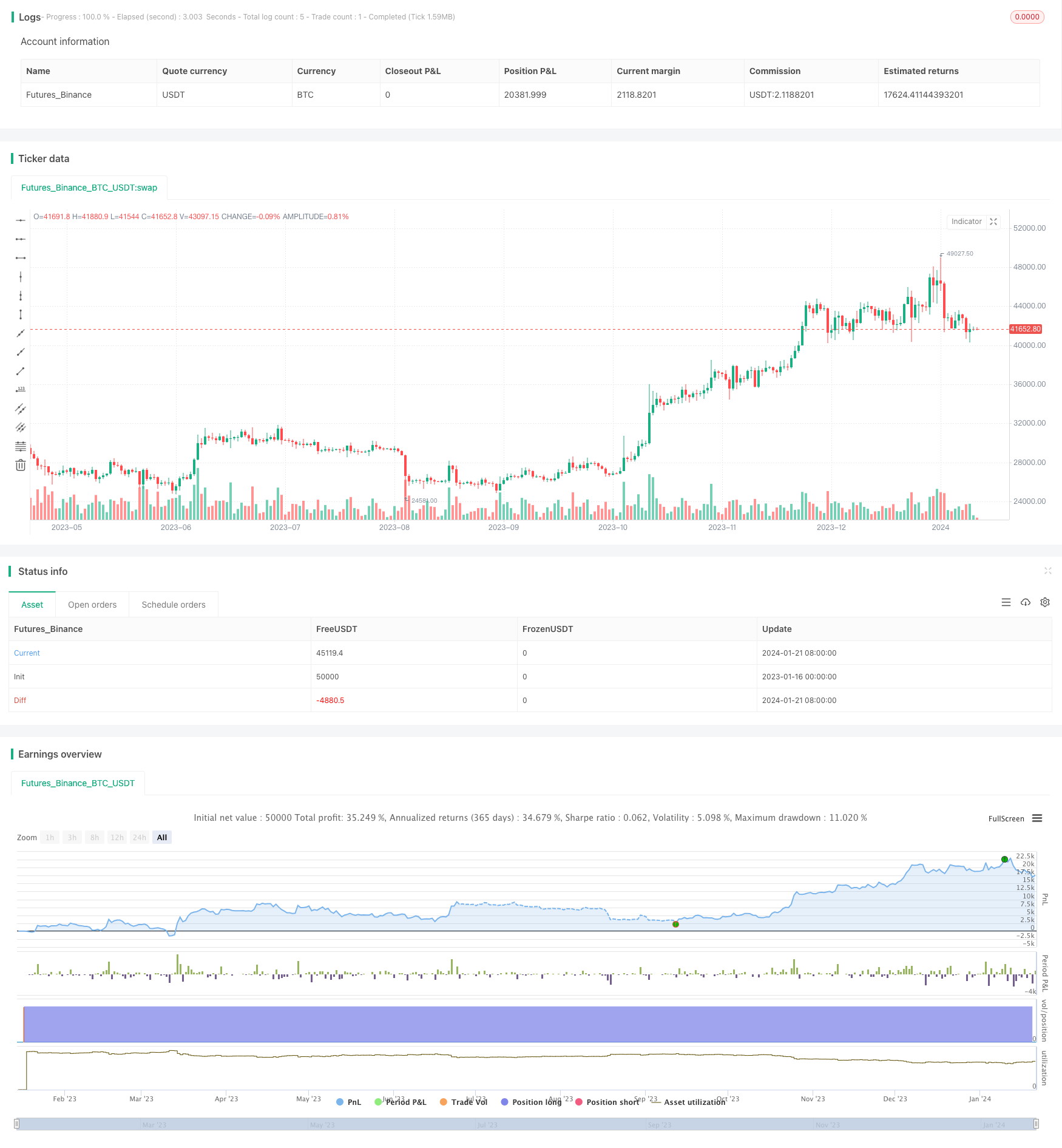

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="Grid Tool",shorttitle= "Grid", overlay= true )

backtest = input(title= "Backtest (no comment-string, disable for API-trading)", type= input.bool, defval= true)

entry_type = input("Long", title= "Long/Short Entry", options= ["Long", "Short"])

X_opt = input("Grid - reentry", title="--- 1st ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

X_opt_2 = input("---", title="--- 2nd ENTRY SIGNAL ---", options= ["---", "Grid - reentry", "Grid - counter trend", "Fractals", "Reverse fractal"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "Bar breakout 1 filter", "Bar breakout 2 filter", "SMA filter", "MACD filter", "RSI50 filter", "Fractals filter",

"Segments filter", "Fractals 1-2-3 filter", "Reverse fractal filter", "EMA21/SMA20 filter", "TRIX filter",

"SuperTrend filter", "Parabolic SAR filter", "ADX filter", "Price X Kumo filter", "Price X Kijun filter", "Kumo flip filter",

"Price filtered Kumo flip filter", "Chikou X price filter", "Chikou X Kumo filter", "Price X Tenkan filter", "Tenkan X Kumo filter",

"Tenkan X Kijun filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "TRIX exit", "Reverse fractal exit", "SMA exit", "MACD exit",

"RSI50 exit", "Fractals exit", "SuperTrend exit", "Parabolic SAR exit", "ADX exit", "Cloud exit", "Kijun exit"])

//--------------------- Signal inputs -----------------------

grid_gap = input(500, type= input.float, title= "Grid gap - base currency", minval= 0, step= 10)

//--------------------- filter inputs --------------------

shared_param = input(false, title= " Shared filter and entry parameters :", type= input.bool)

sb = input(title="Segment max bars", defval= 10, minval= 0, step= 1)

fr_period = input(2, title= "Fractals period", minval= 1)

rsi_period = input(14, title= "RSI period", minval= 1)

ma_period = input(50, title= "MA period", minval= 1)

mult = input(3, type= input.float, title= "SuperTrend multiplier", minval= 1, step= 0.1)

len = input(6, type= input.integer, title= "SuperTrend length", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

di_length_s = input(10, title= "DI length (signals)", minval= 1)

adx_smooth_s = input(10, title= "ADX smooth (signals)", minval= 1)

adx_thres_s = input(25, title= "ADX threshold (signals)", minval= 1)

trix_len_f = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_f = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

//--------------------- exit inputs --------------------

exit_param = input(false, title= " Exit Parameters :", type= input.bool)

trix_len_x = input(14, title= "TRIX Length", type=input.integer, minval=1)

smooth_length_x = input(6, title= "Signal Smoothing Length (TRIX)", type=input.integer, minval=1)

fr_period_x = input(2, title= "Exit fractals - period", minval= 1)

fr_past_x = input(0, title= "Exit fractals - past fractal", minval= 0)

rsi_period_x = input(14, title= "Exit RSI period", minval= 1)

ma_period_x = input(50, title= "Exit MA period", minval= 1)

mult_x = input(2, type= input.float, title= "Exit SuperTrend multiplier", minval= 1)

len_x = input(5, type= input.integer, title= "Exit SuperTrend length", minval= 1)

di_length_x = input(10, title= "Exit ADX period", minval= 1)

adx_smooth_x = input(10, title= "Exit ADX smooth", minval= 1)

adx_thres_x = input(25, title= "Exit ADX threshold", minval= 1)

//----------------------- Backtest periode --------------------------------

b_t_per_start = input(false, title= " Set backtest start or/and trend start :", type= input.bool)

start_year = input(2020, "Start year")

start_month = input(3, "Start month", minval= 1, maxval= 12)

start_day = input(13, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2120, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Ichimoku filter ------------------------

// cross conditions for "Strong" filtered signals

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// Ichimoku filters

kijun_buy_f = close > KJ

kumo_buy_f = close > kumo_high

kumo_flip_buy_f = SA > SB

price_filtered_kumo_flip_buy_f = sasb_x and low > kumo_high

chikou_X_price_buy_f = CS > high[(26-1)]

chikou_X_kumo_buy_f = CS > kumo_high[26-1]

price_X_tenkan_buy_f = close > TK

tenkan_X_kumo_buy_f = TK > kumo_high

tenkan_X_kijun_buy_f = TK > KJ

kumo_filtered_tenkan_X_kijun_buy_f = tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ

kijun_sell_f = close < KJ

kumo_sell_f = close < kumo_low

kumo_flip_sell_f = SA < SB

price_filtered_kumo_flip_sell_f = not sasb_x and high < kumo_low

chikou_X_price_sell_f = CS < low[(26-1)]

chikou_X_kumo_sell_f = CS < kumo_low[26-1]

price_X_tenkan_sell_f = close < TK

tenkan_X_kumo_sell_f = TK < kumo_low

tenkan_X_kijun_sell_f = TK < KJ

kumo_filtered_tenkan_X_kijun_sell_f = not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ

// Ichimoku exits

kijun_buy_x = close > KJ

kumo_buy_x = close > kumo_high

kijun_sell_x = close < KJ

kumo_sell_x = close < kumo_low

//------------------------ grid --------------------------

//up_grid = 0.

//up_grid := nz(high > up_grid[1] + grid_gap and backtest_period() ? close : up_grid[1]) // forward grid long

//dn_grid = 0.

//dn_grid := nz(low < dn_grid[1] - grid_gap and backtest_period() ? close : dn_grid[1]) // forward grid short

re_grid = 0.

re_grid := nz(high > re_grid[1] + grid_gap or low < re_grid[1] - grid_gap ? close : re_grid[1])

//grid_up_buy = up_grid > up_grid[1]

//grid_dn_sell = dn_grid < dn_grid[1]

grid_ct_buy = re_grid < re_grid[1]

grid_ct_sell = re_grid > re_grid[1]

grid_re_buy = re_grid > re_grid[1]

grid_re_sell = re_grid < re_grid[1]

//plot(re_grid,"Plot", color= color.yellow, linewidth= 2)

//---------------------- reverse fractal signal and filter --------------------------

up_bar = close[0] > open[0]

dn_bar = close[0] < open[0]

hl = low[0] > low[1]

lh = high[0] < high[1]

rev_up_fr_sell = pivothigh(high, 3, 0) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and dn_bar and up_bar[1] or

pivothigh(high, 4, 1) and lh and up_bar and up_bar[1]

rev_dn_fr_buy = pivotlow(low, 3, 0) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and up_bar and dn_bar[1] or

pivotlow(low, 4, 1) and hl and dn_bar and dn_bar[1]

ema_f(src, ema_len) => ema(src, ema_len) // ma function definition

sma_f(src, sma_len) => sma(src, sma_len)

ema_21 = ema_f(close, 21) // ema21/sma20 signal

sma_20 = sma_f(close, 20)

ma_cross_buy = close > ema_21 and close > sma_20 and ema_21 > sma_20

ma_cross_sell = close < ema_21 and close < sma_20 and ema_21 < sma_20

//--------------------- TRIX ------------------------

triple_ema_f = ema(ema(ema(close, trix_len_f), trix_len_f), trix_len_f)

trix_f = roc(triple_ema_f, 1)

signal_f = sma(trix_f, smooth_length_f)

triple_ema_x = ema(ema(ema(close, trix_len_x), trix_len_x), trix_len_x)

trix_x = roc(triple_ema_x, 1)

signal_x = sma(trix_x, smooth_length_x)

//filters

trix_buy_f = trix_f > signal_f

trix_sell_f = trix_f < signal_f

//exits

trix_buy_x = trix_x > signal_x

trix_sell_x = trix_x < signal_x

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

//filters

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//exit

macd_buy_x = macdLine_f > signalLine_f

macd_sell_x = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

//entry

rsi_f = rsi(close, rsi_period)

rsi_f_buy = rsi_f > 50

rsi_f_sell = rsi_f < 50

//filters

rsi_f_buy_f = rsi_f > 50

rsi_f_sell_f = rsi_f < 50

//exit

rsi_f_x = rsi(close, rsi_period_x)

rsi_f_buy_x = rsi_f_x > 50

rsi_f_sell_x = rsi_f_x < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

//entry signal

fr_upx = crossover(high, fractal_up_v)

fr_dnx = crossunder(low, fractal_dn_v)

//filters

fr_upx_f = high > fractal_up_v

fr_dnx_f = low < fractal_dn_v

//exit

up_fr_x = pivothigh(fr_period_x, fr_period_x)

dn_fr_x = pivotlow(fr_period_x, fr_period_x)

fractal_up_v_x = valuewhen(up_fr_x, high[fr_period_x], fr_past_x)

fractal_dn_v_x = valuewhen(dn_fr_x, low[fr_period_x], fr_past_x)

fr_upx_x = high > fractal_up_v_x

fr_dnx_x = low < fractal_dn_v_x

//higher low and higher high - lower high and lower low - entry

fractal_dn_v_1 = valuewhen(dn_fr, low[fr_period],1)

fractal_up_v_1 = valuewhen(up_fr, high[fr_period],1)

hl_hh_buy = fractal_dn_v > fractal_dn_v_1 and high > fractal_up_v // 123 signal and filter

lh_ll_sell = fractal_up_v < fractal_up_v_1 and low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

//entry

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//filters

sup_buy_f = close > SuperTrend

sup_sell_f = close < SuperTrend

//exit

[SuperTrend_x, Dir_x] = supertrend(mult_x, len_x)

sup_buy_x = close > SuperTrend_x

sup_sell_x = close < SuperTrend_x

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//filters

psar_buy_f = high > sar(start, inc, max)[0]

psar_sell_f = low < sar(start, inc, max)[0]

//-------------------------- ADX entry and filter ---------------------------

//exit

[diplus_f_x, diminus_f_X, adx_f_x] = dmi(di_length_x, adx_smooth_x)

adx_thres_f_x = adx_f_x < adx_thres_x

//adx signal 1/2 and filters

[diplus_s, diminus_s, adx_s] = dmi(di_length_s, adx_smooth_s)

adx_above_thres = adx_s > adx_thres_s

long_1 = diplus_s > diminus_s and adx_s < diplus_s and adx_s > diminus_s

short_1 = diplus_s < diminus_s and adx_s > diplus_s and adx_s < diminus_s

long_2 = diplus_s > diminus_s and adx_above_thres

short_2 = diplus_s < diminus_s and adx_above_thres

//-------------------------- SMA50 filter and entry---------------------------

//entry

sma_buy = close[2] > ema_f(close, ma_period)

sma_sell = close[2] < ema_f(close, ma_period)

//filters

sma_buy_f = close[2] > sma_f(close, ma_period)

sma_sell_f = close[2] < sma_f(close, ma_period)

//exit

sma_buy_x = close[1] > sma_f(close, ma_period_x)

sma_sell_x = close[1] < sma_f(close, ma_period_x)

//--------------------------- Segments signal ----------------------------

count1_l = 0

count2_l = 0

segment_1_stat_l = false

segment_2_stat_l = false

segment_3_stat_l = false

higher_low = low > low[1]

var line segment_low_1_l = na

var line segment_low_2_l = na

var line segment_low_3_l = na

// long segments

for i=0 to sb

count1_l := count1_l + 1

if low[1] > low[i+2] and higher_low

segment_1_stat_l := true

break

for i=count1_l to sb+count1_l

count2_l := count2_l + 1

if low[1+count1_l] > low[i+2] and segment_1_stat_l

segment_2_stat_l := true

break

for i=count2_l to sb+count2_l

if low[1+count1_l+count2_l] > low[i+2+count1_l] and segment_2_stat_l

segment_3_stat_l := true

break

// short segments

count1_s = 0

count2_s = 0

segment_1_stat_s = false

segment_2_stat_s = false

segment_3_stat_s = false

lower_high = high < high[1]

var line segment_high_1 = na

var line segment_high_2 = na

var line segment_high_3 = na

for i=0 to sb

count1_s := count1_s + 1

if high[1] < high[i+2] and lower_high

segment_1_stat_s := true

break

for i=count1_s to sb+count1_s

count2_s := count2_s + 1

if high[1+count1_s] < high[i+2] and segment_1_stat_s

segment_2_stat_s := true

break

for i=count2_s to sb+count2_s

if high[1+count1_s+count2_s] < high[i+2+count1_s] and segment_2_stat_s

segment_3_stat_s := true

break

// segments signals

seg_stat_l = segment_1_stat_l and segment_2_stat_l and segment_3_stat_l

seg_stat_s = segment_1_stat_s and segment_2_stat_s and segment_3_stat_s

//entry

segments_buy = high > high[1] and seg_stat_l[1]

segments_sell = low < low[1] and seg_stat_s[1]

//filters

segments_buy_f = high > high[1] and seg_stat_l[1]

segments_sell_f = low < low[1] and seg_stat_s[1]

//--------------------------- Entry Signal Options ---------------------------

// buy signal options 1

opt_sig_buy =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_up_buy :

X_opt == "Grid - counter trend" ? grid_ct_buy :

X_opt == "Grid - reentry" ? grid_re_buy :

X_opt == "Fractals" ? fr_upx :

X_opt == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 1

opt_sig_sell =

X_opt == "---" ? na :

// X_opt == "Grid - forward sig" ? grid_dn_sell :

X_opt == "Grid - counter trend" ? grid_ct_sell :

X_opt == "Grid - reentry" ? grid_re_sell :

X_opt == "Fractals" ? fr_dnx :

X_opt == "Reverse fractal" ? rev_up_fr_sell : na

// buy signal options 2

opt_sig_buy_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_up_buy :

X_opt_2 == "Grid - counter trend" ? grid_ct_buy :

X_opt_2 == "Grid - reentry" ? grid_re_buy :

X_opt_2 == "Fractals" ? fr_upx :

X_opt_2 == "Reverse fractal" ? rev_dn_fr_buy : na

// sell signal options 2

opt_sig_sell_2 =

X_opt_2 == "---" ? na :

// X_opt_2 == "Grid - forward sig" ? grid_dn_sell :

X_opt_2 == "Grid - counter trend" ? grid_ct_sell :

X_opt_2 == "Grid - reentry" ? grid_re_sell :

X_opt_2 == "Fractals" ? fr_dnx :

X_opt_2 == "Reverse fractal" ? rev_up_fr_sell : na

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_1 == "Fractals filter" ? fr_upx_f :

entry_f_1 == "SuperTrend filter" ? sup_buy_f :

entry_f_1 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_1 == "SMA filter" ? sma_buy_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_buy :

entry_f_1 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_1 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_1 == "TRIX filter" ? trix_buy_f :

entry_f_1 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_1 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_1 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_1 == "Fractals filter" ? fr_dnx_f :

entry_f_1 == "SuperTrend filter" ? sup_sell_f :

entry_f_1 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_1 == "SMA filter" ? sma_sell_f :

entry_f_1 == "ADX filter" ? adx_above_thres :

entry_f_1 == "Segments filter" ? segments_sell :

entry_f_1 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_1 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_1 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_1 == "TRIX filter" ? trix_sell_f :

entry_f_1 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_1 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_1 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_1 == "Price filtered Kumo flip filter" ?price_filtered_kumo_flip_sell_f :

entry_f_1 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_1 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_1 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_1 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_1 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy_f :

entry_f_2 == "Fractals filter" ? fr_upx_f :

entry_f_2 == "SuperTrend filter" ? sup_buy_f :

entry_f_2 == "Parabolic SAR filter" ? psar_buy_f :

entry_f_2 == "SMA filter" ? sma_buy_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_buy :

entry_f_2 == "Fractals 1-2-3 filter" ? hl_hh_buy :

entry_f_2 == "Reverse fractal filter" ? rev_dn_fr_buy :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_buy :

entry_f_2 == "TRIX filter" ? trix_buy_f :

entry_f_2 == "Price X Kumo filter" ? kumo_buy_f :

entry_f_2 == "Price X Kijun filter" ? kijun_buy_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_buy_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_buy_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_buy_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_buy_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_buy_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_buy_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_buy_f : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell_f :

entry_f_2 == "Fractals filter" ? fr_dnx_f :

entry_f_2 == "SuperTrend filter" ? sup_sell_f :

entry_f_2 == "Parabolic SAR filter" ? psar_sell_f :

entry_f_2 == "SMA filter" ? sma_sell_f :

entry_f_2 == "ADX filter" ? adx_above_thres :

entry_f_2 == "Segments filter" ? segments_sell :

entry_f_2 == "Fractals 1-2-3 filter" ? lh_ll_sell :

entry_f_2 == "Reverse fractal filter" ? rev_up_fr_sell :

entry_f_2 == "EMA21/SMA20 filter" ? ma_cross_sell :

entry_f_2 == "TRIX filter" ? trix_sell_f :

entry_f_2 == "Price X Kumo filter" ? kumo_sell_f :

entry_f_2 == "Price X Kijun filter" ? kijun_sell_f :

entry_f_2 == "Kumo flip filter" ? kumo_flip_sell_f :

entry_f_2 == "Price filtered Kumo flip filter" ? price_filtered_kumo_flip_sell_f :

entry_f_2 == "Chikou X price filter" ? chikou_X_price_sell_f :

entry_f_2 == "Chikou X Kumo filter" ? chikou_X_kumo_sell_f :

entry_f_2 == "Price X Tenkan filter" ? price_X_tenkan_sell_f :

entry_f_2 == "Tenkan X Kumo filter" ? tenkan_X_kumo_sell_f :

entry_f_2 == "Tenkan X Kijun filter" ? tenkan_X_kijun_sell_f : true

//------------------------- exit filter -----------------------

//short exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_buy_x :

exit_f_1 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_1 == "MACD exit" ? macd_buy_x :

exit_f_1 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_1 == "Fractals exit" ? fr_upx_x :

exit_f_1 == "SuperTrend exit" ? sup_buy_x :

exit_f_1 == "Parabolic SAR exit" ? psar_buy :

exit_f_1 == "SMA exit" ? sma_buy_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_buy_x :

exit_f_1 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "TRIX exit" ? trix_sell_x :

exit_f_1 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_1 == "MACD exit" ? macd_sell_x :

exit_f_1 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_1 == "Fractals exit" ? fr_dnx_x :

exit_f_1 == "SuperTrend exit" ? sup_sell_x :

exit_f_1 == "Parabolic SAR exit" ? psar_sell :

exit_f_1 == "SMA exit" ? sma_sell_x :

exit_f_1 == "ADX exit" ? adx_thres_f_x :

exit_f_1 == "Cloud exit" ? kumo_sell_x :

exit_f_1 == "Kijun exit" ? kijun_sell_x : false

//short exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_buy_x :

exit_f_2 == "Reverse fractal exit" ? rev_dn_fr_buy :

exit_f_2 == "MACD exit" ? macd_buy_x :

exit_f_2 == "RSI50 exit" ? rsi_f_buy_x :

exit_f_2 == "Fractals exit" ? fr_upx_x :

exit_f_2 == "SuperTrend exit" ? sup_buy_x :

exit_f_2 == "Parabolic SAR exit" ? psar_buy :

exit_f_2 == "SMA exit" ? sma_buy_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_buy_x :

exit_f_2 == "Kijun exit" ? kijun_buy_x : false

//long exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "TRIX exit" ? trix_sell_x :

exit_f_2 == "Reverse fractal exit" ? rev_up_fr_sell :

exit_f_2 == "MACD exit" ? macd_sell_x :

exit_f_2 == "RSI50 exit" ? rsi_f_sell_x :

exit_f_2 == "Fractals exit" ? fr_dnx_x :

exit_f_2 == "SuperTrend exit" ? sup_sell_x :

exit_f_2 == "Parabolic SAR exit" ? psar_sell :

exit_f_2 == "SMA exit" ? sma_sell_x :

exit_f_2 == "ADX exit" ? adx_thres_f_x :

exit_f_2 == "Cloud exit" ? kumo_sell_x :

exit_f_2 == "Kijun exit" ? kijun_sell_x : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

exit_long = exit_filter_sell_1 or exit_filter_sell_2

exit_short = exit_filter_buy_1 or exit_filter_buy_2

if backtest_period()

if long

strategy.entry("os_b", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.entry("os_b", strategy.long, when = opt_sig_buy_2 and entry_filter_buy_1 and entry_filter_buy_2 and not exit_long,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=buy, amount=100); }" : na)

strategy.close("os_b", when = exit_long)

if short

strategy.entry("os_s",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.entry("os_s",strategy.short, when = opt_sig_sell_2 and entry_filter_sell_1 and entry_filter_sell_2 and not exit_short,

comment= not backtest ? "BybitAPI(BTCUSD) { market(side=sell, amount=100); }" : na)

strategy.close("os_s", when = exit_short)

// {{strategy.order.comment}} #bot - altert message