Adaptive Fibonacci Swing Trading Strategie mit mehreren Zeitrahmen

Überblick

Die Fibonacci-Band-Trading-Strategie ist eine Trend-Tracking-Strategie, die sich aus der Adaptive-Mittellinie, dem Stochastic RSI-Indikator und den Fibonacci-Rücktrittszonen zusammensetzt. Die Strategie verwendet mehrere Indikatoren, um die Entwicklung der Märkte auf verschiedenen Ebenen zu analysieren und die Positionen dynamisch anzupassen.

Strategieprinzip

Die Fibonacci-Band-Trading-Strategie kombiniert die folgenden technischen Indikatoren und Mechanismen:

Adaptive Moving Averages (SMA und WMA): Berechnung von Adaptive Moving Averages für Preise in verschiedenen Perioden (Minuten, Stunden, Tageszeiten usw.). Die Richtung der Tendenz wird anhand der Leerheit der Durchschnittslinie bestimmt.

Stochastic RSI: Berechnung des Stochastic-Werts des RSI-Indikators, um zu beurteilen, ob der RSI überkauft oder überverkauft ist.

Fibonacci-Rückzugszonen: Fibonacci-Rückzugszonen nach den jüngsten Swing-Highs und Swing-Lows zu erstellen, mit optionalen Kauf- und Verkaufspunkten. Diese Zonen sind von potenziellen Trendumkehrungen und Rückschlägen geprägt.

Positionsverwaltung: Dynamische Anpassung der Positionen an die starken und schwachen Signale des Stoch RSI und der adaptiven Durchschnittslinie

Die Strategie beginnt damit, die Richtung des Trends zu ermitteln und einen Kauf- und Verkaufsposten zu erstellen, wenn der Aktienkurs in die Fibonacci-Widerrufszone eintritt. Wenn die Adaptive-Gleichgewicht- und Stoch-RSI ein Eintrittssignal geben, wird der Auftrag in der Nähe des Kauf- und Verkaufsponts ausgeführt. Der Stop-Loss wird außerhalb der Widerrufszone eingestellt, um das Risiko zu kontrollieren.

Analyse der Stärken

Eine Fibonacci-Band-Trading-Strategie, die sich an mehrere Zeitrahmen anpasst, hat folgende Vorteile:

Mehrfache Zeitrahmenanalyse: Beurteilung mehrerer Periodenebenen gleichzeitig (Minuten, Stunden, Tagesscheiben), um die Trends umfassender zu beurteilen

Dynamisches Positionsmanagement: Positionsanpassung und Risikokontrolle.

Die Fibonacci-Region kann verwendet werden, um kurzfristige Trendwende zu erfassen.

Strenge Stop-Losses: Die Stop-Loss-Einstellungen in den Rückzugszonen verhindern erhebliche Verluste.

Signalfilter: Nur in der Nähe von ausgewählten Kauf- und Verkaufspunkten handeln, um falsche Durchbrüche zu vermeiden.

Die Optimierung der Parameter ist groß: Viele Eingabeparameter können an den Markt angepasst werden, um die Strategie zu optimieren.

Risikoanalyse

Diese Strategie birgt folgende Risiken:

Rückzug Zone Ausfallrisiko: Die Preise nicht Fibonacci-Zone oder Zone Ausfall zu berühren, kann nicht Lager zu bauen. Kann durch die Erweiterung der Zone umfassen, erhöhen die Anzahl der Gebiete zu mildern.

Stoppschaden-Tracking-Risiken: Stoppschaden-Static-Einstellungen, die möglicherweise vorher getroffen werden können. Optimierung kann durch mechanische Stoppschaden, Reserve-Stoppschaden-Bereiche usw. durchgeführt werden.

Gefahr eines False-Breakings: Anpassung an die Durchschnittslinie, Stoch RSI, gelegentliche False-Signale, die zu unnötigen Transaktionen führen. Die False-Breakings können angemessen gefiltert werden, um die Wahrscheinlichkeit eines False-Breakings zu verringern.

Zu komplizierte Risiken: Die Verwendung einer Kombination aus verschiedenen Parametern und technischen Indikatoren erhöht die Komplexität der Strategie. Die Optimierung und das Testen sind schwieriger.

Optimierungsrichtung

Die Fibonacci-Band-Trading-Strategie, die sich an mehrere Zeitrahmen anpasst, kann in folgenden Dimensionen weiter optimiert werden:

Test mehr Aktien- und Devisenvarianten, um die Strategie zu beurteilen. Anpassung der Parameter an die verschiedenen Märkte.

Erhöhung der Signalfiltermechanismen, Verringerung der Wahrscheinlichkeit von Falschsignalen und Verbesserung des Signal-Noise-Verhältnisses.

Testen und vergleichen Sie die Effektivität von Parametern für verschiedene Arten von Moving Averages.

Versuchen Sie, den festen Stop in einen Tracking-Stop oder einen Reserve-Stop-Bereich zu ändern, um die Effektivität der Strategie zu verbessern.

Versuchen Sie es mit Breakout-Signalen oder Trend-Tracking-Mechanismen und entwerfen Sie eine langfristige Profitstrategie.

Zusammenfassen

Die Fibonacci-Band-Trading-Strategie, die sich an mehrere Zeitrahmen anpasst, nutzt eine Vielzahl von Analysewerkzeugen, um Trends zu identifizieren und Positionen in den Rücklaufzeiten zu platzieren. Strenge Stop-Loss- und Risikokontrollmechanismen helfen, Gewinne in großen Trends zu optimieren. Die Strategie verfügt über einen größeren Anpassungsraum und eine Optimierungsrichtung und wird nach entsprechender Einstellung und Aktualisierung zu einer stabilen und zuverlässigen quantitativen Handelsstrategie werden.

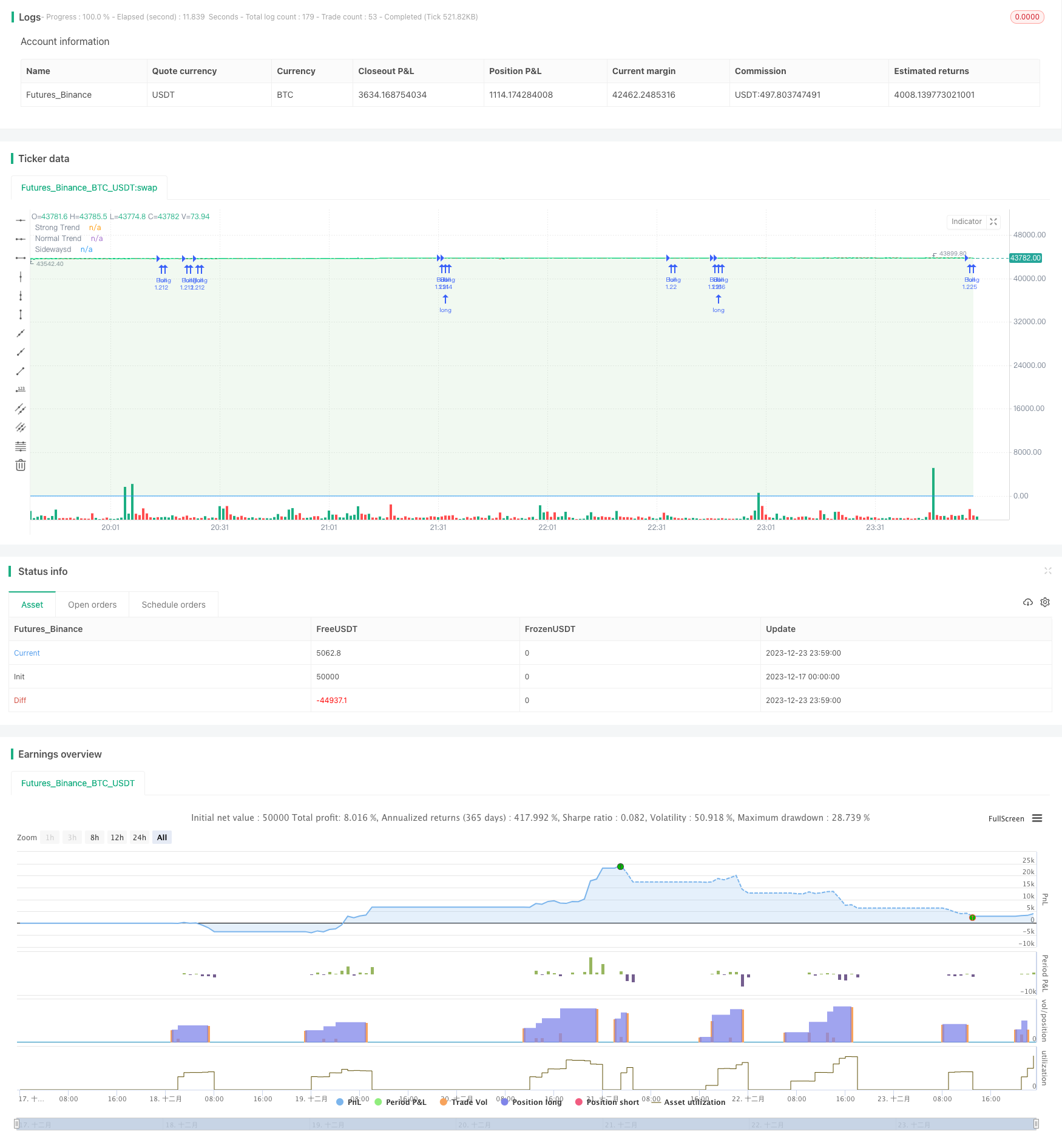

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © imal_max

//@version=5

strategy(title="Auto Fib Golden Pocket Band - Autofib Moving Average", shorttitle="Auto Fib Golden Pocket Band", overlay=true, pyramiding=15, process_orders_on_close=true, calc_on_every_tick=true, initial_capital=10000, currency = currency.USD, default_qty_value=100, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.05, slippage=2)

//indicator("Auto Fib Golden Pocket Band - Autofib Moving Average", overlay=true, shorttitle="Auto Fib Golden Pocket Band", timeframe""")

// Fibs

// auto fib ranges

// fib band Strong Trend

enable_StrongBand_Bull = input.bool(title='enable Upper Bullish Band . . . Fib Level', defval=true, group='══════ Strong Trend Levels ══════', inline="0")

select_StrongBand_Fib_Bull = input.float(0.236, title=" ", options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="0")

enable_StrongBand_Bear = input.bool(title='enable Lower Bearish Band . . . Fib Level', defval=false, group='══════ Strong Trend Levels ══════', inline="1")

select_StrongBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="1")

StrongBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=400, group='══════ Strong Trend Levels ══════', inline="2")

StrongBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=120, group='══════ Strong Trend Levels ══════', inline="2")

// fib middle Band regular Trend

enable_MiddleBand_Bull = input.bool(title='enable Middle Bullish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="0")

select_MiddleBand_Fib_Bull = input.float(0.618, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="0")

enable_MiddleBand_Bear = input.bool(title='enable Middle Bearish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="1")

select_MiddleBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="1")

MiddleBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=900, group='══════ Regular Trend Levels ══════', inline="2")

MiddleBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=400, group='══════ Regular Trend Levels ══════', inline="2")

// fib Sideways Band

enable_SidewaysBand_Bull = input.bool(title='enable Lower Bullish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="0")

select_SidewaysBand_Fib_Bull = input.float(0.6, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="0")

enable_SidewaysBand_Bear = input.bool(title='enable Upper Bearish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="1")

select_SidewaysBand_Fib_Bear = input.float(0.5, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="1")

SidewaysBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=4000, group='══════ Sideways Trend Levels ══════', inline="2")

SidewaysBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=150, group='══════ Sideways Trend Levels ══════', inline="2")

// Strong Band

isBelow_StrongBand_Bull = true

isBelow_StrongBand_Bear = true

StrongBand_Price_of_Low = float(na)

StrongBand_Price_of_High = float(na)

StrongBand_Bear_Fib_Price = float(na)

StrongBand_Bull_Fib_Price = float(na)

/// Middle Band

isBelow_MiddleBand_Bull = true

isBelow_MiddleBand_Bear = true

MiddleBand_Price_of_Low = float(na)

MiddleBand_Price_of_High = float(na)

MiddleBand_Bear_Fib_Price = float(na)

MiddleBand_Bull_Fib_Price = float(na)

// Sideways Band

isBelow_SidewaysBand_Bull = true

isBelow_SidewaysBand_Bear = true

SidewaysBand_Price_of_Low = float(na)

SidewaysBand_Price_of_High = float(na)

SidewaysBand_Bear_Fib_Price = float(na)

SidewaysBand_Bull_Fib_Price = float(na)

// get Fib Levels

if enable_StrongBand_Bull

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bull_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bull) + StrongBand_Price_of_Low //+ fibbullHighDivi

isBelow_StrongBand_Bull := StrongBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_StrongBand_Bull

if enable_StrongBand_Bear

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bear_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bear) + StrongBand_Price_of_Low// + fibbullLowhDivi

isBelow_StrongBand_Bear := StrongBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_StrongBand_Bear

if enable_MiddleBand_Bull

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bull_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bull) + MiddleBand_Price_of_Low //+ fibbullHighDivi

isBelow_MiddleBand_Bull := MiddleBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_MiddleBand_Bull

if enable_MiddleBand_Bear

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bear_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bear) + MiddleBand_Price_of_Low// + fibbullLowhDivi

isBelow_MiddleBand_Bear := MiddleBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_MiddleBand_Bear

if enable_SidewaysBand_Bull

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bull_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bull) + SidewaysBand_Price_of_Low //+ fibbullHighDivi

isBelow_SidewaysBand_Bull := SidewaysBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_SidewaysBand_Bull

if enable_SidewaysBand_Bear

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bear_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bear) + SidewaysBand_Price_of_Low// + fibbullLowhDivi

isBelow_SidewaysBand_Bear := SidewaysBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_SidewaysBand_Bear

// Fib EMAs

// fib ema Strong Trend

StrongBand_current_Trend_EMA = float(na)

StrongBand_Bull_EMA = ta.ema(StrongBand_Bull_Fib_Price, StrongBand_EmaLen)

StrongBand_Bear_EMA = ta.ema(StrongBand_Bear_Fib_Price, StrongBand_EmaLen)

StrongBand_Ema_in_Uptrend = ta.change(StrongBand_Bull_EMA) > 0 or ta.change(StrongBand_Bear_EMA) > 0

StrongBand_Ema_Sideways = ta.change(StrongBand_Bull_EMA) == 0 or ta.change(StrongBand_Bear_EMA) == 0

StrongBand_Ema_in_Downtrend = ta.change(StrongBand_Bull_EMA) < 0 or ta.change(StrongBand_Bear_EMA) < 0

if StrongBand_Ema_in_Uptrend or StrongBand_Ema_Sideways

StrongBand_current_Trend_EMA := StrongBand_Bull_EMA

if StrongBand_Ema_in_Downtrend

StrongBand_current_Trend_EMA := StrongBand_Bear_EMA

// fib ema Normal Trend

MiddleBand_current_Trend_EMA = float(na)

MiddleBand_Bull_EMA = ta.ema(MiddleBand_Bull_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Bear_EMA = ta.ema(MiddleBand_Bear_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Ema_in_Uptrend = ta.change(MiddleBand_Bull_EMA) > 0 or ta.change(MiddleBand_Bear_EMA) > 0

MiddleBand_Ema_Sideways = ta.change(MiddleBand_Bull_EMA) == 0 or ta.change(MiddleBand_Bear_EMA) == 0

MiddleBand_Ema_in_Downtrend = ta.change(MiddleBand_Bull_EMA) < 0 or ta.change(MiddleBand_Bear_EMA) < 0

if MiddleBand_Ema_in_Uptrend or MiddleBand_Ema_Sideways

MiddleBand_current_Trend_EMA := MiddleBand_Bull_EMA

if MiddleBand_Ema_in_Downtrend

MiddleBand_current_Trend_EMA := MiddleBand_Bear_EMA

// fib ema Sideways Trend

SidewaysBand_current_Trend_EMA = float(na)

SidewaysBand_Bull_EMA = ta.ema(SidewaysBand_Bull_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Bear_EMA = ta.ema(SidewaysBand_Bear_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Ema_in_Uptrend = ta.change(SidewaysBand_Bull_EMA) > 0 or ta.change(SidewaysBand_Bear_EMA) > 0

SidewaysBand_Ema_Sideways = ta.change(SidewaysBand_Bull_EMA) == 0 or ta.change(SidewaysBand_Bear_EMA) == 0

SidewaysBand_Ema_in_Downtrend = ta.change(SidewaysBand_Bull_EMA) < 0 or ta.change(SidewaysBand_Bear_EMA) < 0

if SidewaysBand_Ema_in_Uptrend or SidewaysBand_Ema_Sideways

SidewaysBand_current_Trend_EMA := SidewaysBand_Bull_EMA

if SidewaysBand_Ema_in_Downtrend

SidewaysBand_current_Trend_EMA := SidewaysBand_Bear_EMA

// trend states and colors

all_Fib_Emas_Trending = StrongBand_Ema_in_Uptrend and MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

all_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and StrongBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

all_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and StrongBand_Ema_Sideways and SidewaysBand_Ema_Sideways

all_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or StrongBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

allFibsUpAndDownTrend = (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or StrongBand_Ema_Sideways or StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

Middle_and_Sideways_Emas_Trending = MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

Middle_and_Sideways_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

Middle_and_Sideways_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and SidewaysBand_Ema_Sideways

Middle_and_Sideways_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

Middle_and_Sideways_UpAndDownTrend = (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

UpperBand_Ema_Color = all_Fib_Emas_Trend_or_Sideways ? color.lime : all_Fib_Emas_Downtrend ? color.red : allFibsUpAndDownTrend ? color.white : na

MiddleBand_Ema_Color = Middle_and_Sideways_Fib_Emas_Trend_or_Sideways ? color.lime : Middle_and_Sideways_Fib_Emas_Downtrend ? color.red : Middle_and_Sideways_UpAndDownTrend ? color.white : na

SidewaysBand_Ema_Color = SidewaysBand_Ema_in_Uptrend ? color.lime : SidewaysBand_Ema_in_Downtrend ? color.red : (SidewaysBand_Ema_in_Downtrend and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend)) ? color.white : na

plotStrong_Ema = plot(StrongBand_current_Trend_EMA, color=UpperBand_Ema_Color, title="Strong Trend")

plotMiddle_Ema = plot(MiddleBand_current_Trend_EMA, color=MiddleBand_Ema_Color, title="Normal Trend")

plotSideways_Ema = plot(SidewaysBand_current_Trend_EMA, color=SidewaysBand_Ema_Color, title="Sidewaysd")

Strong_Middle_fillcolor = color.new(color.green, 90)

if all_Fib_Emas_Trend_or_Sideways

Strong_Middle_fillcolor := color.new(color.green, 90)

if all_Fib_Emas_Downtrend

Strong_Middle_fillcolor := color.new(color.red, 90)

if allFibsUpAndDownTrend

Strong_Middle_fillcolor := color.new(color.white, 90)

Middle_Sideways_fillcolor = color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

Middle_Sideways_fillcolor := color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Downtrend

Middle_Sideways_fillcolor := color.new(color.red, 90)

if Middle_and_Sideways_UpAndDownTrend

Middle_Sideways_fillcolor := color.new(color.white, 90)

fill(plotStrong_Ema, plotMiddle_Ema, color=Strong_Middle_fillcolor, title="fib band background")

fill(plotMiddle_Ema, plotSideways_Ema, color=Middle_Sideways_fillcolor, title="fib band background")

// buy condition

StrongBand_Price_was_below_Bull_level = ta.lowest(low, 1) < StrongBand_current_Trend_EMA

StrongBand_Price_is_above_Bull_level = close > StrongBand_current_Trend_EMA

StronBand_Price_Average_above_Bull_Level = ta.ema(low, 10) > StrongBand_current_Trend_EMA

StrongBand_Low_isnt_toLow = (ta.lowest(StrongBand_current_Trend_EMA, 15) - ta.lowest(low, 15)) < close * 0.005

StronBand_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Downtrend) > 50 or na(ta.barssince(StrongBand_Ema_in_Downtrend))

MiddleBand_Price_was_below_Bull_level = ta.lowest(low, 1) < MiddleBand_current_Trend_EMA

MiddleBand_Price_is_above_Bull_level = close > MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_above_Bull_Level = ta.ema(close, 20) > MiddleBand_current_Trend_EMA

MiddleBand_Low_isnt_toLow = (ta.lowest(MiddleBand_current_Trend_EMA, 10) - ta.lowest(low, 10)) < close * 0.0065

MiddleBand_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Downtrend) > 50 or na(ta.barssince(MiddleBand_Ema_in_Downtrend))

SidewaysBand_Price_was_below_Bull_level = ta.lowest(low, 1) < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_above_Bull_level = close > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_above_Bull_Level = ta.ema(low, 80) > SidewaysBand_current_Trend_EMA

SidewaysBand_Low_isnt_toLow = (ta.lowest(SidewaysBand_current_Trend_EMA, 150) - ta.lowest(low, 150)) < close * 0.0065

SidewaysBand_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Downtrend) > 50 or na(ta.barssince(SidewaysBand_Ema_in_Downtrend))

StrongBand_Buy_Alert = StronBand_Trend_isnt_fresh and StrongBand_Low_isnt_toLow and StronBand_Price_Average_above_Bull_Level and StrongBand_Price_was_below_Bull_level and StrongBand_Price_is_above_Bull_level and all_Fib_Emas_Trend_or_Sideways

MiddleBand_Buy_Alert = MiddleBand_Trend_isnt_fresh and MiddleBand_Low_isnt_toLow and MiddleBand_Price_Average_above_Bull_Level and MiddleBand_Price_was_below_Bull_level and MiddleBand_Price_is_above_Bull_level and Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Buy_Alert = SidewaysBand_Trend_isnt_fresh and SidewaysBand_Low_isnt_toLow and SidewaysBand_Price_Average_above_Bull_Level and SidewaysBand_Price_was_below_Bull_level and SidewaysBand_Price_is_above_Bull_level and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Sell condition

StrongBand_Price_was_above_Bear_level = ta.highest(high, 1) > StrongBand_current_Trend_EMA

StrongBand_Price_is_below_Bear_level = close < StrongBand_current_Trend_EMA

StronBand_Price_Average_below_Bear_Level = ta.sma(high, 10) < StrongBand_current_Trend_EMA

StrongBand_High_isnt_to_High = (ta.highest(high, 15) - ta.highest(StrongBand_current_Trend_EMA, 15)) < close * 0.005

StrongBand_Bear_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Uptrend) > 50

MiddleBand_Price_was_above_Bear_level = ta.highest(high, 1) > MiddleBand_current_Trend_EMA

MiddleBand_Price_is_below_Bear_level = close < MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_below_Bear_Level = ta.sma(high, 9) < MiddleBand_current_Trend_EMA

MiddleBand_High_isnt_to_High = (ta.highest(high, 10) - ta.highest(MiddleBand_current_Trend_EMA, 10)) < close * 0.0065

MiddleBand_Bear_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Uptrend) > 50

SidewaysBand_Price_was_above_Bear_level = ta.highest(high, 1) > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_below_Bear_level = close < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_below_Bear_Level = ta.sma(high, 20) < SidewaysBand_current_Trend_EMA

SidewaysBand_High_isnt_to_High = (ta.highest(high, 20) - ta.highest(SidewaysBand_current_Trend_EMA, 15)) < close * 0.0065

SidewaysBand_Bear_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Uptrend) > 50

StrongBand_Sell_Alert = StronBand_Price_Average_below_Bear_Level and StrongBand_High_isnt_to_High and StrongBand_Bear_Trend_isnt_fresh and StrongBand_Price_was_above_Bear_level and StrongBand_Price_is_below_Bear_level and all_Fib_Emas_Downtrend and not all_Fib_Emas_Trend_or_Sideways

MiddleBand_Sell_Alert = MiddleBand_Price_Average_below_Bear_Level and MiddleBand_High_isnt_to_High and MiddleBand_Bear_Trend_isnt_fresh and MiddleBand_Price_was_above_Bear_level and MiddleBand_Price_is_below_Bear_level and Middle_and_Sideways_Fib_Emas_Downtrend and not Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Sell_Alert = SidewaysBand_Price_Average_below_Bear_Level and SidewaysBand_High_isnt_to_High and SidewaysBand_Bear_Trend_isnt_fresh and SidewaysBand_Price_was_above_Bear_level and SidewaysBand_Price_is_below_Bear_level and SidewaysBand_Ema_in_Downtrend and not (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Backtester

////////////////// Stop Loss

// Stop loss

enableSL = input.bool(true, title='enable Stop Loss', group='══════════ Stop Loss Settings ══════════')

whichSL = input.string(defval='low/high as SL', title='SL based on static % or based on the low/high', options=['low/high as SL', 'static % as SL'], group='══════════ Stop Loss Settings ══════════')

whichOffset = input.string(defval='% as offset', title='choose offset from the low/high', options=['$ as offset', '% as offset'], group='Stop Loss at the low/high')

lowPBuffer = input.float(1.4, title='SL Offset from the Low/high in %', group='Stop Loss at the low/high') / 100

lowDBuffer = input.float(100, title='SL Offset from the Low/high in $', group='Stop Loss at the low/high')

SlLowLookback = input.int(title='SL lookback for Low/high', defval=5, minval=1, maxval=50, group='Stop Loss at the low/high')

longSlLow = float(na)

shortSlLow = float(na)

if whichOffset == "% as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) * (1 - lowPBuffer)

shortSlLow := ta.highest(high, SlLowLookback) * (1 + lowPBuffer)

if whichOffset == "$ as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) - lowDBuffer

shortSlLow := ta.highest(high, SlLowLookback) + lowDBuffer

//plot(shortSlLow, title="stoploss", color=color.new(#00bcd4, 0))

// long settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

longStopLoss = input.float(0.5, title='Long Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

// short settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

shortStopLoss = input.float(0.5, title='Short Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

/////// Take profit

longTakeProfit1 = input.float(4, title='Long Take Profit in %', group='Take Profit', inline='Input 1') / 100

/////// Take profit

shortTakeProfit1 = input.float(1.6, title='Short Take Profit in %', group='Take Profit', inline='Input 1') / 100

////////////////// SL TP END

/////////////////// alerts

selectalertFreq = input.string(defval='once per bar close', title='Alert Options', options=['once per bar', 'once per bar close', 'all'], group='═══════════ alert settings ═══════════')

BuyAlertMessage = input.string(defval="Bullish Divergence detected, put your SL @", title='Buy Alert Message', group='═══════════ alert settings ═══════════')

enableSlMessage = input.bool(true, title='enable Stop Loss Value at the end of "buy Alert message"', group='═══════════ alert settings ═══════════')

AfterSLMessage = input.string(defval="", title='Buy Alert message after SL Value', group='═══════════ alert settings ═══════════')

////////////////// Backtester

// 🔥 uncomment the all lines below for the backtester and revert for alerts

shortTrading = enable_MiddleBand_Bear or enable_StrongBand_Bear or enable_SidewaysBand_Bear

longTrading = enable_StrongBand_Bull or enable_MiddleBand_Bull or enable_SidewaysBand_Bull

longTP1 = strategy.position_size > 0 ? strategy.position_avg_price * (1 + longTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - longTakeProfit1) : na

longSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - longStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + longStopLoss) : na

shortTP = strategy.position_size > 0 ? strategy.position_avg_price * (1 + shortTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - shortTakeProfit1) : na

shortSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - shortStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + shortStopLoss) : na

strategy.risk.allow_entry_in(longTrading == true and shortTrading == true ? strategy.direction.all : longTrading == true ? strategy.direction.long : shortTrading == true ? strategy.direction.short : na)

strategy.entry('Bull', strategy.long, comment='Upper Band Long', when=StrongBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=MiddleBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=SidewaysBand_Buy_Alert)

strategy.entry('Bear', strategy.short, comment='Upper Band Short', when=StrongBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=MiddleBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=SidewaysBand_Sell_Alert)

// check which SL to use

if enableSL and whichSL == 'static % as SL'

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSL)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSL)

// get bars since last entry for the SL at low to work

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Buy_Alert or MiddleBand_Buy_Alert or SidewaysBand_Buy_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSlLow)

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Sell_Alert or MiddleBand_Sell_Alert or SidewaysBand_Sell_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSlLow)

if not enableSL

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP)