ওভারভিউ

এই কৌশলটি MACD-V ((ATR সহ অস্থিরতা সহ MACD) এবং Fibonacci retracement ব্যবহার করে একাধিক সময় ফ্রেমে লেনদেনের সিদ্ধান্ত নেয়। এটি বিভিন্ন সময় ফ্রেমের MACD-V এবং Fibonacci স্তর গণনা করে এবং তারপরে বর্তমান দামের সাথে ফিবোনাচি স্তরের সম্পর্ক এবং MACD-V এর মানের উপর ভিত্তি করে অবস্থান এবং অবস্থানগুলি খোলার সিদ্ধান্ত নেয়। এই কৌশলটি বাজারের প্রবণতা এবং retracement ক্যাপচার করার জন্য এবং ঝুঁকি নিয়ন্ত্রণ করার জন্য তৈরি করা হয়েছে।

কৌশল নীতি

- MACD-V সূচকটি বিভিন্ন সময় ফ্রেমের (যেমন 5 মিনিট এবং 30 মিনিট) জন্য গণনা করা হয়, MACD-V এর উপর ভিত্তি করে ATR এর ওঠানামার হারকে বিভিন্ন বাজারের অবস্থার সাথে সামঞ্জস্য করার জন্য সামঞ্জস্য করা হয়।

- একটি উচ্চ পর্যায়ের সময় ফ্রেমে (যেমন 30 মিনিট) একটি নির্দিষ্ট সময়ের (যেমন 9 চক্র) জন্য সর্বোচ্চ এবং সর্বনিম্ন মূল্য গণনা করুন এবং তারপরে এই ব্যবধানের উপর ভিত্তি করে একটি ফিবোনাচি রিডাউন স্তর গণনা করুন।

- খোলার শর্ত পূরণ করা হয়েছে কিনা তা নির্ধারণ করার জন্য বর্তমান ক্লোজিং মূল্যের সাথে ফিবোনাচি স্তরের সম্পর্ক এবং MACD-V এর মান এবং পরিবর্তনের দিকের উপর ভিত্তি করে। উদাহরণস্বরূপ, যখন দামটি 38.2% ফিবোনাচি স্তরের কাছাকাছি ফিরে আসে এবং MACD-V 50 থেকে 150 এর মধ্যে নীচে চলে যায় তখন খালি অবস্থান খোলার জন্য।

- পজিশন খোলার পর মুনাফা সুরক্ষার জন্য এবং ঝুঁকি নিয়ন্ত্রণের জন্য ট্রেইলিং স্টপ ব্যবহার করা হয়। দামের চলাচল এবং কৌশলগত প্যারামিটারগুলির উপর নির্ভর করে ট্রেইলিং স্টপের অবস্থানটি গতিশীলভাবে সামঞ্জস্য করা হয়।

- যদি দাম চলমান স্টপ লস বা স্থির স্টপ লস স্তর স্পর্শ করে, তাহলে প্লেইন পজিশন।

সামর্থ্য বিশ্লেষণ

- এই কৌশলটি মাল্টি টাইম ফ্রেম বিশ্লেষণ ব্যবহার করে বাজার প্রবণতা এবং ওঠানামা সম্পর্কে আরও ভাল ধারণা দেয়।

- MACD-V সূচক মূল্যের অস্থিরতা বিবেচনা করে এবং ট্রেন্ডিং এবং অস্থির বাজারে কার্যকরভাবে কাজ করে।

- ফিবোনাচি স্তরগুলি মূল্যের মূল সমর্থন এবং প্রতিরোধের অঞ্চলগুলিকে ভালভাবে ক্যাপচার করে এবং ট্রেডিং সিদ্ধান্তের জন্য রেফারেন্স সরবরাহ করে।

- মুভিং স্টপ ট্রেন্ড চলাকালীন মুনাফা বজায় রাখতে পারে, এবং যখন দাম বিপরীত হয় তখন ঝুঁকি নিয়ন্ত্রণের জন্য সময়মতো পজিশন বন্ধ করে দেয়।

- কৌশলগত লজিক পরিষ্কার, প্যারামিটারগুলি সামঞ্জস্যযোগ্য, এবং অভিযোজিত।

ঝুঁকি বিশ্লেষণ

- কৌশলটি হল যে বাজারে ঘন ঘন লেনদেন হতে পারে, যার ফলে লেনদেনের খরচ বেশি হয়।

- প্রযুক্তিগত সূচকগুলির উপর নির্ভর করে ট্রেন্ডগুলি বিচার করা হয়, যখন বাজারে মিথ্যা ব্রেকআউট বা ধারাবাহিক অস্থিরতা দেখা দেয় তখন ভুল বিচার হতে পারে।

- ফিক্সড স্টপ লস পজিশনের ফলে চরম পরিস্থিতির মোকাবিলা করতে সময় লাগে না, যার ফলে বড় ক্ষতি হয়।

- ভুল প্যারামিটার নির্বাচন করলে কৌশলটি খারাপভাবে কাজ করতে পারে।

অপ্টিমাইজেশান দিক

- প্রবণতা নির্ধারণের জন্য আরও সময়সীমা এবং সূচক যেমন দীর্ঘমেয়াদী এমএ’র প্রবর্তন করা।

- পজিশন ম্যানেজমেন্ট অপ্টিমাইজ করুন, যেমন ATR বা দামের ব্যাপ্তির উপর ভিত্তি করে পজিশনের আকার পরিবর্তন করুন।

- বিভিন্ন বাজার অবস্থার জন্য বিভিন্ন প্যারামিটার সমন্বয় সেট করুন, অভিযোজনশীলতা উন্নত করুন।

- মোবাইল স্টপ-এর উপর ভিত্তি করে মোবাইল স্টপ-এর প্রবর্তন করা হয়েছে, যা নিচে নামার ঝুঁকিকে আরও ভালভাবে নিয়ন্ত্রণ করে।

- কৌশলগুলিকে পুনরায় পরীক্ষা করা এবং সর্বোত্তম প্যারামিটার সমন্বয় খুঁজে বের করার জন্য প্যারামিটার অপ্টিমাইজ করা।

সারসংক্ষেপ

এই কৌশলটি প্রবণতা এবং খোলার সময় নির্ধারণ করে এবং ঝুঁকি এবং মুনাফা গতিশীলভাবে নিয়ন্ত্রণ করার জন্য চলমান স্টপ ব্যবহার করে। কৌশলটির লজিকটি পরিষ্কার এবং অভিযোজিত, তবে ঘন ঘন লেনদেন এবং ভুল সিদ্ধান্তের ঝুঁকি রয়েছে। আরও সূচক, পজিশন পরিচালনা এবং স্টপ লজিকের অপ্টিমাইজেশন এবং প্যারামিটার অপ্টিমাইজেশনের মাধ্যমে কৌশলটির স্থিতিশীলতা এবং লাভজনকতা আরও বাড়ানো যেতে পারে।

ধন্যবাদ

এই কৌশলটির জন্য ব্যবহৃত MACD-v সূচকটি মূলত এর সৃষ্টিকর্তা অ্যালেক্স স্পিরোগ্লু-র।MACD-v.

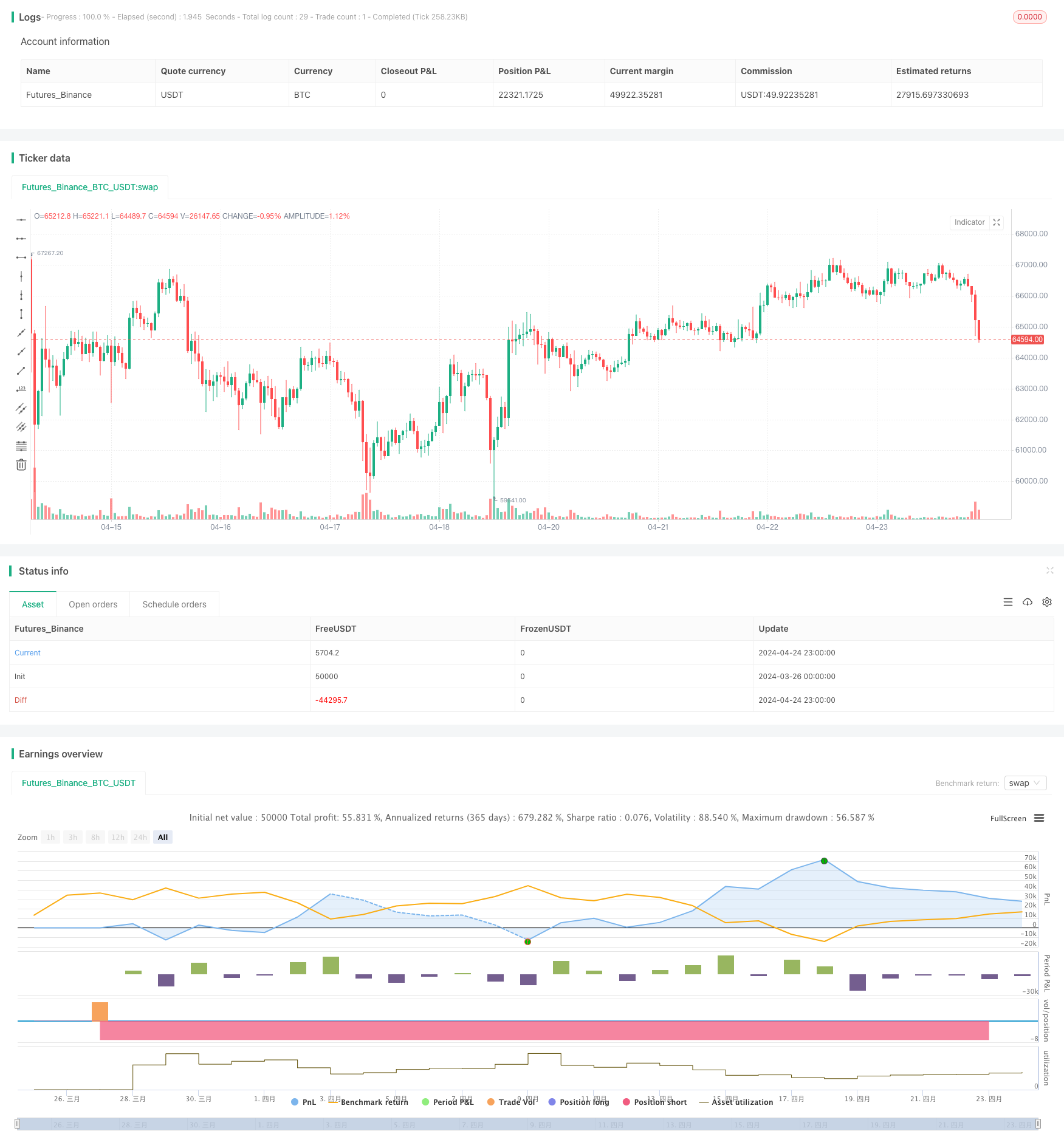

/*backtest

start: 2024-03-26 00:00:00

end: 2024-04-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © catikur

//@version=5

strategy("Advanced MACD-V and Fibonacci Strategy with EMA Trailing TP", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=1000, margin_long=1./10*50, margin_short=1./10*50, slippage=0, commission_type=strategy.commission.percent, commission_value=0.05)

// Parametreler

fast_len = input.int(12, title="Fast Length", minval=1, group="MACD-V Settings")

slow_len = input.int(26, title="Slow Length", minval=1, group="MACD-V Settings")

signal_len = input.int(9, title="Signal Smoothing", minval=1, group="MACD-V Settings")

atr_len = input.int(26, title="ATR Length", minval=1, group="MACD-V Settings")

source = input.source(close, title="Source", group="MACD-V Settings")

//ema_length = input.int(20, title="EMA Length for Trailing TP", group="Trailing TP Settings")

trailing_profit = input.float(1000, title="Trailing Profit", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_offset = input.float(30000, title="Trailing Offset", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_factor = input.float(0.01, title="Trailing Factor", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fix_loss = input.float(20000, title="Fix Loss", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fib_lookback = input.int(9, title="Fibonacci Lookback Periods", minval=1, group="Fibonacci Settings")

macd_tf = input.timeframe("5", title="MACD Timeframe", group="Timeframe Settings")

fib_tf = input.timeframe("30", title="Fibonacci Timeframe", group="Timeframe Settings")

//ema_tf = input.timeframe("30", title="EMA Timeframe for Trailing TP", group="Timeframe Settings")

// MACD-V Hesaplama

atr = ta.atr(atr_len)

ema_slow = ta.ema(source, slow_len)

ema_fast = ta.ema(source, fast_len)

atr_tf = request.security(syminfo.tickerid, macd_tf , atr)

ema_slow_tf = request.security(syminfo.tickerid, macd_tf , ema_slow)

ema_fast_tf = request.security(syminfo.tickerid, macd_tf , ema_fast)

macd = ( ema_fast_tf - ema_slow_tf ) / atr_tf * 100

signal = ta.ema(macd, signal_len)

hist = macd - signal

hist_prev = hist[1]

// log.info("MACD {0} ", macd)

// log.info("Signal {0} ", signal)

// log.info("Histogram {0} ", hist)

// log.info("Previous Histogram {0} ", hist_prev)

// EMA for Trailing TP

//ema_trailing_tf = ta.ema(close, ema_length)

//ema_trailing = request.security(syminfo.tickerid, ema_tf, ema_trailing_tf)

//log.info("EMA Trailing {0} ", ema_trailing)

// Fibonacci Seviyeleri

high_val_tf = ta.highest(high, fib_lookback)

low_val_tf = ta.lowest(low, fib_lookback)

h1 = request.security(syminfo.tickerid, fib_tf, high_val_tf)

l1 = request.security(syminfo.tickerid, fib_tf, low_val_tf)

fark = h1 - l1

//Low ile fark

hl236 = l1 + fark * 0.236

hl382 = l1 + fark * 0.382

hl500 = l1 + fark * 0.5

hl618 = l1 + fark * 0.618

hl786 = l1 + fark * 0.786

//High ile fark

lh236 = h1 - fark * 0.236

lh382 = h1 - fark * 0.382

lh500 = h1 - fark * 0.5

lh618 = h1 - fark * 0.618

lh786 = h1 - fark * 0.786

hbars_tf = -ta.highestbars(high, fib_lookback)

lbars_tf = -ta.lowestbars(low, fib_lookback)

hbars = request.security(syminfo.tickerid, fib_tf , hbars_tf)

lbars = request.security(syminfo.tickerid, fib_tf , lbars_tf)

fib_236 = hbars > lbars ? hl236 : lh236

fib_382 = hbars > lbars ? hl382 : lh382

fib_500 = hbars > lbars ? hl500 : lh500

fib_618 = hbars > lbars ? hl618 : lh618

fib_786 = hbars > lbars ? hl786 : lh786

// log.info("Fibo 382 {0} ", fib_382)

// log.info("Fibo 618 {0} ", fib_618)

// Keep track of the strategy's highest and lowest net profit

var highestNetProfit = 0.0

var lowestNetProfit = 0.0

var bool sell_retracing = false

var bool sell_reversing = false

var bool buy_rebound = false

var bool buy_rallying = false

// Satış Koşulları

sell_retracing := (signal > -20) and (macd > -50 and macd < 150) and (macd < signal) and (hist < hist_prev) and (close < fib_382)

sell_reversing := (macd > -150 and macd < -50) and (macd < signal) and (hist < hist_prev) and (close < fib_618)

// log.info("Retracing var mi: {0} ", sell_retracing)

// log.info("Reversing var mi: {0} ", sell_reversing)

// Alım Koşulları

buy_rebound := (signal < 20) and (macd > -150 and macd < 50) and (macd > signal) and (hist > hist_prev) and ((fib_618 < close) or ((fib_618 > close ) and (close > fib_382)))

buy_rallying := (macd > 50 and macd < 150) and (macd > signal) and (hist > hist_prev) and (close > fib_618)

// log.info("Rallying var mi: {0} ", buy_rallying)

// log.info("Rebound var mi: {0} ", buy_rebound)

// Emirleri Yerleştirme

if (sell_retracing == true and strategy.opentrades == 0 )

strategy.entry("sell_retracing", strategy.short)

if (sell_reversing == true and strategy.opentrades == 0 )

strategy.entry("sell_reversing", strategy.short)

if (buy_rebound == true and strategy.opentrades == 0 )

strategy.entry("buy_rebound", strategy.long)

if (buy_rallying == true and strategy.opentrades == 0 )

strategy.entry("buy_rallying", strategy.long)

// log.info("open order: {0} ", strategy.opentrades )

highestNetProfit := math.max(highestNetProfit, strategy.netprofit)

lowestNetProfit := math.min(lowestNetProfit, strategy.netprofit)

// Plot the net profit, as well as its highest and lowest value

//plot(strategy.netprofit, style=plot.style_area, title="Net profit",

// color=strategy.netprofit > 0 ? color.green : color.red)

//plot(highestNetProfit, color=color.green, title="Highest net profit")

//plot(lowestNetProfit, color=color.red, title="Lowest net profit")

// Trailing Take Profit

//long_trailing_stop = ema_trailing * trailing_factor

//short_trailing_stop = ema_trailing / trailing_factor

//log.info("long trailing stop {0} ", long_trailing_stop)

//log.info("short trailing stop {0} ", short_trailing_stop)

//log.info("avg price {0} ", strategy.position_avg_price)

//trail_price1 = strategy.position_avg_price * (1 + trailing_factor)

//trail_price2 = strategy.position_avg_price * (1 - trailing_factor)

// log.info("position_size {0} ", strategy.position_size)

// Trailing Take Profit

var float long_trailing_stop = 0.0

var float short_trailing_stop = 0.0

//if (strategy.position_size > 0)

// long_trailing_stop := math.max(long_trailing_stop, close * (1 + trailing_factor)) // Yeni bir maksimum değer belirlendiğinde güncelle

//if (strategy.position_size < 0)

// short_trailing_stop := math.min(short_trailing_stop, close * (1 - trailing_factor)) // Yeni bir minimum değer belirlendiğinde güncelle

//log.info("long trailing {0} ", long_trailing_stop)

// log.info("trailing factor{0} ", trailing_factor)

//log.info("short trailing {0} ", short_trailing_stop)

if (strategy.position_size != 0 )

strategy.exit("Exit Long", from_entry="buy_rebound", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Long", from_entry="buy_rallying", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_retracing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_reversing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)