দ্বৈত অন্তর্ভুক্তি এবং প্রবণতা কৌশল

ওভারভিউ

ডাবল ইনক্লুসিভ এবং ট্রেন্ডিং কৌশল হল একটি পরিমাণগত ট্রেডিং কৌশল যা ডাবল ইনক্লুসিভ ফর্ম্যাট এবং মুভিং এভারেজ ব্যবহার করে ট্রেন্ডিংয়ের সিদ্ধান্ত নেয়। এই কৌশলটি ডাবল ইনক্লুসিভ ফর্ম্যাটগুলির সাথে মিলিত হয় যা একটি উচ্চ সম্ভাব্যতার ট্রেডিং সংকেত সরবরাহ করে, এবং একই সাথে বাজারের প্রবণতা নির্ধারণের জন্য মুভিং এভারেজ ব্যবহার করে, প্রবণতার দিক থেকে আরও বেশি স্বল্প করে।

কৌশল নীতি

- প্রবণতা নির্ণয় করার জন্য Hull Moving Average হিসাব করুন।

- যখন একটি দ্বিতীয় অন্তর্নিহিত ফর্ম দেখা দেয়, এটি একটি উচ্চ সম্ভাব্য লেনদেনের সংকেত বলে মনে করা হয়। অন্তর্নিহিত ফর্মটি হ’ল প্রথম দুটি কে লাইনের সর্বোচ্চ মূল্য এবং সর্বনিম্ন মূল্য তৃতীয় কে লাইনের দ্বারা অন্তর্ভুক্ত।

- যদি ক্লোজিং প্রাইস মুভিং এভারেজের উপরে থাকে এবং মাল্টি হেড ইনহেল তৈরি করে, তাহলে ইনহেল ফর্ম্যাট হাই পয়েন্টের কাছাকাছি ক্রয়-বিক্রয় স্টপ অর্ডার স্থাপন করা হয়। যদি ক্লোজিং প্রাইস মুভিং এভারেজের নীচে থাকে এবং খালি হেড ইনহেল তৈরি করে, তাহলে ইনহেল ফর্ম্যাট লো পয়েন্টের কাছাকাছি বিক্রয়-বিক্রয় স্টপ অর্ডার স্থাপন করা হয়।

- স্টপ ওয়ারেন্টি ট্রিগার হওয়ার পর, স্টপ ওয়ারেন্টি এবং স্টপ ওয়ারেন্টি সেট করুন, যা স্টপ ওয়ারেন্টি এবং স্টপ ওয়ারেন্টি অনুপাতের উপর নির্ভর করে।

সামর্থ্য বিশ্লেষণ

- অন্তর্নিহিত ফর্মগুলি একটি উচ্চ সম্ভাব্য বিপরীত সংকেত সরবরাহ করে। ডাবল অন্তর্নিহিত ফর্মগুলির উত্থান স্বল্পমেয়াদে দামের বিপরীত হওয়ার ইঙ্গিত দিতে পারে।

- একটি চলমান গড়ের সাথে মিলিত, এটি একটি বড় প্রবণতার দিকে কাজ করে, যা মুনাফা অর্জনের সম্ভাবনা বাড়ায়।

- প্রবণতা চলাকালীন ব্রেক পয়েন্টের কাছাকাছি স্টপ একক গুদাম ব্যবহার করে, ভাল প্রবেশের সময় পাওয়া যায়।

ঝুঁকি বিশ্লেষণ

- ঘূর্ণিঝড়ের সময়, অন্তর্নিহিত ফর্ম্যাট দ্বারা সরবরাহিত ট্রেডিং সংকেতগুলি প্রায়শই ক্ষতিগ্রস্থ হতে পারে।

- চলমান গড়গুলি প্রবণতা নির্ধারণের একটি সূচক হিসাবেও ভুল সংকেত দিতে পারে, যার ফলে বিপরীতমুখী ব্যবসায়ের ক্ষতি হতে পারে।

- স্টপ লস পয়েন্টের সেটিংটি খুব ছোট এবং দামের সামান্য স্লাইড দ্বারা স্টপ লস ট্রিগার করা হতে পারে।

অপ্টিমাইজেশান দিক

- প্রবণতা নির্ণয় করার জন্য বিভিন্ন প্যারামিটারের চলমান গড় পরীক্ষা করা যেতে পারে।

- অন্যান্য সূচকগুলির সাথে মিলিত হয়ে, আপনি অন্ধ ট্রেডিং এড়াতে পারেন যখন কোনও সুস্পষ্ট প্রবণতা নেই।

- বিগ ডেটা বিশ্লেষণের মাধ্যমে আরও ভাল প্যারামিটার সমন্বয় পাওয়া যায়, যেমন চলমান গড়ের সময়কাল, স্টপ লস গুণক, স্টপ-অফ অনুপাত ইত্যাদি।

- ট্রেডিংয়ের সময় এবং জাতের ফিল্টারিংয়ের শর্তগুলি বিভিন্ন সময়কাল এবং বিভিন্ন জাতের বৈশিষ্ট্যগুলির সাথে খাপ খাইয়ে নেওয়া যেতে পারে।

সারসংক্ষেপ

দ্বৈত অন্তর্নিহিত এবং প্রবণতা কৌশলটি দ্বৈত অন্তর্নিহিত ফর্ম্যাট ব্যবহার করে উচ্চ সম্ভাব্যতার ট্রেডিং সংকেত সরবরাহ করে এবং একই সাথে চলমান গড়কে বড় প্রবণতার দিকনির্দেশের জন্য সহায়তা করে, প্রবণতার দিকের দিকে আরও খালি করে, এটি একটি আরও স্থিতিশীল বিরতিযুক্ত কৌশল। প্যারামিটার অপ্টিমাইজেশন এবং নিয়ম অপ্টিমাইজেশনের মাধ্যমে, কৌশলটি বাজারের সাথে আরও ভালভাবে অভিযোজিত হতে পারে এবং সম্ভাব্য মুনাফা অর্জন করতে পারে।

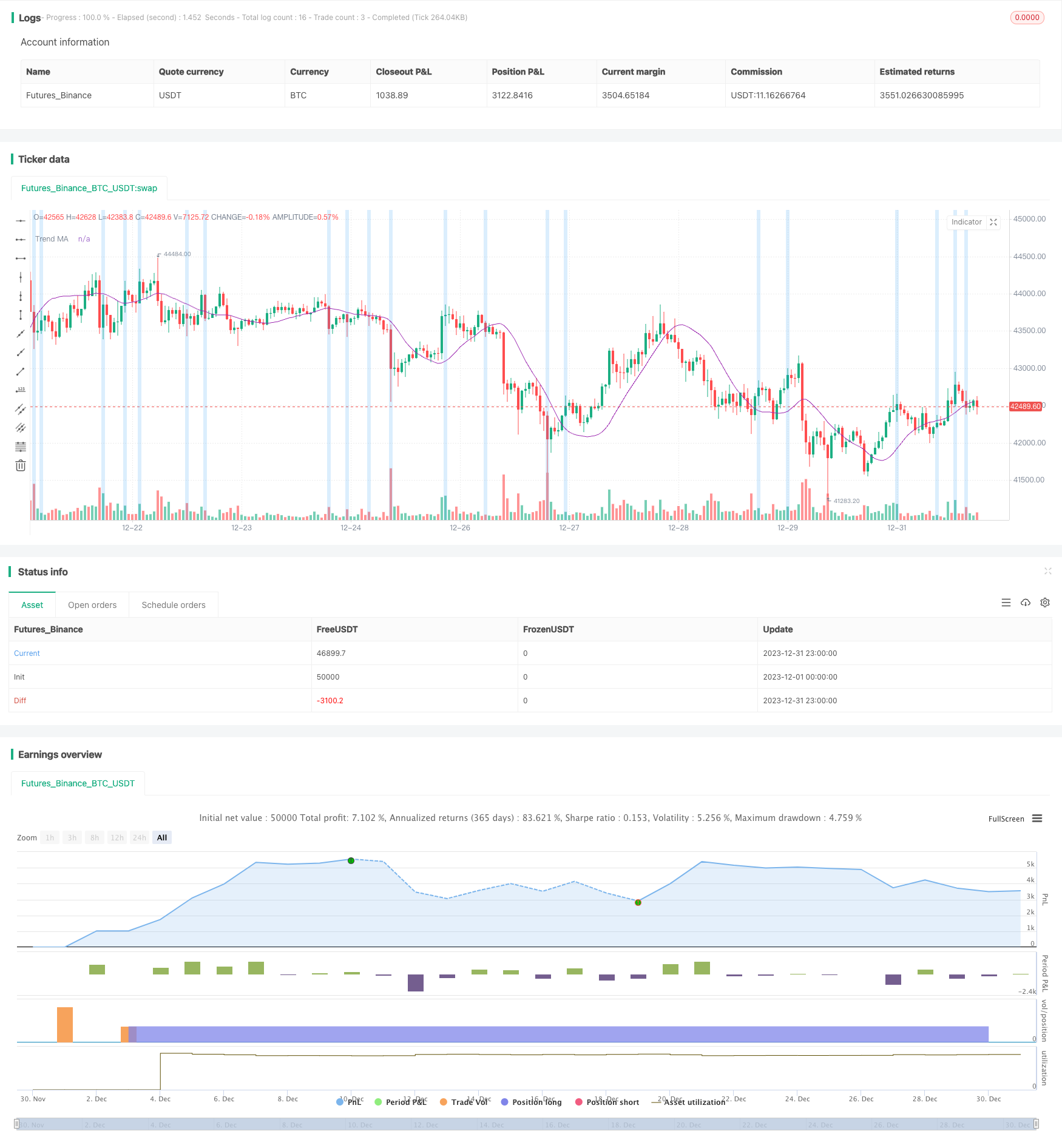

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Kaspricci

//@version=5

strategy(

title = "Double Inside Bar & Trend Strategy - Kaspricci",

shorttitle = "Double Inside Bar & Trend",

overlay=true,

initial_capital = 100000,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

calc_on_every_tick = true,

close_entries_rule = "ANY")

// ================================================ Entry Inputs ======================================================================

headlineEntry = "Entry Seettings"

maSource = input.source(defval = close, group = headlineEntry, title = "MA Source")

maType = input.string(defval = "HMA", group = headlineEntry, title = "MA Type", options = ["EMA", "HMA", "SMA", "SWMA", "VWMA", "WMA"])

maLength = input.int( defval = 45, minval = 1, group = headlineEntry, title = "HMA Length")

float ma = switch maType

"EMA" => ta.ema(maSource, maLength)

"HMA" => ta.hma(maSource, maLength)

"SMA" => ta.sma(maSource, maLength)

"SWMA" => ta.swma(maSource)

"VWMA" => ta.vwma(maSource, maLength)

"WMA" => ta.wma(maSource, maLength)

plot(ma, "Trend MA", color.purple)

// ================================================ Trade Inputs ======================================================================

headlineTrade = "Trade Seettings"

stopLossType = input.string(defval = "ATR", group = headlineTrade, title = "Stop Loss Type", options = ["ATR", "FIX"])

atrLength = input.int( defval = 50, minval = 1, group = headlineTrade, inline = "ATR", title = " ATR: Length ")

atrFactor = input.float( defval = 2.5, minval = 0, step = 0.05, group = headlineTrade, inline = "ATR", title = "Factor ", tooltip = "multiplier for ATR value")

takeProfitRatio = input.float( defval = 2.0, minval = 0, step = 0.05, group = headlineTrade, title = " TP Ration", tooltip = "Multiplier for Take Profit calculation")

fixStopLoss = input.float( defval = 10.0, minval = 0, step = 0.5, group = headlineTrade, inline = "FIX", title = " FIX: Stop Loss ") * 10 // need this in ticks

fixTakeProfit = input.float( defval = 20.0, minval = 0, step = 0.5, group = headlineTrade, inline = "FIX", title = "Take Profit", tooltip = "in pips") * 10 // need this in ticks

useRiskMagmt = input.bool( defval = true, group = headlineTrade, inline = "RM", title = "")

riskPercent = input.float( defval = 1.0, minval = 0., step = 0.5, group = headlineTrade, inline = "RM", title = "Risk in % ", tooltip = "This will overwrite quantity from startegy settings and calculate the trade size based on stop loss and risk percent") / 100

// ================================================ Filter Inputs =====================================================================

headlineFilter = "Filter Setings"

// date filter

filterDates = input.bool(defval = false, group = headlineFilter, title = "Filter trades by dates")

startDateTime = input(defval = timestamp("2022-01-01T00:00:00+0000"), group = headlineFilter, title = " Start Date & Time")

endDateTime = input(defval = timestamp("2099-12-31T23:59:00+0000"), group = headlineFilter, title = " End Date & Time ")

dateFilter = not filterDates or (time >= startDateTime and time <= endDateTime)

// session filter

filterSession = input.bool(title = "Filter trades by session", defval = false, group = headlineFilter)

session = input(title = " Session", defval = "0045-2245", group = headlineFilter)

sessionFilter = not filterSession or time(timeframe.period, session, timezone = "CET")

// ================================================ Trade Entries and Exits =====================================================================

// calculate stop loss

stopLoss = switch stopLossType

"ATR" => nz(math.round(ta.atr(atrLength) * atrFactor / syminfo.mintick, 0), 0)

"FIX" => fixStopLoss

// calculate take profit

takeProfit = switch stopLossType

"ATR" => math.round(stopLoss * takeProfitRatio, 0)

"FIX" => fixTakeProfit

doubleInsideBar = high[2] > high[1] and high[2] > high[0] and low[2] < low[1] and low[2] < low[0]

// highlight mother candel and inside bar candles

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na)

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na, offset = -1)

bgcolor(doubleInsideBar ? color.rgb(33, 149, 243, 80) : na, offset = -2)

var float buyStopPrice = na

var float sellStopPrice = na

if (strategy.opentrades == 0 and doubleInsideBar and barstate.isconfirmed)

buyStopPrice := high[0] // high of recent candle (second inside bar)

sellStopPrice := low[0] // low of recent candle (second inside bar)

tradeID = str.tostring(strategy.closedtrades + strategy.opentrades + 1)

quantity = useRiskMagmt ? math.round(strategy.equity * riskPercent / stopLoss, 2) / syminfo.mintick : na

commentTemplate = "{0} QTY: {1,number,#.##} SL: {2} TP: {3}"

if (close > ma)

longComment = str.format(commentTemplate, tradeID + "L", quantity, stopLoss / 10, takeProfit / 10)

strategy.entry(tradeID + "L", strategy.long, qty = quantity, stop = buyStopPrice, comment = longComment)

strategy.exit(tradeID + "SL", tradeID + "L", profit = takeProfit, loss = stopLoss, comment_loss = "SL", comment_profit = "TP")

if (close < ma)

shortComment = str.format(commentTemplate, tradeID + "S", quantity, stopLoss / 10, takeProfit / 10)

strategy.entry(tradeID + "S", strategy.short, qty = quantity, stop = sellStopPrice, comment = shortComment)

strategy.exit(tradeID + "SL", tradeID + "S", profit = takeProfit, loss = stopLoss, comment_loss = "SL", comment_profit = "TP")

// as soon as the first pending order has been entered the remaing pending order shall be cancelled

if strategy.opentrades > 0

currentTradeID = str.tostring(strategy.closedtrades + strategy.opentrades)

strategy.cancel(currentTradeID + "S")

strategy.cancel(currentTradeID + "L")