Strategie zur Trendfolgeregelung mit mehreren gleitenden Durchschnitten

Überblick

Die Strategie hat die Vorteile von getParameter: 1) Mehrere Moving Averages bilden ein Ratingsystem, das die Richtigkeit der Beurteilung verbessert; 2) Die Parameter des Ratingsystems können flexibel an verschiedene Sorten angepasst werden; 3) Die Ratingbedingungen für die Eintrittsprüfung können konfiguriert werden, um das Risiko zu kontrollieren.

Strategieprinzip

Die Strategie verwendet insgesamt 17 verschiedene Arten von Moving Averages, darunter SMA, EMA, ALMA, SMMA, LSMA, VWMA, DEMA, HMA, KAMA, TEMA, ZLEMA, TRIMA, T3 usw.

Für jeden Moving Average wird die Beziehung zu den Schlusskurs beurteilt. Wenn der Moving Average unter dem Schlusskurs liegt, wird ein Punkt bewertet, wenn er über dem Schlusskurs liegt, wird ein Punkt bewertet.

Summieren Sie die Bewertungen aller Moving Averages und dividieren Sie sie durch die Anzahl der bewertbaren Moving Averages, um eine Gesamtbewertung zu erhalten.

Vergleichen Sie die Komplettbewertung mit der Einstiegsbewertung und entscheiden Sie, in welche Richtung Sie eine Position eröffnen. Wenn die Komplettbewertung erreicht wird, machen Sie mehr Wertminderung, machen Sie mehr; wenn die Negativbewertung erreicht wird, machen Sie leere.

Die Verwendung von beweglichen Durchschnitten mit unterschiedlichen Perioden ermöglicht die Beurteilung von kurz- und langfristigen Trends. Die Verwendung von verschiedenen Arten von beweglichen Durchschnitten ermöglicht eine umfangreichere Referenz für technische Indikatoren und ermöglicht eine vielseitige Bewertung.

Strategische Vorteile

- Mehrfache Moving Average-Bewertungen für mehr Genauigkeit

Die Strategie bewertet 17 verschiedene Moving Averages im Vergleich zu einem einzigen oder mehreren Moving Averages, wodurch die Richtung der Markttrends aus mehr Perspektiven beurteilt werden kann und die Ungenauigkeiten, die durch die Abweichung eines Indikators verursacht werden, verringert werden. Mehrere Indikatoren sind an der Bewertung beteiligt und können die Zuverlässigkeit der Endergebnisse erhöhen.

- Die Parameter des Rating-Systems sind konfigurierbar für verschiedene Sorten

Die Anzahl der Moving Average-Perioden und die Rating-Throughs können mit Parametern eingestellt werden, so dass die Strategie flexibel an die Eigenschaften der verschiedenen Handelsarten angepasst werden kann, was eine Optimierung fördert.

- Konfigurierbare Einstiegs-Rating-Bedingungen, Risikokontrolle

Die Strategie erlaubt die Konfiguration von mehreren entfernten Einstiegs-Rating-Trenchwerten. Die Signalisierung erfolgt erst, wenn der Komplex-Rating die Trenchwert erreicht hat, um Fehlpositionen zu vermeiden, wenn der Markt unklar ist. Eine vernünftige Einstellung der Einstiegs-Trenchwert hilft, unnötige Transaktionen zu reduzieren und das Risiko zu kontrollieren.

Risiken und Lösungen

- Eine einzelne Sorte könnte nicht funktionieren

Die Parameter der Strategie sind auf die Gesamtmarktgestaltung ausgerichtet und können für eine bestimmte Sorte nicht optimal geeignet sein. Die Lösung besteht darin, die Parameter für verschiedene Sorten individuell zu optimieren.

- Mehrfach fehlerhafter Markt

Die Strategie kann in einem Zustand von hohem Marktchaos zu falschen Signalen führen. Die Lösung ist, die Einstiegsbewertung zu senken und die Anzahl der Transaktionen zu reduzieren.

- Langzeitbetrieb kann regelmäßige Optimierungen erfordern

Die Marktumgebung ändert sich ständig, und feste Parameter-Einstellungen führen zu unterschiedlichen Effekten der Strategie. Es wird empfohlen, die Parameter der Optimierung von Zeit zu Zeit neu zu testen, um die Effektivität der Strategie zu gewährleisten.

Optimierungsrichtung

Zusätzliche Indikatoren, wie z. B. die Schwankungsrate und die Transaktionsmenge, wurden hinzugefügt, um eine mehrdimensionale Entscheidungsgrundlage zu schaffen.

Optimierung der Testparameter für verschiedene Sorten und Verbesserung der Anpassungsfähigkeit der Strategie.

Längere Rücklaufzeiten, z. B. ein halbes Jahr, ein Jahr, Beobachtungsparameter und die Dauer der Wirkung.

Es ist besser, die Wirksamkeit verschiedener Moving Averages in verschiedenen Perioden zu untersuchen und eine Kombination zu wählen.

Versuchen Sie, die Parameter automatisch zu optimieren.

Zusammenfassen

Die Strategie hat den Vorteil, dass sie konfigurierbare Parameter hat, die flexibel an verschiedene Sorten angepasst werden können, und die Risikobereitschaft der Strategie kann durch Anpassung der Parameter gesteuert werden. Darüber hinaus kann die Rating-System kontinuierlich optimiert und verbessert werden, um die Strategie-Performance zu verbessern. Insgesamt nutzt die Strategie die Wirkung mehrerer technischer Indikatoren und bildet eine stärkere Trendverfolgung.

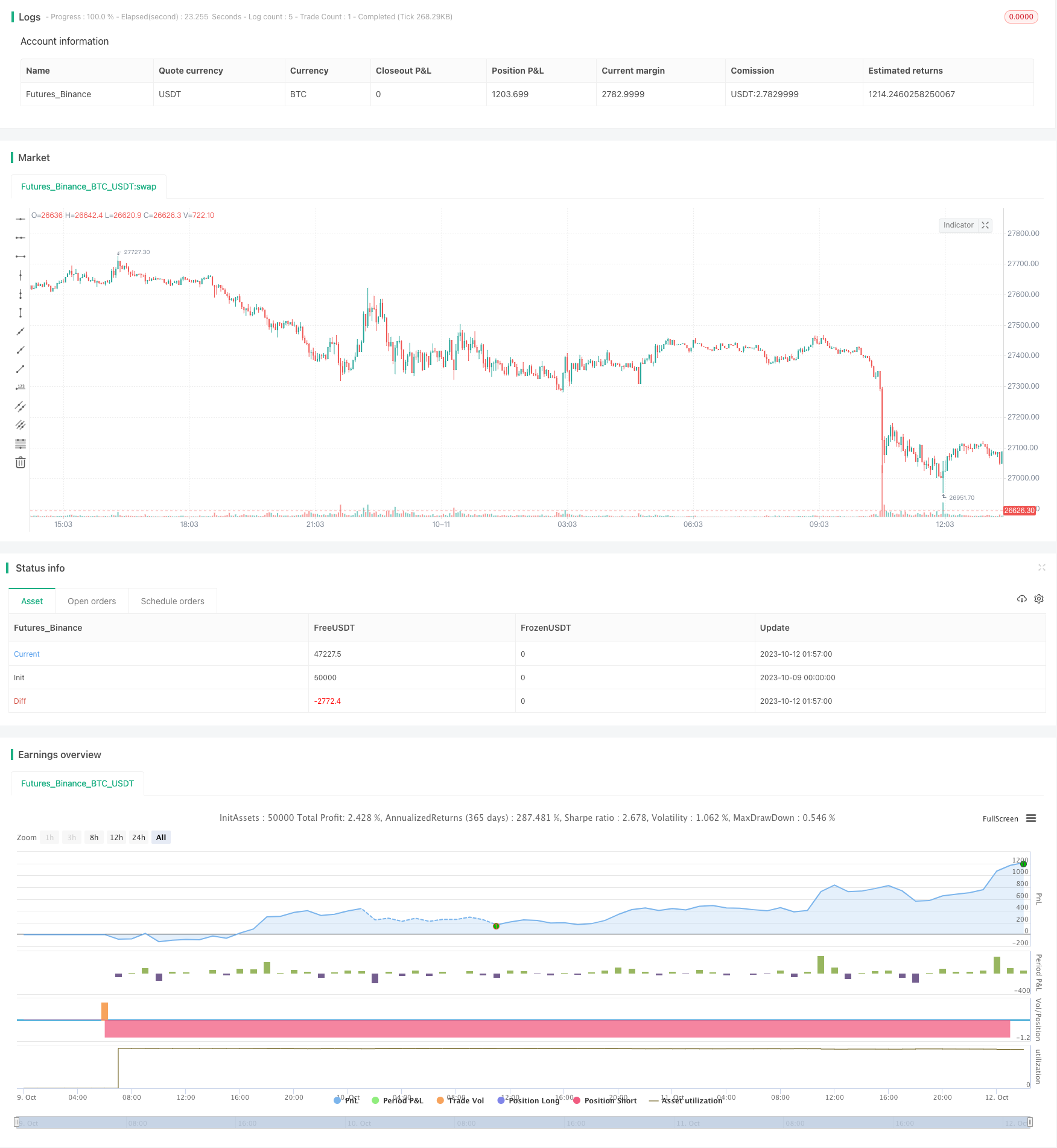

/*backtest

start: 2023-10-09 00:00:00

end: 2023-10-12 02:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy(title='Ultra Moving Average Rating Trend Strategy', overlay=true) //, pyramiding=1,initial_capital = 1000, default_qty_type= strategy.percent_of_equity, default_qty_value = 100, calc_on_order_fills=false, slippage=0,commission_type=strategy.commission.percent,commission_value=0.03)

// //

//==========DEMA

getDEMA(src, len) =>

dema = 2 * ta.ema(src, len) - ta.ema(ta.ema(src, len), len)

dema

//==========HMA

getHULLMA(src, len) =>

hullma = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

hullma

//==========KAMA

getKAMA(src, len, k1, k2) =>

change = math.abs(ta.change(src, len))

volatility = math.sum(math.abs(ta.change(src)), len)

efficiency_ratio = volatility != 0 ? change / volatility : 0

kama = 0.0

fast = 2 / (k1 + 1)

slow = 2 / (k2 + 1)

smooth_const = math.pow(efficiency_ratio * (fast - slow) + slow, 2)

kama := nz(kama[1]) + smooth_const * (src - nz(kama[1]))

kama

//==========TEMA

getTEMA(src, len) =>

e = ta.ema(src, len)

tema = 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

tema

//==========ZLEMA

getZLEMA(src, len) =>

zlemalag_1 = (len - 1) / 2

zlemadata_1 = src + src - src[zlemalag_1]

zlema = ta.ema(zlemadata_1, len)

zlema

//==========FRAMA

getFRAMA(src, len) =>

Price = src

N = len

if N % 2 != 0

N += 1

N

N1 = 0.0

N2 = 0.0

N3 = 0.0

HH = 0.0

LL = 0.0

Dimen = 0.0

alpha = 0.0

Filt = 0.0

N3 := (ta.highest(N) - ta.lowest(N)) / N

HH := ta.highest(N / 2 - 1)

LL := ta.lowest(N / 2 - 1)

N1 := (HH - LL) / (N / 2)

HH := high[N / 2]

LL := low[N / 2]

for i = N / 2 to N - 1 by 1

if high[i] > HH

HH := high[i]

HH

if low[i] < LL

LL := low[i]

LL

N2 := (HH - LL) / (N / 2)

if N1 > 0 and N2 > 0 and N3 > 0

Dimen := (math.log(N1 + N2) - math.log(N3)) / math.log(2)

Dimen

alpha := math.exp(-4.6 * (Dimen - 1))

if alpha < .01

alpha := .01

alpha

if alpha > 1

alpha := 1

alpha

Filt := alpha * Price + (1 - alpha) * nz(Filt[1], 1)

if bar_index < N + 1

Filt := Price

Filt

Filt

//==========VIDYA

getVIDYA(src, len) =>

mom = ta.change(src)

upSum = math.sum(math.max(mom, 0), len)

downSum = math.sum(-math.min(mom, 0), len)

out = (upSum - downSum) / (upSum + downSum)

cmo = math.abs(out)

alpha = 2 / (len + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

vidya

//==========JMA

getJMA(src, len, power, phase) =>

phase_ratio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, power)

MA1 = 0.0

Det0 = 0.0

MA2 = 0.0

Det1 = 0.0

JMA = 0.0

MA1 := (1 - alpha) * src + alpha * nz(MA1[1])

Det0 := (src - MA1) * (1 - beta) + beta * nz(Det0[1])

MA2 := MA1 + phase_ratio * Det0

Det1 := (MA2 - nz(JMA[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(Det1[1])

JMA := nz(JMA[1]) + Det1

JMA

//==========T3

getT3(src, len, vFactor) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

c1 = -1 * math.pow(vFactor, 3)

c2 = 3 * math.pow(vFactor, 2) + 3 * math.pow(vFactor, 3)

c3 = -6 * math.pow(vFactor, 2) - 3 * vFactor - 3 * math.pow(vFactor, 3)

c4 = 1 + 3 * vFactor + math.pow(vFactor, 3) + 3 * math.pow(vFactor, 2)

T3 = c1 * ema6 + c2 * ema5 + c3 * ema4 + c4 * ema3

T3

//==========TRIMA

getTRIMA(src, len) =>

N = len + 1

Nm = math.round(N / 2)

TRIMA = ta.sma(ta.sma(src, Nm), Nm)

TRIMA

//-------------- FUNCTIONS

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : up > down and up > 0 ? up : 0

minusDM = na(down) ? na : down > up and down > 0 ? down : 0

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adx

src = close

res = input.timeframe("", title="Indicator Timeframe")

// Ichimoku Cloud

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

ichimoku_cloud() =>

conversionLine = donchian(9)

baseLine = donchian(26)

leadLine1 = math.avg(conversionLine, baseLine)

leadLine2 = donchian(52)

[conversionLine, baseLine, leadLine1, leadLine2]

calcRatingMA(ma, src) => na(ma) or na(src) ? na : (ma == src ? 0 : ( ma < src ? 1 : -1 ))

calcRating(buy, sell) => buy ? 1 : ( sell ? -1 : 0 )

calcRatingAll() =>

//============== MA =================

SMA10 = ta.sma(close, 10)

SMA20 = ta.sma(close, 20)

SMA30 = ta.sma(close, 30)

SMA50 = ta.sma(close, 50)

SMA100 = ta.sma(close, 100)

SMA200 = ta.sma(close, 200)

EMA10 = ta.ema(close, 10)

EMA20 = ta.ema(close, 20)

EMA30 = ta.ema(close, 30)

EMA50 = ta.ema(close, 50)

EMA100 = ta.ema(close, 100)

EMA200 = ta.ema(close, 200)

ALMA10 = ta.alma(close, 10, 0.85, 6)

ALMA20 = ta.alma(close, 20, 0.85, 6)

ALMA50 = ta.alma(close, 50, 0.85, 6)

ALMA100 = ta.alma(close, 100, 0.85, 6)

ALMA200 = ta.alma(close, 200, 0.85, 6)

SMMA10 = ta.rma(close, 10)

SMMA20 = ta.rma(close, 20)

SMMA50 = ta.rma(close, 50)

SMMA100 = ta.rma(close, 100)

SMMA200 = ta.rma(close, 200)

LSMA10 = ta.linreg(close, 10, 0)

LSMA20 = ta.linreg(close, 20, 0)

LSMA50 = ta.linreg(close, 50, 0)

LSMA100 = ta.linreg(close, 100, 0)

LSMA200 = ta.linreg(close, 200, 0)

VWMA10 = ta.vwma(close, 10)

VWMA20 = ta.vwma(close, 20)

VWMA50 = ta.vwma(close, 50)

VWMA100 = ta.vwma(close, 100)

VWMA200 = ta.vwma(close, 200)

DEMA10 = getDEMA(close, 10)

DEMA20 = getDEMA(close, 20)

DEMA50 = getDEMA(close, 50)

DEMA100 =getDEMA(close, 100)

DEMA200 = getDEMA(close, 200)

HMA10 = ta.hma(close, 10)

HMA20 = ta.hma(close, 20)

HMA50 = ta.hma(close, 50)

HMA100 = ta.hma(close, 100)

HMA200 = ta.hma(close, 200)

KAMA10 = getKAMA(close, 10, 2, 30)

KAMA20 = getKAMA(close, 20, 2, 30)

KAMA50 = getKAMA(close, 50, 2, 30)

KAMA100 = getKAMA(close, 100, 2, 30)

KAMA200 = getKAMA(close, 200 , 2, 30)

FRAMA10 = getFRAMA(close, 10)

FRAMA20 = getFRAMA(close, 20)

FRAMA50 = getFRAMA(close, 50)

FRAMA100 =getFRAMA(close, 100)

FRAMA200 = getFRAMA(close, 200)

VIDMA10 = getVIDYA(close, 10)

VIDMA20 = getVIDYA(close, 20)

VIDMA50 = getVIDYA(close, 50)

VIDMA100 =getVIDYA(close, 100)

VIDMA200 = getVIDYA(close, 200)

JMA10 = getJMA(close, 10, 2, 50)

JMA20 = getJMA(close, 20, 2, 50)

JMA50 = getJMA(close, 50, 2, 50)

JMA100 =getJMA(close, 100, 2, 50)

JMA200 = getJMA(close, 200, 2, 50)

TEMA10 = getTEMA(close, 10)

TEMA20 = getTEMA(close, 20)

TEMA50 = getTEMA(close, 50)

TEMA100 =getTEMA(close, 100)

TEMA200 = getTEMA(close, 200)

ZLEMA10 = getZLEMA(close, 10)

ZLEMA20 = getZLEMA(close, 20)

ZLEMA50 = getZLEMA(close, 50)

ZLEMA100 =getZLEMA(close, 100)

ZLEMA200 = getZLEMA(close, 200)

TRIMA10 = getTRIMA(close, 10)

TRIMA20 = getTRIMA(close, 20)

TRIMA50 = getTRIMA(close, 50)

TRIMA100 =getTRIMA(close, 100)

TRIMA200 = getTRIMA(close, 200)

T3MA10 = getT3(close, 10, 0.7)

T3MA20 = getT3(close, 20, 0.7)

T3MA50 = getT3(close, 50, 0.7)

T3MA100 =getT3(close, 100, 0.7)

T3MA200 = getT3(close, 200, 0.7)

[IC_CLine, IC_BLine, IC_Lead1, IC_Lead2] = ichimoku_cloud()

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

PriceAvg = ta.ema(close, 50)

DownTrend = close < PriceAvg

UpTrend = close > PriceAvg

// calculate trading recommendation based on SMA/EMA

float ratingMA = 0

float ratingMAC = 0

float ratingSMA10 = na

if not na(SMA10)

ratingSMA10 := calcRatingMA(SMA10, close)

ratingMA := ratingMA + ratingSMA10

ratingMAC := ratingMAC + 1

float ratingSMA20 = na

if not na(SMA20)

ratingSMA20 := calcRatingMA(SMA20, close)

ratingMA := ratingMA + ratingSMA20

ratingMAC := ratingMAC + 1

float ratingSMA30 = na

if not na(SMA30)

ratingSMA30 := calcRatingMA(SMA30, close)

ratingMA := ratingMA + ratingSMA30

ratingMAC := ratingMAC + 1

float ratingSMA50 = na

if not na(SMA50)

ratingSMA50 := calcRatingMA(SMA50, close)

ratingMA := ratingMA + ratingSMA50

ratingMAC := ratingMAC + 1

float ratingSMA100 = na

if not na(SMA100)

ratingSMA100 := calcRatingMA(SMA100, close)

ratingMA := ratingMA + ratingSMA100

ratingMAC := ratingMAC + 1

float ratingSMA200 = na

if not na(SMA200)

ratingSMA200 := calcRatingMA(SMA200, close)

ratingMA := ratingMA + ratingSMA200

ratingMAC := ratingMAC + 1

float ratingEMA10 = na

if not na(EMA10)

ratingEMA10 := calcRatingMA(EMA10, close)

ratingMA := ratingMA + ratingEMA10

ratingMAC := ratingMAC + 1

float ratingEMA20 = na

if not na(EMA20)

ratingEMA20 := calcRatingMA(EMA20, close)

ratingMA := ratingMA + ratingEMA20

ratingMAC := ratingMAC + 1

float ratingEMA30 = na

if not na(EMA30)

ratingEMA30 := calcRatingMA(EMA30, close)

ratingMA := ratingMA + ratingEMA30

ratingMAC := ratingMAC + 1

float ratingEMA50 = na

if not na(EMA50)

ratingEMA50 := calcRatingMA(EMA50, close)

ratingMA := ratingMA + ratingEMA50

ratingMAC := ratingMAC + 1

float ratingEMA100 = na

if not na(EMA100)

ratingEMA100 := calcRatingMA(EMA100, close)

ratingMA := ratingMA + ratingEMA100

ratingMAC := ratingMAC + 1

float ratingEMA200 = na

if not na(EMA200)

ratingEMA200 := calcRatingMA(EMA200, close)

ratingMA := ratingMA + ratingEMA200

ratingMAC := ratingMAC + 1

///////////////////////////

float ratingALMA10 = na

if not na(ALMA10)

ratingALMA10 := calcRatingMA(ALMA10, close)

ratingMA := ratingMA + ratingALMA10

ratingMAC := ratingMAC + 1

float ratingALMA20 = na

if not na(ALMA20)

ratingALMA20 := calcRatingMA(ALMA20, close)

ratingMA := ratingMA + ratingALMA20

ratingMAC := ratingMAC + 1

float ratingALMA50 = na

if not na(ALMA50)

ratingALMA50 := calcRatingMA(ALMA50, close)

ratingMA := ratingMA + ratingALMA50

ratingMAC := ratingMAC + 1

float ratingALMA100 = na

if not na(ALMA100)

ratingALMA100 := calcRatingMA(ALMA100, close)

ratingMA := ratingMA + ratingALMA100

ratingMAC := ratingMAC + 1

float ratingALMA200 = na

if not na(ALMA200)

ratingALMA200 := calcRatingMA(ALMA200, close)

ratingMA := ratingMA + ratingALMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingSMMA10 = na

if not na(SMMA10)

ratingSMMA10 := calcRatingMA(SMMA10, close)

ratingMA := ratingMA + ratingSMMA10

ratingMAC := ratingMAC + 1

float ratingSMMA20 = na

if not na(SMMA20)

ratingSMMA20 := calcRatingMA(SMMA20, close)

ratingMA := ratingMA + ratingSMMA20

ratingMAC := ratingMAC + 1

float ratingSMMA50 = na

if not na(SMMA50)

ratingSMMA50 := calcRatingMA(SMMA50, close)

ratingMA := ratingMA + ratingSMMA50

ratingMAC := ratingMAC + 1

float ratingSMMA100 = na

if not na(SMMA100)

ratingSMMA100 := calcRatingMA(SMMA100, close)

ratingMA := ratingMA + ratingSMMA100

ratingMAC := ratingMAC + 1

float ratingSMMA200 = na

if not na(SMMA200)

ratingSMMA200 := calcRatingMA(SMMA200, close)

ratingMA := ratingMA + ratingSMMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingLSMA10 = na

if not na(LSMA10)

ratingLSMA10 := calcRatingMA(LSMA10, close)

ratingMA := ratingMA + ratingLSMA10

ratingMAC := ratingMAC + 1

float ratingLSMA20 = na

if not na(LSMA20)

ratingLSMA20 := calcRatingMA(LSMA20, close)

ratingMA := ratingMA + ratingLSMA20

ratingMAC := ratingMAC + 1

float ratingLSMA50 = na

if not na(LSMA50)

ratingLSMA50 := calcRatingMA(LSMA50, close)

ratingMA := ratingMA + ratingLSMA50

ratingMAC := ratingMAC + 1

float ratingLSMA100 = na

if not na(LSMA100)

ratingLSMA100 := calcRatingMA(LSMA100, close)

ratingMA := ratingMA + ratingLSMA100

ratingMAC := ratingMAC + 1

float ratingLSMA200 = na

if not na(LSMA200)

ratingLSMA200 := calcRatingMA(LSMA200, close)

ratingMA := ratingMA + ratingLSMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingVWMA10 = na

if not na(VWMA10)

ratingVWMA10 := calcRatingMA(VWMA10, close)

ratingMA := ratingMA + ratingVWMA10

ratingMAC := ratingMAC + 1

float ratingVWMA20 = na

if not na(VWMA20)

ratingVWMA20 := calcRatingMA(VWMA20, close)

ratingMA := ratingMA + ratingVWMA20

ratingMAC := ratingMAC + 1

float ratingVWMA50 = na

if not na(VWMA50)

ratingVWMA50 := calcRatingMA(VWMA50, close)

ratingMA := ratingMA + ratingVWMA50

ratingMAC := ratingMAC + 1

float ratingVWMA100 = na

if not na(VWMA100)

ratingVWMA100 := calcRatingMA(VWMA100, close)

ratingMA := ratingMA + ratingVWMA100

ratingMAC := ratingMAC + 1

float ratingVWMA200 = na

if not na(VWMA200)

ratingVWMA200 := calcRatingMA(VWMA200, close)

ratingMA := ratingMA + ratingVWMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingDEMA10 = na

if not na(DEMA10)

ratingDEMA10 := calcRatingMA(DEMA10, close)

ratingMA := ratingMA + ratingDEMA10

ratingMAC := ratingMAC + 1

float ratingDEMA20 = na

if not na(DEMA20)

ratingDEMA20 := calcRatingMA(DEMA20, close)

ratingMA := ratingMA + ratingDEMA20

ratingMAC := ratingMAC + 1

float ratingDEMA50 = na

if not na(DEMA50)

ratingDEMA50 := calcRatingMA(DEMA50, close)

ratingMA := ratingMA + ratingDEMA50

ratingMAC := ratingMAC + 1

float ratingDEMA100 = na

if not na(DEMA100)

ratingDEMA100 := calcRatingMA(DEMA100, close)

ratingMA := ratingMA + ratingDEMA100

ratingMAC := ratingMAC + 1

float ratingDEMA200 = na

if not na(DEMA200)

ratingDEMA200 := calcRatingMA(DEMA200, close)

ratingMA := ratingMA + ratingDEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingHMA10 = na

if not na(HMA10)

ratingHMA10 := calcRatingMA(HMA10, close)

ratingMA := ratingMA + ratingHMA10

ratingMAC := ratingMAC + 1

float ratingHMA20 = na

if not na(HMA20)

ratingHMA20 := calcRatingMA(HMA20, close)

ratingMA := ratingMA + ratingHMA20

ratingMAC := ratingMAC + 1

float ratingHMA50 = na

if not na(HMA50)

ratingHMA50 := calcRatingMA(HMA50, close)

ratingMA := ratingMA + ratingHMA50

ratingMAC := ratingMAC + 1

float ratingHMA100 = na

if not na(HMA100)

ratingHMA100 := calcRatingMA(HMA100, close)

ratingMA := ratingMA + ratingHMA100

ratingMAC := ratingMAC + 1

float ratingHMA200 = na

if not na(HMA200)

ratingHMA200 := calcRatingMA(HMA200, close)

ratingMA := ratingMA + ratingHMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingKAMA10 = na

if not na(KAMA10)

ratingKAMA10 := calcRatingMA(KAMA10, close)

ratingMA := ratingMA + ratingKAMA10

ratingMAC := ratingMAC + 1

float ratingKAMA20 = na

if not na(KAMA20)

ratingKAMA20 := calcRatingMA(KAMA20, close)

ratingMA := ratingMA + ratingKAMA20

ratingMAC := ratingMAC + 1

float ratingKAMA50 = na

if not na(KAMA50)

ratingKAMA50 := calcRatingMA(KAMA50, close)

ratingMA := ratingMA + ratingKAMA50

ratingMAC := ratingMAC + 1

float ratingKAMA100 = na

if not na(KAMA100)

ratingKAMA100 := calcRatingMA(KAMA100, close)

ratingMA := ratingMA + ratingKAMA100

ratingMAC := ratingMAC + 1

float ratingKAMA200 = na

if not na(KAMA200)

ratingKAMA200 := calcRatingMA(KAMA200, close)

ratingMA := ratingMA + ratingKAMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingFRAMA10 = na

if not na(FRAMA10)

ratingFRAMA10 := calcRatingMA(FRAMA10, close)

ratingMA := ratingMA + ratingFRAMA10

ratingMAC := ratingMAC + 1

float ratingFRAMA20 = na

if not na(FRAMA20)

ratingFRAMA20 := calcRatingMA(FRAMA20, close)

ratingMA := ratingMA + ratingFRAMA20

ratingMAC := ratingMAC + 1

float ratingFRAMA50 = na

if not na(FRAMA50)

ratingFRAMA50 := calcRatingMA(FRAMA50, close)

ratingMA := ratingMA + ratingFRAMA50

ratingMAC := ratingMAC + 1

float ratingFRAMA100 = na

if not na(FRAMA100)

ratingFRAMA100 := calcRatingMA(FRAMA100, close)

ratingMA := ratingMA + ratingFRAMA100

ratingMAC := ratingMAC + 1

float ratingFRAMA200 = na

if not na(FRAMA200)

ratingFRAMA200 := calcRatingMA(FRAMA200, close)

ratingMA := ratingMA + ratingFRAMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingVIDMA10 = na

if not na(VIDMA10)

ratingVIDMA10 := calcRatingMA(VIDMA10, close)

ratingMA := ratingMA + ratingVIDMA10

ratingMAC := ratingMAC + 1

float ratingVIDMA20 = na

if not na(VIDMA20)

ratingVIDMA20 := calcRatingMA(VIDMA20, close)

ratingMA := ratingMA + ratingVIDMA20

ratingMAC := ratingMAC + 1

float ratingVIDMA50 = na

if not na(VIDMA50)

ratingVIDMA50 := calcRatingMA(VIDMA50, close)

ratingMA := ratingMA + ratingVIDMA50

ratingMAC := ratingMAC + 1

float ratingVIDMA100 = na

if not na(VIDMA100)

ratingVIDMA100 := calcRatingMA(VIDMA100, close)

ratingMA := ratingMA + ratingVIDMA100

ratingMAC := ratingMAC + 1

float ratingVIDMA200 = na

if not na(VIDMA200)

ratingVIDMA200 := calcRatingMA(VIDMA200, close)

ratingMA := ratingMA + ratingVIDMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingJMA10 = na

if not na(JMA10)

ratingJMA10 := calcRatingMA(JMA10, close)

ratingMA := ratingMA + ratingJMA10

ratingMAC := ratingMAC + 1

float ratingJMA20 = na

if not na(JMA20)

ratingJMA20 := calcRatingMA(JMA20, close)

ratingMA := ratingMA + ratingJMA20

ratingMAC := ratingMAC + 1

float ratingJMA50 = na

if not na(JMA50)

ratingJMA50 := calcRatingMA(JMA50, close)

ratingMA := ratingMA + ratingJMA50

ratingMAC := ratingMAC + 1

float ratingJMA100 = na

if not na(JMA100)

ratingJMA100 := calcRatingMA(JMA100, close)

ratingMA := ratingMA + ratingJMA100

ratingMAC := ratingMAC + 1

float ratingJMA200 = na

if not na(JMA200)

ratingJMA200 := calcRatingMA(JMA200, close)

ratingMA := ratingMA + ratingJMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingTEMA10 = na

if not na(TEMA10)

ratingTEMA10 := calcRatingMA(TEMA10, close)

ratingMA := ratingMA + ratingTEMA10

ratingMAC := ratingMAC + 1

float ratingTEMA20 = na

if not na(TEMA20)

ratingTEMA20 := calcRatingMA(TEMA20, close)

ratingMA := ratingMA + ratingTEMA20

ratingMAC := ratingMAC + 1

float ratingTEMA50 = na

if not na(TEMA50)

ratingTEMA50 := calcRatingMA(TEMA50, close)

ratingMA := ratingMA + ratingTEMA50

ratingMAC := ratingMAC + 1

float ratingTEMA100 = na

if not na(TEMA100)

ratingTEMA100 := calcRatingMA(TEMA100, close)

ratingMA := ratingMA + ratingTEMA100

ratingMAC := ratingMAC + 1

float ratingTEMA200 = na

if not na(TEMA200)

ratingTEMA200 := calcRatingMA(TEMA200, close)

ratingMA := ratingMA + ratingTEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingZLEMA10 = na

if not na(ZLEMA10)

ratingZLEMA10 := calcRatingMA(ZLEMA10, close)

ratingMA := ratingMA + ratingZLEMA10

ratingMAC := ratingMAC + 1

float ratingZLEMA20 = na

if not na(ZLEMA20)

ratingZLEMA20 := calcRatingMA(ZLEMA20, close)

ratingMA := ratingMA + ratingZLEMA20

ratingMAC := ratingMAC + 1

float ratingZLEMA50 = na

if not na(ZLEMA50)

ratingZLEMA50 := calcRatingMA(ZLEMA50, close)

ratingMA := ratingMA + ratingZLEMA50

ratingMAC := ratingMAC + 1

float ratingZLEMA100 = na

if not na(ZLEMA100)

ratingZLEMA100 := calcRatingMA(ZLEMA100, close)

ratingMA := ratingMA + ratingZLEMA100

ratingMAC := ratingMAC + 1

float ratingZLEMA200 = na

if not na(ZLEMA200)

ratingZLEMA200 := calcRatingMA(ZLEMA200, close)

ratingMA := ratingMA + ratingZLEMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

///////////////////////////

float ratingTRIMA10 = na

if not na(TRIMA10)

ratingTRIMA10 := calcRatingMA(TRIMA10, close)

ratingMA := ratingMA + ratingTRIMA10

ratingMAC := ratingMAC + 1

float ratingTRIMA20 = na

if not na(TRIMA20)

ratingTRIMA20 := calcRatingMA(TRIMA20, close)

ratingMA := ratingMA + ratingTRIMA20

ratingMAC := ratingMAC + 1

float ratingTRIMA50 = na

if not na(TRIMA50)

ratingTRIMA50 := calcRatingMA(TRIMA50, close)

ratingMA := ratingMA + ratingTRIMA50

ratingMAC := ratingMAC + 1

float ratingTRIMA100 = na

if not na(TRIMA100)

ratingTRIMA100 := calcRatingMA(TRIMA100, close)

ratingMA := ratingMA + ratingTRIMA100

ratingMAC := ratingMAC + 1

float ratingTRIMA200 = na

if not na(TRIMA200)

ratingTRIMA200 := calcRatingMA(TRIMA200, close)

ratingMA := ratingMA + ratingTRIMA200

ratingMAC := ratingMAC + 1

/////////////////////////

///////////////////////////

float ratingT3MA10 = na

if not na(T3MA10)

ratingT3MA10 := calcRatingMA(T3MA10, close)

ratingMA := ratingMA + ratingT3MA10

ratingMAC := ratingMAC + 1

float ratingT3MA20 = na

if not na(T3MA20)

ratingT3MA20 := calcRatingMA(T3MA20, close)

ratingMA := ratingMA + ratingT3MA20

ratingMAC := ratingMAC + 1

float ratingT3MA50 = na

if not na(T3MA50)

ratingT3MA50 := calcRatingMA(T3MA50, close)

ratingMA := ratingMA + ratingT3MA50

ratingMAC := ratingMAC + 1

float ratingT3MA100 = na

if not na(T3MA100)

ratingT3MA100 := calcRatingMA(T3MA100, close)

ratingMA := ratingMA + ratingT3MA100

ratingMAC := ratingMAC + 1

float ratingT3MA200 = na

if not na(T3MA200)

ratingT3MA200 := calcRatingMA(T3MA200, close)

ratingMA := ratingMA + ratingT3MA200

ratingMAC := ratingMAC + 1

//////////////////////////////////////////

float ratingIC = na

if not (na(IC_Lead1) or na(IC_Lead2) or na(close) or na(close[1]) or na(IC_BLine) or na(IC_CLine))

ratingIC := calcRating(

IC_Lead1 > IC_Lead2 and close > IC_Lead1 and close < IC_BLine and close[1] < IC_CLine and close > IC_CLine,

IC_Lead2 > IC_Lead1 and close < IC_Lead2 and close > IC_BLine and close[1] > IC_CLine and close < IC_CLine)

if not na(ratingIC)

ratingMA := ratingMA + ratingIC

ratingMAC := ratingMAC + 1

ratingMA := ratingMAC > 0 ? ratingMA / ratingMAC : na

float ratingTotal = 0

float ratingTotalC = 0

if not na(ratingMA)

ratingTotal := ratingTotal + ratingMA

ratingTotalC := ratingTotalC + 1

ratingTotal := ratingTotalC > 0 ? ratingTotal / ratingTotalC : na

[ratingTotal, ratingMA]

getSignal2(ratingTotal, ratingMA) =>

float _res = ratingTotal

_res := ratingMA

[ratingTotal, ratingMA] = request.security(syminfo.tickerid, res, calcRatingAll())

tradeSignal = getSignal2(ratingTotal, ratingMA)

rating_entry = input.float(0.95, title='Rating for long', group="Entry Rating %", step=0.05)

rating_exit = input.float(0.75, title='Rating for short', group="Entry Rating %", step=0.05) * -1

long = tradeSignal >= rating_entry

short = tradeSignal <= rating_exit

strategy.entry("long",strategy.long,when=long)

strategy.entry('short',strategy.short,when=short)