Doppelte Bestätigungs-Breakout-Strategie

Überblick

Die Strategie kombiniert das 4-Stunden-Zeit- und das Sonnenlicht-Zeit-Break-Signal und überprüft die K-Linie-Form, bevor ein Handelssignal ausgegeben wird, um eine zuverlässigere Strategie für den Durchbruch zu ermöglichen.

Strategieprinzip

Die Dual-Confirmation-Breakthrough-Strategie identifiziert die effektiveren Breakout-Punkte durch die Kombination von Breakout-Signalen aus kurzen und langen Perioden unter Berücksichtigung der Konsistenz der langen und kurzen Perioden. Insbesondere berechnet die Strategie die Durchschnittswerte für die 4-Stunden- und Tageszeitperioden separat. Wenn der Durchschnitt der kurzen Perioden den Durchschnitt der langen Perioden durchbricht, erzeugt dies ein Kaufsignal, während der umgekehrte Durchbruch ein Verkaufsignal erzeugt.

Durch die oben genannten Mechanismen der Doppelbestätigung und der K-Leitung-Filterung kann das Risiko von Mehrkopf-Stopp oder Leerkopf-Einschließung effektiv vermieden und die Qualität des Handelssignals verbessert werden.

Analyse der Stärken

Die Kombination von 4 Stunden und Tageszeiten verbessert die Signalqualität, indem die Doppel-Zeit-Zyklus-Breakage den Vorteil bietet, sowohl kurzfristige Trends als auch langfristige Trends zu verfolgen.

K-Linienformprüfung, um Fehlsignale zu vermeiden. Vor dem Senden des Signals kann die Formel überprüft werden, um einige falsche Durchbrüche oder auslösende Durchbrüche zu filtern, um Verluste zu vermeiden.

Automatische Optimierung, Flexibilität und Komfort. Die Durchbruchparameter und die Zyklusparameter der Strategie können individuell eingestellt werden. Der Benutzer kann die optimale Kombination von Parametern für verschiedene Handelsarten und Märkte auswählen.

Risikoanalyse

Die Doppel-Breakout-Strategie hat eine schwache Fähigkeit, den Trend bei einem stürmischen Absturz zu verfolgen. Die Strategie kann einen optimalen Vorteil verpassen, wenn sowohl der kurze als auch der lange Zeitraum stark sind.

K-Line-Verifizierungsmechanismen können einige Chancen verpassen. In extremen Situationen wird die K-Line häufig verzerrt, und die Verifizierungsmechanismen machen die Strategie konservativ und verpassen bestimmte Chancen.

Unangemessene Parameter führen auch zu falschen Signalen. Der Benutzer muss die richtigen Doppel-Durchbruch- und K-Linien-Parameter für die jeweilige Sorte auswählen. Unangemessene Parameter beeinträchtigen die Strategie.

Die oben genannten Risiken können durch Anpassung der Parameterkombinationen, Einstellung von Stop-Loss-Behindernissen usw. verbessert und optimiert werden.

Optimierungsrichtung

In Kombination mit der Schwankungsrate wird der Durchbruch zweimal verifiziert. Das Durchbruchsignal, das beispielsweise bei der Expression der Bollinger Bands ausgegeben wird, ist von höherer Qualität.

Hinzugefügt wird ein Stop-Loss-Modul. Die richtige Stop-Loss-Einstellung kann Gewinne sichern und Risiken aktiv vermeiden.

Optimierung der doppelten Durchbruchparameter. Die Parameter können an Merkmale der Sorte wie Tagesfluktuation, Tagelinie-Flüchtungsrate angepasst werden.

Optimierung der Parameter der K-Line-Prüfung. K-Line-Prüfung mit unterschiedlichen Perioden und Parameterkombinationen kann zu stabileren Ergebnissen führen.

Zusammenfassen

Die Doppelbestätigungs-Breakthrough-Strategie, die eine effektive Balance zwischen Kapital-Effizienz und Signalqualität durch die Kombination von Doppelzeit- und K-Linien-Form-Verifizierungsmechanismen erzielt, ist eine empfehlenswerte Short-Line-Breakthrough-Strategie. Der Benutzer kann die entsprechenden Parameter entsprechend seiner Bedürfnisse anpassen, um bessere Ergebnisse zu erzielen.

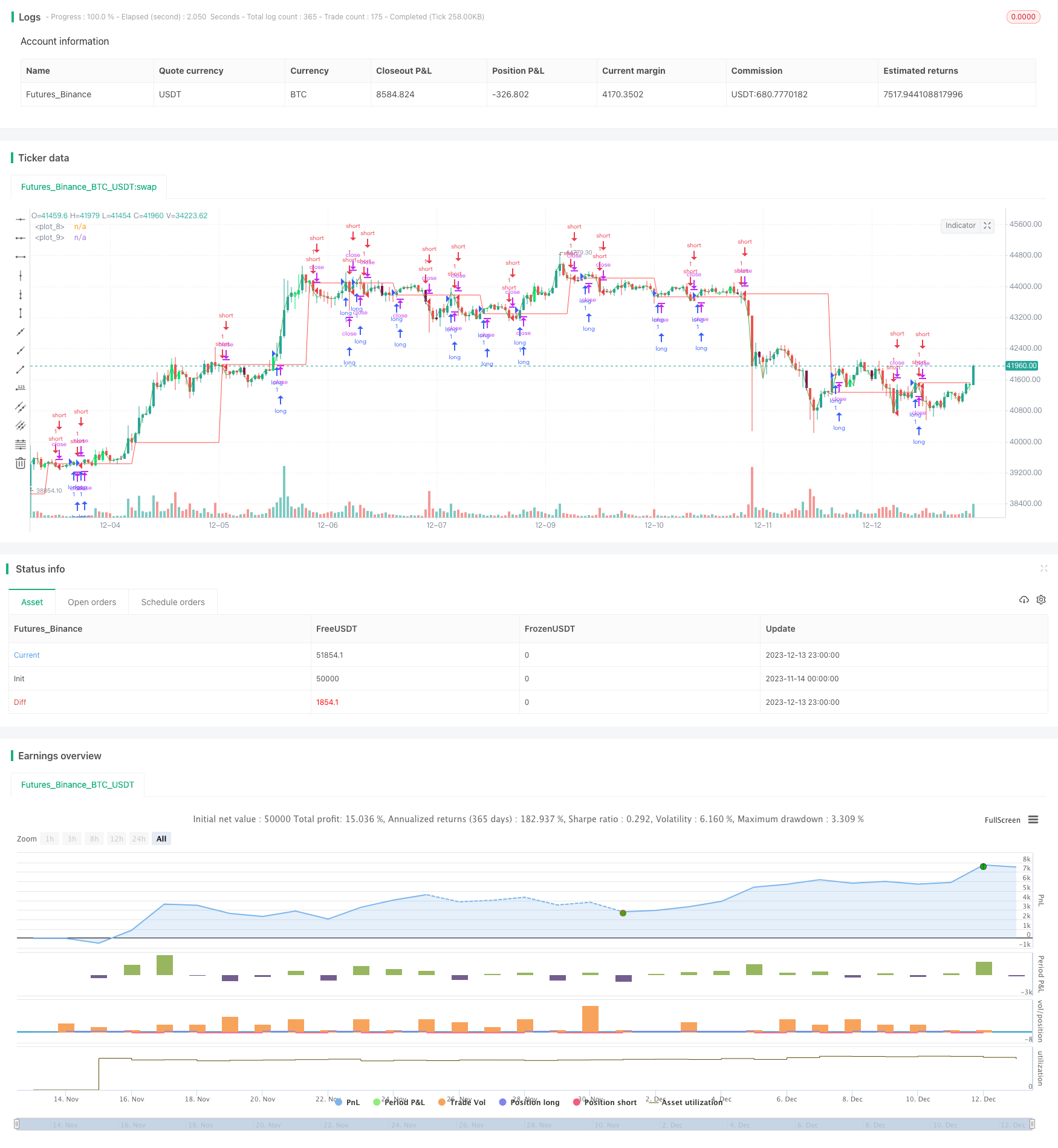

/*backtest

start: 2023-11-14 00:00:00

end: 2023-12-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("breakout ", overlay=true)

tim=input('1440')

sim=input('370')

out1 = request.security(syminfo.tickerid, tim, open)

out2 = request.security(syminfo.tickerid, sim, close)

plot(out1,color=red)

plot(out2,color=green)

length = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=bool)

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range1 = useTrueRange ? tr : (high - low)

rangema = sma(range1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)),lengthKC,0)

bcolor = iff( val > 0,iff( val > nz(val[1]), lime, green),iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : gray

//plot(val, color=bcolor, style=histogram, linewidth=4)

//plot(0, color=scolor, style=cross, linewidth=2)

// this section based on Almost Zero Lag EMA [LazyBear]

// Fast MA - type, length

matype = input(defval="HullMA", title="Fast MA Type: SMA, EMA, WMA, VWMA, SMMA, DEMA, TEMA, HullMA, TMA, ZEMA ( case sensitive )")

malength = input(defval=20, title="Moving Average Length", minval=1)

src = input(close,title="Moving average Source")

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = wma(src, len) // Weighted

v4 = vwma(src, len) // Volume Weighted

v5 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v6 = 2 * v2 - ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2) // Zero Lag Exponential

v11 = sma(sma(src,len),len) // Trianglular

// return variant, defaults to SMA if input invalid.

type=="EMA"?v2 : type=="WMA"?v3 : type=="VWMA"?v4 : type=="SMMA"?v5 : type=="DEMA"?v6 : type=="TEMA"?v7 : type=="HullMA"?v8 : type=="ZEMA"?v10 : type=="TMA"?v11 : v1

// Calculate selected MA and get direction of trend from it.

zlema= variant(matype,src,malength)

col = zlema > zlema[1] ? green : red

up = zlema > zlema[1] ? 1 : 0

down = zlema < zlema[1] ? 1 : 0

//plot(zlema,color=col, style=line, linewidth=4, transp=0)

// Find all Fractals.

// This section based on [RS]Fractal Levels by RicardoSantos

hidefractals = input(false)

hidelevels = input(false)

topfractal = high[2] > high[1] and high[2] > high and high[2] > high[3] and high[2] > high[4]

botfractal = low[2] < low[1] and low[2] < low and low[2] < low[3] and low[2] < low[4]

//plotshape(hidefractals ? na : topfractal, color=green, transp=0, style=shape.triangleup, location=location.abovebar, offset=-2, size=size.tiny)

//plotshape(hidefractals ? na : botfractal, color=red, transp=0, style=shape.triangledown, location=location.belowbar, offset=-2, size=size.tiny)

topfractals = topfractal ? high[2] : topfractals[1]

botfractals = botfractal ? low[2] : botfractals[1]

topfcolor = topfractals != topfractals[1] ? na : green

botfcolor = botfractals != botfractals[1] ? na : red

//plot(hidelevels ? na : topfractals, color=topfcolor, transp=0, linewidth=2)

//plot(hidelevels ? na : botfractals, color=botfcolor, transp=0, linewidth=2)

//

// This section based on Candlestick Patterns With EMA by rmwaddelljr

//

ufb = input(false, title="Use Fractal S/R Cross Patterns")

udc = input(true, title="Use Dark Cloud Cover Patterns" )

upl = input(true, title="Use Piecing Line Patterns" )

ube = input(true, title="Use Engulfing Candle Patterns" )

ubh = input(true, title="Use Harami Candle Patterns" )

upb = input(true, title="Use Defined PinBar Patterns")

pctP = input(66, minval=1, maxval=99, title="Directional PBars, % of Range of Candle the Long Wick Has To Be")

// This section based on CM_Price-Action-Bars by ChrisMoody

// Change the pin bar calculation, so can be used for market direction.

urpb= input(false, title="Use CM Price Action Reversal Pin Bars")

usb = input(false, title="Use CM Price Action Shaved Bars")

uob = input(false, title="Use CM Price Action Outside Bars")

uib = input(false, title="Use CM Price Action Inside Bars")

pctRP = input(72, minval=1, maxval=99, title="CM Reversal PBars, % of Range of Candle the Long Wick Has To Be")

pctS = input(5, minval=1, maxval=99, title="CM Shaved Bars, % of Range it Has To Close On The Lows or Highs")

pblb =input(6,minval=1,title="CM Reversal Pin Bar Lookback Length")

//

stnd = input(true, title="Alert Only Patterns Following Trend")

//

// Get MACD for Alert Filtering

umacd = input(true,title="Alert Only Patterns Confirmed by MACD")

fastMA = input(title="MACD Fast MA Length", defval = 12, minval = 2)

slowMA = input(title="MACD Slow MA Length", defval = 26, minval = 7)

signal = input(title="MACD Signal Length",defval=9,minval=1)

//

sgb = input(false, title="Check Box To Turn Bars Gray")

salc = input(true, title="Show Alert condition Dot")

//

[currMacd,_,_] = macd(close[0], fastMA, slowMA, signal)

[prevMacd,_,_] = macd(close[1], fastMA, slowMA, signal)

plotColor = currMacd > 0 ? currMacd > prevMacd ? green : red : currMacd < prevMacd ? red : green

// Show alert on this bar?

sbarUp = (not umacd or plotColor == green) and (not stnd or up)

sbarDn = (not umacd or plotColor == red) and (not stnd or down)

//PBar Percentages

pctCp = pctP * .01

//Shaved Bars Percentages

pctCs = pctS * .01

pctSPO = pctCs

//ma50 = sma(close,50)

range = high - low

///Reversal PinBars

pctCRp = pctRP * .01

pctCRPO = 1 - pctCRp

//

//pBarRUp= upb and open<close and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

//pBarRDn = upb and open>close and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

pBarRUp = urpb and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

pBarRDn = urpb and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

//Shaved Bars filter to the MA50 line

sBarUp = usb and (close >= (high - (range * pctCs))) // and close>ma50

sBarDown = usb and (close <= (low + (range * pctCs))) // and close<ma50

//Inside Bars

insideBarUp = uib and (high < high[1] and low > low[1])

insideBarDn = uib and (high < high[1] and low > low[1])

outsideBarUp= uob and (high > high[1] and low < low[1])

outsideBarDn= uob and (high > high[1] and low < low[1])

// PinBars representing possible change in trend direction

barcolor(pBarRUp ? green : na)

barcolor(pBarRDn ? red : na)

//Shaved Bars

barcolor(sBarDown ? fuchsia : na)

barcolor(sBarUp ? aqua : na)

//Inside and Outside Bars

barcolor((insideBarUp or insideBarDn)? yellow : na )

barcolor((outsideBarUp or outsideBarDn) ? orange : na )

//Long shadow PinBars supporting market direction

///PinBars Long Upper Shadow represent selling pressure

pBarDn = upb and open < high - (range * pctCp) and close < high - (range * pctCp)

//plotshape(pBarDn and (not pBarRUp and not pBarRDn), title= "Bearish Pin Bar", color=red, style=shape.arrowdown, text="Bearish\nPinBar")

///PinBars with Long Lower Shadow represent buying pressure

pBarUp = upb and open > low + (range * pctCp) and close > low + (range * pctCp)

//plotshape(pBarUp and (not pBarRUp and not pBarRDn), title= "Bullish Pin Bar", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nPinBar")

dcc = udc and (close[1]>open[1] and abs(close[1]-open[1])/range[1]>=0.7 and close<open and abs(close-open)/range>=0.7 and open>=close[1] and close>open[1] and close<((open[1]+close[1])/2))

//plotshape(dcc, title="Dark Cloud Cover",text='DarkCloud\nCover',color=red, style=shape.arrowdown,location=location.abovebar)

ts = timestamp(2021,8,1,8,18)

pln= upl and (close[1]<open[1] and abs(open[1]-close[1])/range[1]>=0.7 and close>open and abs(close-open)/range>=0.7 and open<=close[1] and close<open[1] and close>((open[1]+close[1])/2))

//plotshape(pln, title="Piercieng Line",text="Piercing\nLine",color=green, style=shape.arrowup,location=location.belowbar)

beh = ubh and (close[1] > open[1] and open > close and open <= close[1] and low >= open[1] and open - close < close[1] - open[1] and (high < high[1] and low > low[1]))

//plotshape(beh and not dcc, title= "Bearish Harami", color=red, style=shape.arrowdown, text="Bear\nHarami")

blh = ubh and (open[1] > close[1] and close > open and close <= open[1] and high <= open[1] and close - open < open[1] - close[1] and (high < high[1] and low > low[1]))

//plotshape(blh and not pln, title= "Bullish Harami", location=location.belowbar, color=green, style=shape.arrowup, text="Bull\nHarami")

bee = ube and (close[1] > open[1] and close < open and close<=low[1] and open>= close[1])

//plotshape(bee, title= "Bearish Engulfing", color=red, style=shape.arrowdown, text="Bearish\nEngulf")

ble = ube and (close[1] < open[1] and close > open and close >= high[1] and open<=close[1])

//plotshape(ble, title= "Bullish Engulfing", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nEngulf")

blfr = ufb and crossover(close,topfractals)

//plotshape(blfr and not ble and not blh and not sBarUp, title= "Bullish Fractal Cross", location=location.belowbar, color=green, style=shape.arrowup, text="Fractal\nCross")

befr = ufb and crossunder(close,botfractals)

//plotshape(befr and not bee and not beh and not sBarDown, title= "Bearish Fractal Cross", color=red, style=shape.arrowdown, text="Fractal\nCross")

//

//

bcolorDn = sbarDn and not(pBarRDn or pBarRUp or sBarDown or insideBarDn or outsideBarDn) and (beh or bee or dcc or befr or pBarDn)

bcolorUp = sbarUp and not(pBarRDn or pBarRUp or sBarUp or insideBarUp or outsideBarUp) and (blh or ble or pln or blfr or pBarUp)

barcolor(bcolorDn ? maroon : na)

barcolor(bcolorUp ? lime : na)

//

barcolor(sgb and close ? gray : na)

bullcnd = pBarUp or pln or blh or ble or blfr

bearcnd = pBarDn or dcc or beh or bee or befr

if(true )

longCondition = crossover(out2,out1)

if(longCondition or close > out1 and bullcnd and strategy.position_size == 0)

strategy.entry("long", strategy.long)

//if (pBarRUp) // and bullcnd) //and strategy.position_size == 0)

// strategy.entry("long", strategy.long)

shortCondition = crossunder(out2,out1)

if (shortCondition or close < out1 and bearcnd and strategy.position_size == 0)

strategy.entry("short", strategy.short)

//

barAlertDn = (sbarDn and (befr or bee or beh or pBarDn or dcc)) or (sbarDn and (insideBarDn or outsideBarDn or sBarDown)) or pBarRDn

barAlertUp = (sbarUp and (blfr or ble or blh or pBarUp or pln)) or (sbarUp and (insideBarUp or outsideBarUp or sBarUp)) or pBarRUp

barAlert = barAlertDn or barAlertUp

alertcondition(barAlert,title="CDLTRD Alert", message="CDLTRD Bar Alert")

// show only when alert condition is met and bar closed.

//plotshape(salc and barAlert[1],title= "Alert Indicator Closed", location=location.bottom, color=barAlertDn[1]?red:green, transp=0, style=shape.circle,offset=-1)

//EOF

//if (pBarRDn) //and bearcnd//and strategy.position_size == 0)

// strategy.entry("short", strategy.short)

//strategy.close("long", when = exit)

//strategy.close("short", when = exit2)

//exit3 = sqzOn and sqzOn[1] and sqzOn[2] and sqzOn[3] and sqzOn[4] and sqzOn[5] and sqzOn[6]

//strategy.close("long", when = exit3)

//strategy.close("short", when = exit3)

//else

// alertcondition(condition = time > t, message = "Time exceeded")